|

市场调查报告书

商品编码

1773219

化学品及石化产品静电集尘器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Chemicals and Petrochemicals Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

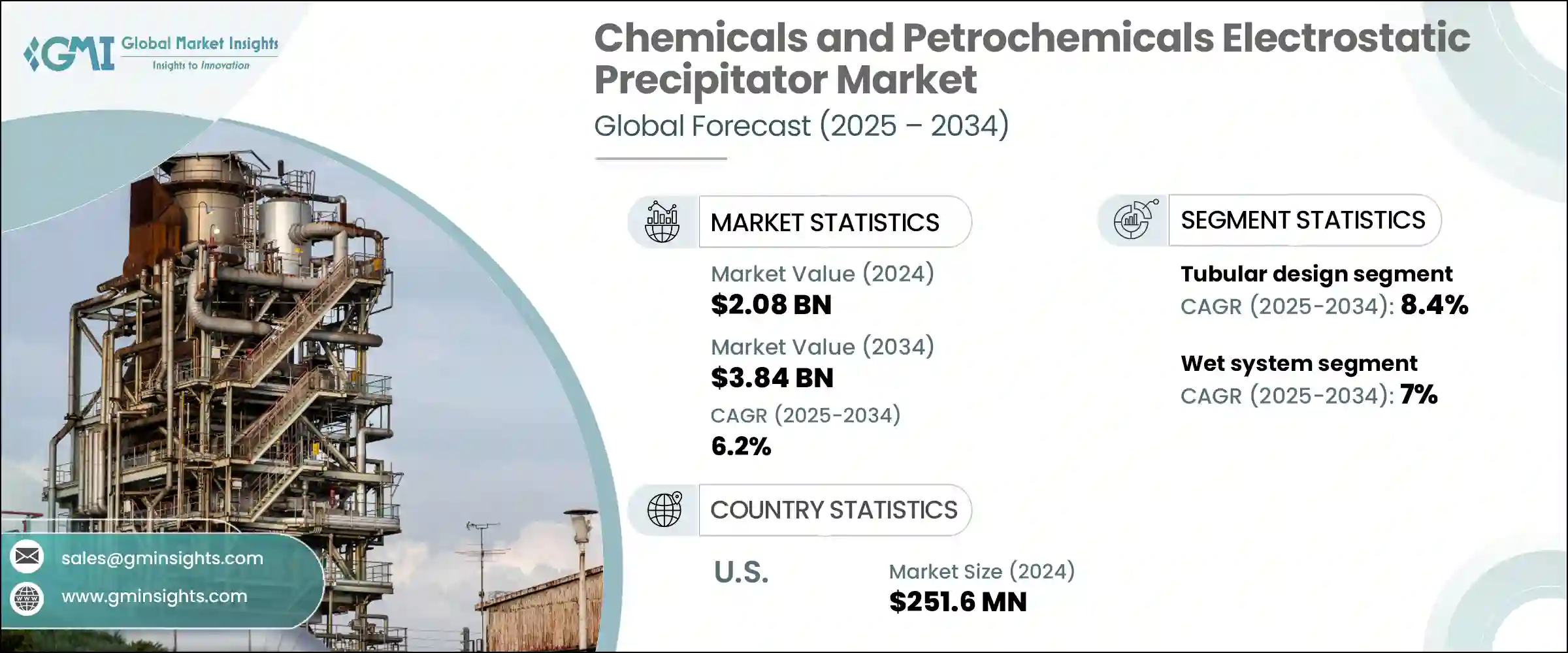

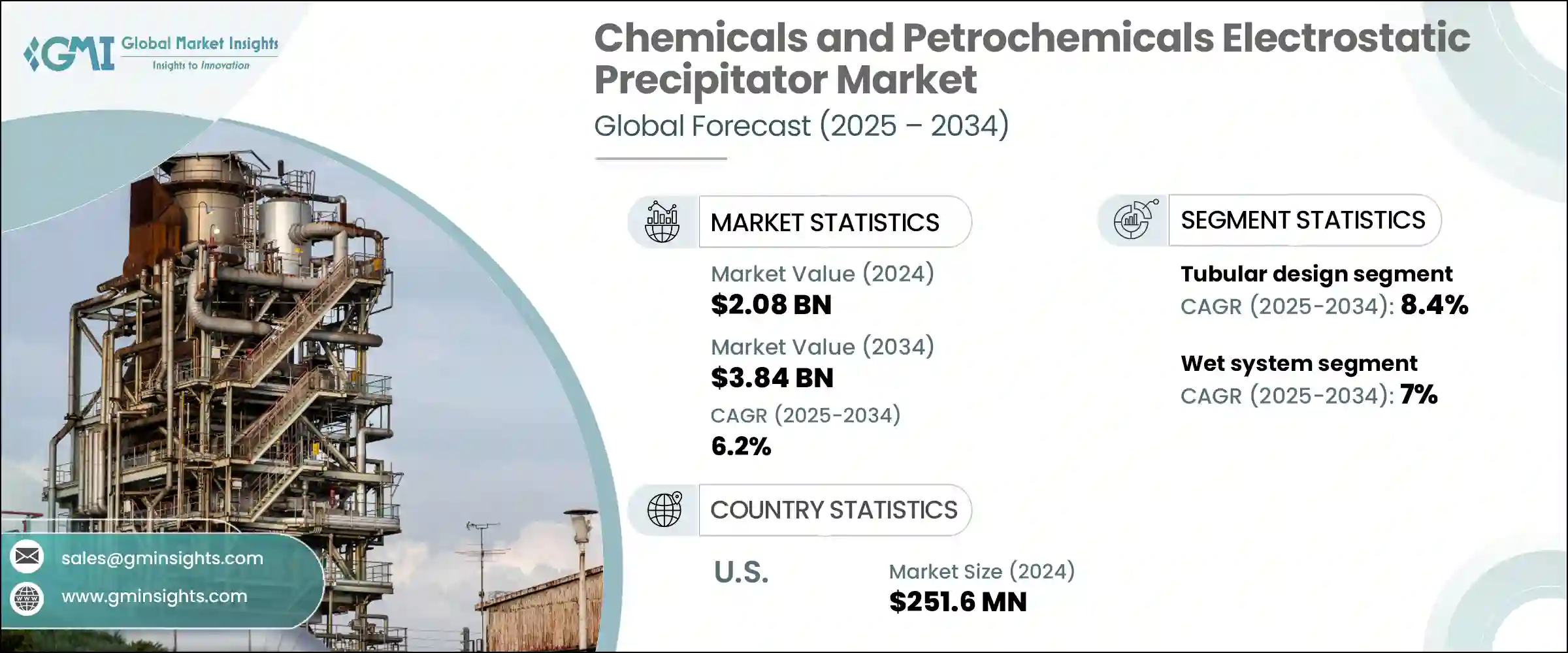

2024 年全球化学品和石化产品静电集尘器市场规模为 20.8 亿美元,预计到 2034 年将以 6.2% 的复合年增长率增长至 38.4 亿美元。随着能够同时捕捉颗粒物和回收有价值副产品的系统日益普及,市场需求正在加速成长。这些副产品可以重新融入生产循环,从而提高整体製程效率和回收利用率。石化加工能力的提升以及现有炼油厂的运营,持续支援静电除尘器部署的扩展。人们对空气品质的认识不断提高(尤其是在高排放工业区),加上对工作场所安全的担忧,正促使工厂营运商投资先进的排放控制系统。合成化学品产量的不断增加以及对永续营运实践的追求,进一步推动了静电除尘器在大容量装置中的整合。

更严格的环境合规规则(尤其是在化学工业)也加速了成熟经济体和发展中经济体的产品采用。随着法规日益严格,尤其是在危险污染物方面,采用清洁生产技术仍将一直是全球工厂的首要任务。工业营运商越来越重视减排解决方案,这些解决方案不仅要符合环境合规性,还要提高能源效率和营运效率。这种日益增长的重视正促使企业普遍转向整合脱硫、颗粒物去除和即时排放监测等多种功能的综合空气污染控制系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20.8亿美元 |

| 预测值 | 38.4亿美元 |

| 复合年增长率 | 6.2% |

预计到2034年,板式静电集尘器市场规模将达到32亿美元,这得益于其高去除效率以及适用于大型加工厂处理干气流的优势。这类系统因其在高吞吐量工业环境中相容于连续运作且易于维护而备受青睐。各化工生产基地烟气处理系统的持续升级将持续推动板式静电集尘器的安装。

2024年,干式静电集尘器系统市场占86.6%。此优势归功于其经济高效的设计、能够管理50°C至450°C范围内的烟气温度以及强大的除尘效率。随着各行各业优先考虑清洁排放,干式静电集尘器因其维护需求低且运作可靠而仍是首选解决方案。这些系统中数位控制和即时监控技术的日益普及,增强了其在大规模工业部署中的吸引力。

预计到2034年,亚太地区化学品和石化产品静电集尘器市场规模将达到18亿美元。推动该市场成长的因素包括工业的快速发展、公众对空气污染日益增长的担忧以及主要国家/地区排放标准的严格执行。随着环保合规投资的增加,该地区各国都优先在现有和新建的化学和石化设施中安装先进的静电除尘器 (ESP) 技术。

对化学品和石化静电除尘器市场竞争格局做出贡献的关键参与者包括 HIMENVIRO、Wood、Enviropol Engineers、Valmet、ELEX、Babcock & Wilcox、ANDRITZ GROUP、GEA Group、Alstom、FLSmidth、KC Cottrell India、PPC Austria Holding、Isgec Hey Engineering、Themaxr Group 和 Themax、Themax、Themax 和 Themax、Themax、Themax、Themax Group 和 Themax。化学品和石化静电除尘器市场的领先公司正在透过投资研发来加强其影响力,重点是提高捕获效率、优化能源并降低维护成本。许多公司正在与石化和化学品製造商结成策略联盟,以确保长期合约。企业也透过在地化製造和服务支援扩大其在亚太等快速成长地区的影响力。此外,将数位监控系统和人工智慧驱动的诊断功能整合到除尘器单元中,使公司能够提供预测性维护解决方案,确保不间断的效能。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依设计,2021 - 2034 年

- 主要趋势

- 盘子

- 管状

第六章:市场规模及预测:依系统,2021 - 2034 年

- 主要趋势

- 干燥

- 湿的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 奈及利亚

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

第八章:公司简介

- ANDRITZ GROUP

- Alstom

- Babcock & Wilcox

- Enviropol Engineers

- ELEX

- FLSmidth

- GEA Group

- HIMENVIRO

- Isgec Heavy Engineering

- KC Cottrell India

- PPC Austria Holding

- Thermax Group

- Valmet

- Wood

The Global Chemicals and Petrochemicals Electrostatic Precipitator Market was valued at USD 2.08 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 3.84 billion by 2034. Demand is accelerating due to the growing use of systems capable of capturing particulate matter while simultaneously recovering valuable by-products. These by-products can be reintegrated into the production cycle, boosting overall process efficiency and recycling efforts. The addition of petrochemical processing capacity alongside existing refinery operations continues to support the expansion of electrostatic precipitator deployments. Greater awareness of air quality, especially in high-emission industrial zones, along with workplace safety concerns, is pushing plant operators to invest in advanced emissions control systems. Increasing synthetic chemical output and the push for sustainable operational practices are further fueling the integration of electrostatic precipitators in large-capacity units.

Tighter environmental compliance rules, particularly across the chemicals sector, are also accelerating product adoption in both mature and developing economies. With regulations becoming more rigorous, particularly for hazardous pollutants, the use of cleaner production technologies will remain a top priority across global facilities. Industrial operators are increasingly prioritizing emission-reduction solutions that not only meet environmental compliance but also enhance energy efficiency and operational productivity. This growing emphasis is prompting a widespread shift toward integrated air pollution control systems that combine multiple functions such as desulfurization, particulate removal, and real-time emissions monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.08 Billion |

| Forecast Value | $3.84 Billion |

| CAGR | 6.2% |

The plate-type electrostatic precipitator segment is expected to reach USD 3.2 billion by 2034, driven by its high removal efficiency and suitability for handling dry gas streams in large processing plants. These systems are favored for their compatibility with continuous operations and ease of maintenance in high-throughput industrial environments. Ongoing upgrades to flue gas treatment systems across various chemical manufacturing sites will continue to drive the installation of plate-type ESPs.

Dry electrostatic precipitator systems segment accounted for 86.6% in 2024. This dominance is attributed to their cost-effective design, ability to manage flue gas temperatures ranging between 50°C and 450°C, and strong collection efficiency. As industries prioritize cleaner emissions, dry ESPs remain the preferred solution due to low maintenance needs and operational reliability. The growing use of digital controls and real-time monitoring technology in these systems is enhancing their appeal for large-scale industrial deployment.

Asia Pacific Chemicals and Petrochemicals Electrostatic Precipitator Market is expected to reach USD 1.8 billion by 2034. Factors driving growth include rapid industrial development, heightened public concern over air pollution, and stricter enforcement of emission standards across key countries. As investments in environmental compliance increase, countries across the region are prioritizing the installation of advanced ESP technologies in both existing and newly built chemical and petrochemical facilities.

Key players contributing to the competitive landscape of the Chemicals and Petrochemicals Electrostatic Precipitator Market include HIMENVIRO, Wood, Enviropol Engineers, Valmet, ELEX, Babcock & Wilcox, ANDRITZ GROUP, GEA Group, Alstom, FLSmidth, KC Cottrell India, PPC Austria Holding, Isgec Heavy Engineering, Thermax Group, and the Thermax Group. Leading companies in the chemicals and petrochemicals electrostatic precipitator market are strengthening their presence by investing in R&D focused on improving capture efficiency, energy optimization, and reducing maintenance costs. Many firms are forming strategic alliances with petrochemical and chemical manufacturers to secure long-term contracts. Businesses are also expanding their footprints in fast-growing regions like Asia Pacific through localized manufacturing and service support. Additionally, integrating digital monitoring systems and AI-driven diagnostics into precipitator units allows companies to offer predictive maintenance solutions, ensuring uninterrupted performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By System, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Wet

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Alstom

- 8.3 Babcock & Wilcox

- 8.4 Enviropol Engineers

- 8.5 ELEX

- 8.6 FLSmidth

- 8.7 GEA Group

- 8.8 HIMENVIRO

- 8.9 Isgec Heavy Engineering

- 8.10 KC Cottrell India

- 8.11 PPC Austria Holding

- 8.12 Thermax Group

- 8.13 Valmet

- 8.14 Wood