|

市场调查报告书

商品编码

1766221

标籤及编码设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Labeling and Coding Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

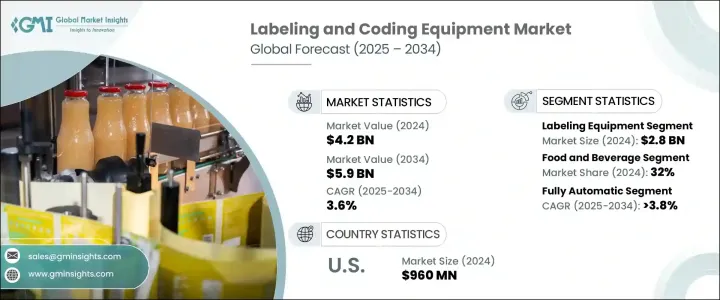

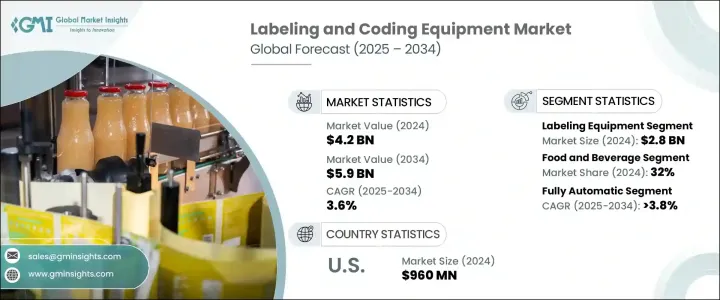

2024年,全球标籤和编码设备市场规模达42亿美元,预计到2034年将以3.6%的复合年增长率成长,达到59亿美元。市场成长的动力源自于电子商务和物流的持续扩张、技术进步以及对精确度和品质保证的重视。雷射编码、热喷墨和连续喷墨列印等列印技术的改进显着提高了标籤列印的效率和准确性。此外,人工智慧 (AI) 与物联网 (IoT) 的结合彻底改变了该行业,提供了即时监控、预测性维护和更高水准的自动化,从而减少了停机时间和营运成本。

标籤和编码设备在化学品、化妆品、製药、食品饮料、农业和电子等各个行业中都至关重要,用于将标籤贴到容器、瓶子和小瓶上。由于对高速、高效和自动化贴标系统的需求不断增长,自动贴标机市场正在迅速扩张。这些能够自动剔除贴错标籤产品的机器需求旺盛,尤其是在亚太地区和北美地区,这些地区不断壮大的中产阶级和不断增长的可支配收入正在推动这些行业的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 3.6% |

2024年,标籤设备市场规模达28亿美元,预计2034年的复合年增长率将达到3.9%。持续成长的关键因素在于标籤设备的重大技术进步。人工智慧 (AI) 和机器视觉系统的整合等创新显着提升了标籤流程。这些技术使机器能够扫描标籤并即时检测潜在的错误或错位,确保标籤正确贴上并符合监管标准。这种自动化程度不仅可以最大限度地减少人为错误,还能确保符合严格的行业法规,使这些机器更加可靠、高效。

2024年,食品饮料产业的市占率将达到32%。随着食品安全法规合规性要求的日益严格,包括美国食品药物管理局(FDA)的《食品安全现代化法案》(FSMA)和欧盟的标籤标准,对精准高速标籤技术的需求也日益增长。这些法规促使食品饮料行业的製造商采用先进的标籤系统,例如热喷墨和雷射打码机,以确保产品的可追溯性并为消费者提供准确的资讯。这些技术不仅有助于确保合规性,还能提高生产效率。凭藉更快的列印速度、更少的停机时间和更少的标籤错误,它们在改进整体包装流程方面发挥着至关重要的作用,从而缩短了产品週转时间,并确保产品能够正确、快速地贴上标籤并投放市场。

美国标籤和编码设备市场占据82%的市场份额,2024年市场规模达9.6亿美元。电子商务和物流的快速成长,加上技术的进步,是美国标籤和编码设备市场的主要驱动力。在客户需求不断增长、全球电子商务和贸易协定的推动下,物流行业实现了显着增长,这鼓励了美国製造商和零售商投资创新的物流解决方案。这种转变使企业能够利用其供应链能力来提供更优质的服务。

全球标籤和编码设备市场的一些知名公司包括 Ambrose Packaging、CVC Technologies、BellatRx、BW Integrated Systems、Markem-Imaje、Hitachi IESA 和 Videojet。这些公司不断创新,开发更有效率、更可靠的标籤解决方案,以满足各行各业日益增长的需求。为了巩固市场地位,标籤和编码设备行业的公司正在采取多种策略。其中包括高度重视人工智慧整合和机器视觉系统等技术进步,以提高标籤流程的精确度和速度。该公司还透过提供各种可自订的解决方案来扩展其产品组合,包括满足各行各业需求的先进编码和标籤系统。此外,这些公司还利用策略合作伙伴关係和收购来提高市场渗透率并扩大地理覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电子商务与物流的扩张

- 技术进步

- 产业陷阱与挑战

- 初期投资及维护成本高

- 网路安全和资料完整性风险

- 机会

- 产品可追溯性需求不断成长

- 永续性和环保包装的兴起

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 贴标设备

- 压敏贴标机

- 列印贴标系统

- 套标机

- 其他(捲筒贴标机等)

- 喷码设备

- 喷墨打码机

- 热转印打码机

- 雷射打码机

- 其他(热喷墨印表机等)

第六章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第七章:市场估计与预测:依印刷媒介,2021 - 2034 年

- 主要趋势

- 初级包装

- 二次包装

- 三级包装

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化妆品和个人护理

- 电子产品

- 物流与零售

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Ambrose Packaging

- BellatRx

- BW Integrated Systems

- CVC Technologies

- Domino Printing Sciences

- HERMA

- Hitachi IESA

- Leibinger

- Markem-Imaje

- Pack Leader USA

- PrintJet Corporation

- ProMach

- Sneed Coding Solutions

- Squid Ink

- Videojet

The Global Labeling and Coding Equipment Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 5.9 billion by 2034. The market growth is being driven by the continued expansion of e-commerce and logistics, technological advancements, and a focus on precision and quality assurance. Improvements in printing technologies, such as laser coding, thermal inkjet, and continuous inkjet printing, have significantly increased the effectiveness and accuracy of labeling processes. Furthermore, the combination of artificial intelligence (AI) and the Internet of Things (IoT) has revolutionized the industry, offering real-time monitoring, predictive maintenance, and higher levels of automation that reduce downtime and operating costs.

Labeling and coding equipment is essential in various industries such as chemicals, cosmetics, pharmaceuticals, food and beverage, agriculture, and electronics, where it is used to attach labels on containers, bottles, and vials. The market for automatic labeling machines is expanding rapidly due to the rising demand for high-speed, efficient, and automated labeling systems. These machines, capable of rejecting mislabeled products automatically, are in high demand, especially in regions such as Asia Pacific and North America, where the growing middle class and increased disposable income are driving the expansion of these industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 3.6% |

In 2024, the labeling equipment segment generated USD 2.8 billion, and it is anticipated to grow at a CAGR of 3.9% throughout 2034. A key factor behind this continued growth is the significant technological progress in labeling equipment. Innovations such as the integration of artificial intelligence (AI) and machine vision systems have significantly enhanced labeling processes. These technologies enable machines to scan labels and detect potential errors or misalignments in real-time, ensuring that labels are properly applied and that they meet regulatory standards. This level of automation not only minimizes human error but also ensures compliance with stringent industry regulations, making these machines more reliable and efficient.

The food & beverage segment held a 32% share in 2024. The demand for precise and high-speed labeling technologies is driven by the growing emphasis on compliance with food safety regulations, including the FDA's Food Safety Modernization Act (FSMA) and the European Union's labeling standards. These regulations have pushed manufacturers in the food and beverage sector to adopt advanced labeling systems, such as thermal inkjet and laser coding machines, to ensure product traceability and provide consumers with accurate information. Not only do these technologies help ensure regulatory compliance, but they also boost production efficiency. With faster printing speeds, reduced downtime, and fewer labeling errors, they play an essential role in improving the overall packaging process, thereby enhancing product turnaround times and ensuring that goods are labeled correctly and swiftly for the market.

United States Labeling and Coding Equipment Market held an 82% share and generated USD 960 million in 2024. The rapid growth of e-commerce and logistics, combined with advancements in technology, is a key driver of the U.S. labeling and coding equipment market. The logistics industry, fueled by rising customer demands, global e-commerce, and trade agreements, has seen significant growth, encouraging U.S.-based manufacturers and retailers to invest in innovative logistics solutions. This shift is enabling companies to leverage their supply chain capabilities for greater service delivery.

Some of the prominent companies operating in the Global Labeling and Coding Equipment Market include Ambrose Packaging, CVC Technologies, BellatRx, BW Integrated Systems, Markem-Imaje, Hitachi IESA, and Videojet. These companies are constantly innovating to develop more efficient and reliable labeling solutions to cater to the increasing demand from various industries. To strengthen their market position, companies in the labeling and coding equipment industry are adopting several strategies. These include a strong focus on technological advancements such as AI integration and machine vision systems, which improve the precision and speed of labeling processes. Companies are also expanding their product portfolios by offering a diverse range of customizable solutions, including advanced coding and labeling systems that cater to various industries. Furthermore, strategic partnerships and acquisitions are being used to increase market penetration and expand the geographical reach of these companies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 End use industry

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce and logistics

- 3.2.1.2 Technological advancement

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Cybersecurity and data integrity risks

- 3.2.3 Opportunities

- 3.2.3.1 Growing demand for product traceability

- 3.2.3.2 Rising sustainability and eco-friendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Labeling equipment

- 5.2.1 Pressure-sensitive labelers

- 5.2.2 Print-and-apply labeling systems

- 5.2.3 Sleeve labelers

- 5.2.4 Others (roll-fed labelers etc.)

- 5.3 Coding equipment

- 5.3.1 Inkjet coding machine

- 5.3.2 Thermal transfer coders

- 5.3.3 Laser coders

- 5.3.4 Others (thermal inkjet printers etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Print Medium, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceutical

- 8.4 Cosmetics and personal care

- 8.5 Electronics

- 8.6 Logistics and retail

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ambrose Packaging

- 11.2 BellatRx

- 11.3 BW Integrated Systems

- 11.4 CVC Technologies

- 11.5 Domino Printing Sciences

- 11.6 HERMA

- 11.7 Hitachi IESA

- 11.8 Leibinger

- 11.9 Markem-Imaje

- 11.10 Pack Leader USA

- 11.11 PrintJet Corporation

- 11.12 ProMach

- 11.13 Sneed Coding Solutions

- 11.14 Squid Ink

- 11.15 Videojet