|

市场调查报告书

商品编码

1716600

工业齿轮箱市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Gearbox Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

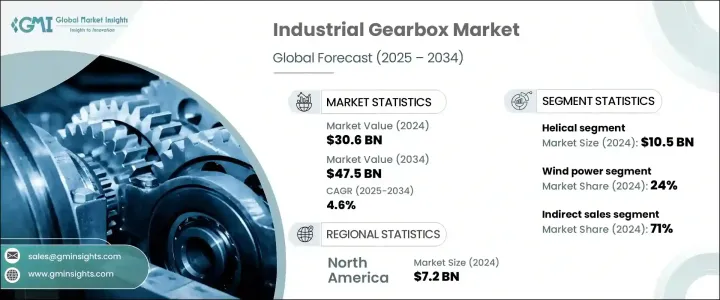

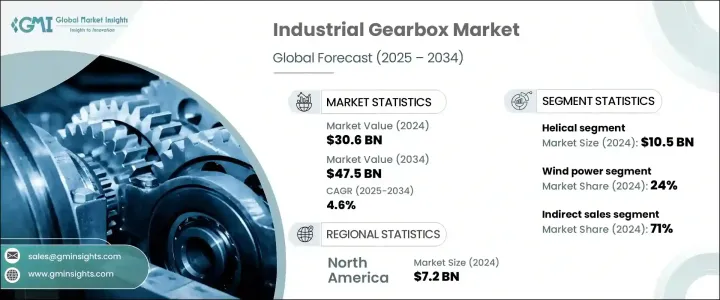

2024 年全球工业齿轮箱市场规模达到 306 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.6%。这一增长得益于各行业日益采用工业自动化以及齿轮箱技术的不断进步。工业齿轮箱在CNC工具机、机器人、传送系统和组装线等自动化应用中发挥着至关重要的作用。这些系统需要能够提供高扭力的变速箱,同时保持紧凑的设计以确保准确的动力传输。各行业对重型机械的需求不断增长,进一步加速了市场扩张。全球对基础设施、公共工程和建筑业日益增长的需求也推动了建筑机械对工业变速箱驱动器的需求。变速箱是起重机、升降机、起重设备以及物料搬运设备中必不可少的部件,在要求苛刻的应用中具有高可靠性和耐用性。

2024年,工业齿轮箱市场的斜齿轮部分价值将达到105亿美元。预计从 2025 年到 2034 年,行星齿轮领域的复合年增长率将达到约 5%。斜齿轮以其运作平稳、耐用和承受高负荷的能力而闻名,广泛应用于汽车、航太、工业机械和机器人等行业。汽车产业,尤其是自动变速箱汽车产量的不断增长以及向电动车(EV)的日益转变,是斜齿轮需求的重要来源。航太工业也依赖斜齿轮在恶劣条件下有效运作的能力,使其成为飞行、无人机和太空应用的理想选择。亚太地区以其强大的汽车製造基础引领斜齿轮的需求,中国、日本和印度等国家是主要供应国。欧洲由于注重替代能源和先进的汽车技术,也发挥关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 306亿美元 |

| 预测值 | 475亿美元 |

| 复合年增长率 | 4.6% |

受清洁和再生能源需求不断增长的推动,风电领域到 2024 年将占工业变速箱市场的约 24%。离岸风电场需要能够承受恶劣环境条件的高容量、高效率变速箱,推动了这项成长。仓储和物流等行业采用自动化进一步推动了对输送系统和自动化机械中安全有效的变速箱的需求。电动车的日益普及也改变了变速箱的需求,因为电动车需要支援高扭力和高效传输能量的专用变速箱。

2024年,间接销售将成为配销通路的主导,占超过71%的市场。对于需要客製化和大量采购的大规模工业应用,公司通常更喜欢直接分销管道。同时,中小企业更倾向于从工业设备经销商处采购,因为经销商备有各种不同品牌的变速箱。当设备或机械需要专用变速箱时,一些公司会从 OEM 购买变速箱。

在北美,美国在 2024 年引领工业变速箱市场,占约 80% 的区域市场份额,创造约 72 亿美元的收入。美国市场的扩张受到变速箱技术的进步、多个行业需求的增长以及对专用变速箱日益增长的兴趣的推动。製造业和能源等行业自动化程度的提高推动了对高效变速箱的需求,而对再生能源(尤其是风能)的投资继续为市场成长创造机会。汽车领域电动车的兴起进一步促进了传动系统和转向系统中对紧凑、高扭力变速箱的需求不断增加。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 各行各业工业自动化的兴起

- 整体变速箱技术的进步

- 产业陷阱与挑战

- 维护要求高

- 齿轮磨损和故障

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 螺旋

- 斜角

- 蠕虫

- 行星

- 其他(直齿、螺旋齿等)

第六章:市场估计与预测:按功率,2021-2034

- 主要趋势

- 小型(高达 500 kW)

- 中型(500 千瓦至 10 兆瓦)

- 大型(10MW以上)

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 风力

- 物料处理

- 建造

- 海洋

- 活力

- 运输

- 其他(农业、矿业等)

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Abex Corporation

- Bonfiglioli

- Davall Gears

- Elecon Engineering

- Flender

- HJ Corporation

- Ishibashi Manufacturing

- Kissling

- Nippon Gear

- Premium Transmission

- Schaeffler

- Stober Antriebstechnik

- Sumitomo Heavy Industries

- WM Berg

- ZF Friedrichshafen

The Global Industrial Gearbox Market reached USD 30.6 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2034. This growth is driven by the increasing adoption of industrial automation across diverse sectors and the continuous advancement in gearbox technology. Industrial gearboxes play a crucial role in automated applications such as CNC machines, robots, conveyor systems, and assembly lines. These systems require gearboxes that deliver high torque while maintaining compact designs to ensure accurate power transmission. The rising demand for heavy-duty machinery across industries further accelerates market expansion. The growing need for infrastructure, public works, and construction globally has also fueled the demand for industrial gearbox drives in construction machinery. Gearboxes are essential in cranes, lifts, hoists, and material-handling equipment, providing high reliability and durability in demanding applications.

In 2024, the helical segment of the industrial gearbox market accounted for USD 10.5 billion. The planetary segment is anticipated to grow at a CAGR of approximately 5% from 2025 to 2034. Helical gears, known for their smooth operation, durability, and capacity to handle high loads, are widely utilized in industries such as automotive, aerospace, industrial machinery, and robotics. The automotive industry, particularly with the growing production of automatic transmission vehicles and the increasing shift toward electric vehicles (EVs), is a significant source of demand for helical gears. The aerospace industry also relies on helical gears for their ability to function effectively in harsh conditions, making them ideal for use in flights, drones, and space applications. Asia Pacific leads the demand for helical gears, driven by its strong automobile manufacturing base, with countries like China, Japan, and India serving as major suppliers. Europe also plays a pivotal role due to its focus on alternative power and advanced automotive technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.6 Billion |

| Forecast Value | $47.5 Billion |

| CAGR | 4.6% |

The wind power segment accounted for approximately 24% of the industrial gearbox market in 2024, driven by increasing demand for clean and renewable energy sources. Offshore wind farms, which require high-capacity and efficient gearboxes capable of withstanding harsh environmental conditions, have fueled this growth. The adoption of automation in industries such as warehousing and logistics has further boosted the demand for secure and effective gearboxes in conveyor systems and automated machinery. The growing popularity of electric cars has also transformed gearbox demand, as EVs require specialized gearboxes that support high torque and transmit energy efficiently.

In 2024, indirect sales dominated the distribution channel, accounting for over 71% of the market share. Companies typically prefer direct distribution channels for large-scale industrial applications where customization and bulk purchases are essential. Meanwhile, small and medium-sized enterprises prefer purchasing from industrial equipment distributors who stock a wide variety of gearboxes from different brands. Some companies source gearboxes from OEMs when specialized gearboxes are needed for equipment or machinery.

In North America, the United States led the industrial gearbox market in 2024, holding around 80% of the regional market share and generating an estimated USD 7.2 billion in revenue. The US market's expansion is fueled by advancements in gearbox technology, rising demand from multiple industries, and growing interest in specialized gearboxes. Increasing automation in industries like manufacturing and energy has driven demand for efficient gearboxes, while investments in renewable energy, particularly wind power, continue to create opportunities for market growth. The rise of EVs in the automotive sector further contributes to the increasing need for compact, high-torque gearboxes in driveline and steering systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise of industrial automation across various sectors

- 3.6.1.2 Advancement in overall gearbox technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High maintenance requirement

- 3.6.2.2 Gear wear and failure

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Helical

- 5.3 Bevel

- 5.4 Worm

- 5.5 Planetary

- 5.6 Others (spur, spiral, etc.)

Chapter 6 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small (up to 500 kW)

- 6.3 Medium (500 kW to 10 MW)

- 6.4 Large (above 10 MW)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Wind power

- 7.3 Material handling

- 7.4 Construction

- 7.5 Marine

- 7.6 Energy

- 7.7 Transportation

- 7.8 Others (agriculture, mining etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Abex Corporation

- 10.2 Bonfiglioli

- 10.3 Davall Gears

- 10.4 Elecon Engineering

- 10.5 Flender

- 10.6 HJ Corporation

- 10.7 Ishibashi Manufacturing

- 10.8 Kissling

- 10.9 Nippon Gear

- 10.10 Premium Transmission

- 10.11 Schaeffler

- 10.12 Stober Antriebstechnik

- 10.13 Sumitomo Heavy Industries

- 10.14 WM Berg

- 10.15 ZF Friedrichshafen