|

市场调查报告书

商品编码

1741038

营养血清市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nutritional Serum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

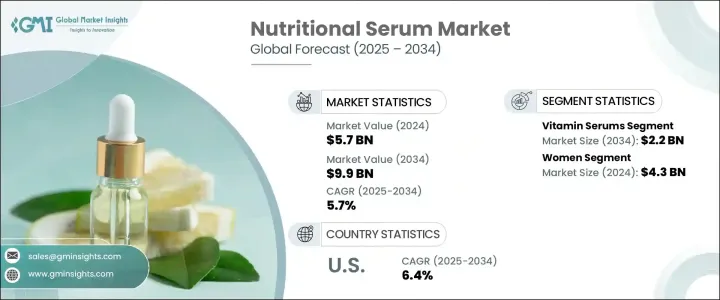

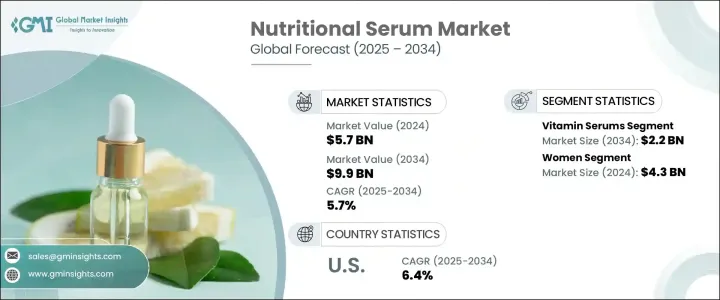

2024 年全球营养精华液市场价值为 57 亿美元,预计年复合成长率为 5.7%,到 2034 年将达到 99 亿美元,这得益于消费者对预防性护肤的日益关注,他们也越来越意识到保持长期皮肤健康的重要性。随着人们寻求针对老化、氧化压力和皮肤瑕疵等问题的针对性解决方案,对专用精华液的需求激增。这一趋势在已开发市场和新兴市场尤为明显,消费者正在寻找有科学研究依据并含有高品质成分的护肤产品。皮肤科医生和护肤品牌正在透过提供更有效、更透明的配方来应对这种转变,以满足对效果显着的产品日益增长的需求。

化妆品科学与技术的进步进一步推动了这个市场的发展。随着烟碱酰胺、透明质酸和维生素C等活性成分的识别和稳定,各大品牌开发出了多功能精华液,能够提供多种护肤功效,同时最大程度地减少刺激。诸如封装和微乳技术等增强型递送系统也透过提高吸收率和生物利用度,使这些产品更加有效。随着这些创新技术使高性能护肤品更加触手可及,先进的皮肤科精华液也越来越受欢迎,无论是高端消费者还是大众消费者都从中受益。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 99亿美元 |

| 复合年增长率 | 5.7% |

市场细分为多种产品类型,包括维生素精华液、抗氧化精华液、保湿精华液、去角质精华液、抗衰老精华液、亮肤精华液、抗痘精华液、控油精华液和紧緻精华液。维生素精华液占据市场主导地位,2024 年价值达 12 亿美元,预计到 2034 年将达到 22 亿美元。维生素 C、E 和 B3(烟碱酰胺)是这些配方中的关键成分,具有促进胶原蛋白生成和提亮肤色等功效。强大的临床支援和皮肤科医生的推荐增强了消费者对维生素精华液的信心,进一步提升了其吸引力。

长期以来,女性一直是营养精华液市场的主要消费者,为其整体价值贡献巨大。据估计,2024 年营养精华液市场规模达 43 亿美元,预计 2025-2034 年期间将以 5.4% 的速度增长,反映出女性护肤意识的不断提升。数位媒体、美妆达人以及精准品牌行销的影响力进一步激发了女性对护肤液的兴趣,从而增加了对专业精华液的需求。不同年龄层的女性尤其青睐能够有效对抗老化、干燥、色素沉淀和肤质不均的精华液。人们对皮肤健康的日益关注,加上资讯取得的便利性,促使更多女性投资于满足自身特定皮肤需求的产品。

2024年,美国营养精华液市场规模达9亿美元,预计到2034年将以6.4%的复合年增长率增长,这得益于消费者认知度的提升、可支配收入的增加以及护肤品行业的蓬勃发展。千禧世代和Z世代正在推动对富含抗氧化剂、维生素和抗衰老成分的精华液的需求。这些年轻一代见多识广,渴望采用注重皮肤健康和长寿的护肤程序。护肤作为一种自我照顾的持续趋势进一步加速了这一需求,使美国成为营养精华液市场的主导者。

全球营养精华液市场的主要参与者包括强生、宝洁、科蒂、露华浓、资生堂、爱茉莉太平洋、拜尔斯道夫、欧莱雅、美体小舖、玫琳凯、高德美、娇韵诗、高丝、联合利华和雅诗兰黛。营养精华液市场的公司采用各种策略来提升其市场占有率,包括持续的产品创新和成分透明度。许多品牌专注于开发满足不同皮肤需求的多功能精华液。他们投资于先进的输送系统,以提高产品的有效性和客户满意度。行销工作着重于与有影响力的人士合作和有针对性的数位行销活动,以提高品牌知名度,尤其是在年轻消费者中。此外,该公司正在扩大其在电子商务平台上的影响力,以接触更广泛的受众,并确保全球消费者能够轻鬆购买他们的产品。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 成长动力

- 消费者对预防性护肤的意识不断提高

- 皮肤科研究与成分创新的进展

- 对个人化和包容性护肤解决方案的需求不断增长

- 产业陷阱与挑战

- 产品成本高,且价格敏感型市场可近性有限

- 严格的监管审批和成分合规挑战

- 成长动力

- 成长潜力分析

- 原料分析

- 监管格局

- 波特的分析

- PESTEL分析

- 消费者行为分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 维生素精华液

- 抗氧化精华液

- 保湿精华液

- 去角质精华液

- 抗老精华素

- 亮白精华液

- 抗痤疮精华液

- 控油精华液

- 紧緻肌肤精华素

- 其他的

第六章:市场估计与预测:依皮肤类型,2021 - 2034

- 主要趋势

- 皮肤干燥

- 油性肌肤

- 正常皮肤

- 敏感肌肤

第七章:市场估计与预测:依定价,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 男士

- 女性

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司现场

- 离线

- 专卖店

- 药局

- 其他(百货商场等)

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Amorepacific

- Beiersdorf

- Clarins

- Coty

- Estee Lauder

- Galderma

- Johnson & Johnson

- KOSE

- L'Oreal

- Mary Kay

- Procter & Gamble

- Revlon

- Shiseido

- The Body Shop

- Unilever

The Global Nutritional Serum Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 9.9 billion by 2034, driven by the increasing focus on preventive skincare, with consumers becoming more aware of the importance of maintaining long-term skin health. As people seek targeted solutions for issues like aging, oxidative stress, and skin imperfections, the demand for specialized serums has surged. This trend is especially evident in both developed and emerging markets, where consumers are looking for skincare products backed by scientific research and containing high-quality ingredients. Dermatologists and skincare brands are responding to this shift by offering more effective and transparent formulations, catering to the growing demand for products that deliver visible results.

Technological advancements in cosmetic science have further fueled this market. With the identification and stabilization of active ingredients such as niacinamide, hyaluronic acid, and vitamin C, brands have developed multifunctional serums that provide multiple skin benefits with minimal irritation. Enhanced delivery systems, such as encapsulation and microemulsion technology, have also made these products more effective by improving absorption and bioavailability. As these innovations have made high-performance skincare more accessible, dermatologically advanced serums have gained popularity, with both high-end and mass-market consumers benefiting from these improvements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 5.7% |

The market is divided into several product types, including vitamin, antioxidant, hydrating, exfoliating, anti-aging, brightening, anti-acne, oil control, and skin-tightening serums. The vitamin serums segment led the market, valued at USD 1.2 billion in 2024, and is expected to reach USD 2.2 billion by 2034. Vitamin C, E, and B3 (niacinamide) are key ingredients in these formulations, providing benefits like collagen boosting and brightening of the skin. Consumer confidence in vitamin serums is bolstered by strong clinical support and endorsements from dermatologists, further increasing their appeal.

Women have long been the primary consumers in the nutritional serum market, contributing significantly to its overall value, which was estimated at USD 4.3 billion in 2024 and is expected to grow at a rate of 5.4% during 2025-2034, reflecting the rising awareness among women about skincare. This heightened interest has been propelled by the influence of digital media, beauty influencers, and targeted brand marketing, which have increased the demand for specialized serums. Women across different age groups are particularly drawn to serums that address aging, dryness, hyperpigmentation, and uneven skin texture. The growing focus on skin health, paired with easy access to information, has encouraged more women to invest in products that cater to their specific skin needs.

U.S. Nutritional Serum Market was valued at USD 900 million in 2024 and is projected to grow at a CAGR of 6.4% through 2034, fueled by high consumer awareness, increased disposable income, and a robust skincare industry. Millennials and Generation Z are driving the demand for serums that feature antioxidants, vitamins, and anti-aging ingredients. These younger generations are well-informed and eager to adopt skincare routines emphasizing skin health and longevity. The ongoing trend of skincare as a self-care has further accelerated this demand, making the U.S. a dominant player in the nutritional serum market.

Major players in the Global Nutritional Serum Market include Johnson & Johnson, Procter & Gamble, Coty, Revlon, Shiseido, Amorepacific, Beiersdorf, L'Oreal, The Body Shop, Mary Kay, Galderma, Clarins, KOSE, Unilever, and Estee Lauder.Companies in the nutritional serum market adopt various strategies to enhance their market presence, including continuous product innovation and ingredient transparency. Many brands are focusing on developing multifunctional serums that cater to diverse skin needs. They invest in advanced delivery systems to increase product effectiveness and customer satisfaction. Marketing efforts focus on influencer collaborations and targeted digital campaigns to increase brand visibility, especially among younger consumers. Additionally, companies are expanding their presence in e-commerce platforms to reach a broader audience and ensure their products are easily accessible to consumers worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising consumer awareness of preventive skincare

- 3.3.1.2 Advancements in dermatological research and ingredient innovation

- 3.3.1.3 Growing demand for personalized and inclusive skincare solutions

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High product costs and limited accessibility in price-sensitive markets

- 3.3.2.2 Stringent regulatory approvals and ingredient compliance challenges

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Raw Material analysis

- 3.6 Regulatory landscape

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Consumer behavior analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Vitamin serums

- 5.3 Antioxidant serums

- 5.4 Hydrating serums

- 5.5 Exfoliating serums

- 5.6 Anti-aging serums

- 5.7 Brightening serums

- 5.8 Anti-acne serums

- 5.9 Oil control serums

- 5.10 Skin-tightening serums

- 5.11 Others

Chapter 6 Market Estimates & Forecast, By Skin Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Dry skin

- 6.3 Oily skin

- 6.4 Normal skin

- 6.5 Sensitive skin

Chapter 7 Market Estimates & Forecast, By Pricing, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Men

- 8.3 Women

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key Trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company site

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Pharmacy

- 9.3.3 Others (departmental stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 The U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Amorepacific

- 11.2 Beiersdorf

- 11.3 Clarins

- 11.4 Coty

- 11.5 Estee Lauder

- 11.6 Galderma

- 11.7 Johnson & Johnson

- 11.8 KOSE

- 11.9 L'Oreal

- 11.10 Mary Kay

- 11.11 Procter & Gamble

- 11.12 Revlon

- 11.13 Shiseido

- 11.14 The Body Shop

- 11.15 Unilever