|

市场调查报告书

商品编码

1716706

光电市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Optoelectronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

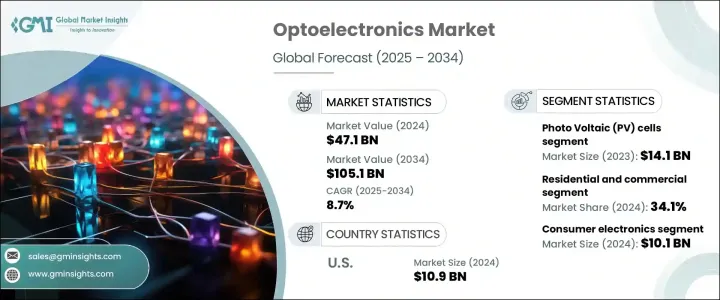

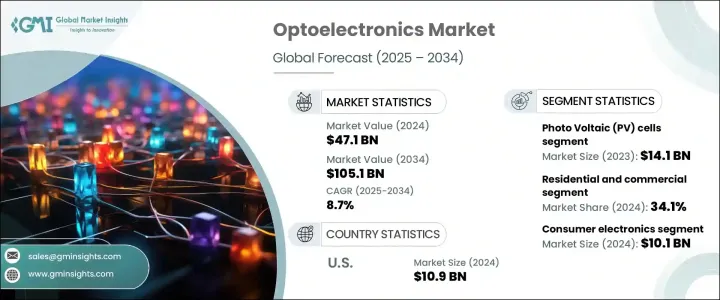

2024 年全球光电市场规模达 471 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.7%。随着各行各业积极寻求功耗更低、性能更佳的电子系统,对节能解决方案的需求不断增长,推动市场的成长。发光二极体 (LED)、雷射二极体和光伏电池等光电设备因其能够提供经济高效且环保的解决方案而广泛应用。对永续性的日益关注,加上降低能源成本的需求,进一步加速了各领域对这些技术的应用。随着各行各业向更绿色的能源替代品转型,光电子技术正成为先进照明系统、通讯技术和成像应用不可或缺的一部分。

此外,光纤网路、智慧显示系统和自动驾驶汽车技术的日益普及正在扩大光电子技术在现代基础设施中的应用范围。感测器技术的进步,加上物联网 (IoT) 和人工智慧 (AI) 解决方案的整合,正在增强光电系统的功能和效率。世界各国政府也透过优惠政策和财政激励措施推动再生能源的应用,这进一步推动了对光伏电池和太阳能解决方案的需求,从而促进了市场的整体成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 471亿美元 |

| 预测值 | 1051亿美元 |

| 复合年增长率 | 8.7% |

光电子市场按类型细分,包括光伏 (PV) 电池、光耦合器、影像感测器、LED 和其他技术。 2023 年,光伏电池领域的产值将达到 141 亿美元,主要得益于人们对再生能源的日益重视以及太阳能技术的进步。钙钛矿太阳能电池、双面组件和高效硅光伏设备等关键创新正在提高这些系统的成本效益和能量转换能力。政府鼓励住宅、商业和工业领域采用太阳能的措施也促进了这一领域的成长。持续向永续能源实践的转变预计将推动光伏技术的进一步应用,使其成为全球能源转型的关键组成部分。

就最终用途应用而言,光电市场服务于住宅、商业和工业领域。受智慧家庭技术、节能照明解决方案和先进显示系统需求不断增长的推动,住宅和商业领域将在 2023 年占据 34.1% 的市场份额。 LED、影像感测器和光伏电池在智慧照明、安全系统和太阳能解决方案等应用中的日益普及正在推动这一领域的成长。消费者越来越多地采用这些技术来提高能源效率并改善整体家庭自动化系统,从而进一步促进市场扩张。

2024 年美国光电市场价值为 109 亿美元,得益于大量研发投资和强大的半导体基础设施,该市场实现了强劲成长。光电设备在自动驾驶汽车、医疗成像和光纤通讯网路等领域的使用日益增多,推动了整个地区的创新和市场扩张。领先技术参与者的存在以及半导体技术的不断进步,增强了美国光电子产业的成长前景,使其成为全球市场的主要贡献者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对节能解决方案的需求不断增长

- 扩大消费性电子产品的应用

- 汽车光电子技术的进步

- 高速光通讯的成长

- 医疗保健和生物医学应用的进步

- 产业陷阱与挑战

- 製造成本高

- 复杂的整合和小型化问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 光伏(PV)电池

- 光耦合器

- 影像感测器

- 发光二极体(LED)

- 其他的

第六章:市场估计与预测:依输出类型,2021-2034

- 主要趋势

- 模拟

- 数位的

第 7 章:市场估计与预测、最终用途,2021 年至 2034 年

- 主要趋势

- 住宅和商业

- 工业的

第 8 章:市场估计与预测、产业、2021-2034 年

- 主要趋势

- 汽车

- 航太和国防

- 消费性电子产品

- 资讯科技

- 卫生保健

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Avago Technologies

- Broadcom Inc.

- Cree Inc.

- Hamamatsu Photonics

- Kyocera Corporation

- LG Innotek

- Lumileds

- Luminit

- Nichia Corporation

- ON Semiconductor

- Osram Licht AG

- Panasonic Corporation

- Renesas Electronics

- Rohm Semiconductor

- Samsung Electronics

- Sharp Corporation

- Sony Corporation

- STMicroelectronics

- Texas Instruments

- Toshiba Corporation

The Global Optoelectronics Market generated USD 47.1 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. The increasing demand for energy-efficient solutions is driving the growth of the market as industries actively seek electronic systems with lower power consumption and improved performance. Optoelectronic devices, such as light-emitting diodes (LEDs), laser diodes, and photovoltaic cells, are gaining widespread adoption due to their ability to deliver cost-effective and eco-friendly solutions. The rising focus on sustainability, combined with the need to reduce energy costs, is further accelerating the adoption of these technologies across various sectors. As industries transition toward greener energy alternatives, optoelectronics is becoming an integral part of advanced lighting systems, communication technologies, and imaging applications.

Additionally, the growing use of fiber-optic networks, intelligent display systems, and autonomous vehicle technologies is expanding the scope of optoelectronics in modern infrastructure. Advancements in sensor technologies, combined with the integration of the Internet of Things (IoT) and artificial intelligence (AI) solutions, are enhancing the functionality and efficiency of optoelectronic systems. Governments worldwide are also promoting renewable energy adoption through favorable policies and financial incentives, which are further driving the demand for photovoltaic cells and solar energy solutions, thereby boosting the market's overall growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.1 Billion |

| Forecast Value | $105.1 Billion |

| CAGR | 8.7% |

The optoelectronics market is segmented by type, including photovoltaic (PV) cells, optocouplers, image sensors, LEDs, and other technologies. The photovoltaic cells segment generated USD 14.1 billion in 2023, primarily driven by the growing emphasis on renewable energy and advancements in solar technology. Key innovations such as perovskite solar cells, bifacial modules, and high-efficiency silicon PV devices are increasing the cost-effectiveness and energy conversion capabilities of these systems. Government initiatives that encourage solar energy adoption across residential, commercial, and industrial sectors are also contributing to the growth of this segment. The ongoing shift toward sustainable energy practices is expected to drive further adoption of PV technologies, making them a critical component of the global energy transition.

In terms of end-use applications, the optoelectronics market serves residential, commercial, and industrial sectors. The residential and commercial segment accounted for 34.1% of the market share in 2023, driven by increasing demand for smart home technologies, energy-efficient lighting solutions, and advanced display systems. The rising popularity of LEDs, image sensors, and photovoltaic cells in applications such as intelligent lighting, security systems, and solar energy solutions is fueling growth in this segment. Consumers are increasingly adopting these technologies to enhance energy efficiency and improve overall home automation systems, further contributing to market expansion.

The U.S. optoelectronics market was valued at USD 10.9 billion in 2024, with robust growth supported by significant investments in research and development and a strong semiconductor infrastructure. The increasing use of optoelectronic devices in sectors such as autonomous vehicles, healthcare imaging, and fiber-optic communication networks is driving innovation and market expansion across the region. The presence of leading technology players, along with ongoing advancements in semiconductor technologies, is enhancing the growth prospects for the U.S. optoelectronics industry, positioning it as a key contributor to the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient solutions

- 3.6.1.2 Expanding applications in consumer electronics

- 3.6.1.3 Advancements in automotive optoelectronics

- 3.6.1.4 Growth in high-speed optical communication

- 3.6.1.5 Advancements in healthcare and biomedical applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing costs

- 3.6.2.2 Complex integration and miniaturization issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Photo Voltaic (PV) cells

- 5.3 Optocouplers

- 5.4 Image sensors

- 5.5 Light Emitting Diodes (LED)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Output Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Analog

- 6.3 Digital

Chapter 7 Market Estimates & Forecast, End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential and commercial

- 7.3 Industrial

Chapter 8 Market Estimates & Forecast, Industry, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace and defense

- 8.4 Consumer electronics

- 8.5 Information technology

- 8.6 Healthcare

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Avago Technologies

- 10.2 Broadcom Inc.

- 10.3 Cree Inc.

- 10.4 Hamamatsu Photonics

- 10.5 Kyocera Corporation

- 10.6 LG Innotek

- 10.7 Lumileds

- 10.8 Luminit

- 10.9 Nichia Corporation

- 10.10 ON Semiconductor

- 10.11 Osram Licht AG

- 10.12 Panasonic Corporation

- 10.13 Renesas Electronics

- 10.14 Rohm Semiconductor

- 10.15 Samsung Electronics

- 10.16 Sharp Corporation

- 10.17 Sony Corporation

- 10.18 STMicroelectronics

- 10.19 Texas Instruments

- 10.20 Toshiba Corporation