|

市场调查报告书

商品编码

1766255

收缩套标机市场机会、成长动力、产业趋势分析及2025-2034年预测Shrink Sleeve Labeling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

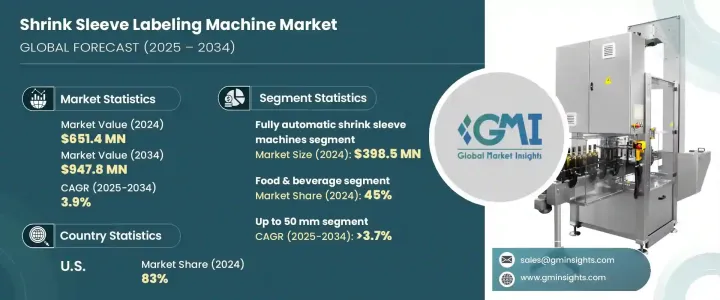

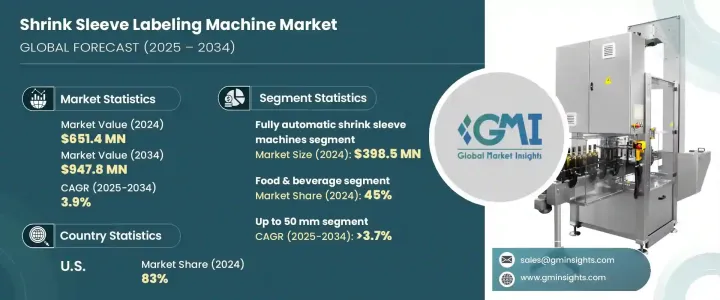

2024年,全球收缩套标机市场规模达6.514亿美元,预计2034年将以3.9%的复合年增长率成长,达到9.478亿美元。这一成长轨迹主要源自于对改进产品包装日益增长的需求,以及自动化技术的持续创新。随着各行各业越来越多地转向智慧标籤系统,製造商对先进解决方案的兴趣日益浓厚,这些解决方案不仅可以提高标籤准确性,还能降低营运效率。

收缩套标技术的演进大大改变了产品外观和品牌形象,推动多个垂直产业的企业纷纷采用高速、高效且适应性强的贴标机。随着企业注重视觉吸引力和品牌形象,这些机器在为各种容器提供无缝整体装饰方面发挥关键作用。热隧道机制和自动化框架的进步也加速了该技术的普及。此外,为了应对日益严格的监管和消费者对包装安全性日益增长的需求,该行业正在进一步升级收缩套标设备。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.514亿美元 |

| 预测值 | 9.478亿美元 |

| 复合年增长率 | 3.9% |

2024年,全自动收缩套标机引领全球市场,营收达3.985亿美元,预计预测期间内复合年增长率为4.1%。这类机器因其无需人工干预即可支援不间断、大批量生产线而广受欢迎。它们与智慧系统集成,可快速贴标,并内建错误检测和剔除机制,有助于减少停机时间并提高效率。这类系统在速度、准确性和可重复性至关重要的大规模製造环境中尤其受欢迎。

半自动机型虽然规模较小,但仍适合中小型企业。这些机器配备了基于感测器的基本技术,可以自动将收缩标籤贴到瓶子、小瓶或容器上,无需人工精确操作。对于处理各种形状和尺寸产品的企业来说,它们是理想之选,也为从手动贴标流程转型的製造商提供了一个经济高效的切入点。

手动收缩套标机继续服务于利基市场,尤其是在需要定製或短期生产的市场。虽然它们的自动化程度有限,但它们灵活且易于操作,非常适合新创公司或小批量生产环境。

从终端用户的角度来看,食品饮料产业在2024年占据全球市场45%的份额,占据主导地位,预计到2034年,该领域的复合年增长率将达到4.2%。该行业正经历消费者偏好的快速变化,导致包装食品、调味饮料和方便食品的需求激增。因此,对能够处理各种尺寸和形状容器的动态贴标系统的需求正在增长。收缩套标机能够实现360度全方位的品牌推广,这是该领域製造商的关键卖点。其防窜改功能也为产品包装增加了一层安全性和保障性,进一步推动了需求的成长。

随着各大品牌力求在竞争激烈的零售环境中脱颖而出,化妆品和个人护理类别也呈现强劲成长。收缩套标机能够在不规则形状的容器上进行高解析度列印,这对于希望提升货架吸引力的企业至关重要。随着环保包装日益受到重视,许多製造商也选择使用可生物降解和可回收的套标材料,这与全球永续发展目标相契合。

製药和化学工业正在采用这些机器来满足严格的合规标准,并支援批次级识别和追踪。尤其是对高精度、防篡改标籤解决方案的需求,正推动这些产业采用先进的收缩套标系统。

以容器直径计算,直径不超过50毫米的容器在2024年成为市场的最大贡献者,预计预测期内复合年增长率将超过3.7%。小直径容器(例如试管、西林瓶和样品瓶)广泛应用于个人护理、製药和营养保健品产业。这些应用需要高速、紧凑的贴标系统,能够精确处理易碎包装,进而推动该领域的成长。

从地区来看,美国引领北美市场,2024年占该地区总收入的83%,收益达1.601亿美元。食品和饮料製造商的强劲存在,加上成熟的自动化包装基础设施,正在推动收缩套标设备的需求。技术升级和精益製造的日益增长,进一步增强了这些设备对美国企业的吸引力。

在这个市场中经营的公司正在积极投资研发并建立策略联盟,以提升其市场影响力。技术改进和以自动化为重点的升级正在帮助企业始终领先于不断变化的行业需求。例如,产业参与者正在将智慧功能整合到他们的机器中,从而实现更快的设定时间、预测性维护以及与现有生产线的无缝整合。这些策略不仅帮助企业满足客户期望,还提供可扩展的解决方案,以适应包装和标籤领域的新兴趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 手动收缩套标机

- 半自动收缩套标机

- 全自动收缩套标机

第六章:市场估计与预测:依货柜类型,2021 - 2034 年

- 主要趋势

- 瓶子

- 罐头

- 罐子

- 其他容器

第七章:市场估计与预测:依货柜直径,2021 - 2034 年

- 主要趋势

- 最大 50 毫米

- 50至100毫米

- 100至150毫米

- 150毫米以上

第八章:市场估计与预测:依套筒容量,2021 - 2034 年

- 主要趋势

- 高达 300 单位/分钟

- 300至400单位/分钟

- 400至600单位/分钟

- 高于600单位/分钟

第九章:市场估计与预测:依最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化妆品和个人护理

- 化学品和肥料

- 汽车

- 其他(营养保健品等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Accutek Packaging Equipment

- Axon

- Bhagwati Labelling Technologies

- BW Integrated Systems

- Crown Packaging

- Dase-Sing Packaging

- Esleeve Enterprise

- Fuji Seal

- King Machine

- Magic Special Purpose Machineries

- Pack Leader USA

- PDC International

- Procus Machinery

- Quadrel

- XH Labeling Machine

The Global Shrink Sleeve Labeling Machine Market was valued at USD 651.4 million in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 947.8 million by 2034. This growth trajectory is primarily driven by the rising demand for improved product packaging, coupled with continuous innovation in automation technologies. With industries increasingly turning to smart labeling systems, manufacturers are witnessing a growing interest in advanced solutions that not only enhance labeling accuracy but also reduce operational inefficiencies.

The evolution of shrink sleeve labeling technology has significantly transformed product aesthetics and branding, pushing businesses across multiple verticals to embrace high-speed, efficient, and adaptable labeling machinery. As companies focus on visual appeal and brand identity, these machines play a pivotal role in delivering seamless full-body decoration on various types of containers. Advancements in heat tunnel mechanisms and automation frameworks are also accelerating the pace of adoption. Moreover, the industry is responding to increasing regulatory and consumer demand for packaging safety, prompting further upgrades in shrink sleeve equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $651.4 Million |

| Forecast Value | $947.8 Million |

| CAGR | 3.9% |

Fully automatic shrink sleeve labeling machines led the global market in 2024, generating revenue of USD 398.5 million and are expected to grow at a CAGR of 4.1% during the forecast period. These machines are gaining widespread acceptance due to their ability to support uninterrupted, high-volume production lines without manual intervention. Their integration with smart systems allows for rapid label application, along with built-in error detection and rejection mechanisms, contributing to reduced downtime and improved efficiency. These systems are especially popular in large-scale manufacturing environments where speed, accuracy, and repeatability are essential.

Semi-automatic variants, although more modest in scale, remain relevant for small and mid-sized enterprises. These machines are equipped with basic sensor-based technologies that can automatically apply shrink labels to bottles, vials, or containers without requiring manual precision. They are ideal for businesses handling diverse product shapes and sizes, and they offer a cost-effective entry point for manufacturers transitioning from manual labeling processes.

Manual shrink sleeve labeling machines continue to serve niche markets, particularly where customization or short-run production is necessary. Although they offer limited automation, they provide flexibility and are easy to operate, making them suitable for start-ups or low-volume production settings.

From an end-use perspective, the food and beverage industry dominated the global market with a 45% share in 2024, and the segment is projected to grow at a CAGR of 4.2% through 2034. This sector is experiencing rapid changes in consumer preferences, leading to a surge in packaged foods, flavored beverages, and convenient meal options. As a result, the need for dynamic labeling systems that can handle containers of varied sizes and shapes is increasing. Shrink sleeve labeling machines enable complete 360-degree branding, which is a key selling point for manufacturers in this space. Their ability to provide tamper-evident features also adds a layer of safety and assurance to the product packaging, further driving demand.

The cosmetics and personal care segment is also registering robust growth as brands strive to stand out in a highly competitive retail environment. Shrink sleeve machines allow for high-resolution printing on irregular container shapes, which is crucial for companies looking to enhance shelf appeal. With a growing focus on environmentally friendly packaging, many manufacturers are also opting for biodegradable and recyclable sleeve materials, which align well with global sustainability goals.

The pharmaceutical and chemical industries are adopting these machines to meet strict compliance standards and to support batch-level identification and tracking. In particular, the demand for highly precise, tamper-proof labeling solutions is spurring the adoption of advanced shrink sleeve systems in these sectors.

By container diameter, the up to 50 mm segment emerged as the top contributor to the market in 2024 and is estimated to grow at a CAGR of over 3.7% during the forecast period. Small-diameter containers such as tubes, vials, and sample bottles are extensively used in personal care, pharmaceutical, and nutraceutical industries. These applications require high-speed, compact labeling systems that can handle fragile packaging with precision, contributing to segment growth.

Regionally, the United States led the North American market, accounting for 83% of regional revenue in 2024, with earnings reaching USD 160.1 million. The strong presence of food and beverage manufacturers, combined with an established infrastructure for automated packaging, is fueling the demand for shrink sleeve labeling equipment. Technological upgrades and an increasing shift toward lean manufacturing have further enhanced the attractiveness of these machines for US-based firms.

Companies operating in this market are actively investing in R&D and forming strategic alliances to enhance their market presence. Technological improvements and automation-focused upgrades are helping firms stay ahead of changing industry requirements. For instance, industry players are integrating smart features into their machines, enabling faster setup times, predictive maintenance, and seamless integration into existing production lines. These strategies are not only helping companies meet customer expectations but also offering scalable solutions that adapt to emerging trends in packaging and labeling.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By container type

- 2.2.4 By container diameter

- 2.2.5 By sleeve capacity

- 2.2.6 By end use industry

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Manual shrink sleeve machines

- 5.3 Semi-automatic shrink sleeve machines

- 5.4 Fully automatic shrink sleeve machines

Chapter 6 Market Estimates & Forecast, By Container Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Cans

- 6.4 Jars

- 6.5 Other containers

Chapter 7 Market Estimates & Forecast, By Container Diameter, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50 mm

- 7.3 50 to 100 mm

- 7.4 100 to 150 mm

- 7.5 Above 150 mm

Chapter 8 Market Estimates & Forecast, By Sleeve Capacity, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Up to 300 units/min

- 8.3 300 to 400 units/min

- 8.4 400 to 600 units/min

- 8.5 Above 600 units/min

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverages

- 9.3 Pharmaceuticals

- 9.4 Cosmetics & personal care

- 9.5 Chemicals and fertilizers

- 9.6 Automotive

- 9.7 Others (nutraceuticals etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Accutek Packaging Equipment

- 12.2 Axon

- 12.3 Bhagwati Labelling Technologies

- 12.4 BW Integrated Systems

- 12.5 Crown Packaging

- 12.6 Dase-Sing Packaging

- 12.7 Esleeve Enterprise

- 12.8 Fuji Seal

- 12.9 King Machine

- 12.10 Magic Special Purpose Machineries

- 12.11 Pack Leader USA

- 12.12 PDC International

- 12.13 Procus Machinery

- 12.14 Quadrel

- 12.15 XH Labeling Machine