|

市场调查报告书

商品编码

1740854

自冷包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Self-cooling Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

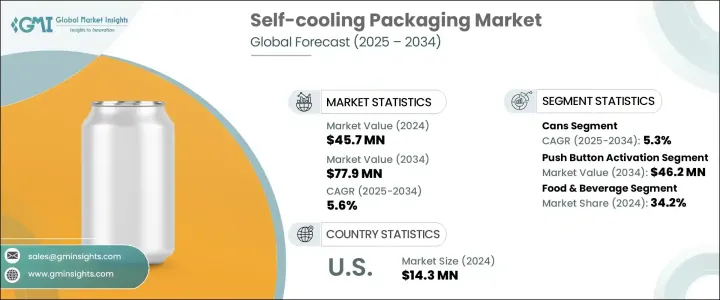

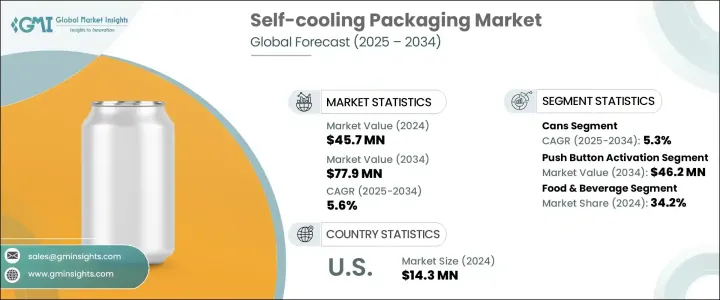

2024年,全球自冷包装市场规模达4,570万美元,预计2034年将以5.6%的复合年增长率成长,达到7,790万美元。这主要得益于功能性和能量饮料需求的不断增长,尤其是在追求便利性和创新性的年轻消费者群体中。随着生活方式的快速发展和城市化程度的提升,全球包装产业正在经历重大变革。如今,消费者对包装的期望远不止于一个容器——他们希望包装能够提升易用性、适应他们的节奏并支持他们的出行习惯。内建即时冷却功能的自冷包装能够即时满足这项需求。它无需外部冷藏,提供更高程度的便利性,与现代消费者的行为相得益彰。这种科技赋能的包装趋势在註重移动性、注重健康习惯和永续性的市场中尤其受到青睐。各大品牌正竞相将创新融入包装设计中,力求在高度饱和的饮料和即食食品市场中脱颖而出。对于饮料业的公司来说,重要的不仅仅是罐子里的东西,而是最终用户的整个消费体验。

随着城市化进程的持续推进,对迎合行动生活方式的包装解决方案的需求激增。自冷包装正成为改变游戏规则的新兴产品,为那些注重便利性和快速性,同时又不牺牲新鲜度的消费者提供选择。随着消费者对健康意识的不断增强,许多消费者更倾向于选择能够在旅行、活动或户外环境中快速、轻鬆消费的产品。自冷技术的整合在零售环境中提供了急需的优势,在零售环境中,货架吸引力和功能优势正日益影响消费者的购买决策。这种包装形式带来了独特的价值主张——随时随地享受即时清爽。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4570万美元 |

| 预测值 | 7790万美元 |

| 复合年增长率 | 5.6% |

美国历届政府引发的贸易紧张局势和进口关税,对铝等原材料的供应和定价产生了重大影响,而铝则是自冷包装的关键材料。这些政策转变引发了全球供应链的广泛中断,迫使製造商重新思考其采购策略。因此,许多公司现在倾向于本地采购模式,并加大研发投入。这项策略重心不仅有助于缓解原物料价格波动,还能增强供应链的韧性。透过重塑框架,品牌商正在努力实现长期营运的可持续性,同时维持产品品质。

在众多产品类型中,自冷罐继续占据主导地位,预计到2034年将以5.3%的复合年增长率成长。这类罐子因其与压力式冷却系统兼容且操作简便,在饮料行业尤其受欢迎。消费者欣赏其耐用的结构和可靠的冷却性能,使其成为旅行、户外活动和体育赛事等通常无法冷藏的场合的理想选择。对于在成熟市场竞争的饮料品牌而言,自冷罐在提供更具吸引力和更优质的用户体验方面具有明显的优势。

预计到2034年,按钮式冷冻市场规模将达到4,620万美元,其直觉易用的设计将日益受到青睐。该市场依靠内建的化学反应,只需轻按即可启动冷冻功能,非常适合时间敏感应用。从忙碌的通勤者到热爱冒险的人,这种冷冻机制都能完美融入人们积极的生活方式。随着人们对携带方便的餐点和饮料的需求不断增长,越来越多的製造商开始在其产品线中采用这种冷却方式。此外,紧急准备和国防等领域也正在探索这种冷冻方式,在这些领域,快速取得冷藏产品可以带来显着的价值提升。

2024年,美国自冷包装市场产值达1,430万美元。随着即食饮料、餐盒和智慧便利食品的日益普及,该市场持续快速扩张。美国製造商正透过改进热调节技术和改进化学工程製程来推动创新,以提供更稳定、更可靠的冷却功能。市场的发展动能也与消费者兴趣转向积极的户外生活方式息息相关。这种变化推动了休閒和国防领域的需求成长。随着美国消费者的环保意识和便利性意识日益增强,本土生产商正加紧推出符合这两种趋势的包装解决方案。

全球自冷包装市场的主要参与者包括 Icetec、deltaH Innovations、Therapak、Tempra Technology、Gobi Technologies 和 Joseph Company International。这些公司正积极拓展业务,包括建立策略联盟、改善活化技术以提高速度和可靠性,以及投资客製化解决方案。透过将产品设计与不断变化的消费者偏好同步,并专注于可持续的、以用户为中心的创新,这些市场领导者正在抓住新兴机会,为自冷领域的未来成长奠定基础。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 功能性和能量饮料市场的成长

- 对便携和便利产品的需求不断增长

- 电子商务成长推动功能性包装需求

- 都市化进程加速,生活方式改变

- 在製药和冷链替代品中的应用日益增多

- 产业陷阱与挑战

- 生产成本高

- 可重复使用性有限且一次性使用

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 罐头

- 袋装

- 盒子和容器

- 其他的

第六章:市场估计与预测:按机制类型,2021-2034

- 主要趋势

- 按钮启动

- 扭转激活

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 製药和医疗保健

- 化妆品和个人护理

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- deltaH Innovations

- Gobi Technologies

- Icetec

- Joseph Company International

- Tempra Technology

- Therapak

The Global Self-Cooling Packaging Market was valued at USD 45.7 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 77.9 million by 2034, driven by the rising appetite for functional and energy beverages, especially among younger consumers who demand convenience and innovation. As lifestyles get faster and more urban-centric, the global packaging industry is undergoing a major shift. Consumers today expect more than just a container-they want packaging that enhances usability, matches their pace, and supports their on-the-go habits. Self-cooling packaging, with its built-in instant chill feature, is answering that demand in real time. It eliminates the need for external refrigeration, offering a next-level convenience that aligns well with modern consumer behavior. This tech-enabled packaging trend is especially gaining traction in markets where mobility, health-conscious habits, and sustainability take center stage. Brands are now racing to incorporate innovation in packaging as a strategy to stand out in a highly saturated beverage and ready-to-eat meal landscape. For companies in the beverage space, it's not just about what's inside the can-it's about how the entire consumption experience feels to the end user.

As urbanization continues to boom, the demand for packaging solutions that cater to mobile lifestyles has surged. Self-cooling packaging is emerging as a game-changer for consumers who prioritize convenience and speed without compromising freshness. With growing awareness around health and wellness, many buyers are leaning toward products that support quick, hassle-free consumption during travel, at events, or in outdoor environments. The integration of self-chilling technology provides a much-needed edge in retail environments, where shelf appeal and functional benefits are increasingly influencing purchase decisions. This format brings in a unique value proposition-instant refreshment anytime, anywhere.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.7 Million |

| Forecast Value | $77.9 Million |

| CAGR | 5.6% |

Trade tensions and import tariffs initiated by previous U.S. administrations have significantly impacted the availability and pricing of raw materials like aluminum, which is a critical component in self-cooling packaging formats. These policy shifts have triggered widespread disruptions across global supply chains, compelling manufacturers to rethink their procurement strategies. As a result, many companies are now leaning into local sourcing models and investing more heavily in R&D. This strategic pivot not only helps mitigate raw material price fluctuations but also enhances supply chain resilience. By reengineering their frameworks, brands are aiming for long-term operational sustainability while maintaining product quality.

Among various product types, self-cooling cans continue to dominate and are projected to grow at a CAGR of 5.3% through 2034. These cans are especially popular in the beverage industry due to their compatibility with pressure-based cooling systems and simple user functionality. Consumers appreciate their durable structure and reliable cooling performance, which make them ideal for travel, outdoor activities, and sporting events-scenarios where refrigeration is often out of reach. For beverage brands competing in mature markets, self-cooling cans offer a clear advantage in delivering a more engaging and premium user experience.

The push-button activation segment is projected to reach USD 46.2 million by 2034, gaining traction due to its intuitive and user-friendly design. This segment relies on a built-in chemical-based reaction that initiates the cooling function with a simple press, making it perfect for time-sensitive use cases. From busy commuters to adventure seekers, this mechanism fits seamlessly into active lifestyles. As demand rises for easy-to-carry meals and beverages, more manufacturers are embracing this activation method across product lines. It's also being explored in sectors like emergency preparedness and defense, where quick access to cooled products can add significant value.

The U.S. Self-Cooling Packaging Market generated USD 14.3 million in 2024. With increasing popularity of grab-and-go beverages, meal kits, and smart convenience food options, this market continues to expand rapidly. U.S.-based manufacturers are pushing innovation by advancing thermal regulation technologies and refining chemical engineering processes to deliver more consistent, reliable cooling features. The market's momentum is also tied to shifting consumer interests toward active, outdoor-oriented lifestyles. This change has driven increased demand from both the recreational and defense segments. As American consumers grow more environmentally and convenience conscious, local producers are stepping up with packaging solutions that align with both trends.

Key players in the Global Self-Cooling Packaging Market include Icetec, deltaH Innovations, Therapak, Tempra Technology, Gobi Technologies, and Joseph Company International. These companies are taking aggressive steps to expand their footprint by forming strategic alliances, refining activation technologies for speed and reliability, and investing in tailored solutions. By syncing product design with evolving consumer preferences and focusing on sustainable, user-centric innovations, these market leaders are tapping into emerging opportunities and setting the stage for future growth in the self-cooling space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of the functional and energy drinks market

- 3.3.1.2 Rising demand for on-the-go and convenience products

- 3.3.1.3 E-commerce growth driving demand for functional packaging

- 3.3.1.4 Increasing urbanization and lifestyle changes

- 3.3.1.5 Increased application in pharmaceuticals and cold chain alternatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of production

- 3.3.2.2 Limited reusability and single-use nature

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & kilo tons)

- 5.1 Key trends

- 5.2 Cans

- 5.3 Pouches

- 5.4 Boxes and containers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Mechanism Type, 2021-2034 (USD Million & kilo tons)

- 6.1 Key trends

- 6.2 Push-button activation

- 6.3 Twist activation

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & kilo tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals & healthcare

- 7.4 Cosmetics & personal care

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 deltaH Innovations

- 9.2 Gobi Technologies

- 9.3 Icetec

- 9.4 Joseph Company International

- 9.5 Tempra Technology

- 9.6 Therapak