|

市场调查报告书

商品编码

1687973

工业标籤:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Industrial Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

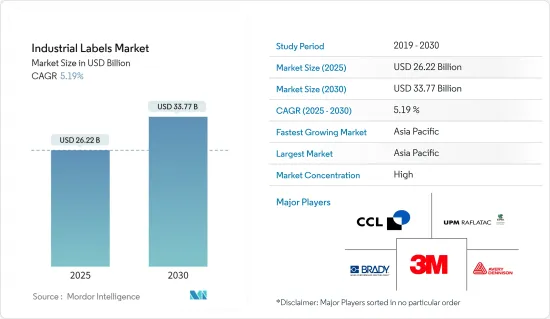

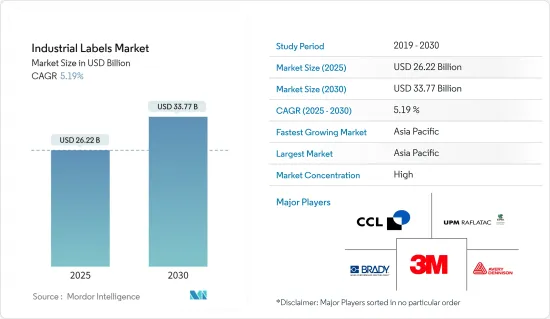

工业标籤市场规模预计在 2025 年为 262.2 亿美元,预计到 2030 年将达到 337.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.19%。

关键亮点

- 市场概况与成长轨迹:工业标籤市场呈现显着的成长轨迹,预计将从 2022 年的 223.5 亿美元扩大到 2028 年的 305.2 亿美元。 36.55% 的成长率主要归因于电子、汽车、医疗、食品饮料等行业的需求增加。随着工业标籤印刷技术的进步,对产品识别和可追溯性的需求不断增加,这推动了市场的扩张。

- 复合年增长率:预计 2023 年至 2028 年市场复合年增长率为 5.19%。

- 数位印刷的成长:到 2028 年,数位印刷领域将达到 144 亿美元,复合年增长率为 6.24%。

- 食品和饮料产业:食品和饮料产业的价值在 2022 年为 38.3 亿美元,预计到 2028 年将达到 49.5 亿美元。

- 安全标籤的扩展:预计到 2028 年,警告/安全标籤将成长到 76.2 亿美元,复合年增长率为 5.38%。

- 食品和饮料产业推动显着成长:食品和饮料产业在推动工业标籤市场方面发挥关键作用。严格的政府法规、创新的包装趋势以及工业标籤解决方案的进步都为这一领域的扩张做出了重大贡献。标籤不仅对于产品识别很重要,而且对于合规性、品牌推广和促销也很重要。

- 监管合规:FDA 2022 年营养成分錶更新推动新标籤需求

- 全球趋势:印度提案的2022年星级标籤系统标誌着食品标籤资讯化程度不断提高的全球趋势。

- 智慧标籤整合:RFID 标籤在饮料产业中越来越受欢迎,以提高可追溯性和永续性。

- 高速解决方案:食品和饮料行业越来越多地转向先进、高品质的标籤系统来满足其包装需求。

- 亚太地区市场将显着成长:亚太地区是工业标籤成长最快的市场之一,受益于经济成长、技术进步以及医疗保健和包装食品等行业需求的成长。快速的工业化和日益增强的健康意识进一步刺激了成长。

- 中国市场成长:中国工业标籤市场预计将从 2022 年的 30.1 亿美元成长到 2028 年的 40.5 亿美元,复合年增长率为 4.91%。

- 印度激增:印度工业标籤市场预计将从 2022 年的 20.3 亿美元成长到 2028 年的 30.8 亿美元,复合年增长率为 7.04%。

- 艾利丹尼森的 AD Stretch倡议将于 2022 年在亚太地区推出,该计画将促进与新兴企业的合作,创造创新的标籤解决方案。

- 对製药业的影响:製药业采用新的标籤技术对亚太地区的市场成长做出了重大贡献。

- 技术进步塑造市场动态:工业标籤市场正在经历变革时期期,由印刷和智慧标籤技术进步所推动。这些技术为各个领域提供了更有效率、更具成本效益和更高品质的工业标籤解决方案。

- 数位印刷的优点:与传统方法相比,数位标籤印刷具有更高的清晰度和清晰度。

- 智慧标籤整合:支援 RFID 和 NFC 的工业标籤正在增强客户参与和可追溯性。

- 永续解决方案:2023 年 4 月,艾利丹尼森推出了针对电子商务领域的永续AD XeroLinr DT 标籤。

- 环保材料:为了回应环境法规,人们对使用环保材料和水基黏合剂的兴趣日益浓厚。

- 竞争格局与未来展望:工业标籤市场分散,艾利丹尼森、3M、CCL Industries 等全球领先企业在主导。为了保持竞争力,公司专注于策略性收购、合作伙伴关係和产品开发。

- CCL 收购 2023 年,CCL Industries 收购了 eAgile Inc. 和 Alert Systems ApS,以加强其智慧标籤产品。

- 永续性重点:人们越来越倾向于使用环保标籤製造工艺和材料。

- 未来驱动力:工业环境日益复杂以及对安全高效标籤系统的需求将继续推动需求。感测器融合和RFID系统的整合有望为全面的资料收集和管理开闢新的途径。

工业标籤市场趋势

其他行业占主要份额

- 最大的细分市场:其他产业在工业标籤市场中,其他产业细分市场将占据最大的市场占有率,到 2022 年将占 40.36%。该细分市场的重要性在于它在各个工业细分市场中的应用范围广泛,超出了主要的最终用途类别。

- 市场规模:2022 年市场规模为 90.2 亿美元,预计到 2028 年将达到 128.6 亿美元,复合年增长率为 5.95%。

- 需求驱动因素:对产品识别、供应链效率和法规遵循的需求不断增加,推动各产业的需求。

- 技术进步:RFID 等智慧标籤技术对于该领域的发展至关重要,尤其是在恶劣的工业环境中。

- 防伪措施:假冒产品的增加促使製造商采用先进的标籤代码来确保产品的真实性和品牌保护。

成长最快的区域:亚太地区

亚太地区将在工业标籤市场中占据最大市场占有率,到 2022 年将达到 36.67%。该地区的成长受到工业化以及医疗保健和包装食品等领域的需求的推动。

- 市场规模:2022 年亚太市场价值为 82 亿美元,预计到 2028 年将达到 115.5 亿美元,复合年增长率为 5.75%。

- 经济成长:亚太地区新兴市场的快速经济发展正在推动该地区对工业标籤的需求。

- 技术创新:艾利丹尼森在亚太地区推出的 AD 拉伸计画专注于与应对永续性挑战的新兴企业伙伴关係。

- 对製药业的影响:受文明病的刺激,製药业的成长促进了对先进标籤解决方案的需求。

工业标籤产业概况

分析报告:工业标章市场的竞争格局

全球企业集团占主导地位

工业标籤市场由艾利丹尼森、3M公司、CCL工业等全球企业集团主导,这些公司拥有丰富的资源、全球影响力和多样化的产品系列。这些公司透过创新、技术进步和策略性收购获得了优势。

历史悠久、实力雄厚的公司:艾利丹尼森和 3M 等公司成立于 1902 年至 1951 年之间,在全球拥有数千名员工,其影响力可见一斑。

技术创新:市场领导优先考虑研发投资和 RFID 等新技术,以保持产业领先地位。

多样化的产品:CCL Industries 的产品范围涵盖农业、化学和安全领域,有助于其保持领先地位。

全球足迹:CCL Industries 的国际影响力使其能够满足广泛的市场需求。

未来成功策略:技术创新、环保标章解决方案和防伪措施是工业标章市场未来成功的关键。采用高解析度数位印刷、UV 印刷和环保替代品的公司将具有竞争优势。

先进的印刷技术:对于希望提高标籤性能和永续性的公司来说,投资高品质的印刷技术至关重要。

永续性:向环保材料和工艺的转变将推动优先考虑环保解决方案的製造商的成长。

防伪:製药和汽车等行业越来越多地采用安全标籤技术来打击仿冒品。

扩大产品系列:跟上新兴产业和不断发展的监管标准对于长期的市场成功至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介:识别技术

第五章市场动态

- 市场驱动因素

- 食品和饮料预计将强劲成长

- 亚太地区成长强劲

- 数位印刷的成长

- 扩展安全标籤

- 市场限制

- 原料成本上涨

第六章市场区隔

- 按原料

- 金属标籤

- 塑胶/聚合物标籤

- 按机制

- 压力标籤

- 收缩套标

- 其他机制

- 依产品类型

- 警告/安全标籤

- 品牌标籤

- 耐候标籤

- 资产标籤

- 其他的

- 透过印刷技术

- 类比印刷

- 数位印刷

- 按最终用户产业

- 电子业

- 饮食

- 汽车

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Avery Dennison Corporation

- 3M Company

- CCL Industries Inc.

- Brady Corporation

- UPM Raflatac

- DuPont de Nemours Inc.

- Brook+Whittle Ltd

- OMNI SYSTEMS

- Asean Pack

- Computer Imprintable Label Systems Ltd(CISL Ltd)

- LabelTac.com

- Orianaa Decorpack Pvt. Ltd

- Dura-ID Solutions Limited

- GA International Inc.

第八章投资分析

第九章:市场的未来

The Industrial Labels Market size is estimated at USD 26.22 billion in 2025, and is expected to reach USD 33.77 billion by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

Key Highlights

- Market Overview and Growth Trajectory: The Industrial Labels Market is experiencing a significant growth trajectory, expanding from USD 22.35 billion in 2022 to an anticipated USD 30.52 billion by 2028. This growth of 36.55% is primarily driven by increasing demand from industries such as electronics, automotive, healthcare, and food and beverage. The need for product identification and traceability has intensified, alongside technological advancements in industrial label printing, boosting the market's expansion.

- CAGR: The market is expected to grow at a CAGR of 5.19% from 2023 to 2028.

- Digital Printing Growth: The digital printing segment is set to reach USD 14.40 billion by 2028, at a CAGR of 6.24%.

- Food and Beverage Segment: Valued at USD 3.83 billion in 2022, the food and beverage sector is forecast to hit USD 4.95 billion by 2028.

- Security Labels Expansion: Warning/Security Labels are expected to grow to USD 7.62 billion by 2028, at a CAGR of 5.38%.

- Food and Beverage Sector Driving Significant Growth: The food and beverage industry plays a pivotal role in driving the industrial labels market. Stringent government regulations, innovative packaging trends, and advancements in industrial labeling solutions are key contributors to this sector's expansion. Labels are critical not only for product identification but also for compliance, branding, and promotions.

- Regulatory Compliance: The FDA's update to the Nutrition Facts label in 2022 has increased demand for new labels.

- Global Trends: India's star rating-based labeling system, proposed in 2022, signifies a trend toward more informative food labeling globally.

- Smart Label Integration: RFID-enabled labels are gaining momentum in the beverage industry for enhanced traceability and sustainability.

- High-Speed Solutions: The adoption of advanced high-quality labeling systems is growing to meet the food and beverage sector's packaging demands.

- APAC Region Witnessing Significant Market Growth: The Asia-Pacific (APAC) region is one of the fastest-growing markets for industrial labels, benefiting from economic growth, technological advancements, and increased demand from industries like healthcare and packaged food. Rapid industrialization and rising health awareness have further accelerated growth.

- China's Market Growth: China's industrial labels market is expected to grow from USD 3.01 billion in 2022 to USD 4.05 billion by 2028, with a CAGR of 4.91%.

- India's Surge: India's industrial labels market will rise from USD 2.03 billion in 2022 to USD 3.08 billion by 2028, registering a CAGR of 7.04%.

- Technological Adoption: Avery Dennison's AD Stretch initiative launched in APAC in 2022 fosters collaboration with startups to create innovative labeling solutions.

- Pharmaceutical Impact: The pharmaceutical sector's adoption of new labeling technologies is significantly contributing to market growth in APAC.

- Technological Advancements Shaping Market Dynamics: The industrial labels market is undergoing a transformation driven by technological innovations in printing and smart labels. These technologies are providing more efficient, cost-effective, and higher-quality industrial labeling solutions across various sectors.

- Digital Printing Superiority: Digital label printing offers improved sharpness and clarity compared to traditional methods.

- Smart Label Integration: RFID and NFC-enabled industrial labels are enhancing customer engagement and traceability.

- Sustainable Solutions: In April 2023, Avery Dennison introduced the sustainable AD XeroLinr DT label, targeting the e-commerce sector.

- Eco-Friendly Materials: The industry is increasingly focusing on the use of eco-friendly materials and water-based adhesives to meet environmental regulations.

- Competitive Landscape and Future Outlook: The industrial labels market is fragmented, with global leaders like Avery Dennison, 3M, and CCL Industries leading the charge in innovation and market expansion. Companies are focusing on strategic acquisitions, collaborations, and product development to maintain their competitive edge.

- CCL's Acquisitions: In 2023, CCL Industries acquired eAgile Inc. and Alert Systems ApS to enhance its intelligent label offerings.

- Sustainability Focus: There is a growing shift towards environmentally friendly label production processes and materials.

- Future Growth Drivers: Increased complexity in industrial environments and the need for safe, efficient labeling systems will continue driving demand. Integration of sensor fusion with RFID systems is expected to open new avenues for comprehensive data collection and management.

Industrial Labels Market Trends

Other Industries Holds Major Share

- Largest Segment: :Other Industries : The Other Industries segment holds the largest market share in the Industrial Labels Market, with a 40.36% share in 2022. This segment's significance is attributed to its diverse industrial applications across sectors beyond the main end-use categories.

- Market Size: The segment was valued at USD 9.02 billion in 2022 and is expected to reach USD 12.86 billion by 2028, with a CAGR of 5.95%.

- Driving Demand: The growing need for product identification, supply chain efficiency, and regulatory compliance drives demand across various industries.

- Technological Advancements: Smart labeling technologies like RFID are crucial to this segment's growth, especially in challenging industrial environments.

- Anti-Counterfeiting Measures: The rise in counterfeiting has led manufacturers to adopt advanced label codes for product authenticity and brand protection.

Fastest-Growing Regional Segment: Asia-Pacific

APAC holds the largest market share in the Industrial Labels Market, accounting for 36.67% in 2022. The region's growth is fueled by industrialization and demand from sectors like healthcare and packaged food.

- Market Value: The APAC market was valued at USD 8.20 billion in 2022 and is projected to reach USD 11.55 billion by 2028, with a CAGR of 5.75%.

- Economic Growth: Rapid economic development in APAC's emerging markets drives demand for industrial labeling in the region.

- Technological Innovation: Avery Dennison's AD Stretch program, launched in APAC, focuses on partnerships with startups to tackle sustainability challenges.

- Pharmaceutical Impact: Growth in the pharmaceutical industry, spurred by lifestyle diseases, is contributing to demand for advanced labeling solutions.

Industrial Labels Industry Overview

Analyst Report: Competitive Landscape of the Industrial Labels Market

Global Conglomerates Dominate:

The Industrial Labels Market is led by global conglomerates like Avery Dennison, 3M Company, and CCL Industries, which possess extensive resources, global reach, and diverse product portfolios. These companies dominate through innovation, technological advancements, and strategic acquisitions.

Established Giants: Founded between 1902 and 1951, companies like Avery Dennison and 3M employ thousands globally, underscoring their influence.

Technological Innovation: Market leaders emphasize R&D investments and new technologies like RFID to stay ahead of industry trends.

Diverse Offerings: CCL Industries' product range spans agriculture, chemicals, and security applications, contributing to its leadership position.

Global Footprint: The extensive international presence of these companies allows them to cater to a wide range of markets.

Strategies for Future Success: Technological innovation, eco-friendly labeling solutions, and anti-counterfeiting measures will be crucial to future success in the Industrial Labels Market. Companies that adopt high-resolution digital printing, UV printing, and eco-friendly alternatives will gain a competitive edge.

Advanced Printing Technologies: Investment in high-quality printing techniques is vital for companies looking to enhance label performance and sustainability.

Sustainability: The shift toward environmentally friendly materials and processes will drive growth for manufacturers that prioritize eco-conscious solutions.

Anti-Counterfeiting: Industries like pharmaceuticals and automotive are increasingly adopting secure labeling technologies to combat counterfeiting.

Expanding Product Portfolios: Adapting to emerging industries and evolving regulatory standards will be critical for long-term market success.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot - Identification Technology

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Food and Beverage is Expected to Register Significant Growth

- 5.1.2 APAC to Witness Significant Growth

- 5.1.3 Digital Printing Growth

- 5.1.4 Security Labels Expansion

- 5.2 Market Restraints

- 5.2.1 Increasing Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Metal Labels

- 6.1.2 Plastic/Polymer Labels

- 6.2 By Mechanism

- 6.2.1 Pressure Sensitive Labelling

- 6.2.2 Shrink Sleeve Labelling

- 6.2.3 Other Mechanism

- 6.3 By Product Type

- 6.3.1 Warning/Security Labels

- 6.3.2 Branding Labels

- 6.3.3 Weatherproof Labels

- 6.3.4 Equipment Asset Tags

- 6.3.5 Other Product Types

- 6.4 By Printing Technology

- 6.4.1 Analog Printing

- 6.4.2 Digital Printing

- 6.5 By End-user Industry

- 6.5.1 Electronics Industry

- 6.5.2 Food & Beverage

- 6.5.3 Automotive

- 6.5.4 Healthcare

- 6.5.5 Other End-user Industry

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 Germany

- 6.6.2.2 United Kingdom

- 6.6.2.3 France

- 6.6.2.4 Spain

- 6.6.3 Asia

- 6.6.3.1 China

- 6.6.3.2 Japan

- 6.6.3.3 India

- 6.6.3.4 South Korea

- 6.6.4 Australia and New Zealand

- 6.6.5 Latin America

- 6.6.5.1 Brazil

- 6.6.5.2 Mexico

- 6.6.5.3 Argentina

- 6.6.6 Middle East and Africa

- 6.6.6.1 United Arab Emirates

- 6.6.6.2 Saudi Arabia

- 6.6.6.3 South Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 3M Company

- 7.1.3 CCL Industries Inc.

- 7.1.4 Brady Corporation

- 7.1.5 UPM Raflatac

- 7.1.6 DuPont de Nemours Inc.

- 7.1.7 Brook + Whittle Ltd

- 7.1.8 OMNI SYSTEMS

- 7.1.9 Asean Pack

- 7.1.10 Computer Imprintable Label Systems Ltd (CISL Ltd)

- 7.1.11 LabelTac.com

- 7.1.12 Orianaa Decorpack Pvt. Ltd

- 7.1.13 Dura-ID Solutions Limited

- 7.1.14 GA International Inc.