|

市场调查报告书

商品编码

1740857

石墨烯注入包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Graphene Infused Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

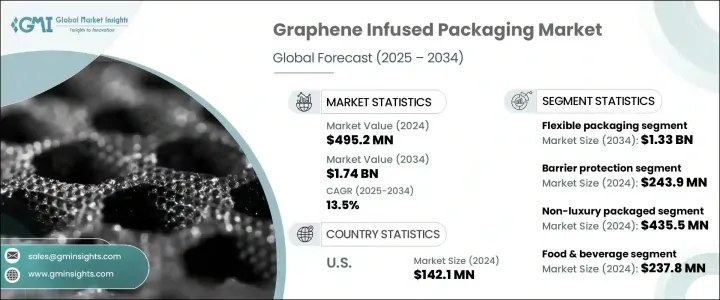

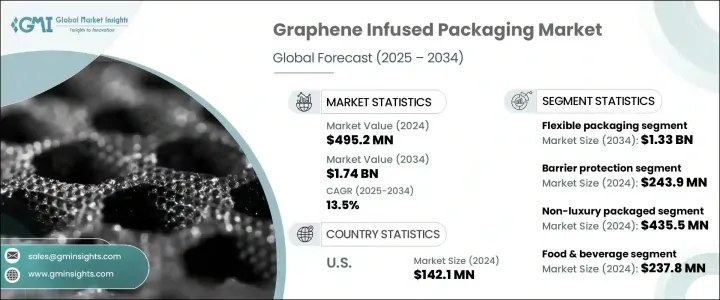

2024年,全球石墨烯浸渍包装市场价值为4.952亿美元,预计到2034年将以13.5%的复合年增长率增长,达到17.4亿美元,这得益于该材料卓越的防潮、防氧和防紫外线性能。石墨烯已成为包装创新领域的颠覆性材料,提供轻盈、耐用且高性能的解决方案,可保持易腐烂商品和敏感电子产品的新鲜度和完整性。随着全球包装领域朝着更智慧、更永续的解决方案迈进,石墨烯浸渍材料因其可回收性和可生物降解性而日益受到重视。这些特性与消费者对环保包装的偏好转变以及日益增长的环境法规压力完美契合。

各大品牌正积极响应市场需求,将石墨烯融入软包装薄膜、层压板和涂层中,不仅延长了保质期,还减少了碳足迹和塑胶垃圾。全球循环经济的蓬勃发展正鼓励製造商创新包装形式,使其既符合绿色目标,又不损害产品性能。此外,石墨烯卓越的热强度和机械强度,为包装安全性、耐用性和透明度至关重要的各个领域增添了价值。食品和饮料公司正在使用石墨烯注入材料来防止变质,而电子公司则利用该材料的抗静电和防护性能来保护精密零件。在製药领域,石墨烯有助于维持敏感药物的无菌性和稳定性,从而创造出更安全、更持久的包装形式。随着研发投入的增加和试点计画的不断涌现,石墨烯的商业化应用正在蓬勃发展。新创公司和材料科学公司正在与大型包装公司合作,以扩大石墨烯的应用规模,并开发满足市场需求的下一代永续包装系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.952亿美元 |

| 预测值 | 17.4亿美元 |

| 复合年增长率 | 13.5% |

国际贸易的变化也影响了石墨烯包装市场的成长路径,特别是对于美国等已开发经济体的生产商。美国对包括石墨烯在内的进口复合材料和特殊材料实施的关税政策提高了生产成本,为依赖外国供应的製造商带来了阻力。由于贸易摩擦,航太、电子和高檔食品包装等行业的营运费用增加,暂时影响了某些垂直行业的需求。然而,该行业对可持续性和性能的承诺保持了这一势头。为此,各公司正在加倍努力进行研究,以使石墨烯加工更有效率、更具成本效益。这包括增强这种材料与生物基聚合物的结合,并透过化学气相沉积和捲对捲製造等先进技术来提高生产的可扩展性。

预计软包装领域将占据主导地位,到2034年市场规模将达到13.3亿美元。石墨烯的超轻、坚固和柔韧特性最能体现软包装的优点。这些材料不仅能提供卓越的阻隔保护,还能实现经济高效的大规模生产。采用可扩展技术生产的石墨烯基薄膜,企业能够提供可持续的替代品,取代零售、食品配送和电商领域广泛使用的传统塑胶薄膜。这些先进的包装形式不仅能减少产品浪费,还能透过降低材料重量和提供更佳的产品保护来优化物流。

从功能性角度来看,阻隔保护仍是石墨烯包装的核心应用,2024年该领域的市值将达到2.439亿美元。石墨烯拥有无与伦比的超薄且坚不可摧的阻隔性能,使其成为产品保存至关重要的应用的理想选择。无论是在药品包装中防止水分侵入,或是在食品储存中阻隔氧气和光线,石墨烯增强材料的性能远超铝箔或聚乙烯等传统材料。石墨烯与高性能聚合物结合,可形成混合材料,不仅更安全、更有效率,还能与现代回收系统相容。

2024年,美国石墨烯注入包装市场规模达到1.421亿美元,这得益于食品、製药和电子等关键产业对永续高性能包装日益增长的需求。美国国内市场参与者正在大力投资研发,并加强新创公司、研究型大学和包装公司之间的合作,以开发自主研发的石墨烯解决方案。儘管由于依赖进口石墨烯以及贸易关税的成本影响,挑战依然存在,但美国正积极致力于建立强大的国内供应链。这些努力旨在减少对原料的依赖,并实现先进石墨烯复合材料的本地化生产,以满足多样化的包装需求。

全球石墨烯注入包装市场的主要参与者包括利乐国际公司 (Tetra Pak International SA)、GRAPHENE GreenTech SL 和 Black Swan Graphene。这些公司正在透过策略性地投资永续创新、与研究机构和技术驱动型新创公司建立合作伙伴关係以及推进可扩展、经济高效的製造流程来增强其市场影响力。透过采用卷对卷生产和混合材料合成等技术,这些参与者正在为石墨烯注入解决方案在全球包装价值链中的更广泛应用铺平道路。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 石墨烯的优异阻隔性能

- 石墨烯基包装可回收、可生物降解

- 食品和医疗保健行业的需求不断增长

- 智慧主动包装集成

- 产业陷阱与挑战

- 高生产成本限制了采用

- 监管障碍延迟商业化

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 软包装

- 硬质包装

第六章:市场估计与预测:依功能,2021-2034

- 主要趋势

- 屏障保护

- 抗静电

- 抗菌

- 热传导

第七章:市场估计与预测:依包装产品类型,2021-2034

- 主要趋势

- 奢华

- 非奢侈品

第八章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 医疗保健和製药

- 消费性电子产品

- 航太与国防

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Tetra Pak International SA

- Black Swan Graphene

- GRAPHENE GrennTech SL

- Haydale Graphene Industries plc

The Global Graphene Infused Packaging Market was valued at USD 495.2 million in 2024 and is estimated to grow at a 13.5% CAGR to reach USD 1.74 billion by 2034, driven by the material's superior barrier properties against moisture, oxygen, and UV radiation. Graphene has emerged as a game-changer in packaging innovation, offering lightweight, durable, and high-performance solutions that preserve the freshness and integrity of perishable goods and sensitive electronics. As the global packaging landscape moves toward smarter, more sustainable solutions, graphene-infused materials are gaining prominence for their recyclability and biodegradability. These qualities align perfectly with shifting consumer preferences for eco-friendly packaging and the rising pressure from environmental regulations.

Brands are responding by incorporating graphene into flexible packaging films, laminates, and coatings that not only extend shelf life but also reduce carbon footprint and plastic waste. The global push toward circular economies is encouraging manufacturers to innovate packaging formats that align with green goals without compromising performance. Moreover, graphene's exceptional thermal and mechanical strength adds value across various sectors where packaging safety, durability, and transparency are essential. Food and beverage companies are using graphene-infused materials to combat spoilage, while electronics firms leverage the material's anti-static and protective properties to shield delicate components. In the pharmaceutical space, graphene helps maintain the sterility and stability of sensitive drugs, creating safer and longer-lasting packaging formats. With increased investments in R&D and a growing number of pilot programs, commercial adoption is gaining momentum. Startups and material science companies are collaborating with large packaging firms to scale graphene applications and develop next-gen sustainable packaging systems that meet market demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $495.2 Million |

| Forecast Value | $1.74 Billion |

| CAGR | 13.5% |

The evolving dynamics of international trade have also influenced the growth path of the graphene-infused packaging market, especially for producers in developed economies such as the United States. Ongoing tariff policies on imported composite and specialty materials, including graphene, have raised production costs, creating headwinds for manufacturers that depend on foreign supplies. Sectors like aerospace, electronics, and premium food packaging have seen increased operational expenses due to these trade frictions, temporarily impacting demand in some verticals. However, the industry's commitment to sustainability and performance has kept the momentum alive. In response, companies are doubling down on research efforts to make graphene processing more efficient and cost-effective. This includes enhancing the material's integration with bio-based polymers and improving production scalability through advanced technologies like chemical vapor deposition and roll-to-roll manufacturing.

The flexible packaging segment is expected to dominate, projected to reach USD 1.33 billion by 2034. Flexible formats benefit the most from graphene's ultra-lightweight, strong, and flexible nature. These materials deliver superior barrier protection while allowing for cost-effective mass production. Using graphene-based films produced with scalable techniques enables businesses to offer sustainable alternatives to conventional plastic films widely used in retail, food delivery, and e-commerce. These advanced packaging formats not only reduce product waste but also optimize logistics through lower material weight and better product protection.

From a functionality standpoint, barrier protection remains the core application of graphene-infused packaging, with this segment valued at USD 243.9 million in 2024. Graphene's unmatched ability to create ultra-thin yet impenetrable barriers makes it ideal for applications where product preservation is critical. Whether it is preventing moisture intrusion in pharmaceutical packaging or blocking oxygen and light in food storage, graphene-enhanced materials deliver a level of performance that outclasses traditional materials like aluminum foil or polyethylene. When combined with high-performance polymers, graphene creates hybrid materials that are not only safer and more effective but also compatible with modern recycling systems.

The U.S. Graphene Infused Packaging Market reached USD 142.1 million in 2024, fueled by growing demand for sustainable, high-performance packaging in key industries such as food, pharma, and electronics. Domestic market players are investing heavily in R&D and ramping up collaborations between startups, research universities, and packaging companies to develop homegrown graphene solutions. Although challenges persist due to dependence on imported graphene and the cost implications of trade tariffs, the U.S. is actively working toward building a robust domestic supply chain. These efforts aim to reduce raw material dependency and enable localized production of advanced graphene composites to support diverse packaging needs.

Key players operating in the global graphene-infused packaging market include Tetra Pak International S.A., GRAPHENE GreenTech S.L., and Black Swan Graphene. These companies are bolstering their market presence by investing strategically in sustainable innovation, forming partnerships with research institutions and tech-driven startups, and advancing scalable, cost-efficient manufacturing processes. By adopting technologies such as roll-to-roll production and hybrid material synthesis, these players are paving the way for broader adoption of graphene-infused solutions across the global packaging value chain.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Superior barrier properties of graphene

- 3.3.1.2 Graphene-based packaging is recyclable and biodegradable

- 3.3.1.3 Rising demand in food & healthcare sectors

- 3.3.1.4 Smart and active packaging integration

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High production costs limit adoption

- 3.3.2.2 Regulatory hurdles delay commercialization

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Flexible packaging

- 5.3 Rigid packaging

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Barrier protection

- 6.3 Antistatic

- 6.4 Antimicrobial

- 6.5 Thermal conduction

Chapter 7 Market Estimates & Forecast, By Packaged Product Type, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Luxury

- 7.3 Non-luxury

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Healthcare & pharmaceuticals

- 8.4 Consumer electronics

- 8.5 Aerospace & defense

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Tetra Pak International S.A.

- 10.2 Black Swan Graphene

- 10.3 GRAPHENE GrennTech S.L.

- 10.4 Haydale Graphene Industries plc