|

市场调查报告书

商品编码

1766307

干式静电集尘器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dry Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

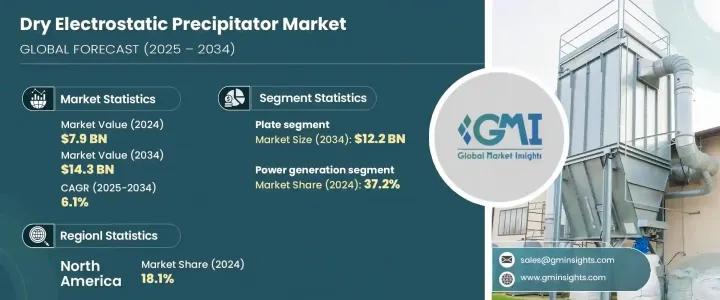

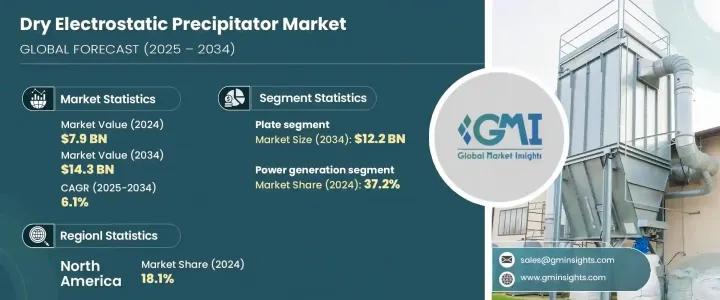

2024年,全球干式静电集尘器市场规模达79亿美元,预计复合年增长率为6.1%,到2034年将达到143亿美元。全球范围内旨在减少空气污染和控制工业源颗粒物排放的更严格的环境法规,对干式静电除尘器的应用产生了强烈的影响。此外,快速的工业化和城镇化进程,尤其是在亚太等新兴市场,正在推动对有效空气污染控制解决方案的需求,从而推动干式静电集尘器的普及。

市场的成长也得益于对先进技术的大量投资,这些技术提升了静电除尘器系统的性能和效率。电极设计、先进材料和精密控制系统的创新正在提高这些系统的除尘效率和可靠性。干式静电集尘器结构紧凑,在处理相同气体量的情况下,所需的垂直空间可减少两到三倍,使其成为空间有限的安装的理想选择。这些系统对PM2.5等细悬浮微粒的除尘效率可达99%以上,适用于发电、水泥和冶金等产业的高容量烟气应用。此外,其连续运作能力以及处理高粉尘负荷且维护成本极低的能力,使其成为经济可行的工业长期解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 143亿美元 |

| 复合年增长率 | 6.1% |

到2034年,板式干式静电集尘器市场规模可望达到122亿美元,这得益于其卓越的细悬浮微粒捕集能力。这些系统表现出极高的捕集效率,尤其适用于较小的颗粒物,使其在控制空气污染方面非常有效。从小型工业运营到大型发电厂,它们用途广泛,这推动了其广泛应用。板式静电集尘器需求的成长归因于其在各种环境下的适应性和高效性,确保更清洁的排放并改善空气品质。这使得它们成为需要先进空气污染控制解决方案的行业的首选,尤其是需要处理大量废气的行业。

製造业预计将经历强劲成长,预计2025年至2034年间的复合年增长率为6.7%。推动这一增长的因素有很多,例如对工业现代化的日益重视、工作场所空气品质法规的日益严格以及人们对呼吸系统健康风险的日益关注。对更清洁、更永续的生产流程的需求也推动了干式静电集尘器的广泛应用。企业正在采用自动化除尘系统来减少空气中的颗粒物,这进一步刺激了对这些技术的需求。随着各行各业努力改善其环境足迹并遵守更严格的监管要求,製造业对干式静电除尘器等有效污染控制技术的需求预计将大幅成长。

预计到2034年,亚太地区干式静电集尘器市场规模将达67亿美元。该地区燃煤发电的持续扩张是市场成长的重要推动力。由于煤炭仍然是许多国家的主要能源,因此对用于减轻污染的排放控制系统的需求正在增加。此外,水泥和金属产业先进空气污染控制技术的采用也进一步推动了干式静电集尘器的应用。旨在减少空气污染的监管措施正在鼓励各行各业投资于更清洁的技术。该地区各工业领域的投资也在增加,这将加速尖端颗粒物控制解决方案的采用,从而促进干式静电除尘器市场的发展。

全球干式静电集尘器行业的知名企业包括 GEAGroup Aktiengesellschaft、Babcock and Wilcox Enterprises、西门子能源、三菱重工、安德里茨集团、Duconenv、Thermax、PPC Industries、住友重工、Wood、Enviropol Engineers、DURR Group、WETAPC、KIX Cottrell。为加强在干式静电集尘器市场的地位,各公司正专注于持续创新和策略伙伴关係。透过投资开发符合严格环境标准的更有效率的系统,他们旨在满足对先进污染控制技术日益增长的需求。各公司也专注于扩大其全球影响力,特别是在新兴市场,工业成长和环境法规为这些市场创造了机会。许多公司也正在使其产品多样化,为从发电到製造的不同行业提供客製化解决方案,进一步巩固其市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依设计,2021 - 2034 年

- 主要趋势

- 盘子

- 管状

第六章:市场规模与预测:依排放产业,2021 - 2034 年

- 主要趋势

- 发电

- 化学品和石化产品

- 水泥

- 金属加工和采矿

- 製造业

- 海洋

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 奈及利亚

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

第八章:公司简介

- ANDRITZ GROUP

- Babcock and Wilcox Enterprises

- Duconenv

- DURR Group

- Enviropol Engineers

- GEA Group Aktiengesellschaft

- KC Cottrell India

- Mitsubishi Heavy Industries

- PPC Industries

- Siemens Energy

- Sumitomo Heavy Industries

- Thermax

- TAPC

- Wood

The Global Dry Electrostatic Precipitator Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 14.3 billion by 2034. The adoption of these systems is being strongly influenced by stricter environmental regulations worldwide aimed at reducing air pollution and controlling emissions of particulate matter from industrial sources. Additionally, rapid industrialization and urbanization, especially in emerging markets like the Asia Pacific, are driving the demand for effective air pollution control solutions, which is propelling the adoption of dry electrostatic precipitators.

The growth of the market is also being fueled by significant investments in advanced technologies that enhance the performance and efficiency of electrostatic precipitator systems. Innovations in electrode designs, advanced materials, and sophisticated control systems are improving the collection efficiency and reliability of these systems. The compact nature of dry ESPs, requiring up to two or three times less vertical space for the same gas volume, makes them ideal for installations with limited space. These systems can achieve collection efficiencies of more than 99% for fine particles like PM2.5, making them suitable for high-capacity flue gas applications in industries such as power generation, cement, and metallurgy. Moreover, their continuous operation capabilities, along with their ability to handle heavy dust loads with minimal maintenance, make them an economically viable long-term solution for industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 6.1% |

The plate-based segment of the dry electrostatic precipitator market is poised to reach USD 12.2 billion by 2034, owing to their superior ability to capture fine particulate matter. These systems have demonstrated high collection efficiency, particularly for smaller particles, making them highly effective in controlling air pollution. Their versatility across a wide range of applications, from small-scale industrial operations to large power plants, has fueled their widespread adoption. The increased demand for plate ESPs is attributed to their adaptability and efficiency in diverse settings, ensuring cleaner emissions and improved air quality. This makes them a preferred choice for industries that require advanced air pollution control solutions, especially those dealing with high volumes of exhaust gases.

The manufacturing sector is expected to experience a robust growth rate, with a projected CAGR of 6.7% between 2025 and 2034. Several factors are driving this growth, such as the increasing emphasis on industrial modernization, stricter workplace air quality regulations, and growing awareness of respiratory health risks. The demand for cleaner, more sustainable production processes is also encouraging the widespread adoption of dry electrostatic precipitators. Companies are adopting automated dust control systems to mitigate airborne particulate matter, further boosting the need for these technologies. As industries strive to improve their environmental footprint and comply with stricter regulatory requirements, the demand for effective pollution control technologies like dry ESPs is expected to grow significantly in the manufacturing sector.

Asia Pacific Dry Electrostatic Precipitator Market is anticipated to reach USD 6.7 billion by 2034. The ongoing expansion of coal-based power generation in the region is a significant contributor to the market growth. As coal remains a primary energy source in many countries, the demand for emission control systems to mitigate pollution is rising. Additionally, the installation of advanced air pollution control technologies in cement and metal industries is further propelling the adoption of dry electrostatic precipitators. Regulatory measures aimed at reducing air pollution are encouraging industries to invest in cleaner technologies. The region is also experiencing increased investments in various industrial sectors, which will accelerate the adoption of cutting-edge particulate control solutions, bolstering the dry ESP market.

Prominent players in the Global Dry Electrostatic Precipitator Industry include GEAGroup Aktiengesellschaft, Babcock and Wilcox Enterprises, Siemens Energy, Mitsubishi Heavy Industries, ANDRITZ GROUP, Duconenv, Thermax, PPC Industries, Sumitomo Heavy Industries, Wood, Enviropol Engineers, DURR Group, TAPC, KC Cottrell India, and WEIXIAN. To strengthen their presence in the dry electrostatic precipitator market, companies are focusing on continuous innovation and strategic partnerships. By investing in the development of more efficient systems that meet stringent environmental standards, they aim to cater to the growing demand for advanced pollution control technologies. Companies are also focusing on expanding their global footprint, particularly in emerging markets, where industrial growth and environmental regulations are creating opportunities. Many companies are also diversifying their product offerings to provide tailored solutions for different industries, from power generation to manufacturing, further cementing their market positions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By Emitting Industry, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Power generation

- 6.3 Chemicals and petrochemicals

- 6.4 Cement

- 6.5 Metal processing & mining

- 6.6 Manufacturing

- 6.7 Marine

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Babcock and Wilcox Enterprises

- 8.3 Duconenv

- 8.4 DURR Group

- 8.5 Enviropol Engineers

- 8.6 GEA Group Aktiengesellschaft

- 8.7 KC Cottrell India

- 8.8 Mitsubishi Heavy Industries

- 8.9 PPC Industries

- 8.10 Siemens Energy

- 8.11 Sumitomo Heavy Industries

- 8.12 Thermax

- 8.13 TAPC

- 8.14 Wood