|

市场调查报告书

商品编码

1773337

有机婴儿食品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Organic Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

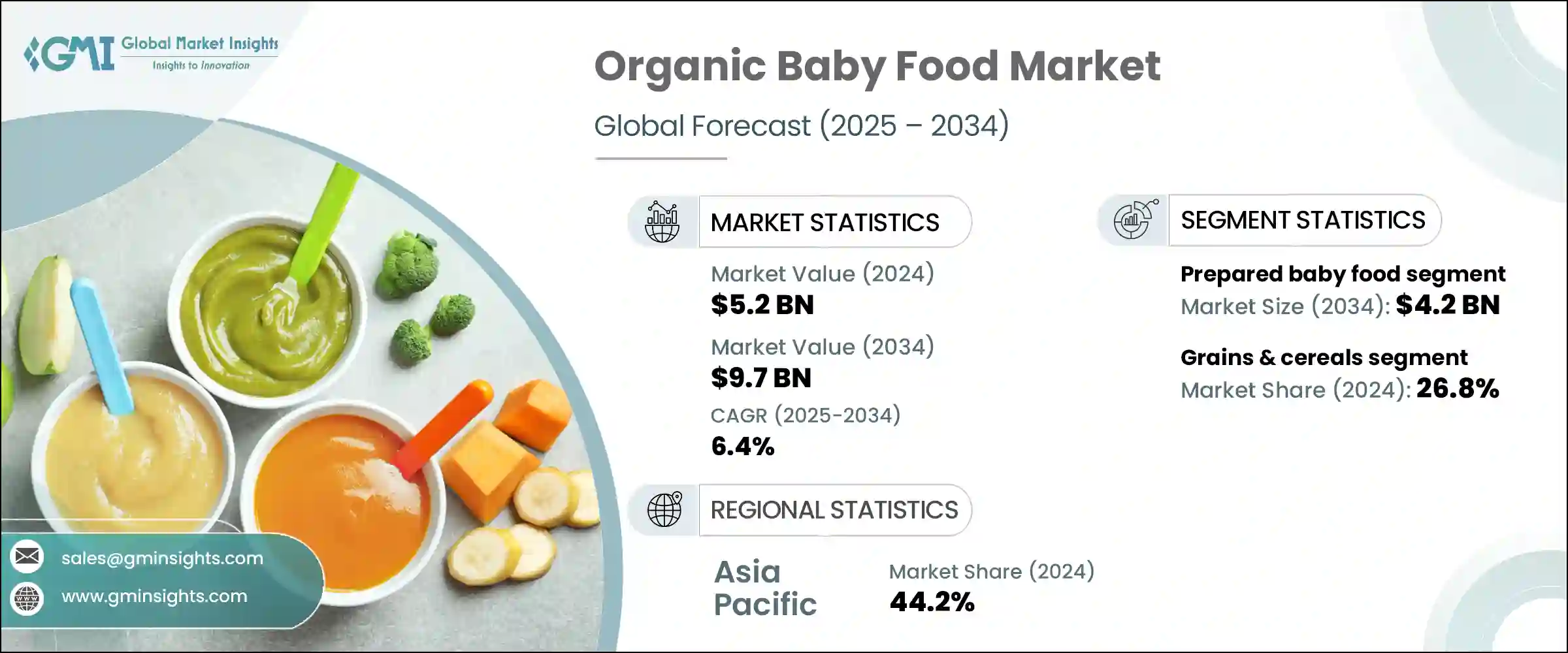

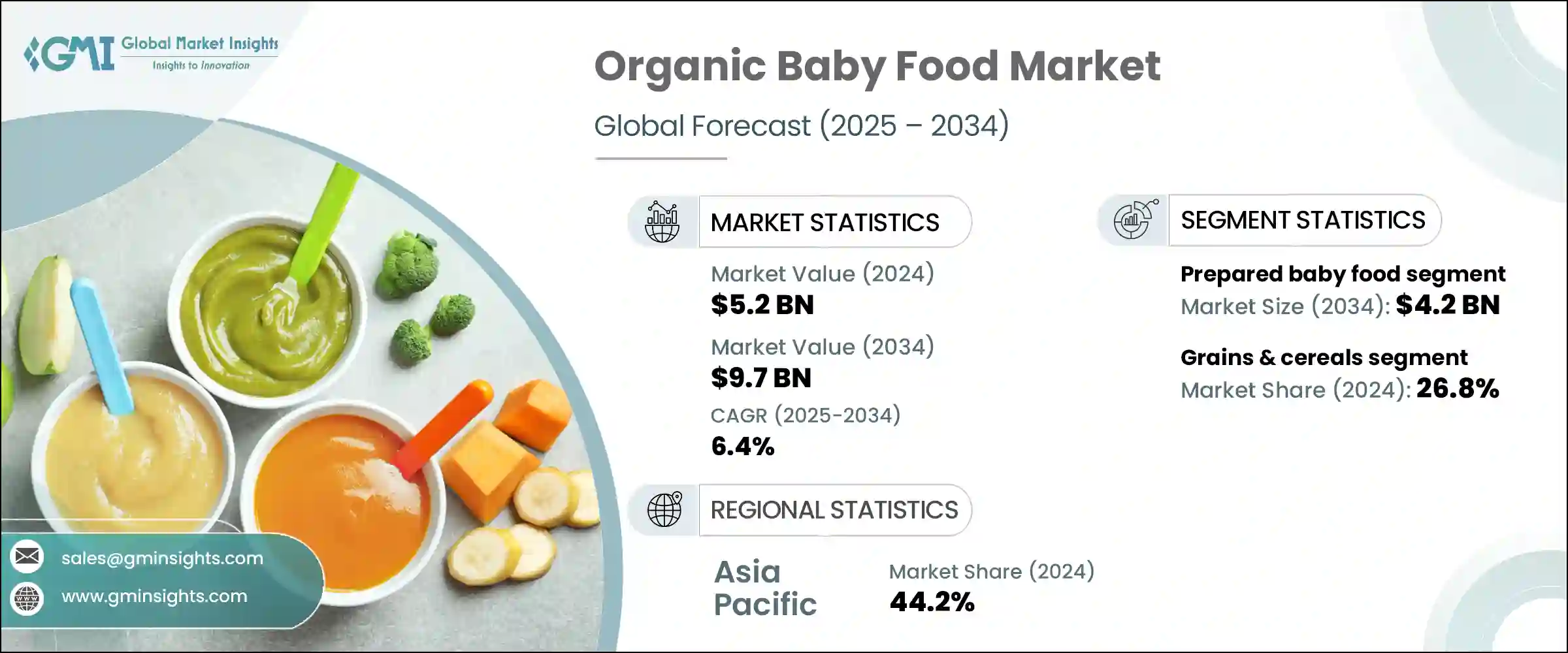

2024年,全球有机婴儿食品市场规模达52亿美元,预计2034年将以6.4%的复合年增长率成长至97亿美元。该市场持续稳定成长,这主要得益于消费者习惯的转变、儿童营养意识的增强以及生活方式的不断变化。现代父母,尤其是千禧世代和Z世代的父母,更重视透明度、清洁标籤成分和无化学成分的产品。随着越来越多的照顾者开始关注婴儿食品,对有机替代品的需求激增。随着家庭更加重视提供更健康的生活开端,不含基因改造生物、防腐剂、人工成分和合成农药的产品越来越受欢迎。

出于对加工食品及其潜在长期健康影响的担忧,有机婴儿食品更受青睐。消费者正积极选择既安全又环保的食品。越来越多的婴儿出现过敏和敏感症状,也加剧了这个市场趋势,推动了对更简单成分配方的需求。加之快节奏的都会生活和不断变化的家庭关係,人们对营养丰富、便捷便捷的餵食方式的需求日益增长,这些餵食方式既方便又不损害品质。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 52亿美元 |

| 预测值 | 97亿美元 |

| 复合年增长率 | 6.4% |

预製有机婴儿食品正成为成长最快的类别,预计到2034年其价值将达到42亿美元,复合年增长率为6.6%。这个细分市场深受当今忙碌的育儿人士的青睐,他们更青睐袋装、罐装和果泥等方便食用的即食食品。这些产品在营养和便利性之间实现了完美平衡,尤其适合希望节省时间的在职父母。随着越来越多的母亲重返职场,对这类产品的需求也随之增长。可重复密封容器和环保材料等包装创新,透过提供便携性、保鲜性和符合永续发展价值的特性,进一步提升了其吸引力。

2024年,谷物和麦片类产品占据主导地位,占26.8%,预计到2034年将以6.1%的复合年增长率成长。该细分市场凭藉其营养成分和多样化的膳食形式(例如粥、婴儿麦片、能量棒和出牙零食)继续保持领先。燕麦、小米、藜麦和米製成的食品能量高,易于消化,适合早期发育。它们在婴儿饮食中的灵活性和基础性作用,使其成为希望用健康天然食材滋养孩子的照顾者的首选。

2024年,亚太地区有机婴儿食品市场占44.2%的市占率。印尼、中国和印度等国的出生率正在上升,中产阶级人口也不断壮大。人们对婴儿营养品中化学添加剂风险的认识不断提高,这正在影响城市和半城市地区的购买模式。该地区各国政府也正在提高食品安全标准,并实施更严格的有机认证规范,提升了消费者的信任度。此外,网路普及率的提高和电子商务的普及,使得更偏远地区也能买到优质的有机婴儿食品,从而扩大了消费者群体。

全球有机婴儿食品市场保持稳定,主要参与者包括 Hero Group、达能公司、Hain Celestial Group、雅培实验室和雀巢公司。为了巩固市场地位,有机婴儿食品领域的领先公司正致力于透过植物配方、无过敏原品种和针对特定发展需求的强化混合物来扩大产品组合。许多公司正在投资永续农业伙伴关係和可追溯性技术,以满足清洁标籤的期望并增强品牌信任。企业也正在利用电子商务的繁荣来扩大分销范围,尤其是在新兴市场。与儿科医生和营养师的合作有助于提高产品可信度,而创新、环保的包装解决方案则支持长期永续发展目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 家长健康意识不断增强

- 人们对传统食品中化学残留物的担忧日益增加

- 过敏和食物敏感的发生率不断上升

- 职业妇女数量不断增加

- 产业陷阱与挑战

- 有机产品的溢价

- 由于不含防腐剂,保存期限有限

- 有机原料的供应链挑战

- 市场机会

- 新兴市场的扩张

- 电子商务成长和直接面向消费者的模式

- 产品创新与多样化

- 成长动力

- 成长潜力分析

- 监管格局

- 全球有机认证标准

- 区域监管差异

- 北美(美国农业部有机认证)

- 欧洲(欧盟有机法规)

- 亚太监管框架

- 标籤要求和声明

- 安全标准和测试协议

- 波特的分析

- PESTEL分析

- 当前的技术趋势

- 新兴技术

- 按地区

- 按产品

- 当前的技术趋势

- 新兴技术

- 主要进口国

- 主要出口国

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 购买模式和偏好

- 愿意为有机产品支付溢价

- 人口因素对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 准备好的婴儿食品

- 婴儿干粮

- 婴儿配方奶粉

- 其他的

第六章:市场估计与预测:依成分类型,2021-2034

- 主要趋势

- 谷物和谷类食品

- 水果

- 蔬菜

- 乳製品

- 肉类和家禽

- 其他的

第七章:市场估计与预测:依年龄段,2021-2034

- 主要趋势

- 婴儿(0-6个月)

- 婴儿(6-12个月)

- 幼儿(12-24个月)

- 儿童(24个月以上)

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 药局和药局

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Abbott Laboratories

- Nestle SA

- Danone SA

- Hero Group

- The Hain Celestial Group, Inc.

- Kraft Heinz Company

- Plum Organics (Campbell Soup Company)

- Once Upon a Farm

- HiPP GmbH & Co. Vertrieb KG

- Amara Organic Foods

- Babylife Organics

- Little Spoon

- Serenity Kids

- Sprout Organic Foods, Inc.

- Tiny Organics

The Global Organic Baby Food Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 9.7 billion by 2034. The market continues to witness steady growth, largely due to shifting consumer habits, greater awareness about child nutrition, and evolving lifestyle dynamics. Modern-day parents, especially those from millennial and Gen Z demographics, are prioritizing transparency, clean-label ingredients, and chemical-free products. As more caregivers become conscious about the foods they give to their infants, the demand for organic alternatives has surged. Products free from GMOs, preservatives, artificial ingredients, and synthetic pesticides are gaining significant popularity as families focus on providing a healthier start in life.

Concerns over processed food and potential long-term health impacts have made organic baby food more desirable. Consumers are actively choosing options that are both safe and environmentally responsible. The increasing number of infants experiencing allergies and sensitivities has also played a role in this market trend, pushing demand for simpler ingredient profiles. Coupled with fast-paced urban living and changing family dynamics, there's a greater need for nutritious yet hassle-free feeding choices that cater to convenience without compromising quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $9.7 Billion |

| CAGR | 6.4% |

Prepared organic baby food is emerging as the fastest-growing category and is forecasted to be valued at USD 4.2 billion by 2034, growing at 6.6% CAGR. This segment resonates well with today's busy caregivers who prefer ready-to-serve meals in convenient formats like pouches, jars, and purees. These products offer the perfect balance of nutrition and ease, especially for working parents looking to save time. With more mothers rejoining the workforce, demand for this category has climbed. Innovations in packaging, such as resealable containers and eco-conscious materials, have further boosted its appeal by offering portability, preserving freshness, and aligning with sustainability values.

The grains and cereals segment held the dominant share in 2024 at 26.8% and is expected to grow at a CAGR of 6.1% through 2034. This segment continues to lead due to its nutritional profile and versatility in meal formats like porridge, infant cereals, bars, and teething snacks. Foods made with oats, millet, quinoa, and rice are high in energy, easily digestible, and suitable for early development. Their flexibility and foundational role in baby diets make them a consistent favorite for caregivers looking to nourish their children with wholesome, natural ingredients.

Asia Pacific Organic Baby Food Market held a 44.2% share in 2024. Countries such as Indonesia, China, and India are seeing a rise in birth rates alongside expanding middle-class populations. Heightened awareness about the risks of chemical additives in baby nutrition is influencing buying patterns across urban and semi-urban areas. Governments across the region are also raising food safety standards and enforcing stricter organic certification norms, which boost consumer trust. Moreover, increased internet access and e-commerce adoption are making premium organic baby food products available in more remote regions, helping grow the customer base.

The Global Organic Baby Food Market remains consolidated, with major players including Hero Group, Danone S.A., The Hain Celestial Group, Abbott Laboratories, and Nestle S.A. To enhance their market position, leading companies in the organic baby food sector are focusing on expanding product portfolios through plant-based formulations, allergen-free variants, and fortified blends for specific developmental needs. Many are investing in sustainable farming partnerships and traceability technologies to meet clean-label expectations and enhance brand trust. Businesses are also capitalizing on the e-commerce boom to widen their distribution footprint, especially in emerging markets. Collaborations with pediatricians and nutritionists help drive product credibility, while innovative, eco-friendly packaging solutions support long-term sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Ingredients type trends

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness among parents

- 3.2.1.2 Growing concerns over chemical residues in conventional food

- 3.2.1.3 Increasing incidence of allergies and food sensitivities

- 3.2.1.4 Rising number of working women

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Premium pricing of organic products

- 3.2.2.2 Limited shelf life due to absence of preservatives

- 3.2.2.3 Supply chain challenges for organic ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 E-commerce growth and direct-to-consumer models

- 3.2.3.3 Product innovation and diversification

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global organic certification standards

- 3.4.2 Regional Regulatory Variations

- 3.4.2.1 North America (USDA organic)

- 3.4.2.2 Europe (EU organic regulations)

- 3.4.2.3 Asia pacific regulatory framework

- 3.4.3 Labeling requirements and claims

- 3.4.4 Safety standards and testing protocols

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns and preferences

- 3.13.2 Willingness to pay premium for organic products

- 3.13.3 Demographic influences on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Prepared baby food

- 5.3 Dried baby food

- 5.4 Infant milk formula

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Ingredients Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Grains & cereals

- 6.3 Fruits

- 6.4 Vegetables

- 6.5 Dairy products

- 6.6 Meat & poultry

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infants (0–6 months)

- 7.3 Babies (6–12 months)

- 7.4 Toddlers (12–24 months)

- 7.5 Children (24+ months)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets & hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies & drug stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Nestle S.A.

- 10.3 Danone S.A.

- 10.4 Hero Group

- 10.5 The Hain Celestial Group, Inc.

- 10.6 Kraft Heinz Company

- 10.7 Plum Organics (Campbell Soup Company)

- 10.8 Once Upon a Farm

- 10.9 HiPP GmbH & Co. Vertrieb KG

- 10.10 Amara Organic Foods

- 10.11 Babylife Organics

- 10.12 Little Spoon

- 10.13 Serenity Kids

- 10.14 Sprout Organic Foods, Inc.

- 10.15 Tiny Organics