|

市场调查报告书

商品编码

1665189

金属加工和采矿静电集尘器市场机会、成长动力、产业趋势分析与预测 2025 - 2034Metal Processing and Mining Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

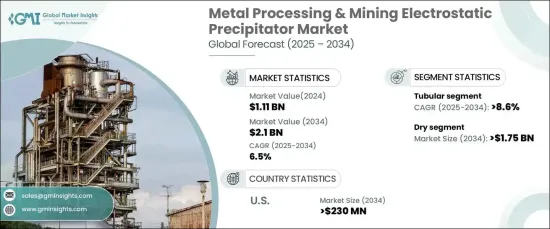

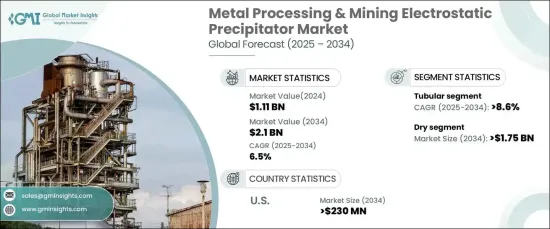

全球金属加工和采矿静电除尘器市场呈现动态成长轨迹,其价值将在 2024 年达到 11.1 亿美元,并预计在 2025 年至 2034 年期间以 6.5% 的复合年增长率增长。这些设备对于冶炼、精炼和矿石提取等过程至关重要,对于那些面临更严格的环境要求和日益严重的健康问题的行业来说至关重要。

随着全球工业化进程加速,控制排放、保障公众健康的重点日益加强。更严格的监管框架要求有效的污染控制解决方案,而企业则面临采用永续做法的压力。人们越来越意识到颗粒物排放对工人和社区的有害影响,这增加了对先进技术的投资。静电除尘器因其能够有效处理高颗粒负荷和大量气体且不影响运行性能而成为首选解决方案。此外,推动降低成本并支持永续发展目标的节能係统正在重塑市场格局。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11.1亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 6.5% |

在金属加工和采矿业,空气中的颗粒物会带来严重的健康风险并导致环境恶化。公司正在优先考虑更清洁的技术以遵守监管标准并提高工作场所的安全性。这些作业过程中产生的灰尘和烟雾不仅影响空气质量,而且还会对生态系统产生长期影响。先进的静电集尘器因其能够降低这些风险同时满足对更清洁、更环保的工业流程日益增长的需求而越来越受到关注。采用具成本效益的系统也有助于企业平衡效率与法规遵从性,进而推动市场大幅成长。

市场依系统类型分为干式系统和湿式系统。干式静电集尘器预计将占据主导地位,到 2034 年其市场价值预计将达到 17.5 亿美元。干式系统具有用水量低、废弃物处理简化、维护成本降低等特点,是一种经济实用的解决方案。技术的进步,包括紧凑的设计和增强的各种粒度性能,进一步推动了它们在整个行业中的应用。

在设计方面,管状和板状系统代表两大主要类别。预计到 2034 年,管状部分将以惊人的 8.6% 的复合年增长率增长,这得益于其卓越的细颗粒物捕获能力。其紧凑的设计对于空间受限的设施特别有吸引力,使其成为旧工厂和密集运营的首选。该设计能够满足严格的颗粒控制要求且不影响效率,这是推动其需求的重要因素。

美国是全球市场的重要参与者,其金属加工和采矿静电除尘器产业预计到 2034 年将创造 2.3 亿美元。企业正在加大对清洁技术的投资,以解决人们对工人健康和公共安全日益增长的担忧。随着各行各业努力削减营运成本并支持永续发展计划,节能係统的采用也正在获得发展动力,巩固了美国作为静电除尘器领先市场的地位。

目录

第 1 章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模及预测:依设计,2021 – 2034 年

- 主要趋势

- 盘子

- 管状

第六章:市场规模及预测:依系统,2021 – 2034 年

- 主要趋势

- 干燥

- 湿的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 奈及利亚

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

第八章:公司简介

- ANDRITZ GROUP

- Babcock & Wilcox

- Elex

- Environ Engineers

- GEA Group

- Kraft Powercon

- McGill AirClean

- Sumitomo Heavy Industries

- Thermax

- VT Corp

- Valmet

The Global Metal Processing And Mining Electrostatic Precipitator Market is on a dynamic growth trajectory, with its value reaching USD 1.11 billion in 2024 and poised to expand at a CAGR of 6.5% from 2025 to 2034. Electrostatic precipitators, engineered to remove fine particulate matter such as dust and smoke from industrial exhaust gases, are becoming indispensable for ensuring cleaner air. These devices are integral to processes like smelting, refining, and ore extraction, making them vital for industries grappling with stricter environmental mandates and rising health concerns.

As industrialization accelerates globally, the focus on controlling emissions and safeguarding public health is intensifying. Stricter regulatory frameworks demand efficient pollution control solutions, while businesses are under pressure to adopt sustainable practices. The increasing awareness of the detrimental effects of particulate emissions on workers and communities has amplified investments in advanced technologies. Electrostatic precipitators are emerging as a preferred solution due to their ability to handle high particulate loads and large gas volumes efficiently without compromising operational performance. Furthermore, the push for energy-efficient systems that reduce costs while supporting sustainability goals is reshaping the market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.11 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6.5% |

In the metal processing and mining sectors, airborne particulates pose significant health risks and contribute to environmental degradation. Companies are prioritizing cleaner technologies to comply with regulatory standards and enhance workplace safety. Dust and fumes generated during these operations not only affect air quality but also have long-term repercussions on ecosystems. Advanced electrostatic precipitators are gaining traction for their ability to mitigate these risks while meeting the growing demand for cleaner, greener industrial processes. The adoption of cost-effective systems is also helping businesses balance efficiency with regulatory compliance, driving substantial market growth.

The market is segmented by system type into dry and wet systems. Dry electrostatic precipitators are projected to dominate, with their market value expected to reach USD 1.75 billion by 2034. These systems are favored for their exceptional efficiency in capturing non-hygroscopic particles commonly found in metal processing and mining operations. With lower water usage, simplified waste disposal, and reduced maintenance costs, dry systems offer an economical and practical solution. Advancements in technology, including compact designs and enhanced performance across various particle sizes, are further boosting their adoption across the industry.

In terms of design, tubular and plate systems represent the two key categories. The tubular segment is forecast to grow at an impressive CAGR of 8.6% through 2034, driven by its superior capacity to capture fine particulates. Its compact design is particularly appealing to facilities with space constraints, making it a top choice for older plants and densely packed operations. This design's ability to meet stringent particulate control requirements without compromising efficiency is a significant factor propelling its demand.

The United States is a key player in the global market, with its metal processing and mining electrostatic precipitator sector expected to generate USD 230 million by 2034. The country's strict environmental regulations and heightened focus on reducing emissions are driving demand for advanced pollution control technologies. Companies are increasingly investing in clean technologies to address growing concerns about worker health and public safety. The adoption of energy-efficient systems is also gaining momentum as industries strive to cut operational costs while supporting sustainability initiatives, solidifying the U.S. as a leading market for electrostatic precipitators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Design, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By System, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Wet

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Babcock & Wilcox

- 8.3 Elex

- 8.4 Environ Engineers

- 8.5 GEA Group

- 8.6 Kraft Powercon

- 8.7 McGill AirClean

- 8.8 Sumitomo Heavy Industries

- 8.9 Thermax

- 8.10 VT Corp

- 8.11 Valmet