|

市场调查报告书

商品编码

1844365

雷射打标机市场机会、成长动力、产业趋势分析及2025-2034年预测Laser Marking Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

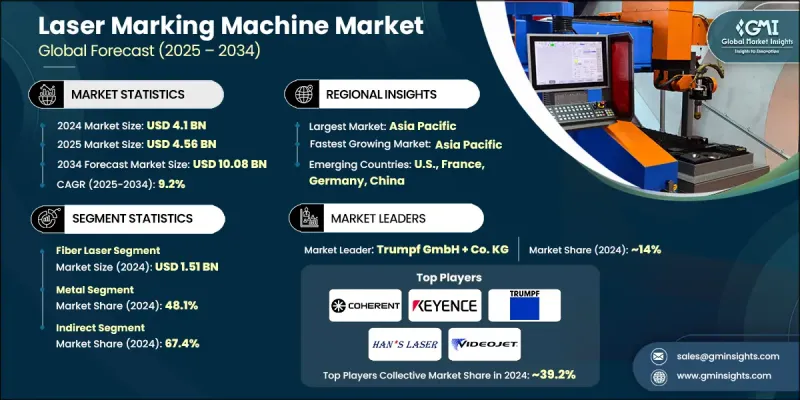

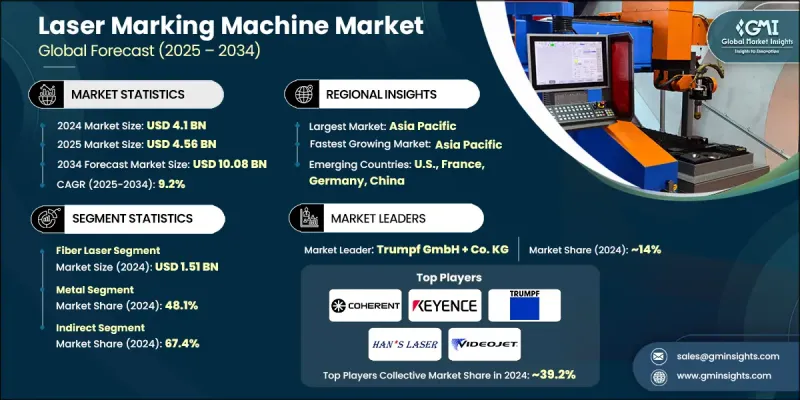

2024 年全球雷射打标机市值为 41 亿美元,预计将以 9.2% 的复合年增长率成长,到 2034 年达到 100.8 亿美元。

这一增长是由快速的技术进步、不断变化的工业需求和不断增长的国内製造业共同推动的。推动这项扩张的主要因素之一是电子、航太、製药、医疗设备和汽车等受到严格监管的行业对可追溯性和合规性的要求日益增长。传统的基于油墨的方法或不干胶标籤不符合当今的耐用性和易读性标准,这些标准正透过监管框架日益严格地执行。另一方面,雷射打标提供永久、准确和防篡改的标记,这对于安全、品质保证和防伪至关重要。向智慧製造和自动化的转变进一步加速了需求。光纤雷射技术因其高速打标、低维护和与多种材料相容而成为主导选择。从区域来看,亚太地区继续引领市场成长,这得益于其大规模的工业基础、政策驱动的製造业升级以及消费性电子和汽车行业不断增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 100.8亿美元 |

| 复合年增长率 | 9.2% |

光纤雷射器市场在2024年创造了15.1亿美元的市场规模,预计2025年至2034年的复合年增长率将达到10.1%。其广泛应用得益于其高效的运作效率、卓越的光束品质以及处理多种基材的能力。光纤雷射系统具有更高的功率密度和更快的处理速度,其性能优于二氧化碳雷射和传统的固态雷射。这些特性使其特别适用于涉及铜、铝和不銹钢等金属的商业应用,这些应用对标记结果的精度、速度和耐用性有很高的要求。

金属领域在2024年占据了48.1%的市场份额,预计到2034年将以8.5%的复合年增长率成长。各行各业对金属的使用日益增多,加上严格的可追溯性标准,使得雷射打标成为识别和品质控制的首选方法。金属上的标记具有卓越的耐用性,并且耐热、耐磨损、耐化学腐蚀,使其成为高要求应用的理想选择。光纤雷射对金属的吸收率高,可实现快速、清洁、精确的标记,同时对周围表面的影响极小,兼具性能和成本效益。

美国雷射打标机市场占82.4%的市场份额,2024年市场规模达8.336亿美元。美国市场主导地位源自于其先进的工业生态系统,涵盖医疗器材、航太、国防、电子和汽车等领域。这些行业高度依赖永久性标记系统来满足法律的可追溯性标准和合规性要求。先进的雷射系统,包括紫外线和超快型号,已被广泛应用于该地区的自动化生产线。设备识别和零件标籤方面的法规在推动雷射打标机的普及方面发挥了核心作用。

影响全球雷射打标机市场的公司包括 Lumentum Operations、LaserStar Technologies、FOBA Technology and Services、Keyence、Coherent、Han's Yueming Laser Group、Gravotech Marking、Laser Photonics、Epilog Laser、IPG Photonics、Huagong Tech、Novantata、Dana Technologyher、大恆新纪元科技、新纪元科技和 Industa Technology。这些主要的行业参与者在研发、自动化和性能驱动的系统开发方面投入了大量资金,以满足下一代标记要求。雷射打标机市场的领先公司正在透过持续的研发投资来巩固其地位,以开发高速、高精度且维护需求极少的系统。他们专注于光纤、紫外线和超快雷射技术的创新,以满足电子、航太和医疗设备等领域的特定需求。正在进行策略性收购和全球扩张,以提高市场渗透率并实现产品组合多样化。製造商还将他们的系统与智慧工厂技术和自动化平台结合,以提供交钥匙解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电子产品小型化和精密化需求不断提高

- 自动化/工业4.0集成

- 高需求领域的成长(电动车电池、汽车、医疗设备

- 产业陷阱与挑战

- 雷射使用的安全和法规遵从性

- 特定材料和应用的限制

- 机会

- 光纤、皮秒/飞秒和紫外线雷射生长

- 与机器视觉、可追溯性和 IIoT 集成

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局(HS 编码 -8456.11)

- 标准和合规要求

- 区域监理框架

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 光纤雷射

- 绿色雷射

- 紫外线雷射

- Co2雷射

- Mopa雷射

- 二极体泵浦雷射

- Nd:yag雷射

- 其他的

第六章:市场估计与预测:依机器类型,2021 - 2034 年

- 主要趋势

- 2D

- 3D

第七章:市场估计与预测:依行程类型,2021 - 2034

- 主要趋势

- 固定的

- 便携的

第八章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 金属

- 玻璃

- 塑胶

- 陶瓷

- 其他的

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 消融

- 退火

- 碳化

- 起泡

- 雕刻

- 其他的

第 10 章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 汽车

- 电子和半导体

- 国防和航太

- 工具机

- 卫生保健

- 包装和标籤

- 其他的

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十三章:公司简介

- Coherent

- Daheng New Epoch Technology

- Danaher

- Epilog Laser

- FOBA Technology and Services

- Gravotech Marking

- Han's Laser Technology Industry Group

- Han's Yueming Laser Group

- Huagong Tech

- IPG Photonics

- Keyence

- Laser Photonics

- LaserStar Technologies

- Lumentum Operations

- Novanta

The Global Laser Marking Machine Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 10.08 billion by 2034.

The growth is driven by the combined impact of rapid technological advancements, evolving industrial demands, and rising domestic manufacturing. One of the main factors fueling this expansion is the growing requirement for traceability and compliance across highly regulated sectors such as electronics, aerospace, pharmaceuticals, medical equipment, and automotive. Traditional ink-based methods or adhesive labels do not meet today's durability and legibility standards, which are increasingly enforced through regulatory frameworks. Laser marking, on the other hand, offers permanent, accurate, and tamper-proof marking essential for safety, quality assurance, and anti-counterfeiting. The transition toward smart manufacturing and automation has further accelerated demand. Fiber laser technologies have emerged as the dominant choice due to their high-speed marking, low maintenance, and compatibility with a wide range of materials. Regionally, Asia-Pacific continues to lead market growth, supported by its large-scale industrial base, policy-driven manufacturing upgrades, and expanding demand in consumer electronics and automotive sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $10.08 Billion |

| CAGR | 9.2% |

The fiber lasers segment generated USD 1.51 billion in 2024 and is forecast to grow at a CAGR of 10.1% from 2025 to 2034. Their widespread adoption is tied to their operational efficiency, superior beam quality, and the ability to work with multiple substrates. With higher power density and faster processing speeds, fiber laser systems outperform both CO2 and traditional solid-state variants. These characteristics make them particularly suitable for commercial applications involving metals like copper, aluminum, and stainless steel, which require precision, speed, and durability in marking outcomes.

The metals segment accounted for a 48.1% share in 2024 and is projected to grow at a CAGR of 8.5% through 2034. The increasing use of metals across industries, combined with strict traceability standards, has made laser marking a preferred method for identification and quality control. Markings on metals deliver exceptional longevity and resistance to heat, abrasion, and chemicals, making them ideal for high-demand applications. Fiber lasers' strong absorption rate for metals allows for fast, clean, and precise marking with minimal impact on surrounding surfaces, offering both performance and cost-effectiveness.

U.S. Laser Marking Machine Market held an 82.4% share and generated USD 833.6 million in 2024. The country's dominance stems from its advanced industrial ecosystem spanning sectors like medical devices, aerospace, defense, electronics, and automotive. These industries rely heavily on permanent marking systems to meet legal traceability standards and compliance requirements. Advanced laser systems, including UV and ultrafast models, are widely integrated into automated production lines across the region. Regulations around device identification and part labeling have played a central role in driving laser marking machine adoption.

Companies shaping the Global Laser Marking Machine Market include Lumentum Operations, LaserStar Technologies, FOBA Technology and Services, Keyence, Coherent, Han's Yueming Laser Group, Gravotech Marking, Laser Photonics, Epilog Laser, IPG Photonics, Huagong Tech, Novanta, Danaher, Daheng New Epoch Technology, and Han's Laser Technology Industry Group. These major industry players are deeply invested in R&D, automation, and performance-driven system development to cater to next-generation marking requirements. Leading companies in the laser marking machine market are strengthening their position through sustained investments in R&D to develop high-speed, high-precision systems with minimal maintenance needs. They are focusing on innovations in fiber, UV, and ultrafast laser technologies to meet the specific demands of sectors like electronics, aerospace, and medical devices. Strategic acquisitions and global expansion are being pursued to enhance market penetration and diversify product portfolios. Manufacturers are also integrating their systems with smart factory technologies and automation platforms to offer turnkey solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Machine type

- 2.2.4 Mobility type

- 2.2.5 Material

- 2.2.6 Application

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Raising electronics miniaturization & precision need

- 3.2.1.2 Automation / Industry 4.0 integration

- 3.2.1.3 Growth in high-demand segments (EV batteries, automotive, medical devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Safety & regulatory compliance for laser use

- 3.2.2.2 Material- and application-specific limits

- 3.2.3 Opportunities

- 3.2.3.1 Fiber, picosecond/femtosecond, and UV laser growth

- 3.2.3.2 Integration with machine vision, traceability & IIoT

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape (HS code -8456.11)

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Fiber laser

- 5.3 Green laser

- 5.4 UV laser

- 5.5 Co2 laser

- 5.6 Mopa laser

- 5.7 Diode-pumped laser

- 5.8 Nd:yag laser

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 2D

- 6.3 3D

Chapter 7 Market Estimates & Forecast, By Mobility Type, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Fixed

- 7.3 Portable

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Metal

- 8.3 Glass

- 8.4 Plastics

- 8.5 Ceramics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Ablation

- 9.3 Annealing

- 9.4 Carbonizing

- 9.5 Foaming

- 9.6 Engraving

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End use Industry, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Electronics & semiconductor

- 10.4 Defense & aerospace

- 10.5 Machine tool

- 10.6 Healthcare

- 10.7 Packaging & labeling

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 Coherent

- 13.2 Daheng New Epoch Technology

- 13.3 Danaher

- 13.4 Epilog Laser

- 13.5 FOBA Technology and Services

- 13.6 Gravotech Marking

- 13.7 Han's Laser Technology Industry Group

- 13.8 Han's Yueming Laser Group

- 13.9 Huagong Tech

- 13.10 IPG Photonics

- 13.11 Keyence

- 13.12 Laser Photonics

- 13.13 LaserStar Technologies

- 13.14 Lumentum Operations

- 13.15 Novanta