|

市场调查报告书

商品编码

1716604

汽车经销商会计软体市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Auto Dealership Accounting Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

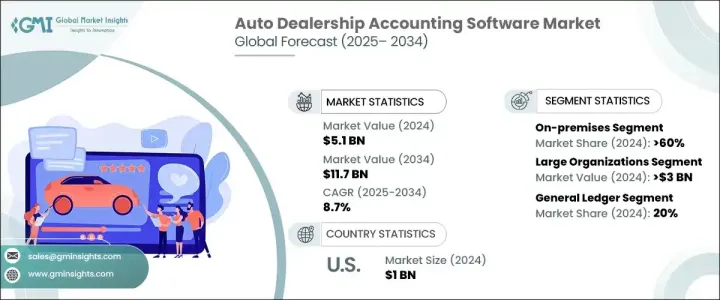

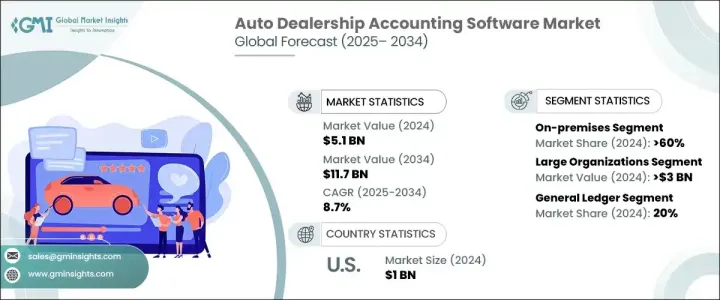

2024 年全球汽车经销商会计软体市场规模达到 51 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.7%。推动这一成长的主要动力是基于云端的会计解决方案的广泛采用。经销商正在迅速转向云端平台,以提高营运效率、简化财务流程并即时存取关键业务资料。随着汽车产业财务管理日益复杂,企业越来越重视与经销商管理系统 (DMS) 无缝整合的会计软体。这种转变使经销商能够实现税务计算、工资处理、费用追踪和合规管理的自动化,同时减少人工错误和营运成本。此外,基于云端的解决方案具有高度可扩展性,使经销商无需大量基础设施投资即可扩展业务。

对数据驱动决策的偏好日益增长是推动市场扩张的另一个因素。汽车经销商正在利用现代会计软体中嵌入的高级分析和人工智慧 (AI) 功能来深入了解销售趋势、客户购买行为和库存週转率。对人工智慧自动化工具的需求不断增长,加速了软体的采用,帮助企业优化其财务工作流程。随着数位转型成为焦点,软体供应商正在整合机器学习演算法和预测分析,以提供增强的财务预测和风险评估能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 117亿美元 |

| 复合年增长率 | 8.7% |

市场根据部署模式分为基于云端的解决方案和内部部署的解决方案。虽然基于云端的系统越来越受欢迎,但内部部署解决方案在 2024 年占据了 60% 的主导市场。许多经销商喜欢内部部署会计软体,因为安全性较高,并且能够完全控制敏感财务资料。汽车销售、医疗保健和金融服务等行业优先考虑严格的资料保护措施,儘管越来越多地转向云端技术,但内部部署解决方案仍是首选。

根据组织规模,市场分为大型企业和中小型企业(SME)。大型经销商在 2024 年的营收为 30 亿美元,这主要归功于他们投资先进会计和经销商管理软体的财务能力。这些企业经营着广泛的经销商网络,需要整合的解决方案来管理库存、销售、客户关係和合规性。透过利用全面的会计系统,大型组织可以提高透明度、改善现金流量管理并优化业务绩效。

2024 年,北美将占据汽车经销商会计软体市场的主导地位,市场占有率为 34%,其中美国占主导地位。该国先进的基础设施、强劲的经济以及领先软体公司的存在促进了对复杂会计解决方案的需求不断增长。美国的监管架构推动企业采用合规的财务管理系统,进一步推动市场成长。随着基于云端和人工智慧的会计解决方案的日益普及,北美经销商处于数位财务转型的前沿,确保了营运效率和长期业务可持续性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 软体供应商

- 服务提供者

- 技术提供者

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 用例

- 衝击力

- 成长动力

- 越来越多地采用基于云端的会计解决方案

- 财务管理自动化需求不断成长

- 严格的监管合规和税务报告要求

- 与客户关係管理 (CRM) 和企业资源规划 (ERP) 系统集成

- 产业陷阱与挑战

- 实施和维护成本高

- 资料安全和网路安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按软体,2021 - 2034 年

- 主要趋势

- 总帐

- 库存管理

- 应付帐款和应收帐款

- 薪资管理

- 财务报告与分析

- 其他的

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 云

- 本地

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型组织

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Autosoft

- Autpraptor

- CAMS

- CDK Global

- DealerBuilt

- DealerSocket

- Fishbowl

- Frazer

- FreshBooks

- Intuit

- LBMC

- MYOB

- NetSuite

- PBS Systems

- Procede Software

- Reynolds and Reynolds

- RouteOne LLC

- Sage Group

- SAP SE

- Xero

The Global Auto Dealership Accounting Software Market reached USD 5.1 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. A primary driver fueling this growth is the widespread adoption of cloud-based accounting solutions. Dealerships are rapidly transitioning to cloud platforms to enhance operational efficiency, streamline financial processes, and gain real-time access to crucial business data. With the increasing complexity of financial management in the auto industry, businesses are prioritizing accounting software that integrates seamlessly with dealer management systems (DMS). This shift allows dealerships to automate tax calculations, payroll processing, expense tracking, and compliance management while reducing manual errors and operational costs. Additionally, cloud-based solutions are highly scalable, enabling dealerships to expand their operations without significant infrastructure investments.

The rising preference for data-driven decision-making is another factor propelling market expansion. Auto dealerships are leveraging advanced analytics and artificial intelligence (AI) features embedded within modern accounting software to gain insights into sales trends, customer purchasing behavior, and inventory turnover. The growing demand for AI-powered automation tools is accelerating software adoption, helping businesses optimize their financial workflows. As digital transformation takes center stage, software providers are integrating machine learning algorithms and predictive analytics to offer enhanced financial forecasting and risk assessment capabilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $11.7 Billion |

| CAGR | 8.7% |

The market is segmented by deployment mode into cloud-based and on-premises solutions. While cloud-based systems are gaining traction, on-premises solutions held a dominant 60% market share in 2024. Many dealerships prefer on-premises accounting software due to heightened security concerns and the ability to maintain full control over sensitive financial data. Industries such as automotive sales, healthcare, and financial services prioritize stringent data protection measures, making on-premises solutions a preferred choice despite the increasing shift toward cloud technology.

Based on organization size, the market is categorized into large enterprises and small to medium enterprises (SME ). Large dealerships accounted for USD 3 billion in revenue in 2024, largely due to their financial capability to invest in advanced accounting and dealer management software. These enterprises operate extensive dealership networks that require integrated solutions for managing inventory, sales, customer relationships, and compliance. By leveraging comprehensive accounting systems, large organizations can enhance transparency, improve cash flow management, and optimize business performance.

North America dominated the auto dealership accounting software market with a 34% share in 2024, led by the United States. The country's advanced infrastructure, strong economy, and the presence of leading software firms contribute to the growing demand for sophisticated accounting solutions. Regulatory frameworks in the U.S. push businesses toward adopting compliant financial management systems, further driving market growth. With the increasing adoption of cloud-based and AI-driven accounting solutions, North American dealerships are at the forefront of digital financial transformation, ensuring operational efficiency and long-term business sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Software providers

- 3.1.1.2 Service providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Use cases

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of cloud-based accounting solutions

- 3.6.1.2 Growing demand for automation in financial management

- 3.6.1.3 Stringent regulatory compliance and tax reporting requirements

- 3.6.1.4 Integration with Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High implementation and maintenance costs

- 3.6.2.2 Data security and cybersecurity concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Software, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 General ledger

- 5.3 Inventory management

- 5.4 Accounts payable and receivable

- 5.5 Payroll management

- 5.6 Financial reporting and analysis

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large organization

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autosoft

- 9.2 Autpraptor

- 9.3 CAMS

- 9.4 CDK Global

- 9.5 DealerBuilt

- 9.6 DealerSocket

- 9.7 Fishbowl

- 9.8 Frazer

- 9.9 FreshBooks

- 9.10 Intuit

- 9.11 LBMC

- 9.12 MYOB

- 9.13 NetSuite

- 9.14 PBS Systems

- 9.15 Procede Software

- 9.16 Reynolds and Reynolds

- 9.17 RouteOne LLC

- 9.18 Sage Group

- 9.19 SAP SE

- 9.20 Xero