|

市场调查报告书

商品编码

1740772

真空密封蔬菜市场机会、成长动力、产业趋势分析及2025-2034年预测Vacuum Sealed Vegetables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

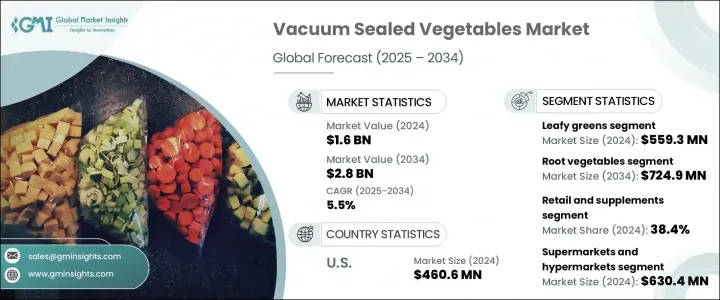

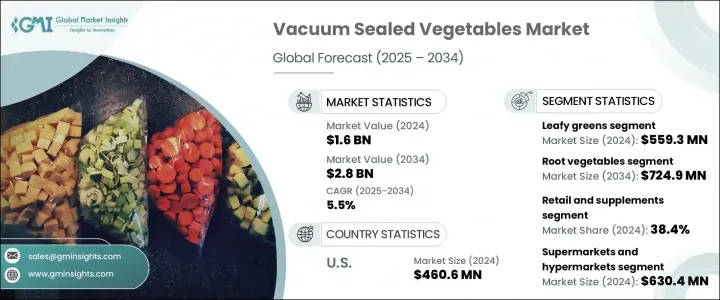

2024年,全球真空密封蔬菜市场规模达16亿美元,预计到2034年将以5.5%的复合年增长率增长,达到28亿美元,这得益于人们对便捷、营养丰富、保质期长的食品日益增长的需求。随着城市生活节奏的加快,消费者越来越青睐即食蔬菜,既能保持新鲜,又能兼顾营养价值。真空密封因其无需依赖合成添加剂,即可锁住蔬菜的风味、口感和营养成分,成为一种广受欢迎的保鲜方法。与冷冻或罐装不同,真空密封能够使蔬菜保持天然新鲜,因此对于追求更健康替代品的清洁标籤爱好者来说,真空密封无疑是理想之选。

向植物性饮食的转变、对健康饮食习惯日益增长的兴趣以及对减少食物浪费意识的不断增强,进一步增强了真空密封蔬菜的吸引力。随着永续性和清洁饮食成为主流,製造商看到了满足环保和健康消费者需求的巨大机会。智慧包装技术的演变、可生物降解材料的进步以及线上购物趋势的增强,预计将在未来十年扩大市场成长。真空密封蔬菜不仅有助于减少腐败、延长保质期,还能实现更大范围的目标,即最大限度地减少对环境的影响并促进理性消费。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 5.5% |

蔬菜市场依种类划分,例如绿叶蔬菜、十字花科蔬菜、根茎类蔬菜等。 2024年,绿叶蔬菜市场价值达5.593亿美元,反映出消费者对高维生素含量和天然较短的保质期的强烈兴趣。真空密封技术可有效延长绿叶蔬菜的保鲜期,防止营养流失、脱水和变质。追求营养便利饮食的忙碌消费者越来越多地选择真空密封的蔬菜,因为它们既能保证品质、口味,又能方便食用。这类蔬菜的市场持续成长,尤其是在註重健康的个人和寻求实用饮食准备解决方案的家庭群体中。

从应用角度来看,市场分为食品加工、餐饮和食品服务、零售和补充剂以及其他领域。零售和补充剂领域在2024年占据了38.4%的市场份额,预计到2034年将以5.2%的复合年增长率稳步增长。这一领域受益于消费者对符合清洁饮食趋势的天然、无防腐剂食品的日益增长的偏好。零售商正在健康食品商店、线上市场和传统零售店拓展其真空密封蔬菜产品线,以满足消费者对便利健康食品日益增长的期望。

2024年,北美真空密封蔬菜市场规模达4.606亿美元,这得益于繁忙的都市生活方式、更高的可支配收入以及对健康省时食品日益增长的需求。该地区的消费者寻求即食蔬菜,以最大限度地保持新鲜,并最大限度地减少烹饪时间。餐盒、植物性饮食和清洁零食等趋势正在推动真空密封蔬菜的普及,而气调包装和可回收真空材料等创新技术则解决了永续性问题。

全球真空密封蔬菜市场的领导者包括 Mondi Group、Sealed Air Corporation、Amcor plc、Multivac 和 Berry Global Inc.。这些公司正在投资尖端包装解决方案、可持续材料和延长保质期的技术。与零售商的策略合作伙伴关係以及积极的数位行销活动正在帮助他们扩大业务范围,而新产品创新和自有品牌产品则继续迎合不断变化的饮食趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对不含防腐剂、营养丰富的食品的需求不断增加。

- 人们对简便、保质、即食食品的需求日益增长。

- 真空密封可保持新鲜度并延长蔬菜的保质期。

- 产业陷阱与挑战

- 冷冻和罐装是经济有效的保存方法。

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按蔬菜类型,2021 - 2034 年

- 主要趋势

- 绿叶蔬菜

- 根茎类蔬菜

- 十字花科蔬菜

- 其他(豆类等)

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 零售和补充品

- 食品加工

- 餐饮及食品服务

- 其他(餐包等)

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 网上销售

- 超市和大卖场

- 专卖店

- 批发分销商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor Limited

- Berry Global Inc.

- Bosch Packaging Technology

- Coveris Holdings SA

- Mondi Group

- MULTIVAC

- Orics Industries, Inc.

- Sealed Air Corporation

- ULMA Packaging

- Winpak Ltd.

The Global Vacuum Sealed Vegetables Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.8 billion by 2034, driven by the surging demand for convenient, nutrient-rich, and long-lasting food options. As urban lifestyles become more fast-paced, consumers are prioritizing ready-to-use vegetables that offer freshness without compromising nutritional value. Vacuum sealing stands out as a preferred method of preservation because it locks in flavor, texture, and nutrients without relying on synthetic additives. Unlike freezing or canning, vacuum sealing keeps vegetables naturally fresh, making it ideal for clean-label enthusiasts who seek healthier alternatives.

The shift toward plant-based diets, rising interest in wellness-focused eating habits, and growing awareness about food waste reduction further strengthen the appeal of vacuum-sealed vegetables. With sustainability and clean eating becoming mainstream priorities, manufacturers are seeing tremendous opportunities to cater to eco-conscious and health-driven consumers. The evolution of smart packaging technologies, advancements in biodegradable materials, and heightened online grocery shopping trends are expected to amplify market growth over the next decade. Vacuum-sealed vegetables not only support reduced spoilage and longer shelf life but also address the broader goals of minimizing environmental impact and promoting mindful consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.5% |

The market is categorized by vegetable types such as leafy greens, cruciferous vegetables, root vegetables, and others. The leafy greens segment captured a market value of USD 559.3 million in 2024, reflecting strong consumer interest driven by high vitamin content and naturally short shelf lives. Vacuum sealing effectively extends the freshness of leafy greens, preventing nutrient loss, dehydration, and spoilage. Busy consumers who prioritize nutritious, low-effort meal solutions are increasingly choosing vacuum-sealed greens that guarantee quality, taste, and convenience. This category continues to gain momentum, particularly among health-conscious individuals and families seeking practical meal prep solutions.

In terms of application, the market is divided into food processing, catering and food services, retail and supplements, and others. The retail and supplements segment accounted for 38.4% of the market share in 2024 and is projected to grow steadily at a CAGR of 5.2% through 2034. This segment benefits from a heightened preference for natural, preservative-free foods that align with clean eating trends. Retailers are expanding their vacuum-sealed vegetable product lines across health food stores, online marketplaces, and traditional retail outlets to meet rising consumer expectations for convenient, healthy foods.

North America Vacuum Sealed Vegetables Market generated USD 460.6 million in 2024, fueled by busy urban lifestyles, higher disposable incomes, and increasing demand for health-centric, time-saving food options. Consumers across the region seek ready-to-use vegetables that offer maximum freshness with minimal preparation. Trends like meal kits, plant-based diets, and clean snacking are driving greater adoption of vacuum-sealed vegetables, while innovations such as modified atmosphere packaging and recyclable vacuum materials address sustainability concerns.

Top players in the Global Vacuum Sealed Vegetables Market include Mondi Group, Sealed Air Corporation, Amcor plc, Multivac, and Berry Global Inc. These companies are investing in cutting-edge packaging solutions, sustainable materials, and extended shelf-life technologies. Strategic partnerships with retailers and aggressive digital marketing efforts are helping them expand their footprint, while new product innovations and private-label offerings continue to cater to evolving dietary trends.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for preservative-free, nutrient-rich food options.

- 3.6.1.2 Growing need for easy, long-lasting, ready-to-use food products.

- 3.6.1.3 Vacuum sealing preserves freshness and extends vegetable longevity.

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Freezing and canning offer cost-effective preservation options.

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Vegetable Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Leafy greens

- 5.3 Root vegetable

- 5.4 Cruciferous vegetables

- 5.5 Others (Legumes and etc)

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Retail & supplements

- 6.3 Food processing

- 6.4 Catering & food services

- 6.5 Others (Meal kits & etc)

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online sales

- 7.3 Supermarkets & hypermarkets

- 7.4 Speciality stores

- 7.5 Wholesale distributors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor Limited

- 9.2 Berry Global Inc.

- 9.3 Bosch Packaging Technology

- 9.4 Coveris Holdings S.A.

- 9.5 Mondi Group

- 9.6 MULTIVAC

- 9.7 Orics Industries, Inc.

- 9.8 Sealed Air Corporation

- 9.9 ULMA Packaging

- 9.10 Winpak Ltd.