|

市场调查报告书

商品编码

1721517

电动车母线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

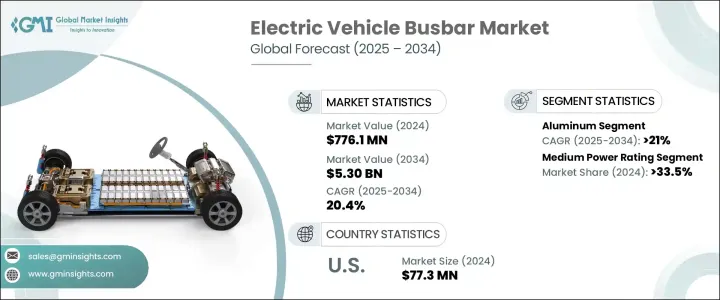

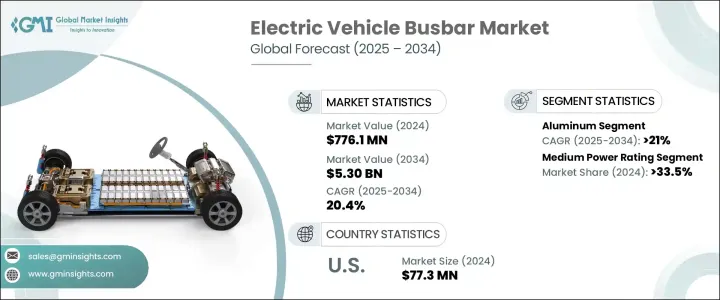

2024 年全球电动车母线市场价值为 7.761 亿美元,预计到 2034 年将以 20.4% 的复合年增长率成长,达到 53 亿美元。电动车普及率的快速成长推动了对高效配电系统的强劲需求,而母线正在成为这一转变中的关键组成部分。随着汽车产业向电气化转变,母线因其能够确保简化的电力传输和最佳的能源效率而在电动车电池系统中变得不可或缺。随着电动车在全球范围内受到环境法规、燃油经济性目标和碳中和承诺的推动,汽车製造商正在整合需要高性能母线的更先进的电气系统。由于电池结构和车辆设计的技术快速进步,以及电动车製造规模的持续努力,市场也正在经历成长的动力。此外,电动车基础设施的扩张,特别是快速充电网路的扩张,继续推动对能够承受高电压和极端温度的先进母线解决方案的需求。

全球范围内电动车充电站安装量的不断增加对扩大电动车母线市场发挥关键作用。这些组件对于管理高压电力传输至关重要,尤其是在目前需求量大的超快速充电系统中。随着电动车的普及,对快速、可靠和高效充电装置的需求也在增长,这进一步提升了对强大的母线技术的需求,这种技术可以增强电流流动,同时最大限度地减少能量损失。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.761亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 20.4% |

市场依材料细分,主要分为铜和铝。铝母线预计到 2034 年将实现 21% 的复合年增长率,这得益于其重量轻和成本优势,使其成为重量和可负担性至关重要的紧凑型电动车车型的理想选择。同时,铜母线凭藉其优异的导电性和热性能在豪华和高性能电动车中占据主导地位。这些特性使得铜成为功率密度和能源效率至关重要的应用中的必不可少的材料。

依功率等级划分,市场包括低、中、高三个类别。 2024 年,中等功率部分占 33.5% 的份额,这得益于对快速加速、快速充电和可靠能源输送的电动跑车和高端汽车的需求不断增长。随着电池设计的创新和消费者对高端电动车兴趣的不断增加,这一领域有望实现稳步增长。

2024 年,美国电动车母线市场产值为 7,730 万美元。通货膨胀削减法案 (IRA) 是推动这一增长的关键因素,该法案通过对使用母线等国产零件的汽车提供税收优惠,推动了电动车的需求。这项政策正在推动製造商投资美国製造的先进、高效的母线系统,进一步增强美国在全球电动车供应链中的地位。

全球电动车母线市场的主要参与者包括西门子、施耐德电气、泰科电子、美尔森、英飞凌科技股份公司、罗格朗、力特尔菲斯公司、安费诺公司、三菱电机公司、魏德米勒介面有限公司、EAE 集团、EG 电子、EMS 集团和罗杰斯公司。这些公司正在大力投资研发、扩大生产规模并建立策略合作伙伴关係,以提供适合下一代电动车的高性能母线系统。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依资料,2021 - 2034 年

- 主要趋势

- 铜

- 铝

第六章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 德国

- 法国

- 荷兰

- 英国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

The Global Electric Vehicle Busbar Market was valued at USD 776.1 million in 2024 and is estimated to grow at a CAGR of 20.4% to reach USD 5.3 billion by 2034. The rapid acceleration in electric vehicle adoption is fueling a robust demand for efficient power distribution systems, and busbars are emerging as a critical component in this transition. As the automotive sector shifts toward electrification, busbars are becoming indispensable in EV battery systems for their ability to ensure streamlined power transfer and optimal energy efficiency. With EVs gaining momentum globally-driven by environmental regulations, fuel economy goals, and carbon neutrality commitments-automakers are integrating more advanced electrical systems that require high-performance busbars. The market is also witnessing increased traction due to rapid technological advancements in battery architecture and vehicle design, as well as ongoing efforts to scale EV manufacturing. Furthermore, the expansion of EV infrastructure, particularly in fast-charging networks, continues to boost demand for advanced busbar solutions that can withstand high voltage and extreme temperatures.

The rising installation of EV charging stations globally plays a key role in expanding the electric vehicle busbar market. These components are vital for managing high-voltage power transfers, especially in ultra-fast charging systems, which are now in high demand. As EV adoption grows, so does the requirement for fast, reliable, and efficient charging setups-further elevating the need for robust busbar technologies that enhance current flow while minimizing energy losses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $776.1 Million |

| Forecast Value | $5.3 Billion |

| CAGR | 20.4% |

The market is segmented by material, primarily into copper and aluminum. Aluminum busbars are expected to witness a CAGR of 21% through 2034, owing to their lightweight nature and cost benefits, making them ideal for compact EV models where weight and affordability are critical. Meanwhile, copper busbars maintain dominance in luxury and high-performance EVs due to their superior conductivity and thermal performance. These attributes make copper an essential material in applications where power density and energy efficiency are paramount.

Segmented by power rating, the market includes low, medium, and high categories. The medium power rating segment held a 33.5% share in 2024, driven by rising demand for electric sports cars and high-end vehicles that require rapid acceleration, fast charging, and reliable energy delivery. With innovations in battery design and increasing consumer interest in premium EVs, this segment is poised to witness steady growth.

The U.S. Electric Vehicle Busbar Market generated USD 77.3 million in 2024. A key contributor to this growth is the Inflation Reduction Act (IRA), which has propelled EV demand through tax incentives for vehicles using domestically produced components like busbars. This policy is pushing manufacturers to invest in advanced, high-efficiency busbar systems made within the U.S., further enhancing the nation's role in the global EV supply chain.

Key players in the global EV busbar market include Siemens, Schneider Electric, TE Connectivity, Mersen SA, Infineon Technologies AG, Legrand, Littelfuse, Inc., Amphenol Corporation, Mitsubishi Electric Corporation, Weidmuller Interface GmbH & Co. KG, EAE Group, EG Electronics, EMS Group, and Rogers Corporation. These companies are heavily investing in R&D, scaling up production, and forming strategic partnerships to deliver high-performance busbar systems tailored to next-generation electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Brar Elettromeccanica SpA

- 8.3 EAE Group

- 8.4 EG Electronics

- 8.5 EMS Group

- 8.6 Infineon Technologies AG

- 8.7 Legrand

- 8.8 Littelfuse, Inc.

- 8.9 Mersen SA

- 8.10 Mitsubishi Electric Corporation

- 8.11 Rogers Corporation

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 TE Connectivity

- 8.15 Weidmuller Interface GmbH & Co. KG