|

市场调查报告书

商品编码

1766269

婴儿果汁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Baby Juice Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

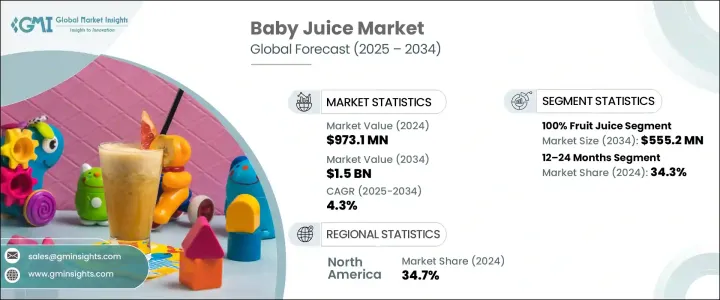

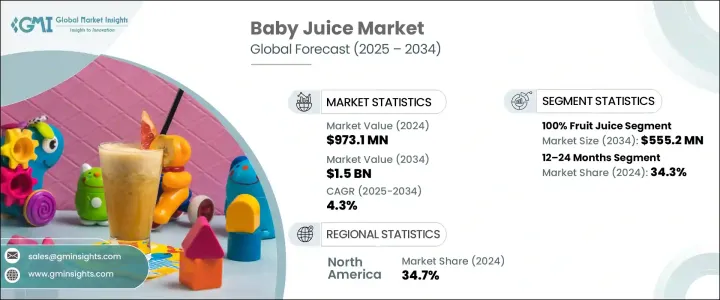

2024年,全球婴儿果汁市场规模达9.731亿美元,预计2034年将以4.3%的复合年增长率成长,达到15亿美元。这一稳定成长反映出家长对儿童早期营养意识的不断提升。家长们越来越注重为婴幼儿提供营养均衡、营养丰富的饮食,而富含必需维生素和矿物质的婴儿果汁正成为备受青睐的选择。随着全球健康意识的增强,对便利强化产品的需求也日益增长。此外,生活方式的改变,包括越来越多的职业母亲和双收入家庭,也增加了对即食婴儿食品和饮料的依赖。这些果汁为日程繁忙的家长,尤其是那些经常出差的家长,提供了一个快速实用的解决方案。

拉丁美洲、亚太和非洲等新兴市场的成长也发挥关键作用。出生率上升、可支配收入增加以及零售基础设施的改善(包括更强大的电商管道),正在推动婴儿营养产品的普及。随着中产阶级人口的不断增长,包装婴儿果汁的取得也变得越来越容易,这推动了其在服务欠缺地区的市场渗透,并巩固了该品类的全球影响力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.731亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 4.3% |

预计到2034年,100%纯果汁市场规模将达5.552亿美元,复合年增长率为4.5%。注重健康的购买行为正日益成为主流,对儿童饮食中糖分过高的担忧促使消费者转向天然替代品。家长越来越青睐不添加糖、注重天然水果成分的果汁。持续进行的促销和宣传活动将这些果汁定位为活力四射、天然鲜活的饮品,引起瞭如今注重营养的育儿者的共鸣。这些偏好与人们逐渐放弃溺爱式餵食方式,转向支持儿童均衡发展的更健康选择相契合。

从年龄层来看,12-24 个月年龄层在 2024 年占据 34.3% 的市场份额,预计到 2034 年将以 6.8% 的复合年增长率增长。这一阶段标誌着儿童饮食习惯的关键转变,因为儿童开始从母乳或配方奶粉过渡到更广泛的固体和半固体食物,包括果汁。这一年龄层的父母尤其挑剔,他们寻求的产品不仅味道好,还能支持免疫力、消化功能和整体发展。针对此年龄层的婴儿果汁通常含有维生素 C、铁和其他重要营养素,并专注于天然成分。包装也扮演重要角色-防溢漏、符合人体工学的奶瓶专为学习独立饮水的幼儿设计,有助于提升对父母和幼儿的吸引力。

2024年,北美婴儿果汁市场占34.7%的市占率。该地区的领先地位得益于先进的分销体系、更高的可支配收入以及消费者对清洁标籤、强化和有机产品的偏好。美国和加拿大的父母越来越注重明智的购买决策,并将早期营养放在首位。产品标籤和安全方面的法规尤其严格,这增强了消费者对货架上产品的信任。政府监管和以营养为重点的标籤有助于建立一个强大透明的婴儿果汁生态系统,确保产品品质的一致性和消费者安全。

活跃于全球婴儿果汁市场的主要参与者包括 Beech-Nut Nutrition Company、卡夫亨氏公司、Sprout Foods, Inc.、金宝汤公司和雀巢公司。领先品牌正在透过提供有机、非基因改造和无过敏原产品来实现产品组合的多样化,从而巩固其市场地位。许多品牌已扩展到添加维生素、矿物质和益生菌的功能性饮料,以吸引註重营养的父母。对美观、便捷的包装(例如可重新密封、防溢容器)的策略性投资正在提高父母和幼儿的可用性。品牌还利用数位行销和社交媒体平台与千禧世代和 Z 世代的父母建立联繫,同时透过电子商务扩大分销以提高可及性。与儿科营养师的合作和遵守安全认证进一步提升了品牌在註重健康的消费者中的信誉和信任。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 方便婴儿食品的需求日益增长

- 发展中经济体可支配所得不断增加

- 职业妇女人口不断增加

- 产品创新与强化

- 产业陷阱与挑战

- 儿童不宜过早饮用果汁

- 与糖含量有关的健康问题

- 偏好完整水果和自製水果

- 严格的监管框架

- 市场机会

- 有机和天然变体的开发

- 新兴市场的扩张

- 电子商务成长

- 功能性和强化型婴儿果汁产品

- 成长动力

- 成长潜力分析

- 监管格局

- 婴儿食品和饮料的全球法规

- FDA法规和指南

- 欧盟监管框架

- 果汁HACCP要求

- 标籤和健康声明法规

- 法规对市场成长的影响

- 波特的分析

- PESTEL分析

- 当前的技术趋势

- 新兴技术

- 按地区

- 按产品

- 当前的技术趋势

- 新兴技术

- 主要进口国

- 主要出口国

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 父母的偏好与决策因素

- 购买模式

- 儿科建议的影响

- 健康和营养意识

- 品牌忠诚度与转换行为

- 不断发展的婴儿营养指南

- 适合年龄的饮料建议

- 儿童早期糖摄取问题

- 果汁在儿童发育中的作用

- 婴幼儿的替代饮料选择

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 100%果汁

- 果汁混合

- 蔬菜汁

- 有机婴儿果汁

- 强化婴儿果汁

- 其他的

第六章:市场估计与预测:依年龄组,2021-2034 年

- 主要趋势

- 6-12个月

- 12–24个月

- 24–36个月

- 36个月以上

第七章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 瓶子

- 袋装

- 纸箱

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 药局和药局

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Nestle SA (Gerber Products Company)

- The Kraft Heinz Company

- Danone SA

- Beech-Nut Nutrition Company

- Hain Celestial Group

- Campbell Soup Company (Plum Organics)

- Nurture Inc. (Happy Family Organics)

- Sprout Foods, Inc.

- Ella's Kitchen

- Once Upon a Farm

- Apple & Eve, LLC

- Welch Foods Inc.

- Bellamy's Organic

- Organix Brands Ltd.

- The Coca-Cola Company

The Global Baby Juice Market was valued at USD 973.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 1.5 billion by 2034. This steady growth reflects rising parental awareness about early childhood nutrition. Parents are increasingly focused on providing well-rounded, nutrient-rich diets for their infants and toddlers, and baby juices-often enriched with essential vitamins and minerals-are becoming a favored option. As health consciousness grows globally, demand for convenient, fortified products is increasing. Additionally, lifestyle changes, including a growing population of working mothers and dual-income households, have boosted reliance on ready-to-consume baby foods and beverages. These juices offer a quick and practical solution for parents with busy schedules, especially those frequently on the go.

Growth in emerging markets across regions such as Latin America, Asia-Pacific, and Africa is also playing a key role. Rising birth rates, higher disposable incomes, and improved retail infrastructure-including stronger e-commerce channels-are supporting the spread of baby nutrition products. As middle-class populations continue to expand, accessibility to packaged baby juices is becoming easier, pushing forward market penetration in underserved regions and cementing the global reach of the category.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $973.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.3% |

The 100% fruit juice segment is forecast to reach USD 555.2 million by 2034, growing at a CAGR of 4.5% during 2034. Health-conscious buying behaviors are becoming more mainstream, and concerns around excess sugar in children's diets have driven consumers toward natural alternatives. Parents are gravitating toward juices with no added sugar and a focus on real fruit content. Ongoing promotions and awareness campaigns that position these juices as energizing and naturally vibrant are resonating with today's nutrition-minded caregivers. These preferences align with the shift away from indulgent feeding practices and a move toward healthier options that support balanced childhood development.

In terms of age demographics, the 12-24 months segment held 34.3% share in 2024 and is expected to grow at a CAGR of 6.8% through 2034. This stage marks a critical shift in dietary habits as children begin to transition from breast milk or formula to a broader range of solid and semi-solid foods, including juices. Parents in this segment are particularly selective, seeking products that not only taste good but also support immunity, digestion, and overall development. Baby juices tailored to this age group typically contain vitamin C, iron, and other important nutrients, with a strong focus on natural ingredients. Packaging also plays a major role-non-spill, ergonomic bottles are designed for toddlers learning to drink independently, helping boost appeal for both parents and young children.

North America Baby Juice Market held 34.7% share in 2024. The region's leadership is backed by advanced distribution systems, higher disposable incomes, and a shift toward clean-label, fortified, and organic options. Parents in both the U.S. and Canada are increasingly driven by informed purchasing decisions that prioritize early-life nutrition. Regulations around product labeling and safety are particularly stringent, which builds trust in the products available on the shelves. Government oversight and nutrition-focused labeling contribute to a robust and transparent baby juice ecosystem, ensuring consistency in quality and consumer safety.

Key players active in the Global Baby Juice Market include Beech-Nut Nutrition Company, The Kraft Heinz Company, Sprout Foods, Inc., Campbell Soup Company, and Nestle S.A. Leading brands are strengthening their market position by diversifying product portfolios with organic, non-GMO, and allergen-free offerings. Many have expanded into functional beverages fortified with vitamins, minerals, and probiotics to appeal to nutrition-savvy parents. Strategic investments in attractive, convenient packaging-such as resealable, spill-proof containers-are enhancing usability for parents and toddlers alike. Brands are also leveraging digital marketing and social media platforms to connect with millennial and Gen Z parents, while broadening distribution via e-commerce to boost accessibility. Collaborations with pediatric nutritionists and compliance with safety certifications further elevate brand credibility and trust among health-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Age group

- 2.2.3 Packaging type

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for convenient baby food options

- 3.2.1.2 Rising disposable income in developing economies

- 3.2.1.3 Increasing working women population

- 3.2.1.4 Product innovations and fortification

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Pediatric recommendations against early juice consumption

- 3.2.2.2 Health concerns related to sugar content

- 3.2.2.3 Preference for whole fruits and homemade options

- 3.2.2.4 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Development of organic and natural variants

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 E-commerce growth

- 3.2.3.4 Functional and fortified baby juice products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global regulations for baby food and beverages

- 3.4.2 FDA regulations and guidelines

- 3.4.3 European Union regulatory framework

- 3.4.4 Juice HACCP requirements

- 3.4.5 Labeling and health claim regulations

- 3.4.6 Impact of regulations on market growth

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.1.1 Juice processing technologies

- 3.6.1.2 Preservation methods

- 3.6.1.3 Packaging innovations

- 3.6.1.4 Quality testing advancements

- 3.6.1.5 Digital technologies in supply chain

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.6.1 Technology and Innovation landscape

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Consumer Behavior Analysis

- 3.13.1 Parental preferences and decision factors

- 3.13.2 Purchase patterns

- 3.13.3 Influence of pediatric recommendations

- 3.13.4 Health and nutrition awareness

- 3.13.5 Brand loyalty and switching behavior

- 3.14 Pediatric nutrition trends

- 3.14.1 Evolving guidelines for infant nutrition

- 3.14.2 Age-appropriate beverage recommendations

- 3.14.3 Sugar intake concerns in early childhood

- 3.14.4 Role of juices in child development

- 3.14.5 Alternative beverage options for infants and toddlers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Liters)

- 5.1 Key trends

- 5.2 100% fruit juice

- 5.3 Fruit juice blends

- 5.4 Vegetable juice

- 5.5 Organic baby juice

- 5.6 Fortified baby juice

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Million) (Kilo Liters)

- 6.1 Key trends

- 6.2 6–12 months

- 6.3 12–24 months

- 6.4 24–36 months

- 6.5 Above 36 months

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Million) (Kilo Liters)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Pouches

- 7.4 Cartons

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Liters)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies and drug stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Liters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Nestle S.A. (Gerber Products Company)

- 10.2 The Kraft Heinz Company

- 10.3 Danone S.A.

- 10.4 Beech-Nut Nutrition Company

- 10.5 Hain Celestial Group

- 10.6 Campbell Soup Company (Plum Organics)

- 10.7 Nurture Inc. (Happy Family Organics)

- 10.8 Sprout Foods, Inc.

- 10.9 Ella’s Kitchen

- 10.10 Once Upon a Farm

- 10.11 Apple & Eve, LLC

- 10.12 Welch Foods Inc.

- 10.13 Bellamy's Organic

- 10.14 Organix Brands Ltd.

- 10.15 The Coca-Cola Company