|

市场调查报告书

商品编码

1716576

NAND 快闪记忆体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测NAND Flash Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

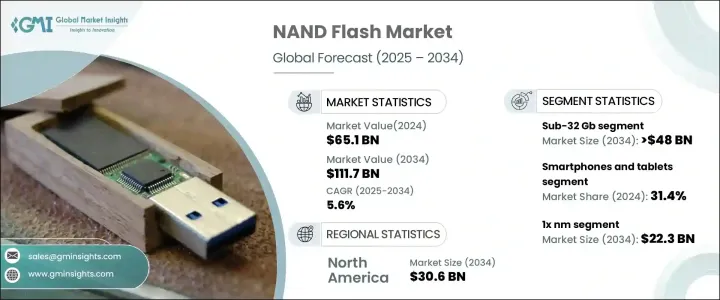

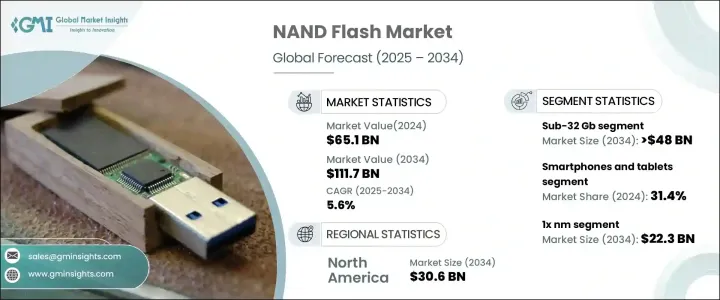

2024 年全球 NAND 快闪记忆体市场规模达到 651 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。市场成长主要得益于消费性电子产品对高效能储存解决方案的需求不断增长,以及 3D NAND 技术的快速进步。随着各行各业数位转型的加速,NAND闪存在实现无缝资料处理、高速运算和大规模储存应用方面发挥着至关重要的作用。连网设备普及率的不断提高、高解析度媒体的激增以及向人工智慧驱动应用的持续转变进一步扩大了对先进 NAND 解决方案的需求。云端运算、边缘运算和物联网整合也加剧了对高密度、节能储存的需求,促使製造商专注于提高效能、减少延迟和优化能耗的创新。

如今的消费者要求设备具有更大的储存容量和更快的性能,从而推动了对 NAND 快闪记忆体产品的庞大需求。製造商正在透过提供高密度、高速记忆体解决方案来应对这一需求,旨在满足智慧型手机、平板电脑和下一代 5G 设备不断变化的需求。随着 4K 和 8K 视讯消费、手机游戏和人工智慧应用的激增,NAND 储存的需求从未如此高涨。业内公司不断投资研发,突破储存效率和耐用性的界限,以满足自动驾驶汽车、智慧家电和工业自动化等新兴技术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 651亿美元 |

| 预测值 | 1117亿美元 |

| 复合年增长率 | 5.6% |

NAND 快闪记忆体市场根据记忆体密度分为几类,包括 32 Gb 以下、32 Gb - 128 Gb、256 Gb - 1 Tb 和 1 Tb 以上。预计到 2034 年,32 Gb 以下市场的产值将达到 480 亿美元,这得益于其在嵌入式系统、消费性电子产品和工业应用中的广泛应用。随着对紧凑、经济高效和节能储存解决方案的需求不断增长,物联网设备尤其促进了该领域的成长。此类别的 NAND 晶片在智慧家电、汽车资讯娱乐系统和工业自动化领域备受青睐,因为这些领域的性能和耐用性至关重要。

根据应用,智慧型手机和平板电脑领域在 2024 年占据了 31.4% 的市场。由于内容创作、基于云端的储存和人工智慧驱动的功能不断增加,行动装置使用量的激增极大地促进了这一领域的扩张。现代智慧型手机需要大量储存空间来处理高解析度照片、4K 和 8K 影片以及高级游戏体验。随着行动装置的不断发展,预计在整个预测期内,对此类 NAND 快闪记忆体解决方案的需求将保持强劲。

预计到 2034 年,美国 NAND 快闪记忆体市场规模将达到 306 亿美元。美国成熟的半导体研发部门将继续推动 NAND 快闪记忆体技术的创新,进一步巩固其作为全球记忆体解决方案领导者的地位。大型科技公司的资料中心严重依赖 NAND 快闪存储,以确保持续的需求。由于美国继续处于数位经济的前沿,对高效、高密度储存解决方案的需求将持续上升,从而塑造 NAND 快闪记忆体市场的未来。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费性电子产品对高效能储存解决方案的需求不断增长

- 资料中心越来越多地采用固态硬碟 (SSD)

- 3D NAND技术的进步

- 人工智慧和物联网应用的扩展

- 汽车产业需求不断成长

- 产业陷阱与挑战

- 供应链中断

- 竞争加剧和价格压力

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按记忆体密度,2021 - 2034 年

- 主要趋势

- 低于 32 Gb

- 32 GB - 128 GB

- 256 GB - 1 TB

- 1 Tb 以上

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 智慧型手机和平板电脑

- SSD 和企业储存

- 消费性电子产品

- 工业和汽车

- 其他的

第七章:市场估计与预测:按技术节点,2021 - 2034 年

- 主要趋势

- 1x 奈米

- 1年奈米

- 2x 奈米

- 3x 奈米以上

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- ADATA

- Cypress Semiconductor

- Greenliant Systems

- Infineon Technologies

- Intel

- ISSI

- Kingston Technology

- Kioxia

- Macronix International

- Micron Technology

- Netlist

- Phison Electronics

- Powerchip Semiconductor

- Samsung Electronics

- Sandisk

- SK Hynix

- SMIC

- Western Digital

- Winbond Electronics

- Yangtze Memory Technologies Co. (YMTC)

The Global NAND Flash Market reached USD 65.1 billion in 2024 and is expected to grow at a CAGR of 5.6% between 2025 and 2034. The market growth is largely fueled by the increasing demand for high-performance storage solutions in consumer electronics, alongside rapid advancements in 3D NAND technology. As digital transformation accelerates across industries, NAND flash memory plays a crucial role in enabling seamless data processing, high-speed computing, and large-scale storage applications. The rising penetration of connected devices, the proliferation of high-resolution media, and the ongoing shift toward AI-driven applications are further amplifying the need for advanced NAND solutions. Cloud computing, edge computing, and IoT integration have also intensified the demand for high-density, power-efficient storage, prompting manufacturers to focus on innovations that enhance performance, reduce latency, and optimize energy consumption.

Consumers today require larger storage capacities and faster performance in their devices, driving substantial demand for NAND flash products. Manufacturers are responding by delivering high-density, high-speed memory solutions designed to support the ever-evolving needs of smartphones, tablets, and next-generation 5G devices. With the surge in 4K and 8K video consumption, mobile gaming, and AI-powered applications, the necessity for NAND storage has never been higher. Companies in the industry continue to invest in research and development, pushing the boundaries of storage efficiency and endurance to cater to emerging technologies such as autonomous vehicles, smart appliances, and industrial automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.1 Billion |

| Forecast Value | $111.7 Billion |

| CAGR | 5.6% |

The NAND Flash Market is segmented by memory density into several categories, including sub-32 Gb, 32 Gb - 128 Gb, 256 Gb - 1 Tb, and above 1 Tb. The sub-32 Gb segment is projected to generate USD 48 billion by 2034, driven by its widespread adoption in embedded systems, consumer electronics, and industrial applications. IoT devices, in particular, have contributed to the segment's growth as demand for compact, cost-effective, and energy-efficient storage solutions rises. NAND chips in this category are highly favored for use in smart appliances, automotive infotainment systems, and industrial automation, where performance and durability are critical.

Based on applications, the smartphones and tablets segment accounted for a 31.4% market share in 2024. The surge in mobile device usage, driven by increasing content creation, cloud-based storage, and AI-driven functionalities, has significantly contributed to this segment's expansion. Modern smartphones require substantial storage to handle high-resolution photos, 4K and 8K video, and advanced gaming experiences. As mobile devices continue to evolve, the demand for NAND flash solutions in this category is expected to remain strong throughout the forecast period.

The U.S. NAND Flash Market is expected to generate USD 30.6 billion by 2034. The country's well-established semiconductor research and development sector continues to drive innovation in NAND flash technology, further solidifying its position as a global leader in memory storage solutions. Major technology companies rely heavily on NAND flash storage for their data centers, ensuring sustained demand. As the U.S. remains at the forefront of the digital economy, the need for efficient, high-density storage solutions will continue to rise, shaping the future of the NAND flash market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-performance storage solutions in consumer electronics

- 3.2.1.2 Rising adoption of solid-state drives (SSDs) in data centres

- 3.2.1.3 Advancements in 3D NAND technology

- 3.2.1.4 Expansion of ai and IoT applications

- 3.2.1.5 Rising demand in automotive industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Rising competition and price pressure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Memory Density, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Sub-32 Gb

- 5.3 32 Gb - 128 Gb

- 5.4 256 Gb - 1 Tb

- 5.5 Above 1 Tb

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Smartphones and tablets

- 6.3 SSDs and enterprise storage

- 6.4 Consumer electronics

- 6.5 Industrial and automotive

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Technology Node, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 1x nm

- 7.3 1y nm

- 7.4 2x nm

- 7.5 3x nm and beyond

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADATA

- 9.2 Cypress Semiconductor

- 9.3 Greenliant Systems

- 9.4 Infineon Technologies

- 9.5 Intel

- 9.6 ISSI

- 9.7 Kingston Technology

- 9.8 Kioxia

- 9.9 Macronix International

- 9.10 Micron Technology

- 9.11 Netlist

- 9.12 Phison Electronics

- 9.13 Powerchip Semiconductor

- 9.14 Samsung Electronics

- 9.15 Sandisk

- 9.16 SK Hynix

- 9.17 SMIC

- 9.18 Western Digital

- 9.19 Winbond Electronics

- 9.20 Yangtze Memory Technologies Co. (YMTC)