|

市场调查报告书

商品编码

1740784

超材料吸收器材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Metamaterial Absorbers Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

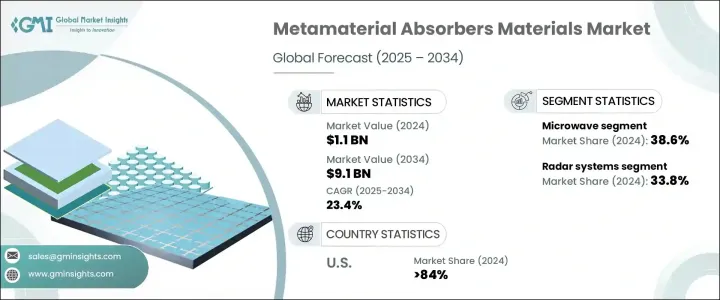

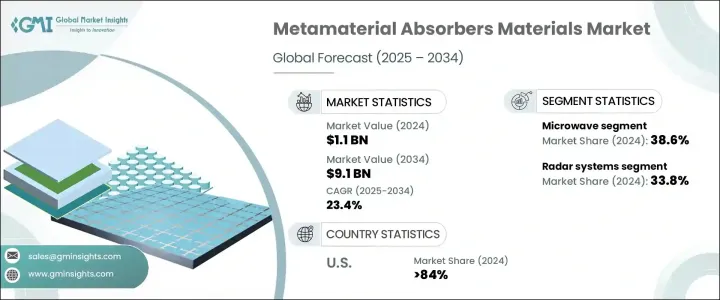

2024 年全球超材料吸波材料市场价值为 11 亿美元,预计到 2034 年将以 23.4% 的复合年增长率增长,达到 91 亿美元,这得益于对电磁干扰屏蔽的需求不断增长以及对高频通信基础设施(尤其是 5G 网路和其他先进系统)的投资不断增加。在国防、电信、汽车和能源等领域,人们越来越关注吸波技术,以提高性能并减少讯号中断。由于传统材料难以应对高频电磁波,超材料吸波材料透过在精确的谐振频率下提供高吸收效率提供了一种有希望的解决方案。持续的研究和创新努力正在提高这些材料的可靠性和应用范围,从而推动开发轻质、高性能的吸收技术,以应对现代基础设施的挑战。

这些先进材料透过工程结构操控电磁波,实现了近乎完全的吸收性能。此类吸波材料如今在民用和军用领域对于提升隐身能力和最大程度减少反射都至关重要。近期的技术发展已透过先进的製造流程生产宽频吸波材料,使其在环境电磁控制和雷达阻断方面具有重要价值。超材料吸波材料设计灵活、性能强大,可整合到下一代航太、汽车和国防系统中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 91亿美元 |

| 复合年增长率 | 23.4% |

根据频率细分,微波吸波材料在2024年占据最大份额,达到38.6%,这得益于其能够有效抑制电磁波,同时重量轻且适用于军事用途。这些材料透过最小化雷达截面,能够有效降低雷达侦测风险,从而增强国防应用中的隐身能力。其高效性和易于整合的特性使其成为安全行业的首选。透过持续创新,扩大角度范围和频宽,该领域的市场主导地位得到了进一步巩固。

2024年,雷达系统应用领域占据33.8%的市场份额,这得益于超材料在提升侦测精度和降低雷达截面特征方面无与伦比的能力。这些材料透过整合轻巧紧凑的组件,使雷达系统能够高效运行,这些组件功耗更低,同时提供卓越的电磁波吸收性能。超材料吸波器的性能优势使其成为速度、精度和隐身性至关重要的现代雷达应用的理想选择。国防和国土安全部门持续的资金投入正在加速创新,其战略重点是提高系统灵敏度,同时最大限度地降低可探测性。随着研究的深入,雷达整合将继续成为推动超材料吸波器材料市场成长的主要领域。

2024年,美国超材料吸波材料市场占据84%的市场份额,产值达2亿美元,这得益于其先进的军事能力、强大的科研基础设施以及联邦机构对下一代国防技术的大力支持。美国在高性能国防和通讯系统超材料的研发和部署方面一直处于领先地位。凭藉持续的创新,该地区透过对研发的战略投资、国防现代化项目以及政府机构与私营行业利益相关者之间的积极合作,保持了领先地位。

该市场的主要公司包括 Kymeta、Meta Materials Inc.、Metamagnetics、TeraView 和 Echodyne。这些公司透过投资专有技术、扩展产品组合、建立策略联盟以及利用政府支持的研发项目来持续发展。他们也正在扩大产能并探索国防级认证,以增强全球竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 国家 1

- 国家 2

- 国家 3

- 主要进口国

- 国家 1

- 国家 2

- 国家 3

- 主要出口国

註:以上贸易统计仅针对重点国家。

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 5G和下一代通讯的扩展

- 微型电子设备的使用日益增多,需要紧凑型吸收器

- 产业陷阱与挑战

- 製造成本高、加工复杂

- 生产製造能耗高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按频率,2021 - 2034 年

- 主要趋势

- 频率

- 微波

- 太赫兹

- 红外线(IR)

- 其他的

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 电磁超材料

- 光子超材料

- 手性超材料

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 雷达系统

- 隐形技术

- 无线通讯

- 医学影像

- 太阳能收集

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Echodyne

- Entuple Technologies

- E-SONG EMC

- JEM Engineering

- Kymeta

- Meta Materials

- Metamagnetics

- MetaShield

- Microwave Measurement System

- Nanohmics

- Phoebus Optoelectronics

- TeraView

The Global Metamaterial Absorbers Materials Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 23.4% to reach USD 9.1 billion by 2034, driven by the increasing demand for electromagnetic interference shielding and rising investments in high-frequency communication infrastructure, particularly for 5G networks and other advanced systems. In sectors like defense, telecommunications, automotive, and energy, there is a growing focus on wave-absorbing technologies to enhance performance and reduce signal disruptions. As traditional materials struggle to cope with high-frequency electromagnetic waves, metamaterial absorbers offer a promising solution by delivering high absorption efficiency at precise resonance frequencies. Continued research and innovation efforts are enhancing the reliability and range of applications for these materials, enabling the development of lightweight, high-performance absorption technologies that address modern infrastructure challenges.

These advanced materials deliver near-complete absorption performance by manipulating electromagnetic waves with engineered structures. Such absorbers are now essential for improving stealth capabilities and minimizing reflection in both civil and military uses. Recent technological developments have produced broadband absorbers through advanced manufacturing processes, making them valuable for environmental electromagnetic control and radar blocking. With design flexibility and strong performance, metamaterial absorbers integrate into next-generation aerospace, automotive, and defense systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 23.4% |

Based on frequency segmentation, microwave frequency absorbers held the largest share at 38.6% in 2024 due to their ability to effectively dampen electromagnetic waves while being lightweight and adaptable for military use. These materials are highly effective in reducing radar detection by minimizing the radar cross-section, which enhances stealth capabilities in defense applications. Their efficiency and ease of integration make them the preferred choice across security-focused industries. Market dominance in this segment has been reinforced through ongoing innovation expanding angular range and bandwidth.

The radar system applications segment held a 33.8% share in 2024, driven by metamaterials' unmatched ability to enhance detection precision and reduce radar cross-section signatures. These materials allow radar systems to operate effectively by integrating lightweight, compact components that consume less power while delivering superior electromagnetic wave absorption. The performance benefits of metamaterial absorbers make them ideal for modern radar applications where speed, accuracy, and stealth are vital. Ongoing funding from defense and homeland security departments is accelerating innovation, with strategic emphasis on increasing system sensitivity while minimizing detectability. As research deepens, radar integration continues to stand out as a prime sector fueling growth in the metamaterial absorbers materials market.

United States Metamaterial Absorbers Materials Market held an 84% share in 2024 and generated USD 200 million reinforced by advanced military capabilities, a robust scientific infrastructure, and dedicated support from federal agencies for next-generation defense technologies. The U.S. has been at the forefront of developing and deploying metamaterials for high-performance defense and communication systems. With continued innovation, the region maintains its lead through strategic investment in R&D, defense modernization programs, and active collaboration between government institutions and private industry stakeholders.

Key companies in this market include Kymeta, Meta Materials Inc., Metamagnetics, TeraView, and Echodyne. These players are advancing by investing in proprietary technologies, expanding their product portfolios, forming strategic alliances, and leveraging government-backed R&D programs. They are also scaling production capacities and exploring defense-grade certifications to enhance global competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major importing countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major exporting countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Expansion of 5g and next-gen communications

- 3.7.1.2 Growing use of miniaturized electronics requiring compact absorbers

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing cost and complex processing

- 3.7.2.2 High energy consumption in production and fabrication

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Frequency, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Frequency

- 5.3 Microwave

- 5.4 Terahertz

- 5.5 Infrared (IR)

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Electromagnetic metamaterials

- 6.3 Photonic metamaterials

- 6.4 Chiral metamaterials

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Radar systems

- 7.3 Stealth technology

- 7.4 Wireless communication

- 7.5 Medical imaging

- 7.6 Solar energy harvesting

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Echodyne

- 9.2 Entuple Technologies

- 9.3 E-SONG EMC

- 9.4 JEM Engineering

- 9.5 Kymeta

- 9.6 Meta Materials

- 9.7 Metamagnetics

- 9.8 MetaShield

- 9.9 Microwave Measurement System

- 9.10 Nanohmics

- 9.11 Phoebus Optoelectronics

- 9.12 TeraView