|

市场调查报告书

商品编码

1740793

婴儿干粮市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dried Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

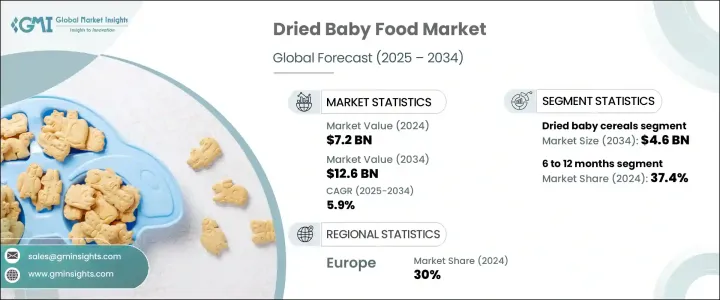

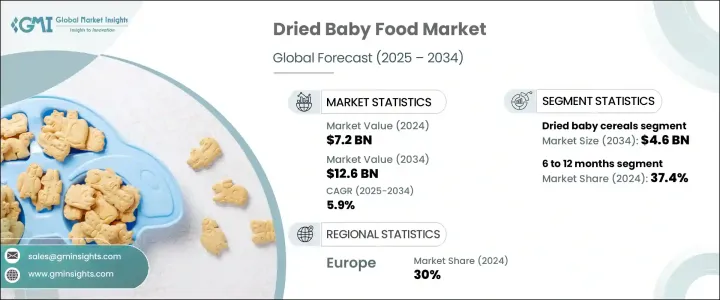

2024年,全球婴儿干粮市场规模达72亿美元,预计到2034年将以5.9%的复合年增长率增长,达到126亿美元,这得益于人们对易于准备且营养均衡的婴儿食品日益增长的偏好。繁忙的生活方式、不断增长的可支配收入以及父母对婴儿健康的日益关注,正在推动已开发地区和发展中地区对婴儿干粮的需求。父母选择婴儿干粮是因为它保质期长、方便食用且营养丰富。该市场的历史性扩张与人们对婴儿营养的认知不断演变息息相关,尤其是在城市中心,省时且安全的餵食方式至关重要。

随着核心家庭和在职父母数量的增加,婴儿食品的选择也明显转向紧凑、方便携带。对于时间紧迫、注重营养和易用性的照顾者来说,便利性和便携性已成为至关重要的因素。因此,製造商正专注于轻巧、可重复密封和一次性包装,以无缝融入忙碌的生活方式。这些包装形式减少了准备时间,最大限度地减少了浪费,并提高了卫生水平,使其成为现代育儿需求的理想选择。有机、非基因改造和清洁标籤产品的趋势正在重塑消费者的偏好,并支撑着全球市场的持续需求。家长对孩子食品的成分越来越谨慎,导致对透明原料采购和最低限度加工配方的需求激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 126亿美元 |

| 复合年增长率 | 5.9% |

在产品类别中,预计到2034年,婴儿干米粉市场规模将达到46亿美元,复合年增长率为6.1%,这得益于市场对强化、无过敏原、易消化、富含益生菌、维生素和必需矿物质的米粉的需求激增。如今,新配方专注于清洁成分和增强营养成分,以应对日益增长的儿童早期健康问题。市场见证了无麸质和有机食品的创新,以满足特定的饮食需求。

根据年龄偏好,6至12个月大的婴儿类别在2024年占据最大份额,达到37.4%,预计到2034年将以6.5%的复合年增长率增长。婴儿发育的这一阶段需要引入更复杂的食物质地和营养成分,这推动了对方便、预先分配饮食的需求。可重复密封容器和一次性包装袋等包装创新使这些产品对在职父母来说更加实用。双收入家庭的增加和即食产品的日益普及也是这一细分市场发展的驱动力。儘管市场正在扩张,但价格方面的担忧可能会略微抑製成长,尤其是在对成本较为敏感的地区。

2024年,欧洲婴儿干粮市场占最大份额,达30%,这得益于人们高度的营养意识和对婴儿食品安全的监管支持。对优质和有机婴儿食品的需求不断增长,并持续影响该地区的产品发展。强劲的购买力以及欧洲家庭对清洁标籤产品的日益青睐也推动了市场扩张。除了强大的监管框架外,欧洲还受益于高购买力,这刺激了对高品质婴儿食品的需求。

雅培实验室、海恩天体集团、Sprout Foods Inc.、明治控股株式会社、雀巢公司、Hero Group、Holle Baby Food GmbH、Arla Foods amba、Ella's Kitchen Limited、Plum PBC、达能公司、菲仕兰坎皮纳、贝拉米培有机有限公司、Riri Baby Food Co. Ltd.、宝可本产品、卡夫米亨氏公司公司、Birnition?和喜宝国际等公司正积极提升市场占有率。领先品牌正在投资产品多元化、永续采购和清洁标籤创新。许多品牌正在扩大有机产品线,与当地分销商合作,并改进包装以提升货架吸引力。此外,各公司也正在增加数位互动和电商管道,以加强全球影响力并提升客户便利性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

- 供应链和分销分析

- 原物料采购

- 製造流程

- 脱水技术

- 冷冻干燥方法

- 品质管制

- 包装创新

- 永续包装

- 智慧包装

- 便利功能

- 分销网络

- 传统零售

- 电子商务

- 直接面向消费者

- 供应链挑战

- 原物料供应情况

- 端对端品质控制

- 后勤

- 供应链优化

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 全球监管标准

- 区域指南

- FDA(美国)

- 欧洲食品安全局(欧盟)

- FSSAI(印度)

- 中国国家食品药物管理局

- 其他区域法规

- 品质和安全标准

- 重金属和污染物

- 营养需求

- 标籤和声明

- 包装安全

- 有机认证标准

- 监理挑战与策略

- 未来监理趋势

- 衝击力

- 成长动力

- 女性劳动参与率上升

- 提高对婴儿营养的认识

- 都市化和生活方式的改变

- 方便且保质期更长

- 产业陷阱与挑战

- 偏好自製婴儿食品

- 严格的监管标准

- 新兴市场的价格敏感度

- 供应链中断

- 市场机会

- 有机和清洁标籤产品

- 强化功能性婴儿干粮

- 新兴市场的扩张

- 电子商务与D2C模型

- 市场挑战

- 重金属污染问题

- 竞争定价压力

- 消费者偏好的改变

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 消费者行为与偏好

- 消费者人口统计

- 购买决策因素

- 营养价值

- 品牌信任

- 价格敏感度

- 方便

- 有机和天然成分

- 消费者购买模式

- 线上与线下

- 订阅模式

- 大量购买

- 消费者意识和教育

- 文化和地域偏好

- 社群媒体和影响者的影响

- 技术创新和产品开发

- 加工技术

- 高级脱水

- 营养保存

- 清洁标籤方法

- 成分创新

- 超级食物

- 替代蛋白质

- 天然防腐剂

- 包装创新

- 可生物降解/可堆肥材料

- 主动智慧包装

- 份量控制

- 数位化集成

- QR 图码和可追溯性

- 行动应用程式

- 电子商务最佳化

- 研发与未来趋势

- 加工技术

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 婴儿干麦片

- 婴儿干粮

- 婴儿干零食和手指食物

- 干果和蔬菜泥

- 冷冻干燥婴儿食品

第六章:市场估计与预测:依来源,2021-2034

- 主要趋势

- 有机的

- 传统的

第七章:市场估计与预测:依年龄段,2021-2034

- 主要趋势

- 4-6个月

- 6-12个月

- 12-24个月

- 24个月以上

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 药局和药局

- 其他的

第九章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 袋装

- 罐子和瓶子

- 罐头

- 盒子和纸箱

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Nestle SA

- Danone SA

- Abbott Laboratories

- Hero Group

- Mead Johnson Nutrition Company

- The Hain Celestial Group, Inc.

- HiPP International

- The Kraft Heinz Company

- Plum, PBC

- Ella's Kitchen Limited

- Gerber Products Company

- Sprout Foods, Inc.

- Beech-Nut Nutrition Corporation

- Bellamy's Organic Pty Ltd

- Arla Foods amba

- FrieslandCampina

- Meiji Holdings Co., Ltd.

- Topfer GmbH

- Holle Baby Food GmbH

- Riri Baby Food Co., Ltd.

The Global Dried Baby Food Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 5.9 % to reach USD 12.6 billion by 2034, driven by the increasing preference for easy-to-prepare and nutritionally balanced infant meals. Busy lifestyles, rising disposable incomes, and growing parental awareness about infant health are pushing demand across developed and developing regions. Parents choose dried baby food for its long shelf life, convenience, and nutritional value. The market's historic expansion can be linked to the evolving perception of baby nutrition, particularly in urban centers where time-saving and safe feeding options are critical.

With an increasing number of nuclear families and working parents, there's also a noticeable shift toward compact, travel-friendly food options for infants. Convenience and portability have become essential factors for time-constrained caregivers who prioritize both nutrition and ease of use. As a result, manufacturers are focusing on lightweight, resealable, and single-serve packaging that fits seamlessly into busy lifestyles. These formats reduce preparation time, minimize waste, and offer greater hygiene, making them ideal for modern parenting needs. The trend toward organic, non-GMO, and clean-label products is reshaping buyer preferences and supporting sustained demand across global markets. Parents are becoming increasingly cautious about what goes into their children's food, leading to a surge in demand for transparent ingredient sourcing and minimally processed formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 5.9% |

Among product categories, the dried baby cereals segment is expected to reach USD 4.6 billion by 2034, growing at a CAGR of 6.1% influenced by the surge in demand for fortified, allergen-free, and easily digestible cereals that contain probiotics, vitamins, and essential minerals. New formulations now focus on clean ingredients and enhanced nutritional profiles to address growing concerns about early childhood health. The market witness's innovation through gluten-free and organic options catering to specific dietary needs.

Based on age-based preferences, the 6 to 12-month category held the largest share in 2024 at 37.4% and is expected to grow at a 6.5% CAGR through 2034. This stage of infant development requires the introduction of more complex food textures and nutritional content, fueling demand for convenient, pre-portioned meals. Packaging innovation, such as resealable containers and single-use pouches, makes these products even more practical for working parents. The rise in dual-income households and the increasing popularity of ready-to-eat products are also driving forces in this segment. Although the market is expanding, pricing concerns may temper growth slightly, especially in more cost-sensitive regions.

Europe Dried Baby Food Market held the largest share of 30% in 2024, driven by high nutritional awareness and regulatory support for infant food safety. Increased demand for premium and organic baby food options continues to shape product development across the region. Market expansion is also supported by strong purchasing power and the rising popularity of clean-label offerings in European households. In addition to a strong regulatory framework, Europe benefits from high purchasing power, which fuels the demand for high-quality baby food products.

Companies such as Abbott Laboratories, The Hain Celestial Group, Sprout Foods Inc., Meiji Holdings Co. Ltd., Nestle S.A., Hero Group, Holle Baby Food GmbH, Arla Foods amba, Ella's Kitchen Limited, Plum PBC, Danone S.A., FrieslandCampina, Bellamy's Organic Pty Ltd, Riri Baby Food Co. Ltd., Gerber Products Company, The Kraft Heinz Company, Beech-Nut Nutrition Corporation, Topfer GmbH, and HiPP International are actively working to enhance market presence. Leading brands invest in product diversification, sustainable sourcing, and clean-label innovation. Many are expanding organic lines, partnering with local distributors, and enhancing packaging for greater shelf appeal. Additionally, companies are increasing digital engagement and e-commerce channels to strengthen global outreach and improve customer convenience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Manufacturers

- 3.1.4 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Supply Chain and Distribution Analysis

- 3.4.1 Raw Material Sourcing

- 3.4.2 Manufacturing Processes

- 3.4.2.1 Dehydration Technologies

- 3.4.2.2 Freeze-Drying Methods

- 3.4.2.3 Quality Control

- 3.4.3 Packaging Innovations

- 3.4.3.1 Sustainable Packaging

- 3.4.3.2 Smart Packaging

- 3.4.3.3 Convenience Features

- 3.4.4 Distribution Network

- 3.4.4.1 Traditional Retail

- 3.4.4.2 E-commerce

- 3.4.4.3 Direct-to-Consumer

- 3.4.5 Supply Chain Challenges

- 3.4.5.1 Raw Material Availability

- 3.4.5.2 End-to-End Quality Control

- 3.4.5.3 Logistics

- 3.4.6 Supply Chain Optimization

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global Regulatory Standards

- 3.7.2 Regional Guidelines

- 3.7.2.1 FDA (U.S.)

- 3.7.2.2 EFSA (EU)

- 3.7.2.3 FSSAI (India)

- 3.7.2.4 CFDA (China)

- 3.7.2.5 Other Regional Regulations

- 3.7.3 Quality and Safety Standards

- 3.7.3.1 Heavy Metals and Contaminants

- 3.7.3.2 Nutritional Requirements

- 3.7.3.3 Labeling and Claims

- 3.7.3.4 Packaging Safety

- 3.7.4 Organic Certification Standards

- 3.7.5 Regulatory Challenges and Strategies

- 3.7.6 Future Regulatory Trends

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising Female Workforce Participation

- 3.8.1.2 Increasing Awareness of Infant Nutrition

- 3.8.1.3 Urbanization and Changing Lifestyles

- 3.8.1.4 Convenience and Longer Shelf Life

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Preference for Homemade Baby Food

- 3.8.2.2 Stringent Regulatory Standards

- 3.8.2.3 Price Sensitivity in Emerging Markets

- 3.8.2.4 Supply Chain Disruptions

- 3.8.3 Market opportunities

- 3.8.3.1 Organic and Clean Label Products

- 3.8.3.2 Fortified and Functional Dried Baby Food

- 3.8.3.3 Expansion in Emerging Markets

- 3.8.3.4. E-commerce and D2 C Models

- 3.8.4 Market Challenges

- 3.8.4.1 Heavy Metal Contamination Concerns

- 3.8.4.2 Competitive Pricing Pressure

- 3.8.4.3 Changing Consumer Preferences

- 3.8.4.4 Sustainability Concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer Behavior and Preferences

- 3.12.1 Consumer Demographics

- 3.12.2 Purchase Decision Factors

- 3.12.2.1 Nutritional Value

- 3.12.2.2 Brand Trust

- 3.12.2.3 Price Sensitivity

- 3.12.2.4 Convenience

- 3.12.2.5 Organic and Natural Ingredients

- 3.12.3 Consumer Buying Patterns

- 3.12.3.1 Online vs. Offline

- 3.12.3.2 Subscription Models

- 3.12.3.3 Bulk Purchases

- 3.12.4 Consumer Awareness and Education

- 3.12.5 Cultural and Regional Preferences

- 3.12.6 Impact of Social Media and Influencers

- 3.13 Technological Innovations and Product Development

- 3.13.1 Processing Technologies

- 3.13.1.1 Advanced Dehydration

- 3.13.1.2 Nutrient Preservation

- 3.13.1.3 Clean Label Methods

- 3.13.2 Ingredient Innovations

- 3.13.2.1 Superfoods

- 3.13.2.2 Alternative Proteins

- 3.13.2.3 Natural Preservatives

- 3.13.3 Packaging Innovations

- 3.13.3.1 Biodegradable/Compostable Materials

- 3.13.3.2 Active and Intelligent Packaging

- 3.13.3.3 Portion Control

- 3.13.4 Digital Integration

- 3.13.4.1 QR Codes and Traceability

- 3.13.4.2 Mobile Apps

- 3.13.4.3 E-commerce Optimization

- 3.13.5 R&D and Future Trends

- 3.13.1 Processing Technologies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dried baby cereals

- 5.3 Dried baby meals

- 5.4 Dried baby snacks and finger foods

- 5.5 Dried fruit and vegetable purees

- 5.6 Freeze-dried baby food

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 4–6 Months

- 7.3 6–12 Months

- 7.4 12–24 Months

- 7.5 Above 24 Months

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies and drugstores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Pouches

- 9.3 Jars and bottles

- 9.4 Cans

- 9.5 Boxes and cartons

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Abbott Laboratories

- 11.4 Hero Group

- 11.5 Mead Johnson Nutrition Company

- 11.6 The Hain Celestial Group, Inc.

- 11.7 HiPP International

- 11.8 The Kraft Heinz Company

- 11.9 Plum, PBC

- 11.10 Ella's Kitchen Limited

- 11.11 Gerber Products Company

- 11.12 Sprout Foods, Inc.

- 11.13 Beech-Nut Nutrition Corporation

- 11.14 Bellamy's Organic Pty Ltd

- 11.15 Arla Foods amba

- 11.16 FrieslandCampina

- 11.17 Meiji Holdings Co., Ltd.

- 11.18 Topfer GmbH

- 11.19 Holle Baby Food GmbH

- 11.20 Riri Baby Food Co., Ltd.