|

市场调查报告书

商品编码

1766227

椰奶和椰奶奶油市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Coconut Milk and Cream Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

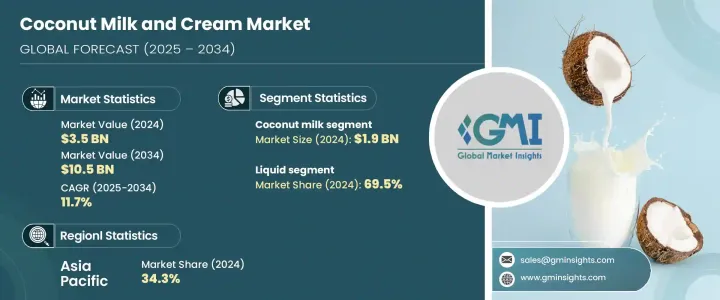

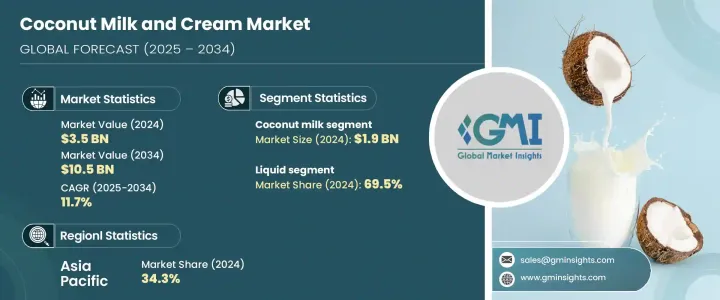

2024年,全球椰奶和椰奶奶油市场价值35亿美元,预计到2034年将以11.7%的复合年增长率成长,达到105亿美元。这一增长主要源于越来越多的消费者追求更健康的生活方式,对无乳製品和植物性产品的需求不断增长。椰子产品因其公认的健康益处,在註重健康的人、纯素食者和乳糖不耐症患者中越来越受欢迎。亚太地区,尤其是印尼和印度等国家,仍然是椰奶和椰奶奶油的最大生产国和消费国,其生产方式充分利用了传统的烹饪方法。

这些地区正在向北美和欧洲市场扩张,纯素食主义、植物性饮食以及椰奶在饮料和甜点中的使用进一步刺激了市场需求。有机和风味椰奶等产品创新,以及对道德采购实践的日益重视,也促进了市场的扩张。随着人们对健康食品的需求日益增长,以及植物性饮食日益成为主流,椰奶和椰奶奶油市场有望持续增长,提供满足不同饮食偏好和烹饪方式的丰富选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 105亿美元 |

| 复合年增长率 | 11.7% |

2024年,椰奶市场占据54.3%的市场份额,价值19亿美元。这个细分市场的主导地位可以归因于消费者需求的不断增长,尤其是在东南亚和加勒比地区,而椰奶是这些地区的主要食材。人们,尤其是纯素食者,转向无乳製品、植物性饮食,进一步扩大了椰奶市场的需求。低热量且不影响口感的低脂椰奶的推出也促进了市场的成长。此外,电子商务的兴起显着提高了产品的可及性,使消费者更容易购买到各种各样的椰子製品。这一趋势正在推动一个充满活力和不断发展的市场,而推动其发展的动力源于消费者偏好的变化以及对烹饪和饮食选择替代品的需求。

2024年,液态椰奶市场占据69.5%的市场份额,预计到2034年将以11.5%的复合年增长率成长。液态椰奶依然是最受欢迎的选择,这主要归功于其在烹饪中的多功能性。东南亚和加勒比地区的菜餚尤其青睐椰奶,这些菜餚都以椰奶为基础。同时,椰奶粉和其他特殊形式的椰奶也在市场中成长,但液态椰奶因其广泛的用途和便利性,仍占据主导地位。

2024年,亚太地区椰奶和椰奶市场占了34.3%的市占率。在该地区,印尼、菲律宾和印度等国家不仅椰子产量庞大,而且在消费和出口方面也占据市场主导地位。该地区成熟的椰子生产能力以及椰奶根深蒂固的烹饪用途,对全球市场动态做出了重要贡献。另一方面,受消费者对植物性饮食和无乳糖替代品日益增长的兴趣推动,北美正在迅速赶上,其中美国占据了该地区最大的市场份额。

全球椰奶和椰奶奶油产业的知名企业包括 McCormick & Company, Inc. (Thai Kitchen)、Danone SA (Silk)、Vita Coco、Dabur India Ltd. 和 Thai Agri Foods Public Company Limited。全球椰奶和椰奶奶油市场中的公司为巩固其地位而采用的关键策略包括专注于创新和产品多样化。许多公司正在投资开发新的品种,例如有机、调味或清淡版椰奶和椰奶奶油,以满足对更健康、低卡路里和植物性选择日益增长的需求。公司越来越多地采用永续的采购方式,以回应消费者对椰子产业道德劳工行为的担忧。这些努力不仅提升了品牌形象,也满足了对环保产品的需求。此外,企业正在利用电子商务平台来提高可及性,确保其产品能够广泛地提供给各个地区的消费者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 椰奶

- 全脂椰奶

- 淡椰奶

- 有机椰奶

- 椰奶

- 普通椰子奶油

- 有机椰子奶油

- 椰子奶油(加糖)

- 其他的

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 液体

- 罐装

- 纸盒

- 其他的

- 粉末

- 传统的

- 有机的

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 烹饪(汤、咖哩、酱汁)

- 烘焙和糖果

- 乳製品替代品

- 饮料

- 冷冻甜点

- 其他的

- 化妆品和个人护理

- 保养品

- 护髮

- 其他的

- 零售/家居

- 其他的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 超市和大卖场

- 便利商店

- 专卖店

- 网路零售

- 餐饮服务

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Thai Agri Foods Public Company Limited

- Danone SA (Silk)

- Goya Foods, Inc.

- McCormick & Company, Inc. (Thai Kitchen)

- Theppadungporn Coconut Co., Ltd. (Chaokoh)

- Celebes Coconut Corporation

- Dabur India Ltd.

- Vita Coco

- Sambu Group

- Nestle SA

- Pureharvest

- Whitewave Foods (Danone)

- Grace Foods

- Marico Limited

- Ducoco Alimentos S/A

- Pacific Foods of Oregon, LLC

The Global Coconut Milk and Cream Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 10.5 billion by 2034. This surge is primarily driven by the increasing demand for dairy-free and plant-based products, as more consumers embrace healthier lifestyles. Coconut products are gaining popularity among health-conscious individuals, vegans, and those with lactose intolerance, due to their perceived health benefits. Asia-Pacific, particularly countries like Indonesia and India, remains the largest producer and consumer of coconut milk and cream, leveraging traditional culinary practices.

These regions are expanding into North American and European markets, where the rise in veganism, plant-based diets, and the usage of coconut milk in beverages and desserts further fuel demand. Product innovations, such as organic and flavored variants, and a growing emphasis on ethical sourcing practices, are also contributing to the market's expansion. As the demand for healthy food options grows and plant-based diets become more mainstream, the coconut milk and cream market is poised for sustained growth, offering a wide range of options that cater to diverse dietary preferences and cooking methods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 11.7% |

The coconut milk segment held a 54.3% share in 2024, valued at USD 1.9 billion. This segment's dominance can be attributed to increasing consumer demand, particularly in Southeast Asian and Caribbean cuisines, where coconut milk is a staple ingredient. The shift towards dairy-free, plant-based diets, especially among vegans, has further amplified the demand. The introduction of light variants of coconut milk, which offer lower calorie options without compromising taste, has also contributed to the market's growth. Additionally, the rise of e-commerce has significantly improved accessibility, making it easier for consumers to purchase a wide variety of coconut-based products. This trend is fueling a dynamic and evolving market, driven by changing consumer preferences and the need for alternatives in cooking and dietary choices.

The liquid coconut milk segment accounted for a 69.5% share in 2024 and is expected to grow at a CAGR of 11.5% through 2034. The liquid form continues to be the most popular, primarily due to its versatility in culinary applications. It is especially favored in Southeast Asian and Caribbean dishes, which use coconut milk as a base for many recipes. Meanwhile, the market is also experiencing growth in other forms, such as powder and specialized variants, but liquid coconut milk remains the dominant segment due to its widespread use and convenience.

Asia-Pacific Coconut Milk and Cream Market held a 34.3% share in 2024. In this region, countries like Indonesia, the Philippines, and India not only produce substantial amounts of coconuts but also lead the market in both consumption and export. The region's established coconut production capabilities and deep-rooted culinary uses of coconut milk contribute significantly to global market dynamics. On the other hand, North America is rapidly catching up, driven by rising consumer interest in plant-based diets and lactose-free alternatives, with the United States holding the largest market share in the region.

Prominent players in the Global Coconut Milk and Cream Industry include McCormick & Company, Inc. (Thai Kitchen), Danone S.A. (Silk), Vita Coco, Dabur India Ltd., and Thai Agri Foods Public Company Limited. Key strategies employed by companies in the Global Coconut Milk and Cream Market to strengthen their position include focusing on innovation and product diversification. Many companies are investing in the development of new variants, such as organic, flavored, or light versions of coconut milk and cream, to meet the growing demand for healthier, low-calorie, and plant-based options. Companies are increasingly adopting sustainable sourcing practices, responding to consumer concerns about ethical labor practices in the coconut industry. These efforts not only enhance the brand image but also cater to the demand for environmentally conscious products. In addition, businesses are leveraging e-commerce platforms to improve accessibility, ensuring that their products are widely available to consumers across various regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Coconut milk

- 5.2.1 Full-fat coconut milk

- 5.2.2 Lite coconut milk

- 5.2.3 Organic coconut milk

- 5.3 Coconut cream

- 5.3.1 Regular coconut cream

- 5.3.2 Organic coconut cream

- 5.4 Cream of coconut (sweetened)

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.2.1 Canned

- 6.2.2 Carton

- 6.2.3 Others

- 6.3 Powder

- 6.3.1 Conventional

- 6.3.2 Organic

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.2.1 Culinary (soups, curries, sauces)

- 7.2.2 Bakery and confectionery

- 7.2.3 Dairy alternatives

- 7.2.4 Beverages

- 7.2.5 Frozen desserts

- 7.2.6 Others

- 7.3 Cosmetics and personal care

- 7.3.1 Skincare

- 7.3.2 Haircare

- 7.3.3 Others

- 7.4 Retail/household

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Convenience stores

- 8.4 Specialty stores

- 8.5 Online retail

- 8.6 Food service

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Thai Agri Foods Public Company Limited

- 10.2 Danone S.A. (Silk)

- 10.3 Goya Foods, Inc.

- 10.4 McCormick & Company, Inc. (Thai Kitchen)

- 10.5 Theppadungporn Coconut Co., Ltd. (Chaokoh)

- 10.6 Celebes Coconut Corporation

- 10.7 Dabur India Ltd.

- 10.8 Vita Coco

- 10.9 Sambu Group

- 10.10 Nestle S.A.

- 10.11 Pureharvest

- 10.12 Whitewave Foods (Danone)

- 10.13 Grace Foods

- 10.14 Marico Limited

- 10.15 Ducoco Alimentos S/A

- 10.16 Pacific Foods of Oregon, LLC