|

市场调查报告书

商品编码

1755374

低压工业电锅炉市场机会、成长动力、产业趋势分析及2025-2034年预测Low Voltage Industrial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

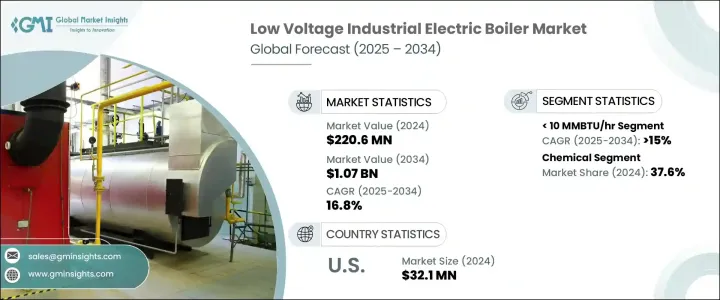

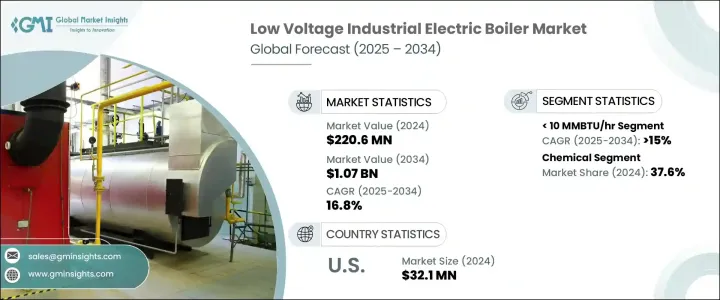

2024年,全球低压工业电锅炉市场规模达2.206亿美元,预计复合年增长率将达16.8%,2034年将达到10.7亿美元。在政府扶持清洁能源系统发展的激励措施的支持下,对节能供暖解决方案的需求日益增长,这正在重塑工业格局。随着脱碳政策的日益重视以及严格排放标准(尤其是工业园区硫氧化物 (SOx) 和氮氧化物 (NOx) 排放标准)的不断提高,这一转变趋势进一步加剧。随着能源成本的上升和环境法规的不断加强,各行各业都优先考虑更清洁、更有效率的暖气系统,以保持合规并降低营运成本。

推动这一势头的另一个因素是人工智慧与工业加热应用的整合。人工智慧驱动的优化正在提升电锅炉的性能和能源效率,使其成为现代工业营运的首选。同时,重点地区对永续基础设施和能源现代化的加大投资,也为市场扩张注入了新的动力。工业用户也投入资源进行研发,以提高电锅炉的性能、安全性和自动化程度,从而创造更多成长机会。永续性在製造和加工环境中的重要性日益提升,这促使企业探索能够实现低排放、相容再生能源并简化与现有营运整合的系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.206亿美元 |

| 预测值 | 10.7亿美元 |

| 复合年增长率 | 16.8% |

低压工业电锅炉专为利用电能产生蒸汽或热水而设计,可实现极低的排放和极高的能源效率。它们与再生能源电网相容,并符合新兴的自动化和安全标准,非常适合现代工业运作。先进的工业设计要求不断发展,对精密设计、可扩展系统的需求正在推动其采用率的提高。这些锅炉不仅具有长期成本效益,而且符合更广泛的永续发展目标,使各行各业能够在不牺牲性能或可靠性的情况下减少碳足迹。

就容量细分而言,市场分为10 MMBTU/小时、10-50 MMBTU/小时、50-100 MMBTU/小时以及100 MMBTU/小时以上。暖气技术的快速创新以及能源价格的上涨,正促使各行各业采用更有效率、更具适应性的锅炉系统。预计到2034年,10 MMBTU/小时容量段的复合年增长率将超过15%。这些系统因其模组化、低安装成本、紧凑的占地面积和安静的运作而尤其受到中小型製造商的青睐。此外,对能源优化的日益关注和不断变化的环境法规,也促使各行各业越来越青睐这些低容量机组。

从应用角度来看,市场涵盖造纸、炼油、食品饮料、化学等多个领域。预计到2024年,化学工业将占据37.6%的市场。主要经济体对营运效率的日益重视以及对化学基础设施资本支出的增加,推动了对高性能电锅炉系统的需求。这些设备能够满足化学过程中常见的严格温度和压力要求,同时满足排放合规标准。

从区域来看,美国市场持续成长,预计2022年市场规模将达2,480万美元,2023年将达2,790万美元,2024年将达3,210万美元。联邦税收抵免政策促进了清洁能源转型(尤其是在工业领域),加上遵守全球减排框架,正在推动电加热工业系统的应用。这些倡议在塑造美国工业前景方面发挥关键作用,越来越多的行业正在升级现有系统,以达到现代能源和环境基准。

预计到2034年,北美市场将强劲扩张,复合年增长率预计将超过20%。该地区蓬勃发展的工业部门,加上持续的技术进步和有利的公私合作倡议,正在创造一个充满活力的成长环境。政府机构与私人企业在工业基础设施建设和扩展方面的策略合作,为电锅炉的推广应用创造了肥沃的土壤。

低压工业电锅炉市场的领导者包括大型製造商和技术公司,各自为锅炉技术和系统整合的进步做出了贡献。他们共同关注创新、能源效率和环保合规,这些都是产业长期成长策略的核心。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 10 百万英热单位/小时

- 10 - 50 百万英热单位/小时

- 50 - 100 百万英热单位/小时

- > 100 百万英热单位/小时

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 食品和饮料

- 纸

- 化学

- 炼油厂

- 其他的

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 热水

- 蒸气

第八章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 德国

- 俄罗斯

- 奥地利

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 菲律宾

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 埃及

- 奈及利亚

- 肯亚

- 摩洛哥

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

第十章:公司简介

- ALFA LAVAL

- Acme Engineering Products

- ACV

- Babcock Wanson

- Bosch Industriekessel

- Cerney

- Chromalox

- Cleaver-Brooks

- Danstoker A/S

- Ecotherm Austria

- FERROLI

- Klopper-Therm

- LACAZE ENERGIES

- PARAT Halvorsen AS

- Precision Boilers

- Reimers Electra Steam

- Ross Boilers

- Thermodyne Boilers

- Thermon

- Thermona

- Vapor Power

The Global Low Voltage Industrial Electric Boiler Market was valued at USD 220.6 million in 2024 and is estimated to grow at a CAGR of 16.8% to reach USD 1.07 billion by 2034. The increasing demand for energy-efficient heating solutions, backed by supportive government incentives for cleaner energy systems, is reshaping the industrial landscape. This shift is further amplified by the growing emphasis on decarbonization and the push to meet strict emission standards, particularly concerning sulfur oxides (SOx) and nitrogen oxides (NOx) in industrial zones. With rising energy costs and increasing environmental regulations, industries are prioritizing cleaner, more efficient heating systems to stay compliant and reduce operational costs.

Another factor driving this momentum is the integration of artificial intelligence into industrial heating applications. AI-driven optimization is enhancing the performance and energy efficiency of electric boilers, making them a preferred choice for modern industrial operations. In tandem with this, heightened investments in sustainable infrastructure and energy modernization across key regions are adding further fuel to market expansion. Industrial users are also channeling resources into research and development to enhance electric boiler performance, safety, and automation, creating additional growth opportunities. The rising importance of sustainability in manufacturing and processing environments is compelling firms to explore systems that offer low emissions, compatibility with renewable sources, and simplified integration into existing operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $220.6 Million |

| Forecast Value | $1.07 Billion |

| CAGR | 16.8% |

Low voltage industrial electric boilers are specifically engineered to generate steam or hot water using electric energy, delivering minimal emissions and high energy efficiency. Their compatibility with renewable energy grids and compliance with emerging automation and safety standards make them well-suited for modern industrial operations. Advanced industrial design requirements continue to evolve, and the need for precision-engineered, scalable systems is contributing to higher adoption rates. These boilers are not only cost-effective in the long term but also align with broader sustainability goals, allowing industries to reduce their carbon footprint without sacrificing performance or reliability.

In terms of capacity segmentation, the market is categorized into 10 MMBTU/hr, 10-50 MMBTU/hr, 50-100 MMBTU/hr, and above 100 MMBTU/hr. The rapid pace of innovation in heating technology, alongside increasing energy prices, is encouraging industries to adopt more efficient and adaptable boiler systems. The 10 MMBTU/hr capacity segment is anticipated to expand at a CAGR of over 15% through 2034. These systems are particularly favored by small and mid-sized manufacturers due to their modularity, low installation costs, compact footprint, and silent operation. Moreover, the rising focus on energy optimization and changing environmental regulations is contributing to the growing preference for these lower-capacity units across various industries.

From an application standpoint, the market includes segments such as paper, refinery, food and beverages, chemical, and others. The chemical sector is projected to hold a significant market share of 37.6% in 2024. A growing emphasis on operational efficiency and increased capital spending on chemical infrastructure in leading economies is driving demand for high-performance electric boiler systems. These units support the stringent temperature and pressure requirements typical in chemical processing while meeting emission compliance standards.

In regional terms, the market in the United States has demonstrated consistent growth, with values estimated at USD 24.8 million in 2022, USD 27.9 million in 2023, and USD 32.1 million in 2024. Federal tax credits promoting clean energy transition, especially in industrial sectors, combined with adherence to global emission reduction frameworks, are encouraging the adoption of electric industrial heating systems. These efforts are playing a pivotal role in shaping the industry outlook in the U.S., with more industries upgrading their existing systems to meet modern energy and environmental benchmarks.

North America, as a whole, is expected to witness strong market expansion with a projected CAGR of over 20% through 2034. The region's booming industrial sector, coupled with continuous technological advancements and favorable public-private initiatives, is fostering a dynamic growth environment. Strategic collaborations between government bodies and private enterprises for the development and expansion of industrial infrastructure are creating fertile ground for the increased deployment of electric boilers.

Leading players in the low voltage industrial electric boiler market include major manufacturers and technology firms, each contributing to the advancement of boiler technologies and system integration. Their collective focus remains on innovation, energy efficiency, and environmental compliance, which are all central to the industry's long-term growth strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 50 MMBTU/hr

- 5.4 50 - 100 MMBTU/hr

- 5.5 > 100 MMBTU/hr

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Paper

- 6.4 Chemical

- 6.5 Refinery

- 6.6 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Hot water

- 7.3 Steam

Chapter 8 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Dealer

- 8.4 Retail

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 ALFA LAVAL

- 10.2 Acme Engineering Products

- 10.3 ACV

- 10.4 Babcock Wanson

- 10.5 Bosch Industriekessel

- 10.6 Cerney

- 10.7 Chromalox

- 10.8 Cleaver-Brooks

- 10.9 Danstoker A/S

- 10.10 Ecotherm Austria

- 10.11 FERROLI

- 10.12 Klopper-Therm

- 10.13 LACAZE ENERGIES

- 10.14 PARAT Halvorsen AS

- 10.15 Precision Boilers

- 10.16 Reimers Electra Steam

- 10.17 Ross Boilers

- 10.18 Thermodyne Boilers

- 10.19 Thermon

- 10.20 Thermona

- 10.21 Vapor Power