|

市场调查报告书

商品编码

1741016

非低温空气分离装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Non-Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

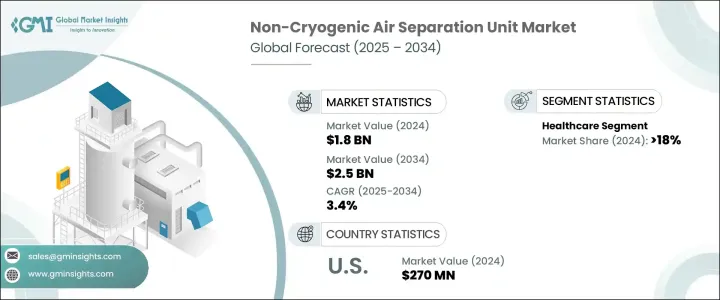

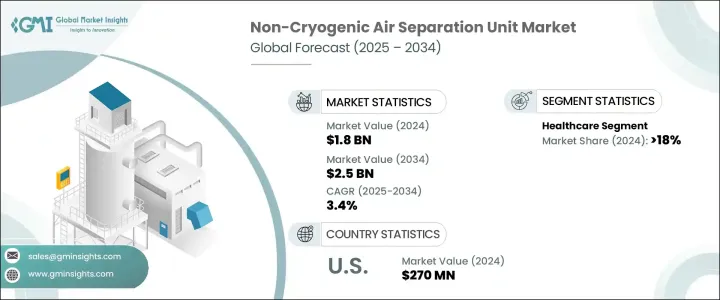

2024年,全球非低温空气分离装置市场规模达18亿美元,预计2034年将以3.4%的复合年增长率成长,达到25亿美元。公共部门措施和有利政策框架的日益支持,推动了各行各业对非低温空气分离系统的需求。这些系统正被工业运营商广泛采用,不仅是为了满足环境合规目标,也是为了与更广泛的永续发展目标和企业社会责任驱动的议程保持一致。随着越来越多的企业致力于脱碳减排,无需依赖低温处理即可实现能源效率的空气分离系统正受到广泛青睐。

环境法规和全球对低碳技术的推动显着提升了这些系统在化学、医疗保健、钢铁和能源等领域的价值。各组织正在采用非低温技术,以实现更清洁的运营,同时降低传统低温工厂的营运复杂性和成本负担。国际环境协定和地方绿色政策推动的监管势头持续激发新兴市场和成熟市场的自愿需求。从小型模组化装置到先进的PSA系统,非低温装置的灵活性与清洁能源和本地化工业生产不断变化的需求相契合。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 3.4% |

根据气体类型,氮气仍然是非低温空气分离装置成长的主要驱动力。它广泛应用于多个行业,尤其是食品饮料、电子和製药行业,使其成为生产和包装作业中不可或缺的能源。食品加工产业对气调包装 (MAP) 的日益依赖是推动这一需求成长的最重要因素之一。除了食品应用外,氮气对于在敏感製造製程(例如半导体製造和製药生产)中创造惰性环境也至关重要,因为在这些製程中,氧化控制和污染预防至关重要。

2024年,医疗保健产业占18%,反映出现场製氧技术使用量的增加。在终端用户方面,石油天然气、钢铁和化学等行业的核心运作都依赖氧气和氮气。尤其是在炼钢过程中,氧气可以提高炉效,而氩气则可以确保去除杂质。随着工业脱碳策略的实施,现场富氧燃烧系统的采用率正在上升。在医疗保健领域,对透过便携式PSA装置生产的医用级氧气的需求正在激增,尤其是在偏远和服务不足的地区。

在监管规定和基础设施投资的推动下,美国非低温空气分离装置市场规模在2024年达到2.7亿美元。氢气开发和氨气生产的资金投入,正在创造对非低温氧气和氮气装置的强劲需求。管道安全监管措施也推动了页岩地区氮气生产装置的安装量增加。这些趋势,加上工业天然气基础设施的现代化建设,将继续塑造美国市场的长期成长。

活跃于全球非低温空气分离装置产业的主要公司包括梅塞尔、AIR WATER INC、Enerflex Ltd.、Technex、盈德气体、Ranch Cryogenics, Inc.、AMCS Corporation、大阳日酸株式会社、空气产品和化学公司、开封空分集团有限公司、CRYOTEC Anlagenbau GmbH、液化空气集团公司和化学公司、黑色分公司、工业公司四川工业公司。为了保持竞争力,领先的企业专注于扩展其模组化产品组合,同时整合基于物联网的自动化和数位监控解决方案。公司正在与能源、医疗保健和工业气体分销商建立策略合作伙伴关係,以加强其区域影响力。此外,研发的重点是提高系统能源效率,提高气体纯度水平,以及为分散和移动用例开发基于 PSA 的紧凑型模型。这些策略正在帮助供应商满足不断增长的市场需求,同时为清洁能源转型做好准备。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 川普政府关税对贸易和整体产业的影响

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依天然气,2021 - 2034 年

- 主要趋势

- 氮

- 氧

- 氩气

- 其他的

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 钢铁

- 石油和天然气

- 卫生保健

- 化学品

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- AMCS Corporation

- CRYOTEC Anlagenbau GmbH

- Enerflex Ltd.

- KaiFeng Air Separation Group Co.,LTD.

- Linde plc

- Messer

- Praxair Technology, Inc.

- Ranch Cryogenics, Inc.

- Sichuan Air Separation Plant Group

- Taiyo Nippon Sanso Corporation

- Technex

- Universal Industrial Gases, Inc.

- Yingde Gases

The Global Non-Cryogenic Air Separation Unit Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.5 billion by 2034. Growing support from public sector initiatives and favorable policy frameworks fuel the demand for non-cryogenic air-separation systems across industries. These systems are being widely adopted by industrial operators not only to meet environmental compliance targets but also to align with broader sustainability goals and CSR-driven agendas. As more corporations commit to decarbonization and emission reduction, air separation systems that offer energy efficiency without relying on cryogenic processing are gaining preference across the board.

Environmental regulations and the global push for low-carbon technologies have significantly elevated the value of these systems in sectors such as chemicals, healthcare, steel, and energy. Organizations are embracing non-cryogenic technologies to achieve cleaner operations while reducing operational complexities and cost burdens associated with traditional cryogenic plants. Regulatory momentum driven by international environmental agreements and local green policies continues generating voluntary demand from emerging and mature markets. From smaller-scale modular units to advanced PSA systems, the flexibility of non-cryogenic setups aligns with the shifting demands for clean energy and localized industrial production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 3.4% |

Based on gas type, nitrogen continues to be the primary driver for the growth of non-cryogenic air separation units. Its widespread use across multiple industries-especially food and beverage, electronics, and pharmaceuticals-has made it essential in production and packaging operations. One of the most significant contributors to this demand is the increasing reliance on modified atmosphere packaging (MAP) within the food processing sector. Beyond food applications, nitrogen is also crucial for creating inert environments in sensitive manufacturing processes, such as in semiconductor fabrication and pharmaceutical production, where oxidation control and contamination prevention are critical.

The healthcare industry accounted for an 18% share in 2024, reflecting increased usage of on-site oxygen production technologies. On the end-user front, sectors such as oil & gas, iron & steel, and chemicals rely on oxygen and nitrogen in their core operations. Particularly in steelmaking, oxygen improves furnace performance while argon ensures the removal of impurities. The adoption of on-site systems for oxygen-enriched combustion is rising with industrial decarbonization strategies. In healthcare, demand for medical-grade oxygen produced via portable PSA units is surging, especially in remote and underserved areas.

U.S. Non-Cryogenic Air Separation Unit Market reached USD 270 million in 2024, supported by regulatory mandates and infrastructure investments. Funding for hydrogen development and ammonia production is creating robust demand for non-cryogenic oxygen and nitrogen units. Regulatory actions concerning pipeline safety are also contributing to higher installations of nitrogen generation units across shale regions. These trends, along with modernization efforts in industrial gas infrastructure, continue to shape long-term growth in the U.S. market.

Major companies active in the Global Non-Cryogenic Air Separation Unit Industry include Messer, AIR WATER INC, Enerflex Ltd., Technex, Yingde Gases, Ranch Cryogenics, Inc., AMCS Corporation, Taiyo Nippon Sanso Corporation, Air Products and Chemicals, Inc., KaiFeng Air Separation Group Co., LTD., CRYOTEC Anlagenbau GmbH, Air Liquide, Universal Industrial Gases, Inc., Linde plc, Sichuan Air Separation Plant Group, and Praxair Technology, Inc. To remain competitive, leading players focus on expanding their modular product portfolios while integrating IoT-based automation and digital monitoring solutions. Companies are entering strategic partnerships with energy, healthcare, and industrial gas distributors to strengthen their regional footprints. Additionally, R&D is centered on boosting system energy efficiency, improving gas purity levels, and developing compact PSA-based models for decentralized and mobile use cases. These tactics are helping suppliers meet rising market demand while positioning themselves for the clean energy transition.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Impact of Trump administration tariffs on trade & overall industry

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Air Products and Chemicals, Inc.

- 8.3 AIR WATER INC

- 8.4 AMCS Corporation

- 8.5 CRYOTEC Anlagenbau GmbH

- 8.6 Enerflex Ltd.

- 8.7 KaiFeng Air Separation Group Co.,LTD.

- 8.8 Linde plc

- 8.9 Messer

- 8.10 Praxair Technology, Inc.

- 8.11 Ranch Cryogenics, Inc.

- 8.12 Sichuan Air Separation Plant Group

- 8.13 Taiyo Nippon Sanso Corporation

- 8.14 Technex

- 8.15 Universal Industrial Gases, Inc.

- 8.16 Yingde Gases