|

市场调查报告书

商品编码

1721624

工业电锅炉市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

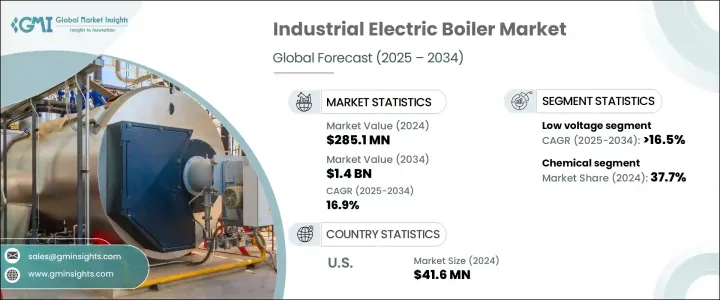

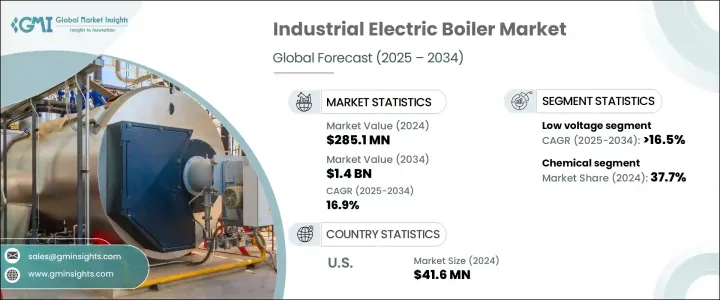

随着全球推动永续能源系统的势头增强,全球工业电锅炉市场价值在 2024 年将达到 2.851 亿美元,预计到 2034 年将以 16.9% 的强劲复合年增长率增长,达到 14 亿美元。各行各业正在迅速转向电加热系统,这主要是由于对节能解决方案的需求不断增长以及政府旨在加速清洁能源采用的倡议。这些趋势对电锅炉在各种工业环境中的部署增加做出了重大贡献。

不断发展的监管框架也鼓励企业重新考虑其供热基础设施。随着工业区对氮氧化物(NOx)和硫氧化物(SOx)的排放限制越来越严格,企业面临越来越大的压力,需要减少对传统燃料系统的依赖。电锅炉是一种更清洁、更环保的替代方案,符合脱碳目标,可在不影响营运效率的情况下提供显着的环境效益。技术进步,尤其是大容量设备的开发以及与人工智慧能源管理工具的集成,使得电锅炉成为更广泛工业应用的更可行、更具吸引力的选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.851亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 16.9% |

已开发经济体和新兴经济体工业化步伐的加速是推动市场向前发展的关键因素。能源基础设施升级的投资不断增加以及对永续製造流程的兴趣日益浓厚,进一步推动了这一成长。特别是,增加用于提高电锅炉性能和效率的研发支出发挥着至关重要的作用。这些发展与化学加工等产业的扩张相辅相成,在这些产业中,高容量、节能的加热至关重要。

工业电锅炉越来越被视为现代工业设施中必不可少的设备。它们依靠电力产生热量,从而无需燃烧以及由此产生的排放。这不仅有助于减少工业运作对环境的影响,而且还提供了更安静、更紧凑、维护更少的系统。这些特性引起了寻求可靠、无排放供暖技术的行业的更大兴趣。

重视清洁和安静操作的行业的需求明显增加。食品和饮料等行业也正在加剧电锅炉的足迹的扩大。同时,发电技术的进步和电网基础设施的改善为电锅炉的广泛应用提供了必要的支援。引入高产量且节省空间的设计是另一个关键发展,可提高空间受限的工业环境中的采用率。

市场依电压等级分为低压和中压部分。为了满足对成本稳定、高效供热系统日益增长的需求,共享工业供热网路的数量不断增加。这些网路正在推广使用电锅炉,特别是在希望减少长期能源支出的地区。预计到 2034 年,低压市场的复合年增长率将超过 16.5%。其强劲的成长轨迹主要归功于政府的支持性政策,例如对采用清洁能源的税收优惠,以及低压设备紧凑、易于维护的优势。

根据应用,市场包括食品和饮料、造纸、化学品、炼油厂等行业。化学领域占有最大份额,到 2024 年将占整个市场的 37.7%。化学製造设施的持续扩张,尤其是在发展中地区,对高效、环保的供暖系统产生了巨大的需求。公司青睐电锅炉,因为它们能够提供稳定的性能,同时满足严格的环境标准。

美国工业电锅炉市场呈现稳定成长,到 2024 年将达到 4,160 万美元,高于 2023 年的 3,640 万美元和 2022 年的 3,150 万美元。这一上升趋势受到清洁能源税收抵免范围不断扩大以及全球为促进工业电气化而做出的更广泛努力的推动。这些措施鼓励企业以电力替代品取代基于化石燃料的系统,进一步支持市场扩张。

预计到 2034 年,北美地区的市场复合年增长率将超过 21.5%。该地区强劲的表现得益于不断增长的工业活动、快速的技术创新以及旨在建立先进工业基础设施的公私合作伙伴关係。这些动态使北美成为全球电锅炉领域的关键参与者。

工业电锅炉市场有几家领先的製造商,以提供先进、高效的锅炉系统而闻名。其中包括 ALFA LAVAL、Acme Engineering Products、ACV、Babcock Wanson、Bosch Industriekessel、Cerney、Chromalox、Cleaver-Brooks、Danstoker A/S、Ecotherm Austria、FERROLI、Klopper-Therml、LACAs ENERGIES、PARHan Halvorsen、Pyneipeers. Boilers、Thermon、Thermona 和 Vapor Power。这些公司正在积极投资产品创新和节能解决方案,以满足全球对永续工业加热技术日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 川普政府关税对贸易和整体产业的影响

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依电压等级,2021 - 2034 年

- 主要趋势

- 低电压

- 中压

第六章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 10 百万英热单位/小时

- 10 - 50 百万英热单位/小时

- 50 - 100 百万英热单位/小时

- 100 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 食品和饮料

- 纸

- 化学

- 炼油厂

- 其他的

第八章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 热水

- 蒸气

第九章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第 10 章:市场规模与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 德国

- 俄罗斯

- 奥地利

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 菲律宾

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 埃及

- 奈及利亚

- 肯亚

- 摩洛哥

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

第 11 章:公司简介

- ALFA LAVAL

- Acme Engineering Products

- ACV

- Babcock Wanson

- Bosch Industriekessel

- Cerney

- Chromalox

- Cleaver-Brooks

- Danstoker A/S

- Ecotherm Austria

- FERROLI

- Klopper-Therm

- LACAZE ENERGIES

- PARAT Halvorsen AS

- Precision Boilers

- Reimers Electra Steam

- Ross Boilers

- Thermodyne Boilers

- Thermon

- Thermona

- Vapor Power

The Global Industrial Electric Boiler Market, valued at USD 285.1 million in 2024, is poised to grow at a robust CAGR of 16.9% to reach USD 1.4 billion by 2034, as the global push toward sustainable energy systems gathers momentum. Industries are rapidly shifting toward electric heating systems, largely due to the rising demand for energy-efficient solutions and government initiatives aimed at accelerating clean energy adoption. These trends are contributing significantly to the increased deployment of electric boilers in various industrial environments.

The evolving regulatory framework is also encouraging businesses to rethink their heating infrastructure. As emission limits for nitrogen oxides (NOx) and sulfur oxides (SOx) tighten in industrial zones, there is growing pressure on companies to reduce their reliance on conventional fuel-based systems. Electric boilers present a cleaner, greener alternative that aligns with decarbonization goals, offering significant environmental benefits without compromising operational efficiency. Technological advancements, especially in the development of high-capacity units and integration with AI-powered energy management tools, are making electric boilers a more viable and attractive option for a wider range of industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $285.1 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 16.9% |

The rising pace of industrialization across both developed and emerging economies is a key factor driving the market forward. This growth is further supported by rising investments in upgrading energy infrastructure and growing interest in sustainable manufacturing processes. In particular, increased R&D spending focused on improving electric boiler performance and efficiency is playing a crucial role. These developments are being complemented by the expansion of industries like chemical processing, where high-capacity, energy-efficient heating is essential.

Industrial electric boilers are increasingly viewed as essential equipment in modern industrial facilities. They rely on electricity to generate heat, eliminating the need for combustion and the resulting emissions. This not only helps reduce the environmental impact of industrial operations but also offers quieter, more compact systems that require less maintenance. These attributes are driving greater interest from sectors seeking reliable, emission-free heating technologies.

There is a noticeable increase in demand from industries that prioritize clean and silent operations. The food and beverage sector, among others, is contributing to the expanding footprint of electric boilers. In parallel, the evolution of power generation technologies and improvements in grid infrastructure are providing the necessary support for widespread electric boiler deployment. The introduction of high-output yet space-efficient designs is another key development enhancing adoption rates across space-constrained industrial settings.

The market is categorized by voltage rating into low voltage and medium voltage segments. A rising number of shared industrial heating networks are emerging as a response to the growing demand for cost-stable, efficient heating systems. These networks are promoting the use of electric boilers, particularly in areas looking to reduce long-term energy expenditures. The low voltage segment is expected to grow at a CAGR of over 16.5% through 2034. Its strong growth trajectory is largely attributed to supportive government policies, such as tax incentives for clean energy adoption, along with the benefits of low voltage units being compact and easy to maintain.

By application, the market includes industries such as food and beverages, paper, chemicals, refinery, and others. The chemical segment holds the largest share, accounting for 37.7% of the total market in 2024. The ongoing expansion in chemical manufacturing facilities, especially across developing regions, is creating significant demand for efficient, environmentally friendly heating systems. Companies are favoring electric boilers due to their ability to deliver consistent performance while meeting stringent environmental standards.

The U.S. industrial electric boiler market has demonstrated steady growth, reaching USD 41.6 million in 2024, up from USD 36.4 million in 2023 and USD 31.5 million in 2022. This upward trend is being fueled by an expanding range of clean energy tax credits and broader global efforts to promote industrial electrification. These initiatives are encouraging companies to replace fossil fuel-based systems with electric alternatives, further supporting market expansion.

Across the North America region, the market is projected to grow at a CAGR of over 21.5% through 2034. The region's strong performance can be linked to increasing industrial activity, rapid technological innovation, and public-private partnerships aimed at building advanced industrial infrastructure. These dynamics are positioning North America as a key player in the global electric boiler space.

The industrial electric boiler market features several leading manufacturers known for offering advanced and efficient boiler systems. These include ALFA LAVAL, Acme Engineering Products, ACV, Babcock Wanson, Bosch Industriekessel, Cerney, Chromalox, Cleaver-Brooks, Danstoker A/S, Ecotherm Austria, FERROLI, Klopper-Therm, LACAZE ENERGIES, PARAT Halvorsen AS, Precision Boilers, Reimers Electra Steam, Ross Boilers, Thermodyne Boilers, Thermon, Thermona, and Vapor Power. These companies are actively investing in product innovation and energy-efficient solutions to meet the growing global demand for sustainable industrial heating technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Impact of trump administration tariffs on trade & overall industry

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 < 10 MMBTU/hr

- 6.3 10 - 50 MMBTU/hr

- 6.4 50 - 100 MMBTU/hr

- 6.5 100 - 250 MMBTU/hr

- 6.6 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Paper

- 7.4 Chemical

- 7.5 Refinery

- 7.6 Others

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Dealer

- 9.4 Retail

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 France

- 10.3.2 UK

- 10.3.3 Poland

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Germany

- 10.3.7 Russia

- 10.3.8 Austria

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Philippines

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 Iran

- 10.5.3 UAE

- 10.5.4 Egypt

- 10.5.5 Nigeria

- 10.5.6 Kenya

- 10.5.7 Morocco

- 10.5.8 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Colombia

- 10.6.4 Chile

Chapter 11 Company Profiles

- 11.1 ALFA LAVAL

- 11.2 Acme Engineering Products

- 11.3 ACV

- 11.4 Babcock Wanson

- 11.5 Bosch Industriekessel

- 11.6 Cerney

- 11.7 Chromalox

- 11.8 Cleaver-Brooks

- 11.9 Danstoker A/S

- 11.10 Ecotherm Austria

- 11.11 FERROLI

- 11.12 Klopper-Therm

- 11.13 LACAZE ENERGIES

- 11.14 PARAT Halvorsen AS

- 11.15 Precision Boilers

- 11.16 Reimers Electra Steam

- 11.17 Ross Boilers

- 11.18 Thermodyne Boilers

- 11.19 Thermon

- 11.20 Thermona

- 11.21 Vapor Power