|

市场调查报告书

商品编码

1750625

点阵打标机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dot Peen Marking Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

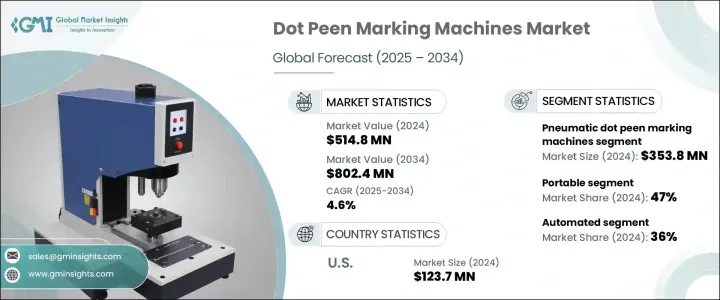

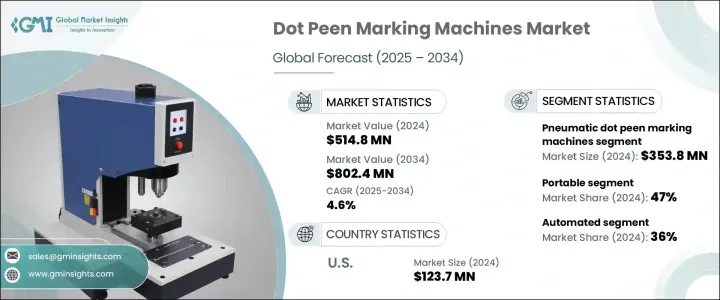

2024年,全球点阵打标机市场规模达5.148亿美元,预计2034年将以4.6%的复合年增长率成长,达到8.024亿美元,这得益于各行各业转型为更自动化、更有效率的生产线。随着工业製造规模不断扩大和多样化,对耐用、永久和高精度打标技术的需求也日益增长。点阵打标机的应用日益广泛,因为它们能够在包括金属和塑胶在内的各种表面上提供一致且清晰的标记。随着企业致力于减少错误、提高可追溯性并提升整体生产效率,向工业4.0的转型进一步增强了自动化打标技术的吸引力。

汽车、製药和电子等行业需要能够确保符合可追溯性标准和品质控制的标记系统。这使得针式打标机成为生产车间的重要资产。这些行业自动化程度的提高正推动整合式和便携式系统得到更广泛的应用。气动打标机因其成本效益高且相容大批量生产,继续占据市场主导地位。气动打标机能够快速、准确地打标,广泛应用于大量生产的组装线。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.148亿美元 |

| 预测值 | 8.024亿美元 |

| 复合年增长率 | 4.6% |

气动点阵打标机在2024年实现了3.538亿美元的市场规模,预计到2034年将以4.4%的复合年增长率成长。其成本效益以及在大批量生产环境中始终如一的性能,使其继续成为工业用户的首选解决方案。这些系统在速度和精度至关重要的快节奏环境中尤其有效,并且与机械手臂和生产线自动化的兼容性进一步增强了其实用性。由于这些机器能够以最低的营运成本和维护成本提供永久性、防篡改的标记,因此越来越受到製造商的青睐。

在安装方面,便携式点阵打标系统在2024年占据了47%的市场。其紧凑的外形、易用性以及对不同工作条件的适应性使其在造船、铁路和建筑设备等经常需要现场打标的行业中尤为重要。这些设备使操作员能够精确地标记大型或固定的部件,无需将重物运送到固定的机器上。随着即时可追溯识别在品质保证流程中的重要性日益提升,便携式机器越来越多地被整合到现有和远端工作环境中。

得益于美国先进的製造能力,美国点阵打标机市场规模在2024年达到1.237亿美元。航太、国防、製药和电子等产业高度依赖可追溯性、法规遵循、产品生命週期追踪——在这些领域,点阵系统能够发挥巨大价值。美国製造商正在投资于能够确保准确性、持久性以及与自动化系统整合的打标技术。

为了巩固市场地位,日立、Pryor Technology、SIC Marking、Gravotech Group、MarkinBOX USA、Dapra Marking Systems、Technomark 和 MECCO 等主要参与者正在加大研发投入,以提高标记精度和系统整合度。 Columbia Marking Tools 和 Borries Markier-Systeme 等公司也专注于模组化和便携式系统开发,而 Pannier 和 COUTH 等其他公司则瞄准新兴经济体,提供可客製化、经济高效的解决方案。策略合作伙伴关係、售后服务和自动化友善设计对于在这个不断成长的市场中保持竞争力至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 工业製造业需求不断成长

- 自动点阵打标机的采用率不断上升

- 产业陷阱与挑战

- 有限的标记深度和表面要求

- 新兴打标机的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 气动

- 电磁

第六章:市场估计与预测:按安装量,2021-2034 年

- 主要趋势

- 便携的

- 桌上型

- 融合的

第七章:市场估计与预测:按运营,2021-2034

- 主要趋势

- 自动化

- 半自动化

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 航太

- 医疗器材

- 电子产品

- 工业工具和设备

- 建造

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Borries Markier-Systeme

- Columbia Marking Tools

- COUTH

- Dapra Marking Systems

- Gravotech Group

- Hitachi

- Kwikmark

- MarkinBOX USA

- MECCO

- Nichol Industries

- Ostling Etchmark

- Pannier

- Pryor Technology

- SIC Marking

- Technomark

The Global Dot Peen Marking Machines Market was valued at USD 514.8 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 802.4 million by 2034, driven by industries' move toward more automated and efficient production lines. As industrial manufacturing continues to scale and diversify, the demand for durable, permanent, and high-precision marking technologies has intensified. Dot peen marking machines are increasingly used because they deliver consistent and legible marks on a range of surfaces, including metals and plastics. The transition to Industry 4.0 is further enhancing the appeal of automated marking technologies, as businesses aim to reduce errors, improve traceability, and enhance overall production efficiency.

Sectors such as automotive, pharmaceuticals, and electronics require marking systems that ensure compliance with traceability standards and quality control. This has made dot peen machines an asset on production floors. The rise in automation across these industries is leading to broader adoption of integrated and portable systems. Pneumatic variants continue to dominate the market due to their cost-effectiveness and compatibility with high-volume operations. With the ability to deliver fast, accurate markings, they are widely used in assembly lines for bulk production processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $514.8 Million |

| Forecast Value | $802.4 Million |

| CAGR | 4.6% |

The pneumatic dot peen marking machines brought in USD 353.8 million in 2024 and are forecasted to grow at a CAGR of 4.4% through 2034. Their cost-effectiveness, combined with consistent performance in high-volume manufacturing environments, continues to position them as a preferred solution for industrial users. These systems are particularly effective in fast-paced settings where speed and accuracy are critical, and their compatibility with robotic arms and production line automation further enhances their utility. Manufacturers increasingly favor these machines due to their ability to deliver permanent, tamper-resistant markings with minimal operational cost and maintenance.

In terms of installation, portable dot peen marking systems made up 47% share in 2024. Their compact form factor, ease of use, and adaptability to different working conditions make them especially valuable in industries such as shipbuilding, railways, and construction equipment, where components often require on-the-spot marking. These units allow operators to mark large or immobile parts with accuracy, eliminating the need to transport heavy items to stationary machines. As the importance of real-time traceable identification continues to grow in quality assurance processes, portable machines are increasingly being integrated into both established and remote work environments.

United States Dot Peen Marking Machines Market reached USD 123.7 million in 2024, driven by the country's advanced manufacturing capabilities. Sectors such as aerospace, defense, pharmaceuticals, and electronics are heavily reliant on traceability, regulatory compliance, and product lifecycle tracking-areas where dot peen systems offer significant value. American manufacturers are investing in marking technologies that ensure accuracy, permanence, and integration with automated systems.

To strengthen their market position, key players such as Hitachi, Pryor Technology, SIC Marking, Gravotech Group, MarkinBOX USA, Dapra Marking Systems, Technomark, and MECCO are investing in R&D to advance marking accuracy and system integration. Companies like Columbia Marking Tools and Borries Markier-Systeme are also focusing on modular and portable system development, while others, such as Pannier and COUTH, are targeting emerging economies with customizable, cost-effective solutions. Strategic partnerships, after-sales services, and automation-friendly designs are becoming critical to remain competitive in this growing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand from industrial manufacturing sector

- 3.6.1.2 Rising adoption of automated dot peen marking machine

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited marking depth and surface requirements

- 3.6.2.2 Competition from emerging marking machines

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Pneumatic

- 5.3 Electromagnetic

Chapter 6 Market Estimates & Forecast, By Installation, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Benchtop

- 6.4 Integrated

Chapter 7 Market Estimates & Forecast, By Operation, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automated

- 7.3 Semi-automated

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Medical devices

- 8.5 Electronics

- 8.6 Industrial tools and equipment

- 8.7 Construction

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Borries Markier-Systeme

- 11.2 Columbia Marking Tools

- 11.3 COUTH

- 11.4 Dapra Marking Systems

- 11.5 Gravotech Group

- 11.6 Hitachi

- 11.7 Kwikmark

- 11.8 MarkinBOX USA

- 11.9 MECCO

- 11.10 Nichol Industries

- 11.11 Ostling Etchmark

- 11.12 Pannier

- 11.13 Pryor Technology

- 11.14 SIC Marking

- 11.15 Technomark