|

市场调查报告书

商品编码

1740962

电动两轮车共享市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Two-Wheeler Sharing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

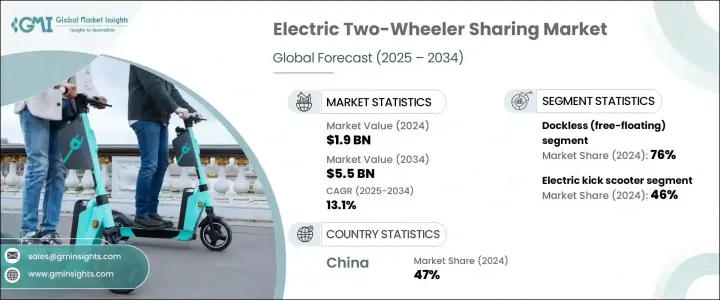

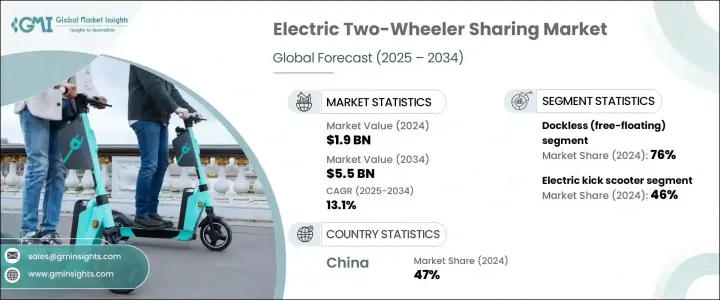

2024 年全球电动两轮车共享市场价值为 19 亿美元,预计到 2034 年将以 13.1% 的复合年增长率成长,达到 55 亿美元。随着城市人口不断增长以及大城市面临日益严重的交通拥堵问题,传统的公共交通和私家车在解决短距离和最后一英里连接方面往往显得力不从心。这时电动两轮车共享服务就派上用场了。这些解决方案提供了一种快速、灵活且环保的替代方案,可无缝融入日常通勤,尤其是在人口稠密的地区。现在,消费者优先考虑便利性、机动性和成本效益,而不是拥有汽车的责任。透过使用者友善的应用程式提供共享电动出行服务,乘客可以即时使用满足其日常交通需求的电动车,而不会造成交通拥堵或污染。城市交通行为的转变也受到更年轻、更精通技术的人群的影响,他们更喜欢移动即服务 (MaaS) 平台,从而将采用率推向新的高度。

日益增强的环保意识和全球对清洁出行的追求已成为该市场的主要成长动力。随着碳排放、空气品质恶化和城市交通拥堵的加剧,电动车作为合理且可持续的解决方案应运而生。共享电动车零废气排放,与传统的燃气驱动汽车相比,维护需求显着降低。这些优势既吸引了希望减少碳足迹的消费者,也吸引了致力于实现永续发展目标的城市官员。政府的支持也发挥着至关重要的作用,从补贴和税收优惠,到零排放区和电动车充电基础设施的建设。这些倡议正在推动电动车的普及,同时也与向智慧绿色城市转型的大趋势相契合。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 55亿美元 |

| 复合年增长率 | 13.1% |

2024年,电动滑板车占据市场主导地位,占46%的份额,预计到2034年将以12.5%的复合年增长率成长。电动滑板车体积小巧、易于使用且价格实惠,使其成为城市骑乘者的首选。在传统车辆难以驾驭的狭窄城市空间中,电动滑板车尤其实用;此外,电动滑板车维护成本低廉,对于寻求快速扩张的出行服务提供者而言,它也是一个极具吸引力的选择。

无桩共享单车系统(或称自由浮动式共享单车系统)在2024年占据了76%的市场份额,占据了市场主导地位,预计将保持强劲增长势头,到2034年将以13%的复合年增长率增长。这些系统允许使用者在指定区域内的任何地点取车和还车,提供无与伦比的便利。基于应用程式的平台可实现无缝预订、追踪和支付,而城市也支援这些系统,因为它们在减少交通拥堵和推进清洁出行目标方面发挥了重要作用。

由于快速的城镇化进程、政府主导的电动车政策以及强大的电动车基础设施,中国电动两轮车共享市场规模在2024年达到3.185亿美元。电池更换站、智慧充电网路以及行动融合服务使得共享电动出行更有效率、便利。

Bird.co、TIER Mobility、Yulu、Bolt、GrabWheels、Voi Technology、Revel、Dott、Lime Micromobility 和 Helbiz 等领先企业正在扩大车队规模、提昇路线和电池效率,并与市政府合作。许多公司正在投资人工智慧车队管理、动态定价和公共交通整合,以提升用户体验并降低成本。环保营运和循环经济实践也日益普及,帮助企业遵守法规并吸引环保意识的使用者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 电动两轮车製造商

- 电池和充电基础设施供应商

- 技术和软体平台开发商

- 共享出行运营商

- 市政当局和监管机构

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 成本細項分析

- 价格趋势

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 城市拥挤加剧,最后一哩需求增加

- 日益增长的环境议题和永续性重点

- 经济高效的行动选择

- 电动车补贴、优惠法规与基础设施投资

- 技术进步和应用程式集成

- 产业陷阱与挑战

- 初期投资高

- 充电基础设施有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 电动摩托车

- 电动滑板车

- 电动自行车

- 电动滑板车

第六章:市场估计与预测:按共享系统,2021 - 2034 年

- 主要趋势

- 停靠

- 无码头(自由浮动)

第七章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 可拆卸/可更换电池

- 固定/整合电池

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人消费者

- 游客

- 企业/机构用户

第九章:市场估计与预测:依商业模式,2021 - 2034 年

- 主要趋势

- B2C(企业对消费者)

- B2B(企业对企业)

- P2P(点对点)共享

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Bird.co

- Bolt

- Bounce Infinity

- Cityscoot

- Cooltra

- Dott

- emmy Sharing

- Felyx

- GoShare (by Gogoro)

- GrabWheels

- Grin

- Helbiz

- HelloBike

- Lime Micromobility

- Meituan (Mobike)

- Revel

- Spin

- TIER Mobility

- Voi Technology

- Yulu

The Global Electric Two-Wheeler Sharing Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 5.5 billion by 2034. As urban populations continue to rise and major cities face mounting congestion issues, traditional public transport, and personal vehicles often fall short when it comes to addressing short-distance and last-mile connectivity. That's where electric two-wheeler sharing services come in. These solutions offer a fast, flexible, and eco-friendly alternative that fits seamlessly into daily commutes, particularly in densely populated areas. Consumers now prioritize convenience, mobility, and cost-efficiency over the responsibilities of vehicle ownership. With shared e-mobility services available through user-friendly apps, riders enjoy real-time access to electric vehicles that meet their daily transport needs without contributing to traffic congestion or pollution. The shift in urban transport behavior is also being shaped by the younger, tech-savvy demographic that prefers mobility-as-a-service (MaaS) platforms, pushing adoption to new heights.

Rising environmental awareness and a global push for clean mobility have become major growth drivers for this market. As carbon emissions, poor air quality, and urban traffic jams escalate, electric mobility emerges as a logical and sustainable solution. Shared electric vehicles produce zero tailpipe emissions and come with significantly lower maintenance demands compared to traditional gas-powered alternatives. These benefits appeal to both consumers looking to reduce their carbon footprint and city officials working toward sustainability targets. Government support is playing a crucial role as well-ranging from subsidies and tax incentives to the rollout of zero-emission zones and electric vehicle charging infrastructure. These initiatives are boosting adoption while also aligning with the broader shift toward smart, green cities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 13.1% |

In 2024, electric kick scooters led the market, holding a 46% share, and are projected to grow at a CAGR of 12.5% through 2034. Their compact size, ease of use, and affordability make them a go-to option for urban riders. They're especially useful in tight urban spaces where traditional vehicles struggle, and their low maintenance costs make them an attractive choice for mobility providers looking to scale quickly.

Dockless, or free-floating, systems dominated the market with a 76% share in 2024 and are expected to maintain strong momentum, growing at a 13% CAGR through 2034. These systems let users pick up and drop off vehicles anywhere within approved areas, offering unmatched convenience. App-based platforms enable seamless booking, tracking, and payment, while cities support these systems for their role in reducing congestion and advancing clean mobility goals.

China's Electric Two-Wheeler Sharing Market reached USD 318.5 million in 2024, thanks to rapid urbanization, government-led EV policies, and strong EV infrastructure. Battery-swapping stations, smart charging networks, and mobile-integrated services have made shared e-mobility efficient and widely accessible.

Leading players like Bird.co, TIER Mobility, Yulu, Bolt, GrabWheels, Voi Technology, Revel, Dott, Lime Micromobility, and Helbiz are expanding fleets, enhancing route and battery efficiency, and partnering with city governments. Many are investing in AI-powered fleet management, dynamic pricing, and public transit integration to improve user experience and cut costs. Eco-conscious operations and circular economy practices are also gaining ground, helping companies comply with regulations and appeal to green-minded users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Electric two-wheeler manufacturers

- 3.2.2 Battery and charging infrastructure providers

- 3.2.3 Technology and software platform developers

- 3.2.4 Shared mobility operators

- 3.2.5 City authorities and regulatory bodies

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Cost breakdown analysis

- 3.7 Price trends

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising urban congestion and last-mile needs

- 3.11.1.2 Growing environmental concerns and sustainability focus

- 3.11.1.3 Cost-effective mobility option

- 3.11.1.4 Subsidies on electric vehicles, favorable regulations, and infrastructure investments

- 3.11.1.5 Technological advancements and app integration

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial investment

- 3.11.2.2 Limited charging infrastructure

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Electric motorcycle

- 5.3 Electric scooter

- 5.4 E-bikes

- 5.5 Electric kick scooter

Chapter 6 Market Estimates & Forecast, By Sharing System, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Key trends

- 6.2 Docked

- 6.3 Dockless (Free-Floating)

Chapter 7 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 Removable/swappable battery

- 7.3 Fixed/integrated battery

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Tourists

- 8.4 Corporate/institutional users

Chapter 9 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 B2C (Business-to-Consumer)

- 9.3 B2B (Business-to-Business)

- 9.4 P2P (Peer-to-Peer) sharing

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bird.co

- 11.2 Bolt

- 11.3 Bounce Infinity

- 11.4 Cityscoot

- 11.5 Cooltra

- 11.6 Dott

- 11.7 emmy Sharing

- 11.8 Felyx

- 11.9 GoShare (by Gogoro)

- 11.10 GrabWheels

- 11.11 Grin

- 11.12 Helbiz

- 11.13 HelloBike

- 11.14 Lime Micromobility

- 11.15 Meituan (Mobike)

- 11.16 Revel

- 11.17 Spin

- 11.18 TIER Mobility

- 11.19 Voi Technology

- 11.20 Yulu