|

市场调查报告书

商品编码

1766318

真空包装机市场机会、成长动力、产业趋势分析及2025-2034年预测Vacuum Packing Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

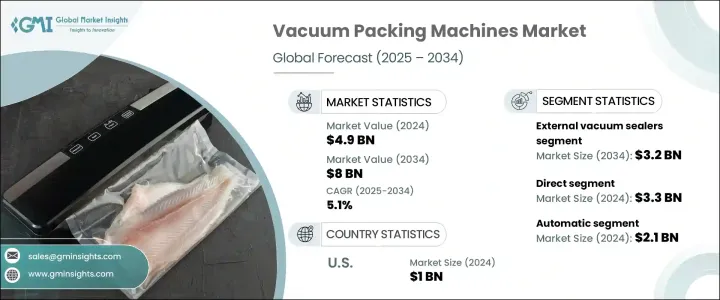

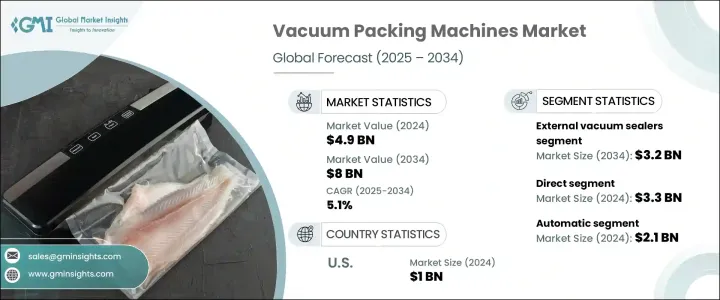

2024年,全球真空包装机市场规模达49亿美元,预计到2034年将以5.1%的复合年增长率成长,达到80亿美元。市场扩张的主要动力源于人们对延长保质期和减少食品浪费日益增长的需求。随着消费者对新鲜预包装食品的需求不断增长,包装技术也不断发展。真空密封製程可以消除氧气,减缓食品腐败,并保护易腐烂产品的完整性。随着对减少浪费和维持食品品质的重视,即食食品、乳製品和肉类等行业正在采用先进的真空解决方案。

此外,全球食品贸易和电子商务的兴起,也增加了对能够承受长途运输的安全包装的需求。真空包装在保持品质、防止污染和避免氧化方面发挥着至关重要的作用。随着人们的购买习惯转向更多包装产品,真空密封在维护长距离供应链中的产品安全方面的作用变得更加关键。出口商和食品配送平台现在更加关注产品的包装方式,尤其是在温度敏感性和腐败风险较高的情况下,以确保食品无论距离多远都能保持最佳状态。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 80亿美元 |

| 复合年增长率 | 5.1% |

2024年,外部真空封口机市场规模达19亿美元,预计2034年将达32亿美元。该市场凭藉其经济实惠、操作简便以及在小规模包装环境中的适应性而占据主导地位。这类机器广泛应用于食品相关行业的中小型企业,能够有效率地去除空气并进行密封,且无需复杂的设定。它们在紧凑空间中的实用性以及便携性和设计的持续改进,也使其在店内和家用领域都颇具吸引力。随着减少食品变质和延长保鲜期的需求不断增长,外部真空封口机仍然是关键的解决方案。使用者友善机型的改进也推动了它们日益普及,这些机型能够在各种环境下实现高效包装。

2024年,直接分销市场规模达33亿美元,预计2034年的复合年增长率将达到5.3%。由于这种方式能够实现生产商和买家之间的直接互动,因此仍然是全球范围内的首选。透过消除中间商,製造商可以更好地了解客户需求,提供专业协助,并提供对资本密集型设备至关重要的客製化解决方案。直销通路不仅可以提高供应商的利润率,还能支持技术合作、个人化咨询和长期服务协议,这些在製药、电子和食品加工等机械客製化较为普遍的行业中都至关重要。

2024年,北美真空包装机市场规模达10亿美元,预计2025年至2034年期间的复合年增长率将达到5.2%。美国凭藉其成熟的食品加工基础设施以及消费者对包装和方便食品日益增长的需求,继续保持领先地位。节能係统、自动化和智慧包装技术的创新正在提升机器性能,并使其与业界标准接轨。这些改进对于乳製品和海鲜等监管严格的行业尤其重要,因为包装的一致性对于合规性和产品安全至关重要。监管支援、技术创新以及不断变化的饮食习惯共同推动该地区的需求。

全球真空包装机市场的主要参与者包括 ULMA、Henkelman、Sammic、MULTIVAC、Cekoi、VC999、Echo、SELO、Koch、Promarks、AMAC、Orved、VAC-STAR、Fischbein 和 Henkovac。真空包装机市场的领先公司正在采取多项策略措施来巩固其市场地位。许多公司专注于研发,以创造技术先进、节能且结构紧凑的机器,以满足各行业的需求。战略伙伴关係和合作关係可以进入更广阔的市场并交流技术专长。一些公司正在透过直接和间接管道加强其全球分销网络,以覆盖更广泛的客户群。客製化已成为关键卖点,公司提供旨在满足特定客户要求的设备。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 外部真空封口机

- 单室

- 双腔

- 喷嘴

- 桌面

- 落地式

- 热成型机

- 托盘封口机

第六章:市场估计与预测:按自动化,2021-2034 年

- 主要趋势

- 手动的

- 半自动

- 自动的

第七章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 软包装

- 硬包装

- 贴体包装

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 食品和饮料

- 製药

- 消费品

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年,

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- AMAC

- Cekoi

- Echo

- Fischbein

- Henkelman

- Henkovac

- Koch

- MULTIVAC

- Orved

- Promarks

- Sammic

- SELO

- ULMA

- VAC-STAR

- VC999

The Global Vacuum Packing Machines Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8 billion by 2034. This market expansion is primarily driven by the increasing demand to extend shelf life and minimize food waste. As consumer demand increases for fresh, pre-packaged food options, packaging technologies continue to evolve. The vacuum sealing process eliminates oxygen, slowing spoilage and protecting the integrity of perishable products. With a heightened emphasis on minimizing waste and preserving food quality, industries such as ready-made meals, dairy, and meat are incorporating advanced vacuum solutions.

Additionally, the rise in global food trade and e-commerce has increased the necessity for secure packaging that can withstand extended transport. Vacuum packaging plays a critical role in maintaining quality, preventing contamination, and avoiding oxidation. As purchasing habits shift toward more packaged products, the role of vacuum sealing becomes even more critical in maintaining product safety across long-distance supply chains. Exporters and food delivery platforms now pay greater attention to how products are packed, especially when temperature sensitivity and spoilage risks are high, ensuring food arrives in prime condition regardless of distance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $8 Billion |

| CAGR | 5.1% |

The external vacuum sealers segment accounted for USD 1.9 billion in 2024 and is projected to reach USD 3.2 billion by 2034. This segment has gained dominance due to its affordability, operational simplicity, and adaptability in small-scale packaging environments. Widely utilized by small to mid-sized businesses in food-related operations, these machines are highly effective at air removal and sealing, all without the need for complex setup. Their practicality in compact spaces and continued improvements in portability and design have also made them appealing for in-store and residential use. As the demand for reducing spoilage and extending freshness rises, external vacuum sealers remain a key solution. Their growing popularity is also backed by advancements in user-friendly models that enable efficient packaging across a variety of settings.

The direct distribution segment was valued at USD 3.3 billion in 2024 and is anticipated to grow at a CAGR of 5.3% throughout 2034. This method remains the preferred choice globally due to the direct interaction it allows between producers and buyers. By eliminating intermediaries, manufacturers can better understand client needs, provide specialized assistance, and deliver tailor-made solutions essential for capital-intensive equipment. The direct sales channel not only boosts profit margins for suppliers but also supports technical engagement, personalized consultation, and long-term service agreements, all of which are critical in sectors such as pharmaceuticals, electronics, and food processing where machinery customization is common.

North America Vacuum Packing Machines Market was valued at USD 1 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2034. The United States continues to lead due to a mature food processing infrastructure and increasing consumer demand for packaged and convenient meals. Innovations in energy-efficient systems, automation, and smart packaging technologies are elevating machine capabilities and aligning with industry standards. These improvements are especially crucial for high-regulation sectors like dairy and seafood, where consistency in packaging is essential for compliance and product safety. The combination of regulatory support, technology innovation, and evolving food habits continues to drive demand in the region.

Some of the major players in the Global Vacuum Packing Machines Market include ULMA, Henkelman, Sammic, MULTIVAC, Cekoi, VC999, Echo, SELO, Koch, Promarks, AMAC, Orved, VAC-STAR, Fischbein, and Henkovac. Leading companies in the vacuum packing machines market are employing several strategic initiatives to reinforce their market positions. Many focus on research and development to create technologically advanced, energy-efficient, and compact machines that cater to various industries. Strategic partnerships and collaborations allow access to wider markets and the exchange of technological expertise. Several firms are enhancing their global distribution networks through both direct and indirect channels to reach a broader customer base. Customization has become a key selling point, with companies offering equipment designed to meet specific client requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Automation

- 2.2.4 Packaging type

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 External vacuum sealers

- 5.2.1 Single chamber

- 5.2.2 Double chamber

- 5.2.3 Nozzle

- 5.2.4 Tabletop

- 5.2.5 Floor-standing

- 5.3 Thermoforming machines

- 5.4 Tray sealing machines

Chapter 6 Market Estimates & Forecast, By Automation, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

Chapter 7 Market Estimates & Forecast, By Packaging type, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Flexible packaging

- 7.3 Rigid packaging

- 7.4 Skin packaging

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Consumer goods

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 The U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 AMAC

- 11.2 Cekoi

- 11.3 Echo

- 11.4 Fischbein

- 11.5 Henkelman

- 11.6 Henkovac

- 11.7 Koch

- 11.8 MULTIVAC

- 11.9 Orved

- 11.10 Promarks

- 11.11 Sammic

- 11.12 SELO

- 11.13 ULMA

- 11.14 VAC-STAR

- 11.15 VC999