|

市场调查报告书

商品编码

1631601

欧洲光电:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Optoelectronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

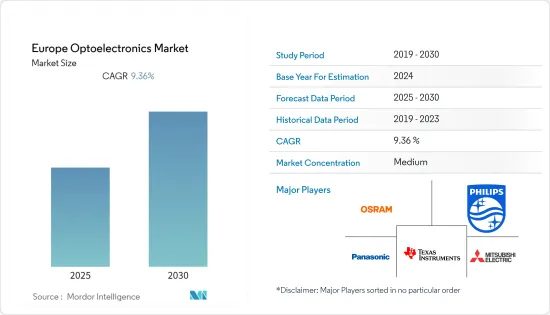

预计欧洲光电市场预测期内复合年增长率为9.36%

主要亮点

- 地方政府对启动子发现计画的更多参与增强了许多半导体导向产业,这些产业得到了高度技术互联环境的支持。例如,德国政府承诺在2020年将研究公司数量增加到2万家,创新企业数量增加到14万家。

- 根据德国贸易投资署统计,德国电子电气相关企业生产超过10万种电子产品和系统,包括自动化系统、电子医疗设备、汽车电子和微电子元件等。

- 在汽车行业,OEM专注于开发下一代电动和自动驾驶汽车。英国正在鼓励采用自动驾驶汽车。该计划旨在创建一个先进的环境来测试自动驾驶和联网汽车,包括紧急车辆警告(EVW)、道路作业警告(RWW)、紧急电子煞车灯(EEBL)、交通状况警告(TCW)等技术。

- 此外,英国是欧盟(EU)外国直接投资的主要目的地,在高科技领域的份额不断增加。设计和製造方面的丰富专业知识,加上策略性和商业友善环境,意味着英国照明产业透过联合研究和直接投资为企业提供了重要的投资机会。

- COVID-19 的爆发影响了世界各地汽车产业的生产设施。 COVID-19在欧洲国家的疫情影响了该地区的汽车产业。西班牙、俄罗斯、英国、义大利、法国和德国是继美国之后受影响最严重的国家,前所未有的国家封锁给该地区境况不佳的汽车产业带来了新的压力。

欧洲光电市场趋势

汽车产业推动市场成长

- 由于全球经济状况改善、生活方式改变、中阶不断壮大以及消费者可支配收入增加,全球对豪华和超豪华汽车的需求不断增加。在汽车中,光电器件可用于乘员检测、驾驶员疲劳检测、夜视、光学防盗系统和远端无钥匙进入。

- 光电技术越来越多地应用于汽车中,以实现照明和煞车等车辆功能的自动化。此外,光电技术越来越多地被纳入车辆安全系统中,例如使用主动或被动红外线系统的夜视系统,以提高驾驶人在前灯无法到达的区域或危险驾驶情况下的视野。

- 汽车购买者最关心的是乘客和车辆的安全。世界各地监管机构的目标是让汽车更安全。随着大众对汽车安全意识的不断增强以及政府对安全功能的要求,光电技术作为汽车的标准配备提供了各种安全功能。 BMW的主动式转向头灯、梅赛德斯的多光束 LED 头灯是汽车行业中最好的头灯之一,可改善道路上的显示和能见度,使车辆更安全、乘客更舒适。

- 汽车光电市场预计将因 LED 的采用而受益匪浅。 LED 用于煞车灯、水坑灯、危险灯、警告灯等。全球汽车製造业的成长是推动全球汽车光电市场向前发展的原因之一。此外,巴西、中国和印度等新兴市场对豪华车的需求不断增长预计将推动市场扩张。

- 根据世界半导体贸易统计数据,2020年欧洲半导体销售收益达375.2亿美元,预计2021年将增加至454.5亿美元。

LED产业带动市场成长

- 欧洲是LED需求最有利的地区之一,预计在预测期内将维持其需求。这反映了德国、义大利和法国等国家严格的政府法规,例如能源绩效合约(EPC)。

- 工业研究津贴是德国在各个领域生产如此多先进和尖端产品的主要原因之一。德国政府的巨额支出是推动德国研究文化的标誌之一。然而,在寻找新方法、产品和应用方面,德国私营部门是主要投资者。研究文化以及政府补助和资金也推动了对光电子研究的需求。巴伐利亚拥有超过 500 家光学技术领域的公司,因此成为德国第一大位置。

- 在德国,欧盟 (EU) 照明相关法规的变化正在推动住宅和商业应用对 LED 照明解决方案的需求。 2018年,欧盟(EU)宣布禁止使用低效率灯、卤素灯和灯泡。

- 自2011年以来,德国光电产业每年持续成长。德国约有20家中型本土製造业生产光电元件和产品。这些公司服务于国内外各种行业,包括精密工具、光学检测系统、雷射技术、测量和控制技术、航太和医疗技术。

- Ficosa 子公司 Adasens Automotive、Agfa-Gevaert HealthCare、Sill Optik、Osram Opto Semiconductors、Menlo Systems 和 Toptica Photonics 等主要企业的总部均位于德国。光学技术的重点地区是慕尼黑-奥格斯堡、埃尔兰根-纽伦堡和雷根斯堡。

欧洲光电产业概况

随着 Osram Licht AG、Koninklijke Philips NV、 伙伴关係 Corporation、Texas Instruments Inc. 和 Stanley Electric Co. 的出现,光电子市场上的竞争公司之间的竞争持续加剧。在发展并显着提高市场占有率。

- 2021 年 7 月 - Volpi 是美国和瑞士开展业务的主要企业之一,与荷兰 TOPIC Embedded Systems 合作,扩大其光电测量解决方案组合,并进一步推动其数位化倡议。产品开发已经开始,Volpi 和 TOPIC 正在积极就客户合约进行合作。

- 2021 年 2 月 - 东芝电子欧洲有限公司宣布其广泛的光电产品组合中新增产品。 TLP241 Bisa 高电流光继电器适用于可程式逻辑控制器 (PLC) 和 I/O 介面等工业设备,以及 HVAC(暖气、通风和空调)等大楼自动化系统。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19市场评估

第五章市场动态

- 市场驱动因素

- 对智慧家用电子电器和下一代技术的需求不断增长

- 增加工业技术的使用

- 市场限制因素

- 製造加工成本高

第六章 市场细分

- 依零件类型

- LED

- 雷射二极体

- 影像感测器

- 光耦合器

- 太阳能电池

- 其他零件类型

- 按最终用户产业

- 车

- 航太/国防

- 家用电子电器

- 资讯科技

- 医疗保健

- 住宅/商业

- 工业

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 其他国家

第七章 竞争格局

- 公司简介

- Osram Licht AG

- Koninklijke Philips NV

- Panasonic Corporation

- Texas Instruments Inc.

- Stanley Electric Co.

- Mitsubishi Electric

- Infineon Technologies AG

- On Semiconductor

- Maxim Integrated

- Analog Devices GmbH

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 72188

The Europe Optoelectronics Market is expected to register a CAGR of 9.36% during the forecast period.

Key Highlights

- The increasing involvement of regional government in promoter search programs has enhanced many semiconductors-oriented industries, and it is supported by high technology connectivity environment. For instance, the German Government is committed to increasing the number of research companies to 20,000 and innovative companies to 140,000 by the year 2020.

- According to Germany Trade & Invest, Germany's electronics, and electrical companies manufacture more than 100 thousand different electronic products and systems, ranging from automation systems, electronic medical equipment, automotive electronics, and microelectronic components.

- In the automotive industry, OEMs have been focusing on developing the next generation of electrified, autonomous vehicles. The United Kingdom is encouraging the adoption of autonomous cars. The UK government also funded GBP 100 million to the UK Connected Intelligence Transport Environment(UKCITE), a project that aims to create an advanced environment for testing autonomous and connected vehicles, which include technologies, such as emergency vehicle warning(EVW), road works warning(RWW), emergency electronic brake light(EEBL), and traffic condition warning(TCW).

- Furthermore, the United Kingdom is the leading destination for foreign direct investment into the European Union, with a growing proportion coming in high technology sectors. With the significant expertise in design and manufacturing, combined with policy and a business-friendly environment, the United Kingdom lighting industry offer significant investment opportunities to businesses through collaboration and direct investment.

- The outbreak of COVID-19 affected the production facilities of automotive industries across the globe. COVID-19 outbreak in European countries affected the automobile industry in the region. Spain, Russia,United Kingdom, Italy, France, and Germany is the worst-affected country after the UnitedStates, and the unprecedented lockdown of the country has heaped fresh pressure on thee region's ailing car sector.

Europe Optoelectronics Market Trends

Automobile Industry to Drive the Market Growth

- The improving global economic conditions, changing lifestyle, rising middle class, and increase in the disposable income of the consumers have increased the demands of sales of luxury and ultra-luxury cars across the globe. In a vehicle, optoelectronics devices can be used for occupant detection, drowsy driver detection, night vision, optical immobilizer, and remote keyless entry.

- Optoelectronics are increasingly being used in automobiles to automate vehicle functions such as lighting and brakes. Furthermore, optoelectronic is gradually being included in vehicle safety systems such as night vision systems, which use active or passive infrared systems to improve the distance a driver can see beyond the reach of headlights or in hazardous driving circumstances.

- Vehicle buyers' primary concern is the safety of the passengers and the vehicle. The goal of regulatory authorities all around the world is to increase automobile safety. Because of raising public awareness of vehicle safety and government demands for safety features, Optoelectronics is now offering a variety of safety features as standard equipment in automobiles. BMW Adaptive Headlights, Mercedes Multibeam LED headlights are one of the best headlights available in the automobile industry, this improves the display and visibility on road, thus making the vehicle more secure and safer for the passengers.

- The Automotive Optoelectronic market is expected to benefit considerably from the adoption of LEDs. They're utilised for things like brake lights, puddle lights, hazard lights, and warning lights, among other things. Growing automotive manufacturing around the world is one of the reasons driving the global Automotive Optoelectronic market forward. Furthermore, rising demand for luxury cars in developing nations such as Brazil, China, and India would propel market expansion.

- According to the world semiconductor Trade Statistics In 2020, revenue from the sale of semiconductors in Europe reached 37.52 billion U.S. dollars, with forecasts projecting it will rise to 45.45 billion U.S. dollars in 2021.

LED Industry to drive the Market Growth

- Europe is one of the most lucrative regions for the LED demand and is expected to maintain the demand over the forecast period. This is a reflection of stringent government regulations such as energy performance contracting(EPC) in countries such as Germany, Italy, and France, among others.

- Industrial Research funding is one of the major reasons why Germany has so many advanced and cutting edge products let it be any field. The massive spending by the German government is one of the prominent features that fuels up the research culture in Germany. However, the German private sector is the main investor when it comes to looking for new methods, products, and applications. The Research culture and subsidies and funds by the government fuel the Optoelectronics Research needs also. Therefore, with more than 500 companies in the field of optical technologies, Bavaria is the number one location in Germany.

- Germany has been experiencing growth in demand for LED lighting solutions both for residential and commercial applications due to change in European Union regulations related to lighting. In 2018, European Union banned the use of less efficient light, halogen light bulbs, as a part of the final stage of the European Union energy rules directive (EC244/2009) with the aim of improving energy efficiency and cutting the carbon footprint across the region.

- Since 2011, Germany's photonics industry has been growing every year. there are around 20 medium sized, local manufacturing company in Germany that are manufacturing Optoelectronics components and products. They cater a variety of industries such as precision tools, optical inspection systems, laser technology, measurement and control technology, aerospace, medical technology, etc. both locally and International.

- Key international players such as Ficosa subsidiary Adasens Automotive, Agfa-Gevaert HealthCare, Sill Optik, Osram Opto Semiconductors, Menlo Systems and Toptica Photonics all have sites in Germany. The regional focus areas for optical technologies are Munich-Augsburg, Erlangen-Nuremberg and Regensburg.

Europe Optoelectronics Industry Overview

The competitive rivalry in the optoelectronics market is high owing to the presence of major players like Osram Licht AG, Koninklijke Philips NV, Panasonic Corporation, Texas Instruments Inc., Stanley Electric Co., and many more. Strategic partnerships and mergers and acquisitions have allowed the companies to grow and gain a substantial amount of market share and maintaining a strong foothold in the market.

- July 2021- Volpi, one of the prominent players in optoelectronics with operations in the United States and Switzerland, has partnered with Netherlands-based TOPIC Embedded Systems to expand its portfolio of optoelectronic measurement solutions and further advance its digital initiatives. Product development is already underway and Volpi and TOPIC are actively collaborating on the client engagements.

- February 2021 - Toshiba Electronics Europe GmbH announced a new addition to its expansive optoelectronics portfolio. The TLP241 Bisahigh-current Photorelay, targeted at use in industrial equipment, such as programmable logic controllers(PLCs) and I/O interfaces, as well as building automation systems like HVAC(heating,ventilation,andairconditioning).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Smart Consumer Electronics and Next-generation Technologies

- 5.1.2 Increasing Industrial Applications of the Technology

- 5.2 Market Restraints

- 5.2.1 High Manufacturing and Fabricating Costs

6 MARKET SEGMENTATION

- 6.1 By Component type

- 6.1.1 LED

- 6.1.2 Laser Diode

- 6.1.3 Image Sensors

- 6.1.4 Optocouplers

- 6.1.5 Photovoltaic Cells

- 6.1.6 Other Component Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Consumer Electronics

- 6.2.4 Information Technology

- 6.2.5 Healthcare

- 6.2.6 Residential and Commercial

- 6.2.7 Industrial

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Osram Licht AG

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Panasonic Corporation

- 7.1.4 Texas Instruments Inc.

- 7.1.5 Stanley Electric Co.

- 7.1.6 Mitsubishi Electric

- 7.1.7 Infineon Technologies AG

- 7.1.8 On Semiconductor

- 7.1.9 Maxim Integrated

- 7.1.10 Analog Devices GmbH

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219