|

市场调查报告书

商品编码

1716681

静电集尘器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

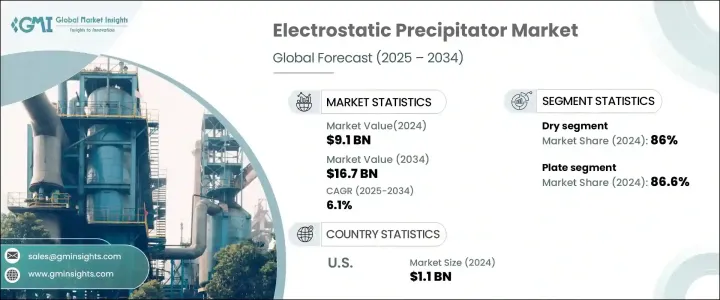

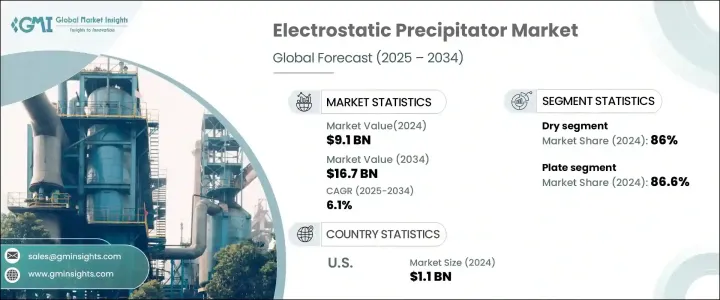

2024 年全球静电集尘器市场规模达 91 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 6.1%。这一成长主要得益于新兴经济体的快速工业化,其中钢铁製造、化学品生产和燃煤发电等产业持续扩张。随着这些产业的发展,对高效率排放控制系统的需求变得越来越重要。世界各国政府都在执行严格的环境法规,要求各产业采用先进技术有效管理空气污染。静电除尘器以其有效去除工业排放中的颗粒物的能力而闻名,随着各行各业努力遵守这些严格的标准,静电除尘器正受到越来越多的关注。此外,人们对环境永续性和减少有害排放的重要性的认识不断提高,正在推动各行各业投资可靠的空气污染控制技术。

人们对永续工业实践的日益关注,以及公众对空气品质问题的认识不断提高,进一步扩大了对静电除尘器的需求。各行各业的公司都认识到需要对其污染控制系统进行现代化改造,以满足不断变化的环境标准并最大限度地减少碳足迹。随着工业运作的扩大和政府实施更严格的空气品质法规,新兴经济体(尤其是亚太地区的新兴经济体)对静电除尘器的需求激增。此外,ESP技术的进步,包括能源效率和颗粒去除能力的提高,正在增强这些系统对于旨在平衡营运效率和环境合规性的行业的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 167亿美元 |

| 复合年增长率 | 6.1% |

2024 年,干式静电集尘器占据了 86% 的市场份额,这反映了其在需要有效去除烟气中颗粒物的行业中的受欢迎程度。这些系统在水泥和钢铁生产等行业尤其受到青睐,因为在这些行业中遵守严格的环境法规至关重要。干式静电集尘器能够高效捕获细颗粒物,同时保持较低的营运成本,使其成为寻求可靠排放控制解决方案的行业的首选。

根据设计,市场分为板式和管式部分,其中板式静电集尘器在 2024 年将占据 86.6% 的份额。板式 ESP 广泛应用于工业应用,因为它们能够以最小的能耗捕获干湿颗粒。它们的低营运成本和高效率使其成为需要可靠污染控制技术的行业的理想解决方案。

受污染控制技术持续投资和更严格的空气品质法规实施的推动,美国静电除尘器市场在 2024 年创造 11 亿美元。随着大众对空气品质的关注度不断加深,静电除尘器的采用预计将进一步增加,从而促进未来几年市场的持续成长。对清洁空气的需求不断增长以及行业满足环境合规标准的需求是支持美国静电除尘器市场扩张的关键因素。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依系统,2021 年至 2034 年

- 主要趋势

- 干燥

- 湿的

第六章:市场规模及预测:依设计,2021 年至 2034 年

- 主要趋势

- 盘子

- 管状

第七章:市场规模及预测:依排放业,2021 年至 2034 年

- 主要趋势

- 发电

- 化学品和石化产品

- 水泥

- 金属加工和采矿

- 製造业

- 海洋

- 其他的

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 奈及利亚

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

第九章:公司简介

- Babcock and Wilcox Enterprises

- DURR Group

- DUCON

- FLSmidth

- Fuel Tech

- GEA Group

- GEECO Enercon

- KC Cottrell India

- Monroe Environmental

- Mitsubishi Heavy Industries.

- Sumitomo Heavy Industries

- Trion

- Valmet

- Wood

The Global Electrostatic Precipitator Market generated USD 9.1 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. This growth is primarily driven by the rapid industrialization of emerging economies, where industries such as steel manufacturing, chemical production, and coal-based power generation continue to expand. As these industries grow, the demand for efficient emissions control systems becomes increasingly critical. Governments worldwide are enforcing strict environmental regulations that require industries to implement advanced technologies to manage air pollution effectively. Electrostatic precipitators, known for their ability to efficiently remove particulate matter from industrial emissions, are gaining traction as industries strive to comply with these stringent standards. Additionally, growing awareness about environmental sustainability and the importance of reducing harmful emissions is pushing industries to invest in reliable air pollution control technologies.

The increasing focus on sustainable industrial practices, along with heightened public awareness of air quality concerns, is further amplifying the demand for electrostatic precipitators. Companies across various industries are recognizing the need to modernize their pollution control systems to meet evolving environmental standards and minimize their carbon footprint. Emerging economies, particularly in Asia-Pacific, are witnessing a surge in demand for electrostatic precipitators as industrial operations expand and governments enforce more rigorous air quality regulations. Moreover, advancements in ESP technology, including improvements in energy efficiency and particle removal capacity, are enhancing the appeal of these systems for industries aiming to balance operational efficiency with environmental compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $16.7 Billion |

| CAGR | 6.1% |

The dry electrostatic precipitator segment accounted for 86% of the market share in 2024, reflecting its popularity in industries that require efficient removal of particulate matter from flue gases. These systems are particularly favored in sectors such as cement and steel production, where maintaining compliance with strict environmental regulations is essential. Dry electrostatic precipitators offer high efficiency in capturing fine particles while keeping operational costs low, making them a preferred choice for industries seeking reliable emissions control solutions.

By design, the market is divided into plate and tubular segments, with plate electrostatic precipitators capturing an 86.6% share in 2024. Plate ESPs are widely used in industrial applications due to their ability to capture both dry and wet particles with minimal energy consumption. Their low operating costs and high efficiency make them an ideal solution for industries that need dependable pollution control technologies.

The US electrostatic precipitator market generated USD 1.1 billion in 2024, driven by continued investments in pollution control technologies and the implementation of stricter air quality regulations. As public concern about air quality intensifies, the adoption of electrostatic precipitators is expected to increase further, contributing to sustained market growth in the coming years. The rising demand for cleaner air and the need for industries to meet environmental compliance standards are key factors supporting the expansion of the US electrostatic precipitator market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By System, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Dry

- 5.3 Wet

Chapter 6 Market Size and Forecast, By Design, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Plate

- 6.3 Tubular

Chapter 7 Market Size and Forecast, By Emitting Industry, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Power generation

- 7.3 Chemicals and petrochemicals

- 7.4 Cement

- 7.5 Metal processing & mining

- 7.6 Manufacturing

- 7.7 Marine

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.5.4 Nigeria

- 8.5.5 Angola

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Peru

Chapter 9 Company Profiles

- 9.1 Babcock and Wilcox Enterprises

- 9.2 DURR Group

- 9.3 DUCON

- 9.4 FLSmidth

- 9.5 Fuel Tech

- 9.6 GEA Group

- 9.7 GEECO Enercon

- 9.8 KC Cottrell India

- 9.9 Monroe Environmental

- 9.10 Mitsubishi Heavy Industries.

- 9.11 Sumitomo Heavy Industries

- 9.12 Trion

- 9.13 Valmet

- 9.14 Wood