|

市场调查报告书

商品编码

1876610

储油气回收装置市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Storage Vapor Recovery Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

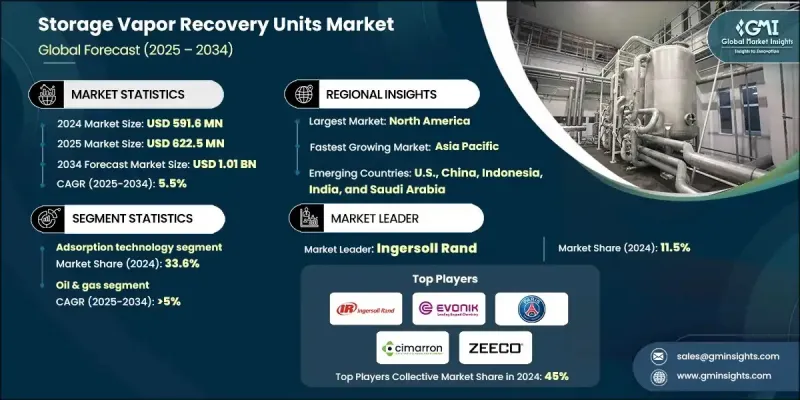

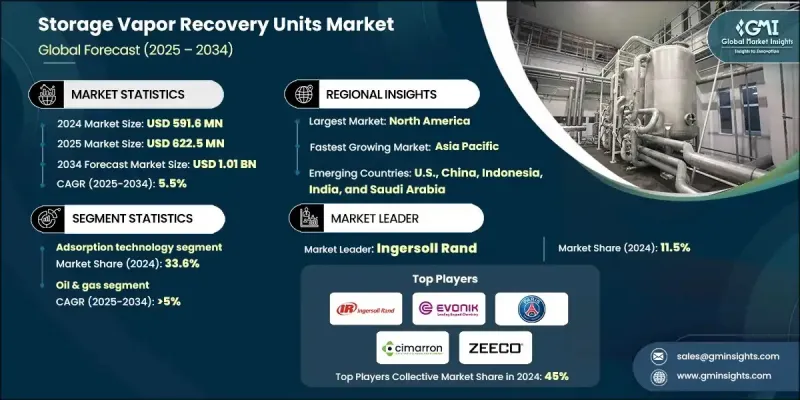

2024 年全球储气回收装置市值为 5.916 亿美元,预计到 2034 年将以 5.5% 的复合年增长率成长至 10.1 亿美元。

模组化和节能係统设计的进步,以及各行业对低维护回收解决方案日益增长的需求,共同推动了市场的稳定扩张。储槽蒸汽回收装置 (VRU) 的设计旨在捕获和回收储槽在灌装或温度变化等操作过程中释放的碳氢化合物蒸气。这些蒸气含有挥发性有机化合物 (VOC),不仅造成环境污染,也意味着宝贵碳氢化合物的损失。智慧感测器和远端监控系统的日益普及,透过实现预测性维护和提高透明度,正在改变营运格局。对化学和製药储存设施中 VOC 排放控制的日益重视,持续推动高效回收技术的应用。专为小型和城市设施设计的紧凑型 VRU 正在迅速普及,而活性碳基系统因其卓越的回收效率和灵活性而日益受到青睐。此外,低温冷凝技术在温度敏感型储存作业的应用,为特殊应用领域创造了新的机会。针对传统油气产业以外的排放控制监管框架的不断扩展,进一步推动了多个产业对先进蒸汽回收基础设施的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.916亿美元 |

| 预测值 | 10.1亿美元 |

| 复合年增长率 | 5.5% |

2024年,基于冷凝技术的产业市场规模预计为1.371亿美元。对低温蒸汽回收需求的不断增长,推动了基于冷凝技术的蒸汽回收装置(VRU)的应用,尤其是在化学和製药公司中。机械冷凝和低温冷凝技术的持续创新,显着提高了蒸汽捕集率,并增强了工业排放控制的效率。

预计2025年至2034年间,石油天然气产业将以5%的复合年增长率成长。上游和中游储能基础设施的不断发展是推动石油天然气应用领域对油气回收装置需求的主要因素。旨在减少油罐区、炼油厂和装卸码头碳氢化合物排放的环保法规日益严格,使得油气回收装置的整合成为合规的必然要求。随着甲烷和挥发性有机化合物(VOC)减量策略的日益受到重视,这些系统正成为整个能源产业排放管理框架中的关键组成部分。

2024年,欧洲储气库油气回收装置市场规模预估为1.724亿美元。欧盟挥发性有机化合物(VOC)指令下严格的监管标准,为工业储气库采用油气回收装置创造了有利环境。对永续物流和环保基础设施的投资不断增长,并持续推动该地区市场的扩张。先进的膜技术和吸附技术的持续应用,提高了系统效率,并支持该地区向低排放工业实践转型。

全球储气罐蒸汽回收装置市场的主要企业包括Cimarron Energy、KAPPA GI、Koch Engineered Solutions、Cool Sorption、Ingersoll Rand、Tecam、ALMA Group、Kilburn Engineering、BORSIG、Evonik、Zeeco、VOCZero、Flogistix、SCS Technologies、BORSIG、Evonik、Zeeco、VOCZero、Flogistix、SCS Technologies、SUSPE Technologies、SPES、LexDivU特性、SPEC、BUUS乐、B.STIT、STIT、MITSIT、SPES特性、SEXSPE併这些市场领导者正致力于产品创新、技术进步和策略合作,以巩固其市场地位。许多公司正在开发配备智慧感测器和数位监控系统的模组化即插即用型储气罐蒸汽回收装置,以提高运作效率并减少维护需求。各公司强调能源优化和系统紧凑性,以满足空间受限的工业环境的需求。与终端用户和EPC承包商建立策略合作伙伴关係,有助于拓展分销网络并改善售后服务。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 蒸汽回收装置的成本结构分析

- 新兴机会与趋势

- 数位化和物联网集成

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- Key partnerships & collaborations

- Major M&A activities

- Product innovations & launches

- Market expansion strategies

- 策略倡议

- 竞争性标竿分析

- 创新与技术格局

第五章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 缩合

- 吸附

- 吸收

- 压缩

第六章:市场规模及预测:依最终用途划分,2021-2034年

- 主要趋势

- 石油和天然气

- 化工及石油化工

- 其他的

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 挪威

- 波兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 阿曼

- 南非

- 奈及利亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第八章:公司简介

- ALMA Group

- BORSIG

- Cimarron Energy

- Cool Sorption

- Evonik

- Flogistix

- Ingersoll Rand

- KAPPA GI

- Kilburn Engineering

- Koch Engineered Solutions

- LeROI

- PETROGAS

- PSG

- Reynold India

- S&S Technical

- SCS Technologies

- SYMEX Technologies

- Tecam

- VOCZero

- Zeeco

The Global Storage Vapor Recovery Units Market was valued at USD 591.6 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.01 billion by 2034.

The market's steady expansion is driven by advancements in modular and energy-efficient system design, coupled with the rising need for low-maintenance recovery solutions across industries. Storage vapor recovery units (VRUs) are engineered to capture and reclaim hydrocarbon vapors released from storage tanks during operations such as filling or temperature variations. These vapors contain volatile organic compounds that not only contribute to environmental pollution but also represent a loss of valuable hydrocarbons. The growing integration of smart sensors and remote monitoring systems is transforming the operational landscape by enabling predictive maintenance and improving transparency. Increasing emphasis on controlling VOC emissions in chemical and pharmaceutical storage facilities continues to propel the adoption of high-efficiency recovery technologies. Compact VRUs designed for small-scale and urban installations are witnessing rapid uptake, while activated carbon-based systems are gaining popularity due to their superior recovery efficiency and flexibility. Furthermore, the deployment of cryogenic condensation technologies in temperature-sensitive storage operations is creating new opportunities in specialized applications. Expanding regulatory frameworks addressing emission control beyond traditional oil and gas sectors are further driving demand for advanced vapor recovery infrastructure across multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $591.6 Million |

| Forecast Value | $1.01 Billion |

| CAGR | 5.5% |

The condensation-based technology segment was valued at USD 137.1 million in 2024. Rising requirements for low-temperature vapor recovery are fueling the adoption of condensation-based VRUs, especially in chemical and pharmaceutical facilities. Continued innovation in mechanical and cryogenic condensation techniques is significantly improving vapor capture rates and enhancing the efficiency of industrial emission control.

The oil & gas sector is projected to grow at a CAGR of 5% between 2025 and 2034. The increasing development of upstream and midstream storage infrastructure is a major factor driving the need for vapor recovery units in oil and gas applications. Strengthening environmental regulations aimed at reducing hydrocarbon emissions from tank farms, refineries, and loading terminals has made the integration of VRUs a compliance imperative. With a growing emphasis on methane and VOC reduction strategies, these systems are becoming vital components in emission management frameworks throughout the energy industry.

Europe Storage Vapor Recovery Units Market was valued at USD 172.4 million in 2024. Strict regulatory standards under EU VOC directives are creating a robust environment for VRU adoption across industrial storage sites. Rising investment in sustainable logistics and environmentally responsible infrastructure continues to contribute to the region's market expansion. Ongoing adoption of advanced membrane and adsorption technologies is improving system efficiency and supporting the region's transition toward low-emission industrial practices.

Prominent companies operating in the Global Storage Vapor Recovery Units Market include Cimarron Energy, KAPPA GI, Koch Engineered Solutions, Cool Sorption, Ingersoll Rand, Tecam, ALMA Group, Kilburn Engineering, BORSIG, Evonik, Zeeco, VOCZero, Flogistix, SCS Technologies, S&S Technical, LeROI, PETROGAS, SYMEX Technologies, PSG, and Reynold India. Leading players in the Storage Vapor Recovery Units Market are focusing on product innovation, technological advancement, and strategic collaborations to strengthen their market position. Many companies are developing modular, plug-and-play VRUs equipped with smart sensors and digital monitoring to enhance operational efficiency and reduce maintenance needs. Firms are emphasizing energy optimization and system compactness to cater to space-constrained industrial settings. Strategic partnerships with end-users and EPC contractors are helping expand distribution networks and improve after-sales service.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Technology trends

- 2.4 End Use trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of vapor recovery units

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization and IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Condensation

- 5.3 Adsorption

- 5.4 Absorption

- 5.5 Compression

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Chemical & petrochemical

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.3.7 Norway

- 7.3.8 Poland

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Malaysia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Egypt

- 7.5.5 Oman

- 7.5.6 South Africa

- 7.5.7 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 ALMA Group

- 8.2 BORSIG

- 8.3 Cimarron Energy

- 8.4 Cool Sorption

- 8.5 Evonik

- 8.6 Flogistix

- 8.7 Ingersoll Rand

- 8.8 KAPPA GI

- 8.9 Kilburn Engineering

- 8.10 Koch Engineered Solutions

- 8.11 LeROI

- 8.12 PETROGAS

- 8.13 PSG

- 8.14 Reynold India

- 8.15 S&S Technical

- 8.16 SCS Technologies

- 8.17 SYMEX Technologies

- 8.18 Tecam

- 8.19 VOCZero

- 8.20 Zeeco