|

市场调查报告书

商品编码

1644621

全球收缩套管贴标机市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Shrink Sleeve Applicator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

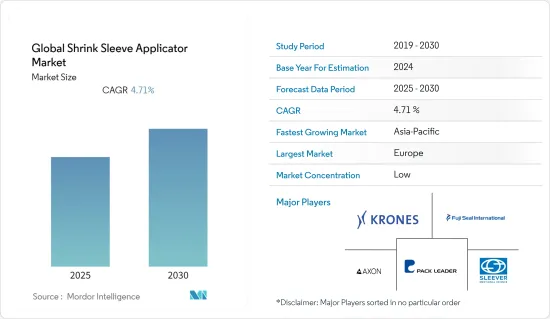

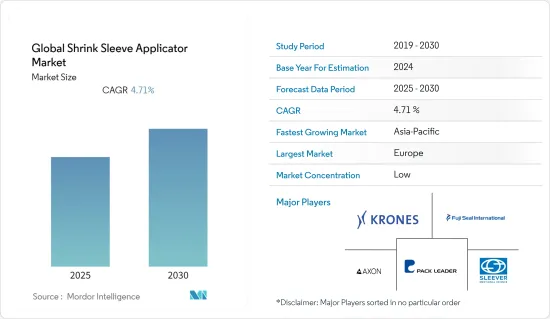

预测期内,全球收缩套管涂抹器市场预计将以 4.71% 的复合年增长率成长。

收缩套管涂抹器用于实现平稳、快速、高效的操作输出。收缩套管涂抹器非常省时,并利用技术来确保最低的成本和高品质的输出,从而提供高性能的产品系列。与包装器材相关的技术进步是推动市场对收缩套筒标籤机需求的关键因素之一。

製造商宣传并打造其品牌产品,其产品采用优质、有吸引力的标籤进行包装。这一趋势将导致对能够高效实现这一目标的包装器材的需求激增。收缩套管涂抹器是製造商实现这一目标的最佳选择之一。

对能够消除浪费的全机械化和自动化设备的需求不断增长以及其在处理玻璃和塑胶容器方面的多功能性是推动未来市场发展的一些因素。

COVID-19疫情对标籤包装产业供应链造成严重扰乱,影响了需求和供应链。不过,世界各国政府都认为食品和製药业务对于抵消 COVID-19 对市场带来的影响至关重要。出于卫生原因而对包装食品进行改造的趋势预计将在预测期内增加对收缩套管涂抹机的需求。

由于製造设备中使用了诸如PLC、SCADA、HMI等自动化最尖端科技,收缩套管贴标机市场正面临着诸如机器安装成本上升和新技术创新等挑战,而环保标籤的日益流行可能很快就会抵消供应商市场的衝击。

收缩套标机市场趋势

食品包装占据主要市场占有率

收缩套管涂抹机在食品包装中的应用主要是为了封闭或包裹食品,以防止其受到化学、物理和生物来源的篡改和污染,并反映製造商的详细信息,新法律强制要求在包装上压印主要成分,所有这些都可以通过收缩套管涂抹机高效快速地完成。

随着人口不断增长至90多亿,包装行业的製造商需要自动化和设备来高效完成任务同时保持品质。收缩套标机可帮助您製作美观且高品质的包装。未来食品包装的品质和数量都需要大幅提升。

食品包装产业正在经历一场具有突破性的新技术的变革:铸造标籤。在使用收缩贴标机为产品贴标时,该设备现在能够将 3 到 4 种套标机整合为一体。透过简单更换模组,即可实现多种类型、多种品种的铸造标籤。

2004年,《食品过敏标籤和消费者保护法》获得通过,1906年,美国颁布了《食品和药品法》,禁止州际贸易中贴错标籤和掺假的食品、饮料和药品。由于食品对包装和标籤的品质要求,这些法规正在推动收缩套管贴标机市场的发展。

食品包装的进步在维护食品供应安全方面发挥着重要作用,而根据海关规定,保持标籤完好至关重要。收缩套标贴机设备可维持标准标籤,使食品能够从原产地安全地远距运输,确保包装品质和标籤完美无缺。

欧洲占大部分市场

根据欧盟委员会发布的报告,2022年1月,欧盟农产品贸易总额达283亿欧元,较2021年成长25%。出口额达158亿欧元,进口额达125亿欧元,分别成长16%和38%。

欧盟成功推行开放、进入贸易政策,推动了欧盟农业贸易的成功。使用收缩套标设备包装的产品标籤体现了产品的可持续生产、安全、营养和高品质的良好声誉,推动了该地区市场的发展。

瑞士、中国、中东和北非是欧盟农产品出口主要成长地区。欧盟出口降幅最大的国家是土耳其、美国、日本和新加坡。海关对进出口的要求迫使製造商遵守食品标籤监管法。否则,将导致整批产品被拒收,并使製造商蒙受损失。收缩套管贴标机的创新使得各种产品的贴标变得简单而有效率。

2022 年 1 月,即俄罗斯入侵之前,从乌克兰的进口额达到 10 亿欧元,比去年同期增长 88%,其中谷物进口额增长 2.58 亿欧元(136%)。其中,从美国的进口成长了16%,从中国的进口成长了67%。谷物运输有包装破裂和产品损坏的风险,使用 PVC 薄膜收缩套标机进行集体包装可以避免这些风险(资料来源:欧盟委员会)。

出口增幅最大的是英国、美国和中国,占欧盟农产品出口总额的40%。在去年大幅下滑之后,对英国的出口增加了 8.94 亿欧元(成长 36%),达到 2020 年的水准。随着蔬菜、鸡蛋、啤酒和其他饮料等出口的不断增加,加工和贴标此类产品需要能够以极高的速度处理贴标的技术,同时还要保持收缩套管贴标机可以轻鬆实现的品质一致性。

收缩套标机产业概况

收缩套筒标籤市场竞争激烈,同时被主要企业分割。为了保持领先地位,这些行业参与企业正在采取合作、合资和新产品发布的策略来满足日益增长的客户需求。

2022 年 5 月-Tripack LLC 宣布将在佛罗里达州开设一家製造工厂,以满足饮料业对装饰铝罐日益增长的需求。 Tri-Pack 计划在佛罗里达州莱克兰开设第三家製造工厂,该工厂占地超过 30,000 平方英尺,可容纳多条包装生产线。

2021 年 5 月-为政府机构、全球企业、消费者和中小型企业提供专业标籤、安全和包装解决方案的供应商 CCL Industries Inc. 宣布收购新加坡的 Lux Global Label Asia Pte Ltd.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 自动贴标机的使用有助于减少套筒标籤消费量,这在很大程度上受到近期减薄趋势的推动。

- 医药和食品领域的需求不断扩大,目前这两个领域占需求的大部分

- 市场限制

- 关于标籤清晰度的严格监管限制对整个供应链带来了挑战。

- 收缩套管涂抹器的演变和最近的技术进步。

第六章 市场细分

- 依设备类型

- 半自动和手动

- 自动化

- 按最终用户产业

- 硬体维修

- 软调频

- 按最终用户

- 食物

- 饮料

- 药品

- 个人护理及化妆品

- 工业(化工、汽车)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 其他的

第七章 竞争格局

- 公司简介

- Krones AG

- Fujiseal International

- Finpac Group

- Pack Leader Machinery Inc.

- Sleever International

- Tripack Group

- Axon Corporation

- USLUGA SHPK

- Label-Aire Corporation

- Benison Group

第 8 章 相对定位分析-根据预定义标准对顶级供应商进行排名

第九章 市场展望

The Global Shrink Sleeve Applicator Market is expected to register a CAGR of 4.71% during the forecast period.

Shrink Sleeve Applicator is used for smooth, high speed, and efficient operations output. Shrink Sleeve applicators are very time efficient, giving a high-performance product range ensuring minimal cost with high-quality output using technology. Technological advancement related to packaging machinery is one of the crucial factors that propel the demand for shrink sleeve label applicators in the market.

Manufacturers promote and brand the packaged product with high quality and attractive labeling. This trend leads to an upsurge in demand for packaging machinery, which can efficiently achieve this goal. The shrink sleeve applicators are one of the best options to achieve this goal of manufacturers.

The rising demand for fully mechanized and automated equipment that can eliminate wastage and the versatility of handling glass and plastic containers are among the key drivers to propel the market in the future.

The COVID-19 outbreak caused significant disruption in the supply chain in the labeling and packaging industry and has affected the demand and supply chain. However, governments worldwide have deemed food and pharma-related businesses essential to offset the effects of covid 19 on the market. Changing trends to adapt packaged food because of hygiene will increase the demand for shrink sleeve applicators in the forecast period.

The shrink sleeve applicator market has been facing challenges like higher installation costs of machinery and new technological innovation with the use of cutting edge technologies in automation like plc, SCADA, and HMI in manufacturing units, and increasing trends towards eco-friendly labels soon may offset the market for the vendors.

Shrink Sleeve Applicator Market Trends

Food Packaging Accounted to Hold the Major Market Share

The use of shrink sleeve applicators in food packaging is mainly to enclose or wrap food products to protect them from tampering or contamination from chemical, physical, and biological sources, reflecting the manufacturer details the new laws made it mandatory to emboss the main ingredient on the packaging all these can be done efficiently and at a fast pace with Shrink Sleeve applicators.

With the increase in the population of over 9 billion, the manufacturers in the packaging industry require automation and equipment to achieve the task efficiently while maintaining quality. All these can be delivered by using shrink sleeve applicators with attractive and quality packaging. The quality and quantity of food packaging will have to increase considerably.

The food packaging industry is going through a transformation with the traditional breakthrough technology of casting labels. When it comes to labeling the product using shrink label applicators, the equipment now can integrate three to four trapping label machine varieties into one. It only needs to change the modules to realize the casting label of different types and varieties.

In 2004, the Food Allergy Labeling and Consumer Protection Act was passed, and In 1906, Food and Drugs Act (prohibited interstate commerce in misbranded and adulterated foods, drinks, and drugs.) in the United States. These regulations drive the shrink sleeve applicator market for the requirement of quality packaging and labeling of food products.

Advances in food packaging play a primary role in keeping the food supply safe, and keeping the label intact is very important because of customs regulations. Shrink sleeve applicator equipment ensures quality Packaging with perfect labeling maintaining standard labeling enabling food products to travel safely for long distances from their point of origin.

Europe Accounts to Hold the Major Share of the Market

As per the report published by the European Commission, the total EU agri-food trade reached a value of EUR 28.3 billion in January 2022, a 25% increase compared to 2021. Exports reached EUR 15.8 billion, while imports were valued at EUR 12.5 billion, representing an increase of 16% and 38%, respectively.

The successful promotion of the European union's open and accessible trade policy drives the success of European Union agricultural trade. The excellent reputation of products as sustainably produced, safe, nutritious, and of high quality reflected on the labels of the packaging products using the shrink sleeve applicators equipment is driving the market in the region.

Switzerland, China, the Middle East, and North Africa were the major growth regions for EU agri-food exports. The value of EU exports fell most to Turkey, the United States, Japan, and Singapore. The custom requirement for exports and imports requires the manufacturer to follow the regulatory laws regarding labeling the food products. Failing short may result in the rejection of the entire batch causing loss to the manufacturer. The shrink sleeve applicators' technological innovation labeling of various products becomes easy and efficient.

Before the Russian invasion, imports from Ukraine had grown by 88% YOY in January 2022 to reach a value of EUR 1 billion, primarily driven by cereals imports, which grew by EUR 258 million (136%). Elsewhere, imports from the US grew by 16%, while imports from China increased by 67%. Cereal shipping includes chances of rupturing the packages and spoilage of the product but can be avoided by using group packaging with a shrink sleeve aaplicator using PVC film (source: European Commission).

The largest export increase was noted to the United Kingdom, the United States, and China, for 40% of all EU agri-food exports. Exports to the UK grew by EUR 894 million (+36%) to 2020 levels after a sharp decline last year. The primarily increase in exports of vegetables, poultry & eggs, beer, and other beverages, processing and labeling of products at this level need technology, which can process the labeling at a very high rate maintaining the uniformity in quality which shrink sleeve applicators can achieve in no time.

Shrink Sleeve Applicator Industry Overview

The shrink sleeve labels market is competitive and simultaneously fragmented because of different domestic and international key players. These industry players have incorporated strategies to remain at the forefront and satisfy customers' increasing demand with collaborations, joint ventures, and new product launches.

May 2022 - Tripack LLC announced opening a manufacturing facility in Florida to fulfill the growing demand for decorated aluminum cans in the beverage industry. Tripack plans to open a third manufacturing facility in Lakeland, Florida with over 30,000 sq ft and space for multiple packaging lines.

May 2021 - CCL Industries Inc., a specialty label, security, and packaging solutions provider for government institutions, global corporations, consumers, and small businesses, announced the acquisition of Lux Global Label Asia Pte Ltd, based in Singapore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent trend of downgauging has been a major driver for the use of automated applicator machines as they contribute to lower consumption of sleeve label

- 5.1.2 Growing demand from Pharmaceutical and food sectors which currently account for a large share of the demand

- 5.2 Market Restraints

- 5.2.1 Stringent regulatory constraints pertaining to the visibility of labels remains a challenge across the supply chain

- 5.3 Evolution of Shrink Sleeve Applicators and recent advancements in technology

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Semi-automated & Manual

- 6.1.2 Automated

- 6.2 By End-user Vertical

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical

- 6.3.4 Personal care & Cosmetics

- 6.3.5 Industrial (Chemicals & Automotive)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle-East and Africa

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Krones AG

- 7.1.2 Fujiseal International

- 7.1.3 Finpac Group

- 7.1.4 Pack Leader Machinery Inc.

- 7.1.5 Sleever International

- 7.1.6 Tripack Group

- 7.1.7 Axon Corporation

- 7.1.8 USLUGA SHPK

- 7.1.9 Label-Aire Corporation

- 7.1.10 Benison Group