|

市场调查报告书

商品编码

1740778

太阳能光电製造设备市场机会、成长动力、产业趋势分析及2025-2034年预测Solar PV Manufacturing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

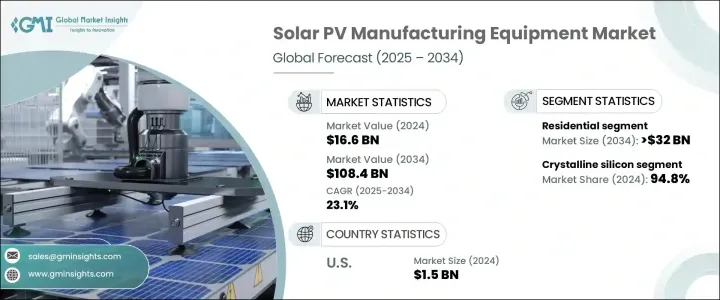

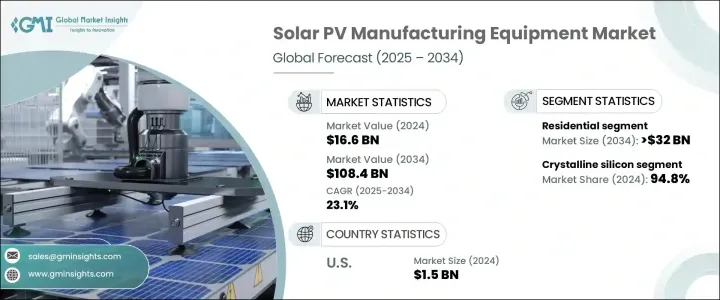

2024年,全球太阳能光电製造设备市场规模达1,66亿美元,预计2034年将以23.1%的复合年增长率成长,达到1,084亿美元。推动这一增长的因素包括:对能源独立的日益关注,以及对可靠且具有韧性的太阳能组件国产化需求的日益增长。地缘政治不确定性的加剧,加剧了各国实现製造业务本地化的迫切性,尤其是在晶圆、电池和组件等关键上游组件方面。这种向国内生产的转变正在增强工业活力,并鼓励对太阳能光电基础设施和设备的大规模投资。

先进电池技术的日益普及正在进一步重塑太阳能光电製造设备市场的格局。製造商正大力投资最先进的生产线,以应对高效能电池类型和组件设计的创新。这些改进不仅提高了能源产量,也有助于优化生产成本。设备开发商越来越多地将自动化、人工智慧工具和机器学习整合到他们的系统中,从而显着提高了製造精度和可扩展性。这一趋势降低了新企业的进入门槛,并为现有企业提供了拓展业务的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 166亿美元 |

| 预测值 | 1084亿美元 |

| 复合年增长率 | 23.1% |

随着各国加强实现脱碳目标并因应电力消耗成长,多个产业对太阳能设备的需求日益增长。工业规模的机械製造比以往任何时候都更加重要,以满足住宅、商业和公用事业领域日益增长的太阳能部署需求。上游环节,包括多晶硅、硅锭、硅片、太阳能电池和成品组件的生产,持续面临巨大的需求,推动了设备市场的扩张。

贸易政策也显着影响市场动态。对外国太阳能光电产品的贸易限制正促使全球製造商实现供应链多元化,并将产能迁移至其他製造业友善的地区。虽然这种转变有助于新兴工业中心的发展,并减少对传统供应来源的依赖,但预计在转型期间会导致设备价格短期上涨,并影响专案进度。

根据应用领域,市场可分为住宅、商业和公用事业领域。预计到2034年,住宅领域的市场规模将超过320亿美元,这得益于能源成本上涨、房主对永续发展意识的提升以及有利的监管激励措施。诸如智慧功能和电池储能係统整合等技术进步,使住宅太阳能装置更具吸引力。消费者也寻求更大的能源自主权,他们对电网中断期间备用解决方案的兴趣日益浓厚,这也推动了该行业的蓬勃发展。

从技术面来看,太阳能光电製造设备市场分为薄膜硅和晶体硅两类。晶体硅技术目前占据市场主导地位,截至2024年,其市占率高达94.8%。其主导地位归功于其更高的能量转换率、丰富的材料供应以及持续的技术改进。在众多应用中,单晶硅仍然是首选,因为它能够在有限的空间中提供更高的输出功率,使其成为住宅屋顶以及高密度商业或公用事业设施的理想选择。

从区域来看,北美市场成长显着,2024年北美市场占全球市场份额的9.6%以上,预计到2034年这一数字还将上升。光是美国一国,2022年的市场价值就达到10亿美元,2023年将增加至12亿美元,2024年将增加至15亿美元。扶持性政策措施在推动这一成长方面发挥着至关重要的作用。旨在支持国内製造业的综合立法方案,包括税收抵免和生产激励措施,正在降低资本成本,并吸引太阳能供应链上的新投资。

随着全球供应链脆弱性不断显现,国内製造业生态系统正受到优先重视,导致垂直整合营运的投资激增。企业越来越多地将整个生产流程(从原材料到最终产品组装)纳入内部,以确保更好地控製成本、品质和交付週期。与区域企业的策略合作伙伴关係也日益频繁,这为企业提供了获得本地专业知识的机会,并有助于更快地渗透市场。这些合作正在促进技术转让,并加速下一代太阳能技术的商业化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依製造设备,2021 年至 2034 年

- 主要趋势

- 硅设备

- 铸锭设备

- 晶圆设备

- 细胞设备

- 模组设备

第六章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 晶体硅

- 薄膜

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 公用事业

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

第九章:公司简介

- Adani Solar

- Emmvee

- First Solar

- Goldi Solar

- Grew Solar

- JA Solar

- LDK Solar

- Premier Energies

- RenewSys

- Servotech Renewable Power System

- Tata Power Solar

- Tongwei Solar

- Trina Solar

- Vikram Solar

- Waaree Energies

The Global Solar PV Manufacturing Equipment Market was valued at USD 16.6 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 108.4 billion by 2034. This expansion is driven by the increasing focus on energy independence and the growing need for reliable and resilient domestic production of solar components. Rising geopolitical uncertainties have intensified the urgency for countries to localize manufacturing operations, especially for critical upstream components such as wafers, cells, and modules. This shift toward domestic production is enhancing industrial activity and encouraging major investments in solar PV infrastructure and equipment.

Growing adoption of advanced cell technologies is further reshaping the landscape of the solar PV manufacturing equipment market. Manufacturers are heavily investing in state-of-the-art production lines capable of handling innovations in high-efficiency cell types and module designs. These enhancements not only improve energy yields but also help optimize production costs. Equipment developers are increasingly integrating automation, AI tools, and machine learning into their systems, which is significantly improving manufacturing precision and scalability. This trend is lowering entry barriers for new players and providing opportunities for existing companies to expand operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $108.4 Billion |

| CAGR | 23.1% |

As countries ramp up efforts to meet decarbonization goals and tackle rising electricity consumption, demand for solar equipment is intensifying across multiple sectors. Industrial-scale machinery fabrication is becoming more vital than ever to meet the rising need for solar deployment across residential, commercial, and utility applications. The upstream segment, which includes the production of polysilicon, ingots, wafers, solar cells, and finished modules, continues to experience substantial demand, fueling the expansion of the equipment market.

Trade policies are also shaping the market dynamics significantly. Trade restrictions on foreign solar PV products are prompting global manufacturers to diversify their supply chains and relocate production capacities to alternative manufacturing-friendly regions. While this shift supports the development of emerging industrial hubs and reduces dependency on traditional supply sources, it is expected to cause a short-term increase in equipment prices and affect project timelines during the transition.

By application, the market is categorized into residential, commercial, and utility segments. The residential segment is expected to surpass USD 32 billion by 2034, bolstered by rising energy costs, increased homeowner awareness of sustainability, and favorable regulatory incentives. Technological advancements, such as the integration of smart features and battery storage in home systems, are making residential solar installations more appealing. Consumers are also seeking greater energy autonomy, and their growing interest in backup solutions during grid outages is contributing to the sector's momentum.

In terms of technology, the solar PV manufacturing equipment market is segmented into thin film and crystalline silicon categories. Crystalline silicon technology currently dominates the market with a 94.8% share as of 2024. Its dominance is attributed to its higher energy conversion rates, abundant material availability, and ongoing technological enhancements. Among the various applications, monocrystalline silicon remains the preferred choice due to its ability to deliver greater output in limited space, making it ideal for both residential rooftops and high-density commercial or utility installations.

Regionally, the market is witnessing notable growth in North America, which accounted for over 9.6% of the global market share in 2024-a figure expected to increase by 2034. The United States alone recorded a market value of USD 1 billion in 2022, rising to USD 1.2 billion in 2023 and USD 1.5 billion in 2024. Supportive policy measures are playing a crucial role in driving this growth. Comprehensive legislative packages aimed at bolstering domestic manufacturing, including tax credits and production incentives, are reducing capital costs and attracting new investments across the solar supply chain.

As global supply chain vulnerabilities continue to surface, domestic manufacturing ecosystems are being prioritized, leading to a surge in investment in vertically integrated operations. Companies are increasingly bringing in-house the entire production process-from raw materials to final product assembly-to ensure better control over costs, quality, and lead times. Strategic partnerships with regional firms are also becoming more frequent, providing access to local expertise and facilitating faster market penetration. These collaborations are fostering technology transfer and speeding up the commercialization of next-generation solar technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Company benchmarking

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Manufacturing Equipment, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Silicon equipment

- 5.3 Ingots equipment

- 5.4 Wafer equipment

- 5.5 Cells equipment

- 5.6 Module equipment

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Crystalline silicon

- 6.3 Thin film

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Mexico

Chapter 9 Company Profiles

- 9.1 Adani Solar

- 9.2 Emmvee

- 9.3 First Solar

- 9.4 Goldi Solar

- 9.5 Grew Solar

- 9.6 JA Solar

- 9.7 LDK Solar

- 9.8 Premier Energies

- 9.9 RenewSys

- 9.10 Servotech Renewable Power System

- 9.11 Tata Power Solar

- 9.12 Tongwei Solar

- 9.13 Trina Solar

- 9.14 Vikram Solar

- 9.15 Waaree Energies