|

市场调查报告书

商品编码

1766270

植物蛋白加工设备市场机会、成长动力、产业趋势分析及2025-2034年预测Plant-Based Protein Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

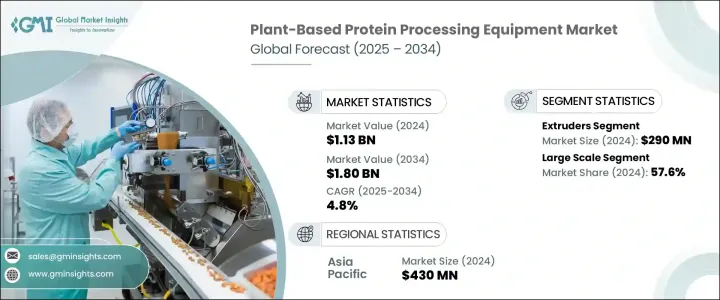

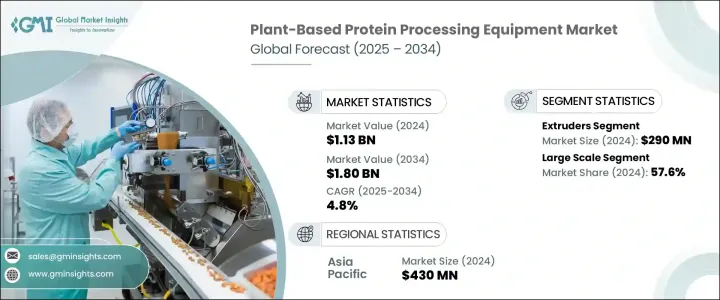

2024年,全球植物蛋白加工设备市场规模达11.3亿美元,预计2034年将以4.8%的复合年增长率成长,达到18亿美元。消费者行为向植物性饮食、健康生活方式和永续发展的转变,正在推动对植物性食品的需求,并推动从豆类和谷物中提取功能性蛋白质的技术的投资。随着食品生产商扩大经营规模,他们正在寻求能够提供高效、产品一致性和营养完整性的设备。这些趋势促使製造商采用专门的系统,以满足不同蛋白质来源不断变化的加工需求。

消费者对肉类替代品日益增长的兴趣也影响着生产能力的扩张,尤其是在全球市场。然而,儘管潜力不断增长,但由于建立和维护商业规模工厂需要大量的资本投入,该行业仍然面临挑战。挤压、干燥、发酵和组织化等製程需要符合严格卫生和安全标准的精密机械。对于规模较小的公司来说,购买、安装和升级这些设备的成本往往成为一大障碍。在发展中地区,获得资金支持和监管基础设施的管道有限,进一步加剧了新进业者和新兴企业面临的挑战。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11.3亿美元 |

| 预测值 | 18亿美元 |

| 复合年增长率 | 4.8% |

挤压系统细分市场在2024年占据最大份额,收入达2.9亿美元。这些系统对于塑造各种食品应用中使用的组织化植物蛋白及其类似物至关重要。它们将大豆、小麦和豌豆蛋白加工成能够复製动物性食品质地和口感的产品。挤压机能够同时处理高水分和低水分挤压工艺,适用于各种植物性食品应用,包括零食、肉饼和富含蛋白质的产品。其多功能性和高生产效率使其成为现代加工生产线的核心零件。

2024年,大规模生产占了57.6%的市场。这一增长反映了消费者对植物蛋白需求的增长,以及由此给生产商带来的在工业规模下稳定产出的压力。主要製造商正在升级其设施,采用先进设备,例如高容量干燥机、均质机、分离机和挤出机。这些投资有助于提高产量,减少人工劳动,并确保不同生产批次的一致性。高产出系统对于支援需要可靠供应链来供应各种蛋白质产品的大型品牌和零售商至关重要。

2024年,亚太地区植物蛋白加工设备产业产值达4.3亿美元,占38%的市占率。该地区受益于植物蛋白的文化盛行和强劲的农业产量。亚太地区各国长期以来的饮食习惯都包含大豆和豆科植物製品,为植物性创新的采用奠定了坚实的基础。快速的工业化、人口驱动的食品需求以及对永续性日益增长的关注,共同支撑着该地区加工设备的成长。政府的积极支持以及旨在促进食品创新和蛋白质采购自给自足的新倡议,正在进一步加速该地区市场的发展。

植物蛋白加工设备产业的主要参与者包括 Equinom、Clextral SAS、Hosokawa Micron BV、Alfa Laval、Netzsch-Feinmahltechnik GmbH、Flottweg SE、Bep International LLC、SPX FLOW Inc、Lyco Manufacturing、Koch Separation、ex International LLC、SPX FLOW Inc、Lyco Manufacturing、Koch Separation、exANDRITZ AG、Glater Group、Huht GroupHeler Group、Huhers Group、HANDRITZ。为了扩大市场份额,该领域的公司优先考虑对研发和先进自动化技术的策略性投资。许多公司正在与食品生产商和新创公司建立合作伙伴关係,共同开发符合新产品创新的客製化加工解决方案。全球製造商也正在透过在地化生产中心和服务网络扩大其在新兴经济体的影响力。为了满足需求的可扩展性,领先的公司正在推出模组化、节能的系统,以灵活地处理各种植物蛋白。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 植物性食品需求不断成长

- 各种食品中植物性蛋白质的采用

- 专注于替代蛋白质的新创企业的成长

- 产业陷阱与挑战

- 初始资本投入高

- 扩大生产的复杂性

- 机会

- 供应链优化

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按应用

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 卧螺离心机和离心机

- 研磨机和破碎机

- 烘干机

- 挤出机

- 过滤系统

- 包装系统

- 其他的

第六章:市场估计与预测:依生产能力,2021 年至 2034 年

- 主要趋势

- 中小型

- 大规模

第七章:市场估计与预测:按蛋白质类型,2021 年至 2034 年

- 主要趋势

- 大豆蛋白

- 豌豆蛋白

- 小麦蛋白

- 鹰嘴豆蛋白

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 粉末

- 分离株

- 浓缩物

- 组织化产品

第九章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Alfa Laval

- ANDRITZ AG

- Bepex International LLC

- Buhler Group

- Clextral SAS

- Coperion GmbH

- Equinom

- Flottweg SE

- GEA Group

- Glatt Group

- Hosokawa Micron BV

- Koch Separation Solutions

- Lyco Manufacturing

- Netzsch-Feinmahltechnik GmbH

- SPX FLOW Inc

The Global Plant-Based Protein Processing Equipment Market was valued at USD 1.13 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.8 billion by 2034. Shifts in consumer behavior toward plant-forward diets, health-conscious living, and sustainability are fueling demand for plant-based foods, driving investment in technologies that extract functional proteins from legumes and grains. As food producers scale up their operations, they're seeking equipment capable of delivering efficiency, product consistency, and nutritional integrity. These trends are encouraging manufacturers to adopt specialized systems that meet the evolving processing requirements of diverse protein sources.

Increased consumer interest in meat alternatives is also influencing the expansion of manufacturing capabilities, particularly across global markets. However, despite the growing potential, the industry continues to face challenges due to the substantial capital investment needed to establish and maintain commercial-scale plants. Processes like extrusion, drying, fermentation, and texturization demand precision-engineered machinery that complies with strict hygiene and safety standards. For smaller companies, the costs associated with purchasing, installing, and upgrading this equipment often become a major hurdle. In developing regions, limited access to financial support and regulatory infrastructure further intensifies the challenge for new entrants and emerging firms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.13 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.8% |

Extrusion systems segment accounted for the largest share in 2024, with revenue of USD 290 million. These systems are essential in shaping textured plant proteins and analogs used in a variety of food applications. They process soy, wheat, and pea proteins into products that replicate the texture and mouthfeel of animal-based foods. With the ability to handle both high- and low-moisture extrusion methods, extruders provide adaptability for a wide array of plant-based food applications including snacks, patties, and protein-enriched products. Their versatility and production efficiency make them a core part of modern processing lines.

In 2024, the large-scale segment held 57.6% share. This growth reflects increased consumer demand for plant-derived proteins and the resulting pressure on producers to deliver consistent output at industrial volumes. Major manufacturers are upgrading their facilities with advanced equipment such as high-capacity dryers, homogenizers, separators, and extruders. These investments help enhance throughput, reduce manual labor, and ensure uniformity across production batches. High-output systems are vital in supporting large brands and retailers that require reliable supply chains for a wide range of protein-based products.

Asia Pacific Plant-Based Protein Processing Equipment Industry generated USD 430 million and held 38% share in 2024. The region benefits from both the cultural prevalence of plant proteins and strong agricultural output. Countries across Asia Pacific have long-standing dietary habits that incorporate soy and legume-based products, creating a solid base for the adoption of plant-based innovations. Rapid industrialization, combined with population-driven food demand and growing concerns about sustainability, are supporting the growth of processing equipment across this region. Favorable government support and new initiatives aimed at food innovation and self-sufficiency in protein sourcing are further accelerating market development in this region.

Major players in the Plant-Based Protein Processing Equipment Industry include Equinom, Clextral SAS, Hosokawa Micron B.V, Alfa Laval, Netzsch-Feinmahltechnik GmbH, Flottweg SE, Bepex International LLC, SPX FLOW Inc, Lyco Manufacturing, Koch Separation Solutions, ANDRITZ AG, Glatt Group, Coperion GmbH, GEA Group, and Buhler Group. To expand their market presence, companies in this space are prioritizing strategic investments in R&D and advanced automation technologies. Many are forming partnerships with food producers and startups to co-develop customized processing solutions that align with new product innovations. Global manufacturers are also increasing their footprint in emerging economies through localized production hubs and service networks. To meet demand scalability, leading firms are launching modular, energy-efficient systems that offer flexibility in handling various plant proteins.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for plant-based foods

- 3.2.1.2 Adoption of plant-based protein in various food products

- 3.2.1.3 Growth of startups focused on alternative proteins

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Complexity in scaling production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By application

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Decanter and centrifuges

- 5.3 Grinders and crushers

- 5.4 Dryers

- 5.5 Extruders

- 5.6 Filtration systems

- 5.7 Packaging systems

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Production Capacity, 2021 – 2034 (USD Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Small and medium scale

- 6.3 Large scale

Chapter 7 Market Estimates and Forecast, By Protein Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Soy protein

- 7.3 Pea protein

- 7.4 Wheat protein

- 7.5 Chickpea protein

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Isolates

- 8.4 Concentrates

- 8.5 Texturized products

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval

- 11.2 ANDRITZ AG

- 11.3 Bepex International LLC

- 11.4 Buhler Group

- 11.5 Clextral SAS

- 11.6 Coperion GmbH

- 11.7 Equinom

- 11.8 Flottweg SE

- 11.9 GEA Group

- 11.10 Glatt Group

- 11.11 Hosokawa Micron B.V

- 11.12 Koch Separation Solutions

- 11.13 Lyco Manufacturing

- 11.14 Netzsch-Feinmahltechnik GmbH

- 11.15 SPX FLOW Inc