|

市场调查报告书

商品编码

1773360

硅胶身体磨砂膏市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Silicone Body Scrubber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

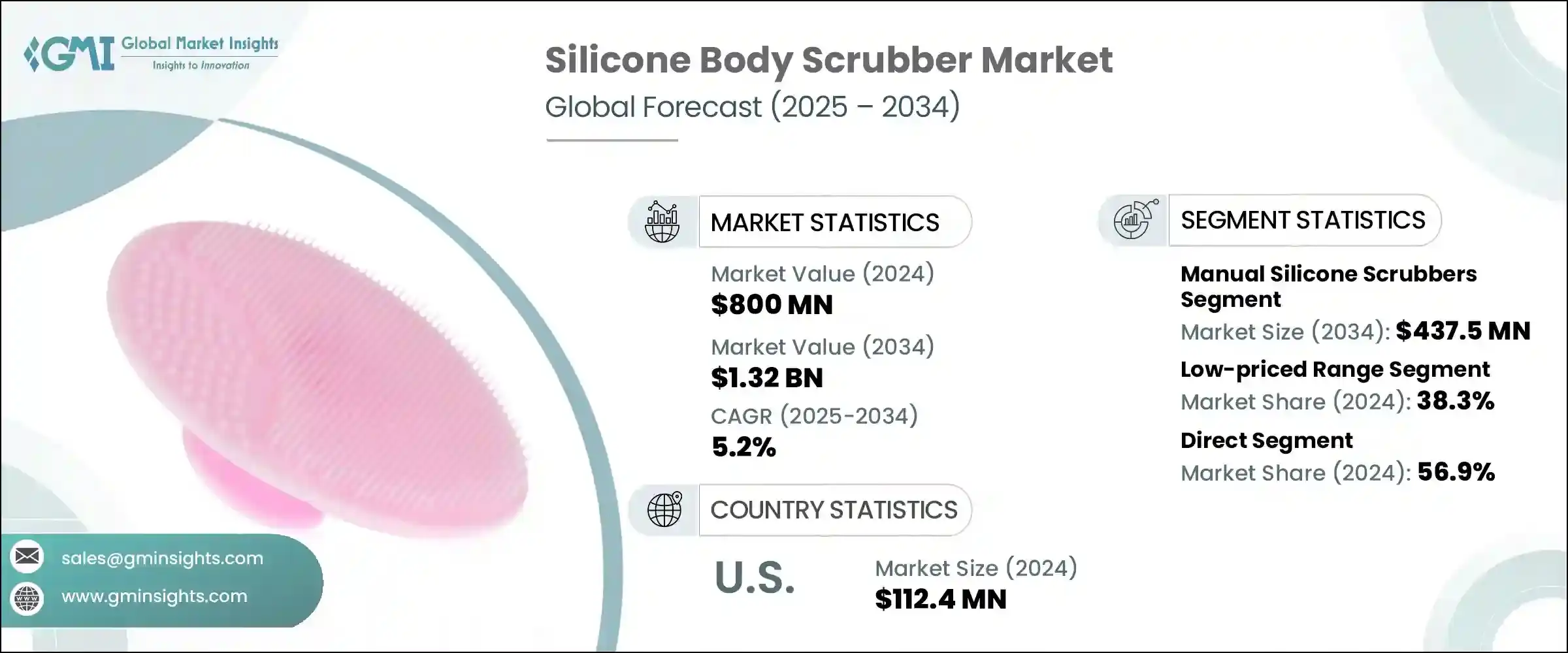

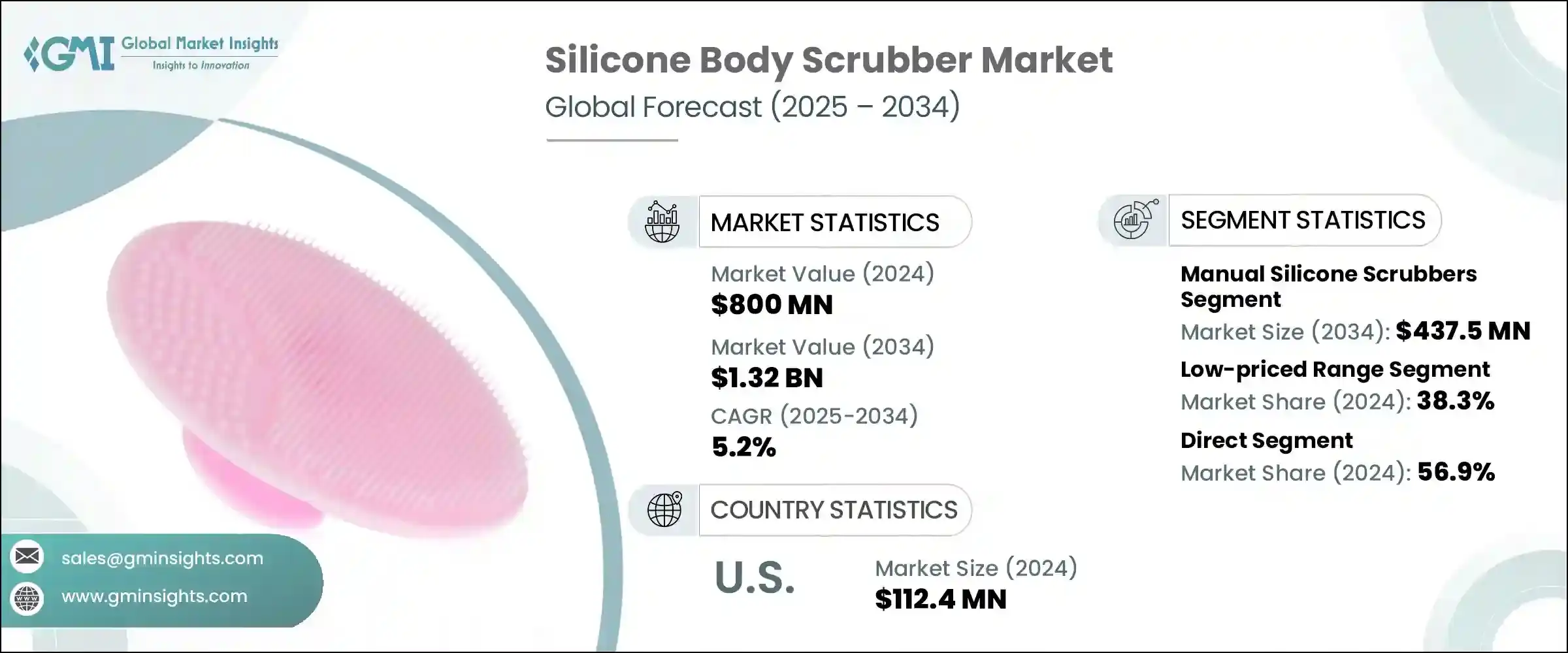

2024年,全球硅胶身体磨砂膏市场规模达8亿美元,预计2034年将以5.2%的复合年增长率成长,达到13.2亿美元。这一增长反映了全球护肤习惯的转变,去角质因其促进血液循环、清洁肌肤、改善肤色等益处而日益流行。年轻的城市消费者尤其推动这一趋势,积极采用以健康为中心的个人护理流程。经皮肤科医生认可的护肤实践的兴起以及官方对去角质的支持,使硅胶身体磨砂膏成为日常卫生的必备工具。随着消费者对长期皮肤健康的理解加深,他们开始寻求兼具功效、卫生性和耐用性的解决方案。

市场扩张的关键驱动因素之一是硅胶刷头相较于传统清洁用品所具备的独特优势。与多孔替代品不同,硅胶不会滋生细菌或霉菌,从而带来更卫生的护肤体验。消费者越来越多地选择可重复使用和可回收的工具,而随着人们日益意识到与一次性塑胶相关的环境问题,硅胶刷头作为环保选择颇具吸引力。其较长的使用寿命也减少了频繁的重复购买,这与个人护理领域许多行业普遍存在的可持续发展目标和减废倡议相契合。手动硅胶刷头在全球市场占据主导地位,主要原因在于其功能简单且经济高效。这些产品无需电池或电源,易于使用、清洁和存放,因此吸引了广泛的人群。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8亿美元 |

| 预测值 | 13.2亿美元 |

| 复合年增长率 | 5.2% |

低价产品类别在2024年占据38.3%的市场份额,预计在2025-2034年期间的复合年增长率为4.5%。这些经济实惠的选择正在发展中国家取得显着进展,因为在这些国家,经济实惠是消费者决策的核心。亚太地区占全球需求的40%以上,其应用范围涵盖大型城市中心和小型城镇。在这些地区,兼具耐用性和易于维护性的经济高效的卫生解决方案持续受到青睐,尤其是在寻求耐用且简单清洁替代品的初次使用者群体中。

2024年,美国硅胶身体磨砂膏市场规模达1.124亿美元,预计2025年至2034年间的复合年增长率将达5.6%。随着美国消费者在护肤、卫生和环保购物方面的投入日益增加,该市场正呈现强劲成长动能。由于注重优质、不含双酚A且经皮肤科医生推荐的材质,美国消费者(尤其是千禧世代和Z世代)选择硅胶身体磨砂膏作为丝瓜络的更好替代品。较高的认知度、优质的分销管道以及对医用级硅胶日益增长的偏好,推动了该领域在北美的持续成长。

塑造产业格局的关键公司包括 Silicone Scrubs、TreeActiv、EcoTools、Shower Bouquet、Cleanlogic、Pure Enrichment、Earth Therapeutics、Aquis、INNERNEED、Body Benefits、Sud Scrub、Seraphic Skincare、The Bathery、Salux 和 Toiletries。为了维持并扩大市场份额,硅胶身体磨砂膏市场的领导者正在实施以产品创新、品牌差异化和永续性为中心的策略。许多企业专注于采用符合人体工学和美学设计的医用级、不含双酚A的硅胶,以满足消费者对舒适和卫生的期望。这些公司也正在拓展电商业务,并利用与网红的合作,瞄准更年轻、更注重护肤的人。此外,他们也正在投资可回收包装和碳中和生产方法,以顺应日益增长的环保意识。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计(HS编码-39269099)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 手动硅胶刷

- 电动/声波硅胶清洗器

- 背部刷子

- 足部磨砂膏

- 手套式洗涤器

第六章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场估计与预测:依皮肤类型,2021-2034

- 主要趋势

- 敏感的

- 油性

- 干燥

- 普通的

第八章:市场估计与预测:依消费者群体,2021-2034 年

- 主要趋势

- 男性

- 女性

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 个人

- 商业/饭店用途

- 沙龙和美容诊所

- 水疗中心和健康中心

- 其他(医院及养老院、皮肤科诊所等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务平台

- 品牌自有网站

- 离线

- 超市/大卖场

- 美容和化妆品商店

- 药局和保健品零售商

- 专业零售(生活风格、高级礼品店)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿联酋

- 沙乌地阿拉伯

第十二章:公司简介

- Aquis

- Body Benefits

- Cleanlogic

- Earth Therapeutics

- EcoTools

- INNERNEED

- Pure Enrichment

- Salux

- Seraphic Skincare

- Shower Bouquet

- Silicone Scrubs

- Sud Scrub

- The Bathery

- Tooletries

- TreeActiv

The Global Silicone Body Scrubber Market was valued at USD 800 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.32 billion by 2034. This growth reflects a shift in global skincare habits, with exfoliation gaining popularity due to its benefits, like enhanced circulation, cleaner skin, and improved skin tone. Younger, urban consumers are especially driving this momentum, actively adopting wellness-focused personal care routines. The rise of dermatologically approved skin practices and official support for exfoliation has helped legitimize silicone scrubbers as essential tools for maintaining daily hygiene. With a greater understanding of long-term skin health, consumers are turning toward solutions that combine performance with sanitation and durability.

One of the key drivers behind the market's expansion is the unique set of benefits silicone scrubbers offer over traditional cleansing items. Unlike porous alternatives, silicone doesn't trap bacteria or mold, creating a more hygienic skincare experience. Consumers are increasingly selecting reusable and recyclable tools, with silicone scrubbers appealing as eco-conscious choices amid rising awareness of environmental issues tied to single-use plastics. Their long life span also reduces frequent repurchases, which aligns with broader sustainability goals and waste-reduction initiatives seen across many sectors in personal care. Manual silicone scrubbers dominate the global market, primarily because of their simple functionality and cost-efficiency. These products don't require batteries or power and are easy to use, clean, and store, which makes them attractive to a broad range of demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $800 Million |

| Forecast Value | $1.32 Billion |

| CAGR | 5.2% |

The lower-priced product category represented 38.3% share in 2024 and is anticipated to grow at a CAGR of 4.5% during 2025-2034. These affordable options are making substantial inroads in developing economies, where affordability is central to consumer decisions. The Asia-Pacific region accounts for more than 40% of the global demand, where adoption spans both large urban centers and smaller towns. In these areas, cost-effective hygiene solutions that offer both longevity and ease of maintenance continue to gain ground, especially among first-time users seeking durable and simple cleansing alternatives.

United States Silicone Body Scrubber Market was valued at USD 112.4 million in 2024 and is estimated to grow at a CAGR of 5.6% between 2025 and 2034. This market is experiencing strong momentum as US consumers become increasingly invested in skincare, hygiene, and eco-conscious shopping. With a focus on premium, BPA-free, and dermatologist-recommended materials, American buyers-especially Millennials and Gen Z-are choosing silicone scrubbers as better alternatives to loofahs. High awareness levels, superior distribution channels, and growing preference for medical-grade silicone contribute to the continued growth of this segment in North America.

Key companies shaping the industry include Silicone Scrubs, TreeActiv, EcoTools, Shower Bouquet, Cleanlogic, Pure Enrichment, Earth Therapeutics, Aquis, INNERNEED, Body Benefits, Sud Scrub, Seraphic Skincare, The Bathery, Salux, and Toiletries. To maintain and expand their market presence, leading players in the silicone body scrubber market are executing strategies centered on product innovation, brand differentiation, and sustainability. Many are focusing on medical-grade, BPA-free silicone with ergonomic and aesthetic designs to meet consumer expectations for comfort and hygiene. These companies are also expanding into e-commerce and leveraging influencer partnerships to target younger, skincare-conscious demographics. Additionally, they're investing in recyclable packaging and carbon-neutral production methods to align with rising eco-preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Price range

- 2.2.4 Skin type

- 2.2.5 Consumer group

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code-39269099)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual silicone scrubbers

- 5.3 Electric/sonic silicone scrubbers

- 5.4 Back scrubbers

- 5.5 Foot scrubbers

- 5.6 Glove-style scrubbers

Chapter 6 Market Estimates & Forecast, By Price range, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Skin type, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Sensitive

- 7.3 Oily

- 7.4 Dry

- 7.5 Normal

Chapter 8 Market Estimates & Forecast, By Consumer group, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Male

- 8.3 Female

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Commercial/hotel use

- 9.3.1 Salons & beauty clinics

- 9.3.2 Spas & wellness centers

- 9.3.3 Others(hospitals & elder care facilities, dermatological clinics, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce platforms

- 10.2.2 Brand-owned websites

- 10.3 Offline

- 10.3.1 Supermarkets/hypermarkets

- 10.3.2 Beauty and cosmetic stores

- 10.3.3 Pharmacies and wellness retailers

- 10.3.4 Specialty retail (lifestyle, premium gift shops)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Aquis

- 12.2 Body Benefits

- 12.3 Cleanlogic

- 12.4 Earth Therapeutics

- 12.5 EcoTools

- 12.6 INNERNEED

- 12.7 Pure Enrichment

- 12.8 Salux

- 12.9 Seraphic Skincare

- 12.10 Shower Bouquet

- 12.11 Silicone Scrubs

- 12.12 Sud Scrub

- 12.13 The Bathery

- 12.14 Tooletries

- 12.15 TreeActiv