|

市场调查报告书

商品编码

1773252

绝育市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Spay and Neuter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

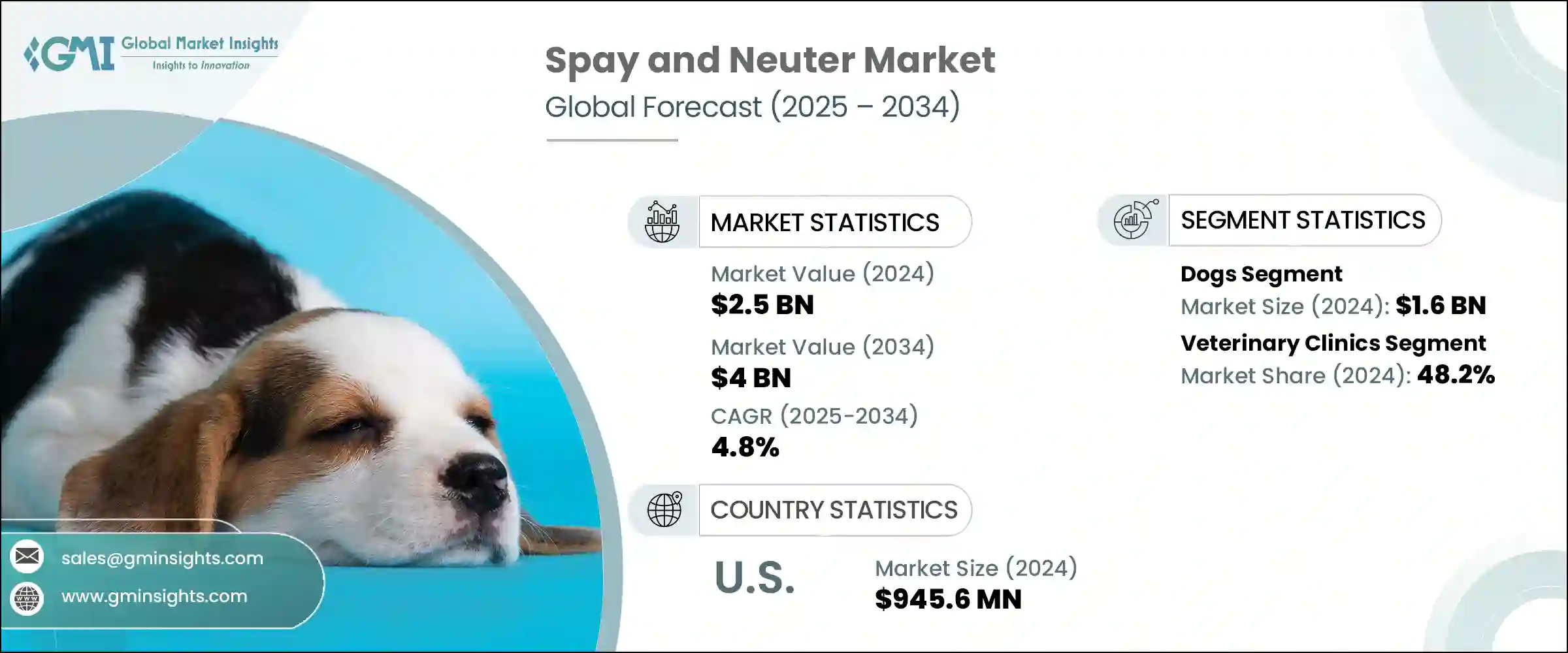

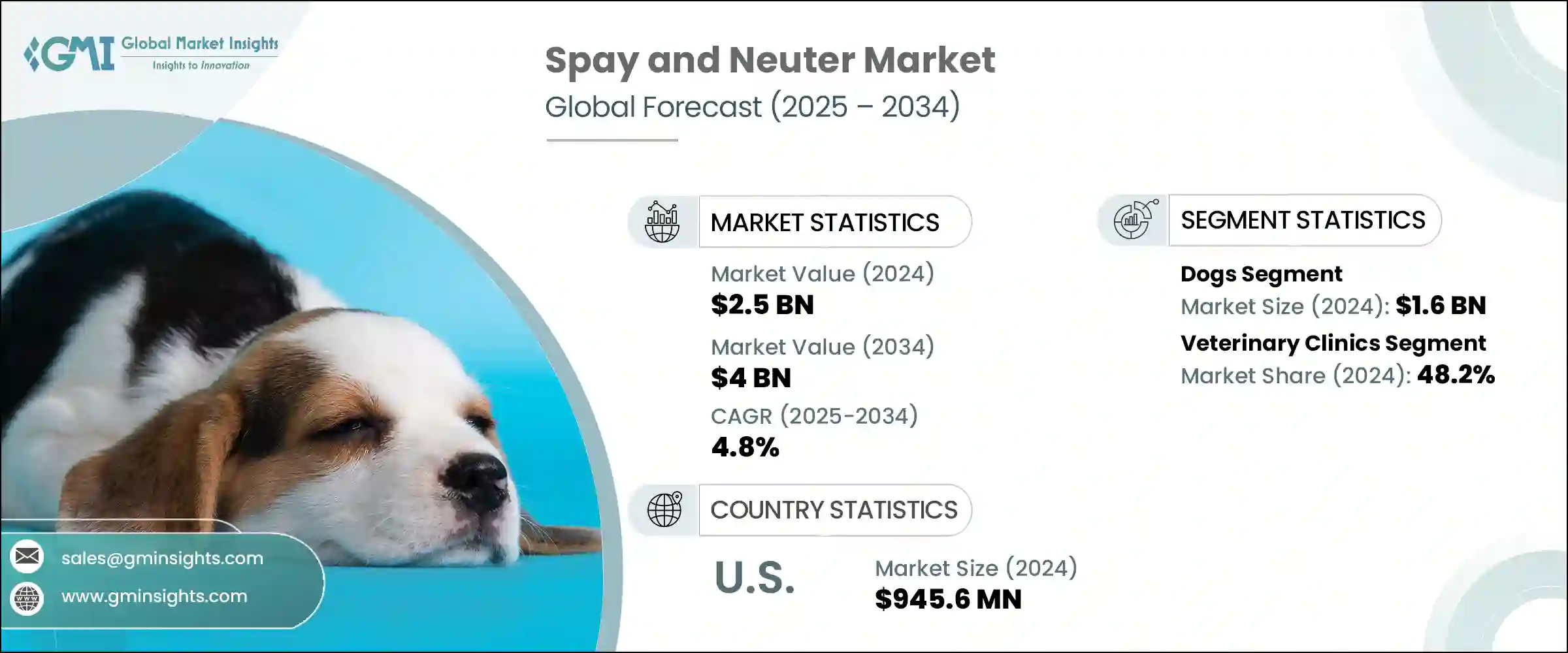

2024年,全球绝育市场规模达25亿美元,预计2034年将以4.8%的复合年增长率成长,达到40亿美元。人们对宠物数量过剩以及绝育手术带来的健康益处的认识不断提高,是推动这一增长的主要动力。由兽医协会、政府和动物福利组织领导的公共宣传活动持续鼓励人们养育负责任的宠物。教育和社区推广活动也正在转变人们对宠物绝育的观念,导致城乡绝育率显着上升。这种观念的转变,加上机构的努力,在推动市场发展方面发挥了至关重要的作用。

推动市场扩张的另一个关键因素是全球伴侣动物拥有量的稳定成长。随着越来越多的家庭开始接纳宠物,对兽医服务的需求,尤其是绝育服务的需求也日益增长。全球各地家庭饲养数亿隻猫狗,对绝育服务的需求激增。在许多情况下,救助中心和领养机构要求绝育作为领养的条件,这进一步加速了绝育服务的普及。动物领养比商业繁殖越来越受欢迎——这通常是由针对流浪动物种群的宣传活动所推动的——这强化了绝育作为一项必要的健康和种群控制措施的地位,也加剧了对价格合理且易于获取的绝育程序的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 4.8% |

2024年,宠物狗占了最大的市场份额,产值达16亿美元。这种主导地位主要源自于宠物狗被广泛饲养,以及消费者在宠物照护方面的支出不断增长。欧洲各国报告称,宠物狗数量众多,导致绝育需求增加。狗主人更有可能选择绝育作为整体健康和行为管理的一部分。此外,新兴市场可支配收入的不断增长以及宠物保险覆盖率的不断提高,使得绝育服务在经济上更加可行。这些趋势预计将在未来几年推动该领域的成长。

2024年,兽医诊所占了最高份额,达到48.2%。强劲的患者数量和极具竞争力的价格支撑着其领先地位,使其成为宠物主人的热门选择。诊所配备先进的手术设备,提供专业的护理,确保安全和品质。从全面的术前评估到术后护理,诊所为这些手术提供了可靠的环境。许多诊所还推出了促销套餐、分期付款计划和社区合作伙伴关係,以帮助扩大基本服务的覆盖范围。兽医诊所凭藉其专业知识、经济实惠的价格以及积极的推广策略,已成为全球绝育手术的主要管道。

2024年,美国绝育市场规模达9.456亿美元。美国广泛的兽医基础设施和发达的专业人才网络支撑着持续的绝育服务需求。仅凭家庭宠物的数量就推动了对常规动物医疗保健的需求,尤其是绝育手术。腹腔镜和内视镜等微创手术的技术进步,因其缩短了恢復时间并降低了併发症发生率,正在逐渐普及。此外,随着消费者在宠物健康和预防性医疗保健方面的支出不断增加,对绝育服务的需求预计将保持在高位,这将巩固美国在全球市场的主导地位。

绝育市场的主要参与者包括 Auburn Valley Humane Society、Alley Cat Allies、CVS Group Plc、Banfield Pet Hospital、The PAWS Clinic、Companions Spay & Neuter、Fix Long Beach、Indian Street Animal Clinic、VetPartners Group Limited、Houston Humane Society、Petco Aanimal Clinic、VetPartners Group Limited、Houston Veterinary Health 和 S/Nipped Clinic。为了巩固其在竞争激烈的绝育市场中的地位,公司正在采取一系列有针对性的策略。许多公司专注于将诊所网路扩展到服务不足或农村地区,以吸引更广泛的客户群。提供捆绑服务,包括疫苗接种和健康检查以及绝育,可以提高便利性并促进普及。各组织也正在投资教育活动并与收容所密切合作,以简化与收养相关的绝育流程。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 人们对绝育益处的认识不断提高

- 扩大流动绝育诊所

- 绝育手术的进步

- 公共/私人组织的支持倡议

- 产业陷阱与挑战

- 绝育手术相关风险

- 一些国家反对绝育手术的规定/文化信仰

- 市场机会

- 政府和非政府组织的人口控制倡议

- 强制绝育法律和宠物许可规定

- 成长动力

- 成长潜力分析

- 监管格局

- 2024年各国宠物拥有量统计数据

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新服务推出

- 扩张计划

第五章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 狗

- 绝育

- 绝育

- 猫

- 绝育

- 绝育

- 其他动物类型

- 绝育

- 绝育

第六章:市场估计与预测:按服务供应商,2021 年至 2034 年

- 主要趋势

- 兽医诊所

- 兽医院

- 其他服务提供者

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Alley Cat Allies

- Auburn Valley Humane Society

- Animal Spay-Neuter Clinic

- Banfield Pet Hospital

- CVS Group Plc

- Companions Spay & Neuter

- Ethos Veterinary Health

- Fix Long Beach

- Holt Road Pet Hospital

- Houston Humane Society

- Indian Street Animal Clinic

- Naoi Animal Hospital

- Petco Animal Supplies

- S/Nipped Clinic

- The PAWS Clinic

- VetPartners Group Limited

The Global Spay and Neuter Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 4 billion by 2034. Rising awareness about pet overpopulation and the health benefits associated with sterilization procedures are major drivers behind this growth. Public campaigns led by veterinary associations, governments, and animal welfare organizations continue to encourage responsible pet ownership. Educational and community outreach initiatives are also transforming perceptions around pet sterilization, leading to a significant rise in procedure rates across both urban and rural areas. This evolving mindset, supported by institutional efforts, has played a crucial role in fueling market momentum.

Another key contributor to the market's expansion is the steady increase in global companion animal ownership. As more families welcome pets into their homes, the demand for veterinary services, especially sterilization, is growing. With hundreds of millions of dogs and cats living in households across regions, demand for spay and neuter services has surged. In many cases, rescue centers and adoption agencies require sterilization as a condition for adoption, further accelerating the uptake. The growing popularity of animal adoption over commercial breeding-often driven by awareness campaigns against stray populations-has reinforced sterilization as a necessary health and population control measure, amplifying the need for affordable and accessible procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4 Billion |

| CAGR | 4.8% |

In 2024, dogs held the largest segment share of the market, generating USD 1.6 billion. This dominance is largely due to the widespread adoption of dogs as pets, coupled with rising consumer spending on their care. Countries in Europe report high populations of pet dogs, which contributes to increased demand for sterilization. Dog owners are more likely to opt for spaying or neutering as part of general health and behavioral management. Additionally, expanding disposable incomes in emerging markets and the rising uptake of pet insurance coverage continue to make sterilization services more financially feasible. These combined trends are expected to fuel segment growth in the coming years.

The veterinary clinics segment commanded the highest share in 2024, accounting for 48.2%. Their leadership position is backed by strong patient volumes and competitive pricing, making them a popular choice among pet owners. Clinics offer expert care with advanced surgical equipment, ensuring safety and quality. From comprehensive pre-surgery evaluations to follow-up care, clinics provide a reliable environment for these procedures. Many of them are also introducing promotional packages, installment payment plans, and community partnerships that help expand access to essential services. Their expertise, affordability, and proactive outreach strategies have made veterinary clinics the primary channel for spay and neuter operations globally.

U.S. Spay and Neuter Market generated USD 945.6 million in 2024. The country's extensive veterinary infrastructure and a well-developed network of professionals support consistent demand for sterilization services. The sheer number of household pets alone boosts the requirement for regular animal healthcare, particularly spay and neuter operations. Technological advancements in minimally invasive surgeries like laparoscopy and endoscopy are gaining ground due to their reduced recovery times and lower complication rates. Moreover, with rising consumer expenditure on pet wellness and preventive healthcare, the demand for sterilization services is expected to remain high, reinforcing the U.S. as a dominant force in the global market.

Leading participants in the Spay and Neuter Market include Auburn Valley Humane Society, Alley Cat Allies, CVS Group Plc, Banfield Pet Hospital, The PAWS Clinic, Companions Spay & Neuter, Fix Long Beach, Indian Street Animal Clinic, VetPartners Group Limited, Houston Humane Society, Petco Animal Supplies, Naoi Animal Hospital, Animal Spay-Neuter Clinic, Holt Road Pet Hospital, Ethos Veterinary Health, S/Nipped Clinic. To reinforce their position in the competitive spay and neuter market, companies are adopting a range of targeted strategies. Many focus on expanding clinic networks into underserved or rural areas to capture a broader clientele. Offering bundled services, including vaccinations and wellness check-ups with sterilization, improves convenience and boosts uptake. Organizations are also investing in educational campaigns and working closely with shelters to streamline adoption-linked sterilization processes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Animal type

- 2.2.3 Service provider

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness about the benefits of spaying and neutering

- 3.2.1.2 Expansion of mobile spay and neuter clinics

- 3.2.1.3 Advancement in the spay and neuter surgical procedures

- 3.2.1.4 Supportive initiatives by public/ private organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk associated with spay and neuter surgeries

- 3.2.2.2 Regulations/ cultural beliefs against spay and neuter surgeries in some countries

- 3.2.3 Market opportunities

- 3.2.3.1 Government and NGO initiatives for population control

- 3.2.3.2 Mandatory sterilization laws and pet licensing regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pet ownership statistics by country, 2024

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New service launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dogs

- 5.2.1 Spaying

- 5.2.2 Neutering

- 5.3 Cats

- 5.3.1 Spaying

- 5.3.2 Neutering

- 5.4 Other animal types

- 5.4.1 Spaying

- 5.4.2 Neutering

Chapter 6 Market Estimates and Forecast, By Service Provider, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Veterinary clinics

- 6.3 Veterinary hospitals

- 6.4 Other service providers

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alley Cat Allies

- 8.2 Auburn Valley Humane Society

- 8.3 Animal Spay-Neuter Clinic

- 8.4 Banfield Pet Hospital

- 8.5 CVS Group Plc

- 8.6 Companions Spay & Neuter

- 8.7 Ethos Veterinary Health

- 8.8 Fix Long Beach

- 8.9 Holt Road Pet Hospital

- 8.10 Houston Humane Society

- 8.11 Indian Street Animal Clinic

- 8.12 Naoi Animal Hospital

- 8.13 Petco Animal Supplies

- 8.14 S/Nipped Clinic

- 8.15 The PAWS Clinic

- 8.16 VetPartners Group Limited