|

市场调查报告书

商品编码

1740974

低温空气分离装置市场机会、成长动力、产业趋势分析及2025-2034年预测Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

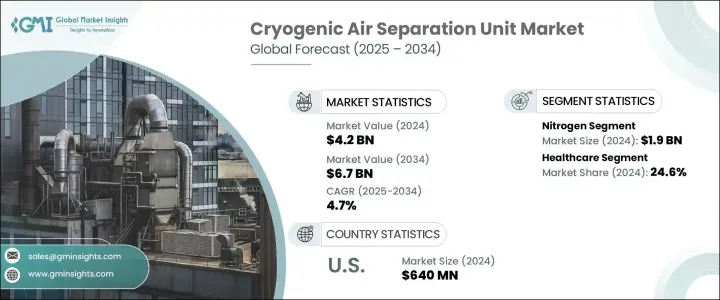

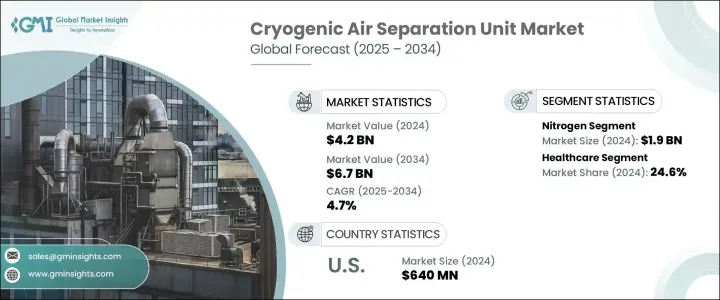

2024年,全球低温空气分离装置市场规模达42亿美元,预计2034年将以4.7%的复合年增长率成长,达到67亿美元。这主要得益于钢铁、化工和製造业等各行各业对氧气、氮气和氩气等工业气体需求的不断增长。随着工业活动的扩张,尤其是在发展中国家,对这些气体的需求激增,从而推动了对空气分离技术的投资。

此外,新冠疫情凸显了全球医疗体系的脆弱性,尤其是在危机高峰期,医用级氧气的短缺尤为突出。这种迫切性促使各国政府和私人医疗机构优先投资医用气体基础设施。因此,对能够大规模生产高纯度氧气的低温空气分离装置的需求激增。医院和急救机构开始升级其製氧能力,包括新建和改造。除了当前的危机应对措施外,这一趋势还在持续,成为增强医疗韧性的更广泛努力的一部分,尤其是在医疗服务可近性迅速扩大的新兴市场。这种转变也鼓励了医用气体的本地生产,减少了对进口的依赖,并确保了各地区的长期供应稳定。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 67亿美元 |

| 复合年增长率 | 4.7% |

预计到2034年,氩气市场规模将达到14亿美元,这得益于其在建立惰性气体环境方面发挥的重要作用,而惰性气体环境对于精密驱动的工业应用至关重要。随着製造技术日益专业化,对稳定、无反应环境的需求也日益增长。氩气在TIG焊接、电子製造、雷射切割以及特殊玻璃和太阳能板生产等製程的广泛应用,凸显了其日益增长的重要性。清洁能源转型,尤其是太阳能技术的扩展,将继续成为氩气需求的主要催化剂,因为氩气在高温製程中对于保护材料免受污染至关重要。

医疗保健产业在2024年将占24.6%的市场份额,仍是低温空气分离装置的主要终端应用领域。医院、诊所和长期照护中心越来越依赖这些系统来现场生产医用级氧气。随着人口老化和慢性呼吸系统疾病对全球医疗保健系统造成更大压力,这项需求也变得越来越迫切。因此,对医用气体基础设施的投资不断增长,尤其是在那些寻求提高医疗可及性和紧急准备水准的地区。

2024年,美国低温空气分离装置市场规模达6.4亿美元。受页岩气勘探开发增加和清洁氢燃料解决方案推动,北美工业成长催生了对本地化、高容量空分装置的需求。许多此类设施位于偏远或高需求地区,现场天然气生产比运输效率更高。此外,农业和製药业不断增长的氮气需求也强化了空分装置在支持该地区关键供应链方面的作用。

全球低温空气分离装置市场的主要参与者包括液化空气集团、空气产品和化学品公司、AIR WATER INC、AMCS Corporation、CRYOTEC Anlagenbau GmbH、Enerflex Ltd.、开封空气分离集团有限公司、林德公司、梅塞尔、普莱克斯技术公司、Ranch Cryogenics, Inc.、市场公司、林德公司、梅塞尔、普莱克斯技术公司、Ranch Cryogenics, Inc.、市场公司、林德公司、大阳品牌级气体股会、市场级气体股会、市场级电株式产业节和股式工业公司。这些公司专注于合併、收购和合作等策略性倡议,以增强其市场地位和技术能力。为了加强其市场地位,公司正在采取几项关键策略。首先,他们正在投资研发,以提高其产品的效率和环境永续性。这包括将再生能源整合到空气分离装置中以减少碳足迹。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 对贸易的影响

- 展望与未来考虑

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依天然气,2021 - 2034 年

- 主要趋势

- 氮

- 氧

- 氩气

- 其他的

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 钢铁

- 石油和天然气

- 卫生保健

- 化学品

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Evoqua Water Technologies LLC

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- AMCS Corporation

- CRYOTEC Anlagenbau GmbH

- Enerflex Ltd.

- KaiFeng Air Separation Group Co., LTD.

- Linde plc

- Messer

- Praxair Technology, Inc.

- Ranch Cryogenics, Inc.

- Sichuan Air Separation Plant Group

- TAIYO NIPPON SANSO CORPORATION

- Technex

- Universal Industrial Gases, Inc.

- Yingde Gases

The Global Cryogenic Air Separation Unit Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 6.7 billion by 2034, driven by the increasing demand for industrial gases such as oxygen, nitrogen, and argon across various sectors including steel, chemicals, and manufacturing. As industrial activities expand, particularly in developing nations, the need for these gases has surged, prompting investments in air separation technologies.

Additionally, the COVID-19 pandemic highlighted vulnerabilities in global healthcare systems, particularly the shortage of medical-grade oxygen during peak crisis periods. This urgency pushed governments and private healthcare providers to prioritize investments in medical gas infrastructure. As a result, demand surged for cryogenic air separation units capable of producing high-purity oxygen at scale. Hospitals and emergency care facilities began upgrading their oxygen generation capabilities, leading to new installations and retrofits. Beyond the immediate crisis response, this trend has continued as part of broader efforts to strengthen healthcare resilience, especially in emerging markets where healthcare access is expanding rapidly. The shift also encouraged local production of medical gases, reducing reliance on imports and ensuring long-term supply stability across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 4.7% |

The argon segment is projected to hit USD 1.4 billion by 2034, driven by its essential role in establishing inert atmospheres crucial for precision-driven industrial applications. As manufacturing technologies become more specialized, the need for stable, non-reactive environments has intensified. Argon's widespread adoption in processes such as TIG welding, electronics fabrication, laser cutting, and the production of specialty glass and solar panels underscores its growing relevance. The clean energy transition, particularly the expansion of solar technology, continues to be a major catalyst for argon demand, as the gas is indispensable in protecting materials from contamination during high-temperature procedures.

The healthcare industry, accounting for a 24.6% share in 2024, remains a major end-use segment for cryogenic air separation units. Hospitals, clinics, and long-term care centers increasingly depend on these systems to generate medical-grade oxygen onsite. This need is becoming more pressing as aging populations and chronic respiratory conditions place greater strain on healthcare systems worldwide. In response, investments in medical gas infrastructure have grown, particularly in regions seeking to enhance healthcare access and emergency readiness.

U.S. Cryogenic Air Separation Unit Market reached USD 640 million in 2024. Industrial growth in North America, supported by increased exploration of shale gas and a push for cleaner hydrogen fuel solutions, has created demand for localized, high-capacity ASU installations. Many of these facilities are in remote or high-demand zones where on-site gas generation is more efficient than transportation. Additionally, rising nitrogen demand in agriculture and pharmaceutical manufacturing reinforces the role of ASUs in supporting critical supply chains across the region.

Key players in the Global Cryogenic Air Separation Unit Market include Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co., LTD, Linde plc, Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases. These companies focus on strategic initiatives such as mergers, acquisitions, and partnerships to enhance their market presence and technological capabilities. To strengthen their presence in the market, companies are adopting several key strategies. Firstly, they are investing in research and development to enhance the efficiency and environmental sustainability of their products. This includes integrating renewable energy sources into air separation units to reduce carbon footprints.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Evoqua Water Technologies LLC

- 8.2 Air Liquide

- 8.3 Air Products and Chemicals, Inc.

- 8.4 AIR WATER INC

- 8.5 AMCS Corporation

- 8.6 CRYOTEC Anlagenbau GmbH

- 8.7 Enerflex Ltd.

- 8.8 KaiFeng Air Separation Group Co., LTD.

- 8.9 Linde plc

- 8.10 Messer

- 8.11 Praxair Technology, Inc.

- 8.12 Ranch Cryogenics, Inc.

- 8.13 Sichuan Air Separation Plant Group

- 8.14 TAIYO NIPPON SANSO CORPORATION

- 8.15 Technex

- 8.16 Universal Industrial Gases, Inc.

- 8.17 Yingde Gases