|

市场调查报告书

商品编码

1773343

蒸汽回收装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vapor Recovery Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

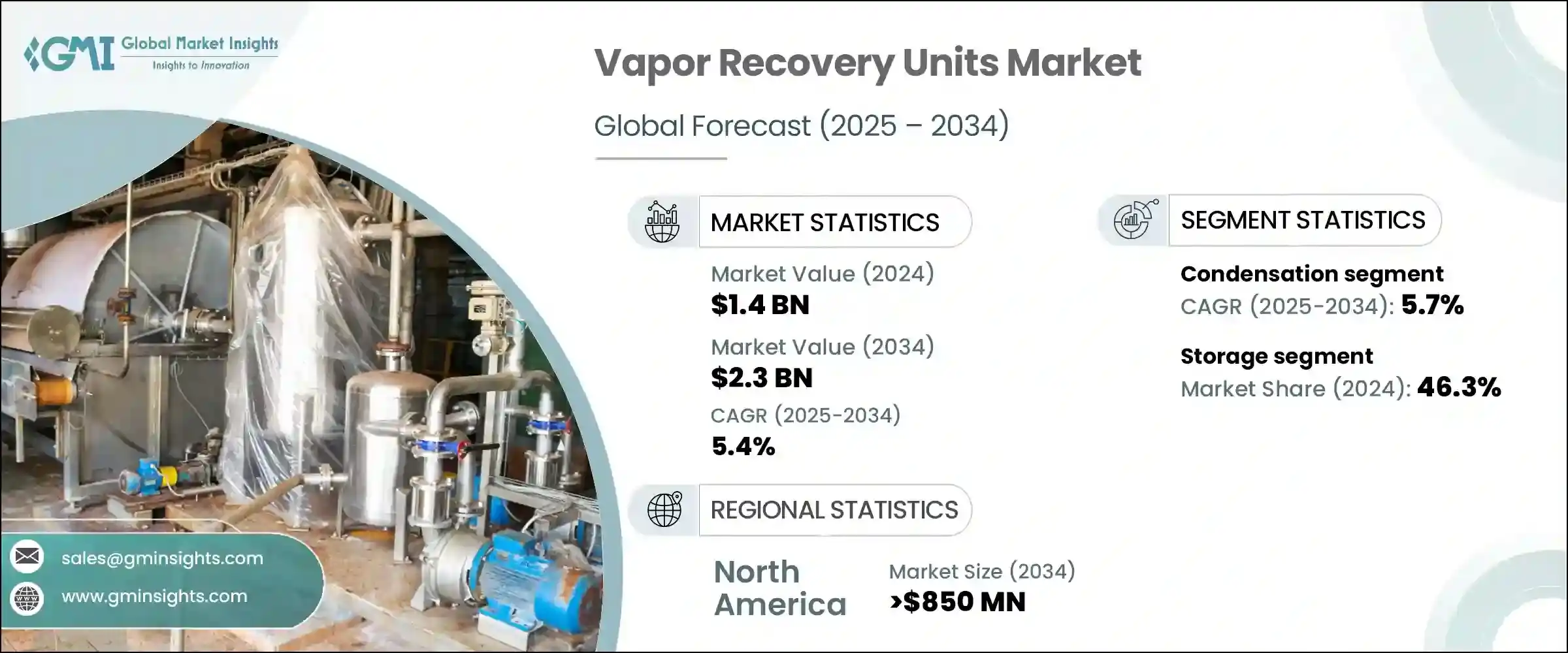

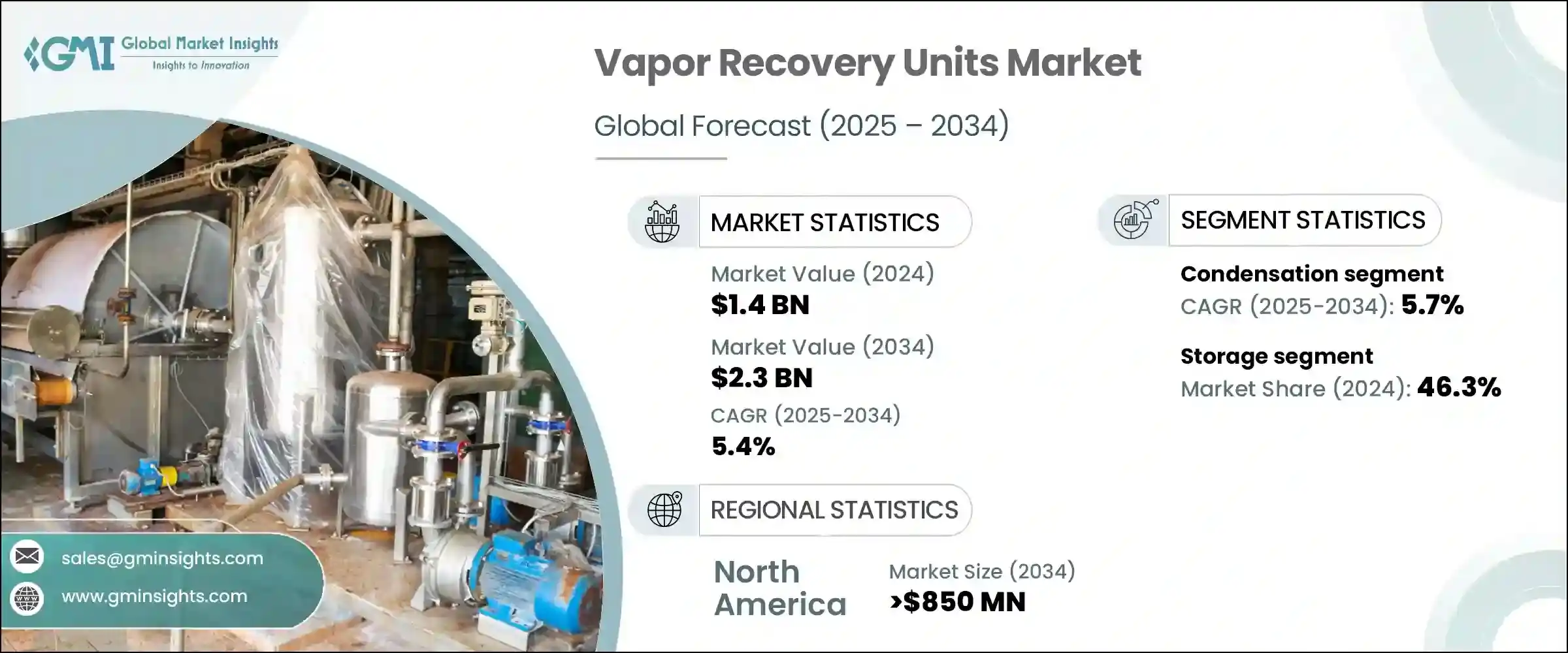

2024年,全球蒸汽回收装置市场规模达14亿美元,预计2034年将以5.4%的复合年增长率成长至23亿美元。人们日益意识到控制挥发性有机化合物(VOC)排放对环境和监管的重要性,这在加速市场发展动能方面发挥着重要作用。一些发展中国家的政府正在推出更严格的排放标准,迫使各行各业部署蒸汽回收技术作为合规策略的一部分。这些装置为捕获和回收原本会排放到大气中的碳氢化合物蒸气提供了一个可持续的解决方案。随着各行各业寻求环保高效的传统排放控制系统替代方案,VRU正迅速成为可行且更受欢迎的选择。

人们越来越倾向于选择更清洁的技术,这些技术不仅能最大限度地减少环境影响,还能带来营运成本优势,这推动了VRU在多个行业的应用。市场扩张的主要驱动力之一是燃料储存设施和原油码头数量的不断增长,尤其是在快速工业化的地区。这些地区的营运商正在投资蒸汽回收系统,以符合日益严格的污染标准并提高整体製程效率。 VRU回收宝贵燃油蒸气的能力转化为额外的成本节约,使其成为营运商的策略性投资。此外,市场对紧凑型、撬装式蒸汽回收系统的需求也不断增长,这些系统专为空间受限的装置或行动应用而设计。这些现代化的系统配备了先进的功能,例如改进的过滤系统、耐腐蚀材料、整合式冷凝器和自清洁机制,有助于最大限度地缩短维护间隔并提高运作可靠性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 5.4% |

此外,回收燃料的转售价值,加上合规和检查所需的劳动力减少,进一步推动了VRU系统的普及。随着市场越来越注重性能,重点正转向能够稳定输出并减少营运中断的高效系统。随着能源基础设施的扩张和全球储存网路燃料吞吐量的提高,对此类装置的需求持续成长。

从技术面来看,蒸汽回收装置市场细分为冷凝、吸附、吸收和压缩系统。其中,冷凝系统市场预计到2034年将以5.7%的复合年增长率扩张。这一成长主要得益于人们对闭环冷却系统日益增长的兴趣,该系统使营运商能够限制用水量并增强其营运的可持续性。在不影响回收率的情况下,向环保设计转变,正显着推动冷凝式蒸汽回收装置市场的发展。这些系统因其能够高效回收各种碳氢化合物并符合环保目标的能力而日益受到青睐。

依应用领域划分,市场可分为加工、储存和运输。 2024年,储存应用领域占最大份额,为46.3%,预计在整个预测期内仍将保持主导地位。这主要是由于监管部门强调最大限度地减少储罐排放,尤其是储罐呼吸和工作损耗所产生的排放。随着排放标准的收紧,设施营运商越来越被迫将VRU整合到其终端基础设施中,以保持合规并避免处罚。储存产业仍然是这些系统的主要应用领域,大型和中型设施的需求都呈现强劲势头。

从区域分析来看,美国油气回收装置市场规模在2022年为3.736亿美元,2023年增加至3.898亿美元,2024年达到4.072亿美元。美国油气回收装置(VRU)的采用率持续强劲,尤其是在上游石油作业和页岩盆地。随着页岩勘探活动的成长,对能够管理油罐电池排放并符合《清洁空气法》的排放控制技术的需求也日益增长。此外,炼油厂和燃油配送终端正在增加对VRU的投资,以满足严格的空气品质要求并减少其环境足迹。这些倡议正在为供应商创造新的商机,并推动该地区市场的持续成长。

蒸汽回收装置市场的竞争格局较为分散,既有大型工业製造商,也有专业的系统整合商。排名前五的厂商,包括英格索兰 (Ingersoll Rand)、PSG、Cimarron Energy、Kilburn 和 Zeeco,合计占约 40% 的市占率。这些公司专注于策略性产品创新、技术服务扩展和增强系统整合能力,以巩固其市场地位。随着竞争加剧,各厂商也正在投资在地化製造、自动化和模组化系统开发,以满足不同产业不断变化的终端用户需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 缩合

- 吸附

- 吸收

- 压缩

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 加工

- 贮存

- 运输

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 石油和天然气

- 化工和石化

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 挪威

- 波兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 阿曼

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第九章:公司简介

- ALMA Group

- BORSIG

- Cimarron Energy

- Cool Sorption

- Flogistix

- Ingersoll Rand

- KAPPA GI

- Kilburn

- Koch Engineered Solutions

- PSG

- Reynold India

- S&S Technical

- SCS Technologies

- SYMEX Technologies

- Tecam

- VOCZero

- Zeeco

The Global Vapor Recovery Units Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 2.3 billion by 2034. Growing awareness regarding the environmental and regulatory importance of controlling volatile organic compound (VOC) emissions is playing a significant role in accelerating market momentum. Governments in several developing nations are rolling out stricter emissions norms, compelling industries to deploy vapor recovery technologies as part of their compliance strategy. These units offer a sustainable solution for capturing and recycling hydrocarbon vapors that would otherwise be released into the atmosphere. As industries seek eco-friendly and efficient alternatives to traditional emission control systems, VRUs are rapidly emerging as a viable and preferred choice.

The increasing preference for cleaner technologies that not only minimize environmental impact but also offer operational cost benefits is fueling VRU adoption across multiple sectors. One of the primary drivers for market expansion is the growing number of fuel storage facilities and crude oil terminals, especially in rapidly industrializing regions. Operators in these areas are investing in vapor recovery systems to align with tightening pollution norms and to improve overall process efficiency. The ability of VRUs to recover valuable fuel vapors translates into added cost savings, making them a strategic investment for operators. Moreover, the market is witnessing rising demand for compact, skid-mounted vapor recovery systems designed for space-constrained setups or mobile applications. These modern systems are being equipped with advanced features such as improved filtration, corrosion-resistant materials, integrated condensers, and self-cleaning mechanisms, which help minimize maintenance intervals and enhance operational reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.4% |

Additionally, the resale value of recovered fuel, combined with reduced labor requirements for compliance and inspection, is further encouraging the uptake of VRU systems. As the market becomes more performance-driven, the emphasis is shifting toward high-efficiency systems that deliver consistent output while reducing operational disruptions. The demand for such units continues to rise in line with expanding energy infrastructure and increasing fuel throughput across global storage networks.

Technologically, the vapor recovery units market is segmented into condensation, adsorption, absorption, and compression systems. Among these, the condensation segment is expected to expand at a CAGR of 5.7% through 2034. This growth is largely supported by growing interest in closed-loop cooling systems, which allow operators to limit water consumption and enhance the sustainability profile of their operations. The shift toward eco-conscious designs that reduce resource use without compromising recovery rates is giving a considerable push to the condensation VRU segment. These systems are gaining traction for their ability to recover a wide range of hydrocarbons efficiently while aligning with environmental goals.

By application, the market is classified into processing, storage, and transportation. In 2024, the storage application segment held the largest share at 46.3%, and it is expected to maintain dominance throughout the forecast period. This is largely due to the regulatory emphasis on minimizing emissions from storage tanks, particularly emissions stemming from tank breathing and working losses. As emissions standards tighten, facility operators are increasingly compelled to integrate VRUs into their terminal infrastructure to stay in compliance and avoid penalties. The storage sector remains the primary area of application for these systems, with demand showing strong momentum across both large and mid-sized facilities.

In terms of regional analysis, the vapor recovery units market in the United States stood at USD 373.6 million in 2022, rose to USD 389.8 million in 2023, and reached USD 407.2 million in 2024. The country continues to witness strong adoption of VRUs, particularly across upstream oil operations and shale basins. As shale exploration activities grow, there is heightened demand for emissions control technologies capable of managing tank battery releases and complying with the Clean Air Act. Additionally, refineries and fuel distribution terminals are increasing their investment in VRUs to meet strict air quality mandates and reduce their environmental footprint. These efforts are creating new business opportunities for suppliers and driving consistent market growth in the region.

The competitive landscape of the vapor recovery units market is moderately fragmented, with a mix of large-scale industrial manufacturers and specialized system integrators. The top five players, which include Ingersoll Rand, PSG, Cimarron Energy, Kilburn, and Zeeco, collectively account for around 40% of the market share. These companies are focusing on strategic product innovation, technical service expansion, and enhanced system integration capabilities to strengthen their position. As competition intensifies, players are also investing in localized manufacturing, automation, and modular system development to cater to evolving end-user needs across diverse sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Condensation

- 5.3 Adsorption

- 5.4 Absorption

- 5.5 Compression

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Processing

- 6.3 Storage

- 6.4 Transportation

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Chemical & petrochemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Norway

- 8.3.8 Poland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 Oman

- 8.5.6 South Africa

- 8.5.7 Nigeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ALMA Group

- 9.2 BORSIG

- 9.3 Cimarron Energy

- 9.4 Cool Sorption

- 9.5 Flogistix

- 9.6 Ingersoll Rand

- 9.7 KAPPA GI

- 9.8 Kilburn

- 9.9 Koch Engineered Solutions

- 9.10 PSG

- 9.11 Reynold India

- 9.12 S&S Technical

- 9.13 SCS Technologies

- 9.14 SYMEX Technologies

- 9.15 Tecam

- 9.16 VOCZero

- 9.17 Zeeco