|

市场调查报告书

商品编码

1740825

真空密封鱼市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vacuum Sealed Fish Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

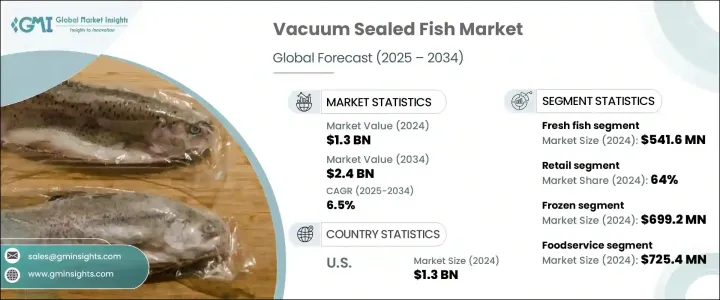

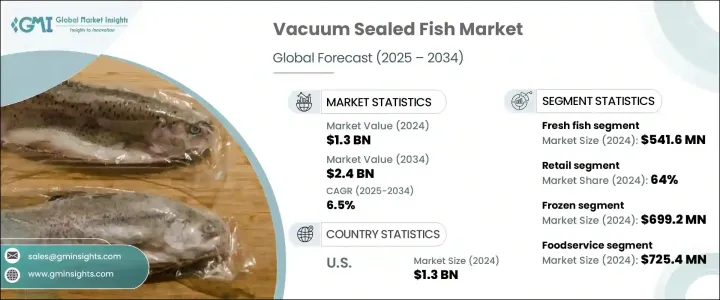

2024年,全球真空密封鱼类市场规模达13亿美元,预计到2034年将以6.5%的复合年增长率增长,达到24亿美元,这得益于消费者对便利性、更长保质期和更高食品安全性日益增长的需求。真空密封技术可以去除空气,并将鱼类包裹在高阻隔包装中,从而保持新鲜度、风味、质地和营养价值,同时显着减少腐败和细菌滋生。随着忙碌的生活方式成为常态,越来越多的消费者寻求快速、健康、高品质的食品选择,这推动了真空密封海鲜的普及。注重健康的消费者尤其青睐这种包装方式,因为它无需添加防腐剂即可保留鱼类的天然品质。日益增强的环保意识也推高了真空密封鱼类的需求,许多消费者更重视永续包装和减少食物浪费。零售商和品牌正在利用这些趋势,扩大真空密封产品线,推广野生捕捞和有机鱼类品种,并推出环保包装创新技术。随着国际贸易的扩大和冷链物流的进步,全球真空密封鱼类产业将在未来十年实现强劲成长。

零售分销管道的扩张、可支配收入的提高以及对即食或易烹饪海鲜食品日益增长的需求,进一步推动了真空密封鱼类市场的成长。永续食品选择正日益成为主流,推动了对真空密封产品的需求。企业不断创新,利用可生物降解和可回收材料,同时透过有机和野生捕捞产品拓展产品组合。消费者对便利性、安全性和品质的偏好转变,为市场参与者开闢了新的途径,为未来几年的大幅扩张奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 6.5% |

市场细分为贝类、鲜鱼、熟鱼和其他产品。鲜鱼市场价值 5.416 亿美元(2024 年),因其高感知品质、营养价值和更长的保质期而占据最大市场份额。真空密封包装能够锁住鲜味和鲜嫩,为注重卫生和便利的消费者提供可靠的选择。鲑鱼、鲔鱼和鳕鱼等热门鱼种通常采用真空密封,以在运输和储存过程中保持最佳新鲜度。

贝类市场规模在2024年达到3.076亿美元,预计2034年将达到5.253亿美元,展现出强劲的成长潜力。虾、龙虾、牡蛎和淡菜等易腐烂的贝类产品受益于真空密封,真空密封可延长保质期,并在不使用化学防腐剂的情况下保留其天然风味和口感。这不仅吸引了注重健康的消费者,也透过确保产品完整性来支持全球出口。

2024年,美国真空密封鱼市场产值达13亿美元,这得益于人们对价值驱动、环保便利的海鲜日益增长的偏好。真空密封工艺可以保持新鲜度,最大限度地减少腐败,并透过减少食物浪费来符合永续发展趋势,从而吸引具有环保意识的消费者。

全球真空密封鱼类产业的主要参与者包括 Bumble Bee Foods、Blue Circle Foods、Dongwon Industries、Icelandic Group、Mowi ASA、Gorton's、Pacific Seafood Group、Thai Union Group、Stolt-Nielsen Limited 和 Trident Seafood Corporation。各公司正在创新永续包装,扩大有机和野生捕捞产品供应,并与零售商建立合作伙伴关係,以扩大分销管道并吸引日益增长的消费者兴趣。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅提供重点国家

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对方便、保质、安全的海鲜选择的需求不断增加。

- 人们越来越意识到真空密封鱼的健康益处和营养价值。

- 受城市化和收入增加的推动,新兴市场的海鲜消费不断增长。

- 产业陷阱与挑战

- 过度捕捞和气候变迁导致鱼类供应不稳定。

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 鲜鱼

- 贝类

- 熟鱼

- 其他(腌製产品等)

第六章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 零售

- 大部分

第七章:市场估计与预测:按保存,2021 - 2034 年

- 主要趋势

- 《冰雪奇缘》

- 新鲜的

- 熏製

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 餐饮服务

- 工业的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 网上销售

- 超市/大卖场

- 专卖店

- 批发分销商

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Blue circle foods

- Bumble bee foods

- Dongwon industries

- Gorton's

- Icelandic group

- Mowi ASA (formerly Marine Harvest)

- Pacific seafood group

- Stolt-Nielsen limited

- Thai union group

- Trident seafood corporation

The Global Vacuum Sealed Fish Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 2.4 billion by 2034, driven by rising consumer demand for convenience, longer shelf life, and improved food safety. Vacuum sealing technology removes air and encloses fish in high-barrier packaging, preserving freshness, flavor, texture, and nutritional value while significantly reducing spoilage and bacterial growth. With busy lifestyles becoming the norm, more consumers are looking for quick, healthy, and high-quality food options, boosting the popularity of vacuum-sealed seafood. Health-conscious buyers are especially drawn to this packaging method for its ability to retain natural qualities without the need for preservatives. Growing environmental awareness has also pushed demand higher, with many consumers prioritizing sustainable packaging and minimal food waste. Retailers and brands are capitalizing on these trends by expanding their vacuum-sealed product lines, promoting wild-caught and organic fish varieties, and introducing eco-friendly packaging innovations. With international trade expanding and cold chain logistics advancing, the global vacuum-sealed fish industry is poised for robust growth over the next decade.

The growth of the vacuum-sealed fish market is further supported by the expansion of retail distribution channels, rising disposable incomes, and an increasing appetite for ready-to-eat or easy-to-cook seafood meals. Sustainable food choices are becoming more mainstream, fueling the demand for vacuum-sealed products. Companies continue to innovate with biodegradable and recyclable materials while widening their portfolios with organic and wild-caught options. Changing consumer preferences toward convenience, safety, and quality opens new avenues for market players, setting the stage for significant expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 6.5% |

The market is segmented into shellfish, fresh fish, cooked fish, and other products. The fresh fish segment, valued at USD 541.6 million in 2024, holds the largest market share because of its high perceived quality, nutritional benefits, and longer shelf life. Vacuum-sealed packaging locks in flavor and tenderness, offering a reliable choice for consumers who prioritize hygiene and convenience. Popular species like salmon, tuna, and cod are commonly vacuum sealed to maintain optimal freshness during transport and storage.

The shellfish segment, valued at USD 307.6 million in 2024, is expected to generate USD 525.3 million by 2034, demonstrating strong growth potential. Highly perishable shellfish like shrimp, lobster, oysters, and mussels benefit from vacuum sealing, which extends shelf life and preserves natural taste and texture without chemical preservatives. This appeals to health-focused consumers and supports global exports by ensuring product integrity.

U.S. Vacuum Sealed Fish Market generated USD 1.3 billion in 2024, driven by a growing preference for value-driven, eco-friendly, and convenient seafood options. The vacuum-sealing process preserves freshness, minimizes spoilage, and aligns with sustainability trends by reducing food waste, attracting eco-conscious consumers.

Key players in the global vacuum-sealed fish industry include Bumble Bee Foods, Blue Circle Foods, Dongwon Industries, Icelandic Group, Mowi ASA, Gorton's, Pacific Seafood Group, Thai Union Group, Stolt-Nielsen Limited, and Trident Seafood Corporation. Companies are innovating with sustainable packaging, expanding organic and wild-caught offerings, and forming partnerships with retailers to broaden distribution and capture growing consumer interest.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: The above trade statistics will be provided for key countries only

- 3.4 Profit margin analysis

- 3.5 Key news and initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing consumer demand for convenient, long-lasting, and safe seafood options.

- 3.7.1.2 Rising awareness of health benefits and nutritional value of vacuum-sealed fish.

- 3.7.1.3 Growing seafood consumption in emerging markets driven by urbanization and rising incomes.

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 Volatility in fish supply due to overfishing and climate change.

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Freshfish

- 5.3 Shellfish

- 5.4 Cooked fish

- 5.5 Others (marinated products & etc.)

Chapter 6 Market Estimates and Forecast, By Packaging type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Retail

- 6.3 Bulk

Chapter 7 Market Estimates and Forecast, By Preservation, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Frozen

- 7.3 Fresh

- 7.4 Smoked

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Foodservice

- 8.3 Industrial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Online sales

- 9.3 Supermarket / hypermarket

- 9.4 Specialty stores

- 9.5 Wholesale distributors

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Blue circle foods

- 11.2 Bumble bee foods

- 11.3 Dongwon industries

- 11.4 Gorton's

- 11.5 Icelandic group

- 11.6 Mowi ASA (formerly Marine Harvest)

- 11.7 Pacific seafood group

- 11.8 Stolt-Nielsen limited

- 11.9 Thai union group

- 11.10 Trident seafood corporation