|

市场调查报告书

商品编码

1782088

麵团基预混料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dough-Based Premixes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

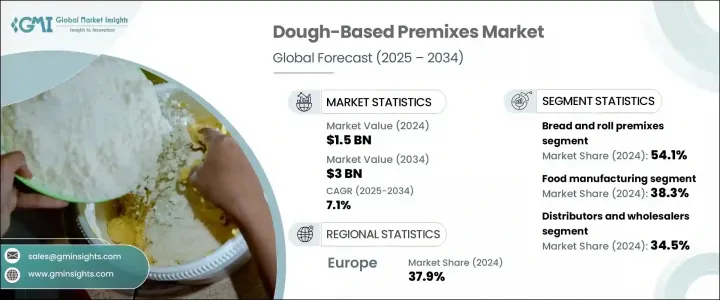

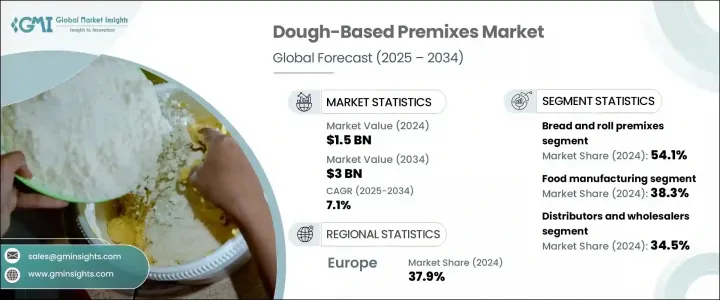

2024 年全球麵团预混料市场价值 15 亿美元,预计年复合成长率为 7.1%,到 2034 年将达到 30 亿美元。麵团预混料是预製的烘焙原料混合物,例如麵粉、膨鬆剂、酵素和乳化剂,旨在简化麵包、麵包捲、糕点、披萨和鬆饼等产品的麵团製备。这些预混料可确保一致性,节省製备时间,并为商业烘焙师和家庭消费者提供便利。随着对高效省时且品质稳定的产品的需求不断增长,市场正在稳步增长。关键机会在于清洁标籤选项、无麸质配方、创新产品发布和强化预混料。餐饮连锁店的扩张、城市化以及新兴经济体家庭烘焙的兴起进一步推动了这一成长。

冷链物流、客製化预混料解决方案以及燕麦基、高蛋白和富含纤维的混合等功能性配料的创新,正在为包装食品、快餐店和零售市场开闢新的发展方向。随着全球健康意识和便利化趋势的不断提升,基于麵团的预混料越来越被视为打造下一代烘焙产品和解决方案的重要组成部分。消费者要求烘焙食品不仅节省时间,还要满足更高的营养和清洁标籤成分标准。这种转变推动了预混料配方的创新,包括无麸质、富含维生素和矿物质以及富含功能性纤维和蛋白质的选项。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 7.1% |

2024年,麵包和捲状预混料占据市场主导地位,占54.1%,价值8.274亿美元。该细分市场的领先地位源于零售和工业烘焙行业对白麵包、全麦麵包、特色麵包和手工麵包预混料的广泛需求。消费者越来越寻求既省时又营养丰富、用途多样的麵包选择,以满足健康趋势和传统偏好。

食品製造业占38.3%的市场份额,2024年产值达5.873亿美元。由于包装和冷冻食品生产商以及自有品牌对一致、可扩展和可定製麵团配方的需求不断增长,该行业占据领先地位。预混料有助于简化生产流程,并确保大型烘焙工厂的一致性。商业烘焙(包括大型工业化、中型和手工烘焙)也受益于即用型预混料的创新。同时,连锁餐厅、独立餐厅和机构厨房等餐饮服务机构也依赖预混料来提高便利性并缩短准备时间。

2024年,欧洲麵团预混料市场占37.9%的市占率。欧洲大陆浓厚的烘焙文化、手工和工业烘焙食品的高消费量,以及乐斯福、焙乐道和欧格等知名烘焙解决方案公司的存在,共同构成了其主导地位。德国、法国和英国等国家是主要驱动力,这主要源自于人们对便利、清洁标籤和健康麵团产品的需求。欧盟制定的严格品质标准以及人们对强化、无麸质和有机烘焙预混料日益增长的兴趣,将继续推动产品创新和市场成长。

阿彻丹尼尔斯米德兰公司 (ADM)、通用磨坊、嘉吉公司、Dawn Foods 和 Puratos Group 等领先企业凭藉其创新能力和广泛的分销网络脱颖而出,在塑造市场格局中发挥关键作用。为了巩固其在麵团预混料市场的立足点,各公司专注于持续的产品创新,开发符合当前健康趋势的清洁标籤、无麸质和强化配方。他们投资研发,以创建可自订的预混料,以满足不同地区的口味和用途。与餐饮服务提供者、零售连锁店和大型烘焙商建立策略合作伙伴关係和合作关係,使这些公司能够扩大业务范围并快速回应市场需求。此外,公司透过采用先进的冷链物流来增强其供应链,以维持产品品质并支援全球分销。行销工作也强调对消费者进行便利性、营养和永续性方面的教育,以提高品牌忠诚度和市场渗透率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 麵包和麵包卷混合物

- 白麵包预拌粉

- 全麦和特殊麵包混合物

- 手工麵包预拌粉

- 蛋糕和鬆饼预拌粉

- 分层蛋糕混合物

- 纸杯蛋糕和鬆饼预拌粉

- 特色蛋糕粉

- 披萨麵团混合物

- 传统披萨麵团

- 薄皮品种

- 无麸质披萨麵团

- 糕点和饼干混合物

- 丹麦麵包和羊角麵包混合物

- 饼干混合物

- 特色糕点预拌粉

- 特种和功能性混合物

- 无麸质配方

- 有机和清洁标籤产品

- 高蛋白和强化混合物

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业烘焙

- 大型工业麵包店

- 中型商业麵包店

- 小型手工麵包店

- 餐饮服务

- 连锁餐厅

- 独立餐厅

- 机构餐饮服务

- 食品製造

- 包装食品生产商

- 冷冻食品製造商

- 自有品牌製造商

- 零售和消费者

- 杂货店和超市连锁店

- 特色食品店

- 线上零售平台

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 製造商到最终用户

- 合约製造

- 分销商和批发商

- 食品服务分销商

- 特殊配料经销商

- 零售通路

- 超市和大卖场

- 特色食品店

- 线上零售平台

- 设备和技术合作伙伴关係

- 综合解决方案提供者

- 技术平台合作伙伴关係

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Dawn Foods

- Lesaffre Group

- Puratos Group

- Kerry Group

- General Mills (North America)

- ADM (Archer Daniels Midland)

- Cargill, Incorporated

- Goodman Fielder Food Service (Asia-Pacific)

- Eurogerm KB

- Ardent Mills

- Lallemand Baking

- FRITSCH Group

- Rheon Automatic Machinery

- Rondo AG

The Global Dough-Based Premixes Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3 billion by 2034. Dough-based premixes are ready-made blends of baking ingredients such as flour, leavening agents, enzymes, and emulsifiers designed to simplify dough preparation for products like bread, rolls, pastries, pizzas, and muffins. These premixes ensure consistency, save preparation time, and provide convenience for both commercial bakers and home consumers. The market is steadily growing as demand rises for products that offer time efficiency and consistent quality. Key opportunities lie in clean-label options, gluten-free formulations, innovative product launches, and fortified mixes. This growth is further fueled by the expansion of foodservice chains, urbanization, and the rising trend of home baking in emerging economies.

Innovations in cold chain logistics, customizable premix solutions, and the inclusion of functional ingredients like oat-based, high-protein, and fiber-enriched blends are creating new avenues in packaged foods, quick-service restaurants, and retail markets. As health consciousness and convenience trends continue to rise worldwide, dough-based premixes are increasingly recognized as vital components in creating the next generation of bakery products and solutions. Consumers are demanding baked goods that not only save time but also meet higher standards for nutrition and clean-label ingredients. This shift is driving innovation in premix formulations to include options that are gluten-free, fortified with vitamins and minerals, and enriched with functional fibers and proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3 Billion |

| CAGR | 7.1% |

The bread and roll premixes segment dominated the market in 2024, holding a 54.1% share and was valued at USD 827.4 million. This segment's leadership stems from the widespread demand for white, whole grain, specialty, and artisanal bread mixes across retail and industrial baking sectors. Consumers increasingly seek bread options that are not only timesaving but also nutritious and versatile enough to meet both health trends and traditional preferences.

The food manufacturing segment held a 38.3% share and generated USD 587.3 million in 2024. This sector leads due to rising demand from packaged and frozen food producers as well as private label brands requiring consistent, scalable, and customizable dough formulas. Premixes contribute to streamlining production processes and ensuring uniformity in large-scale bakery operations. Commercial baking-which includes large industrial, medium-scale, and artisanal bakeries-also benefits from ready-to-use premix innovations. Meanwhile, foodservice establishments such as chain restaurants, standalone eateries, and institutional kitchens rely on premixes to enhance convenience and reduce preparation time.

Europe Dough-Based Premixes Market held a 37.9% share in 2024. The continent's strong baking culture, high consumption of both artisanal and industrial baked goods, and the presence of established bakery solutions companies like Lesaffre, Puratos, and Eurogerm contribute to its dominance. Countries like Germany, France, and the United Kingdom are key drivers, propelled by demand for convenient, clean-label, and health-enhanced dough products. Strict quality standards set by the European Union and rising interest in fortified, gluten-free, and organic bakery premixes continue to fuel product innovation and market growth.

Leading players such as Archer Daniels Midland Company (ADM), General Mills, Cargill Incorporated, Dawn Foods, and Puratos Group stand out for their innovation capabilities and broad distribution networks, playing pivotal roles in shaping the market landscape. To strengthen their foothold in the dough-based premixes market, companies focus on continuous product innovation by developing clean-label, gluten-free, and fortified formulations that align with current health trends. They invest in R&D to create customizable premixes tailored to different regional tastes and applications. Strategic partnerships and collaborations with foodservice providers, retail chains, and large-scale bakers allow these firms to expand their reach and respond quickly to market needs. Additionally, companies enhance their supply chains by adopting advanced cold chain logistics to maintain product quality and support global distribution. Marketing efforts also emphasize consumer education around convenience, nutrition, and sustainability to boost brand loyalty and market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bread and roll mixes

- 5.2.1 White bread mixes

- 5.2.2 Whole grain and specialty bread mixes

- 5.2.3 Artisanal bread mixes

- 5.3 Cake and muffin mixes

- 5.3.1 Layer cake mixes

- 5.3.2 Cupcake and muffin mixes

- 5.3.3 Specialty cake mixes

- 5.4 Pizza dough mixes

- 5.4.1 Traditional pizza dough

- 5.4.2 Thin crust varieties

- 5.4.3 Gluten-free pizza dough

- 5.5 Pastry and cookie mixes

- 5.5.1 Danish and croissant mixes

- 5.5.2 Cookie and biscuit mixes

- 5.5.3 Specialty pastry mixes

- 5.6 Specialty and functional mixes

- 5.6.1 Gluten-free formulations

- 5.6.2 Organic and clean label products

- 5.6.3 High-protein and fortified mixes

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Commercial baking

- 6.2.1 Large-scale industrial bakeries

- 6.2.2 Medium-scale commercial bakeries

- 6.2.3 Small artisanal bakeries

- 6.3 Food service

- 6.3.1 Restaurant chains

- 6.3.2 Independent restaurants

- 6.3.3 Institutional food service

- 6.4 Food manufacturing

- 6.4.1 Packaged food producers

- 6.4.2 Frozen food manufacturers

- 6.4.3 Private label manufacturers

- 6.5 Retail and consumer

- 6.5.1 Grocery and supermarket chains

- 6.5.2 Specialty food stores

- 6.5.3 Online retail platforms

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.2.1 Manufacturer to end-user

- 7.2.2 Contract manufacturing

- 7.3 Distributors and wholesalers

- 7.3.1 Food service distributors

- 7.3.2 Specialty ingredient distributors

- 7.4 Retail channels

- 7.4.1 Supermarkets and hypermarkets

- 7.4.2 Specialty food stores

- 7.4.3 Online retail platforms

- 7.5 Equipment and technology partnerships

- 7.5.1 Integrated solutions providers

- 7.5.2 Technology platform partnerships

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 1.1 Key trends

- 1.2 North America

- 1.2.1 U.S.

- 1.2.2 Canada

- 1.3 Europe

- 1.3.1 Germany

- 1.3.2 UK

- 1.3.3 France

- 1.3.4 Spain

- 1.3.5 Italy

- 1.3.6 Netherlands

- 1.3.7 Rest of Europe

- 1.4 Asia Pacific

- 1.4.1 China

- 1.4.2 India

- 1.4.3 Japan

- 1.4.4 Australia

- 1.4.5 South Korea

- 1.4.6 Rest of Asia Pacific

- 1.5 Latin America

- 1.5.1 Brazil

- 1.5.2 Mexico

- 1.5.3 Argentina

- 1.5.4 Rest of Latin America

- 1.6 Middle East and Africa

- 1.6.1 Saudi Arabia

- 1.6.2 South Africa

- 1.6.3 UAE

- 1.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Dawn Foods

- 9.2 Lesaffre Group

- 9.3 Puratos Group

- 9.4 Kerry Group

- 9.5 General Mills (North America)

- 9.6 ADM (Archer Daniels Midland)

- 9.7 Cargill, Incorporated

- 9.8 Goodman Fielder Food Service (Asia-Pacific)

- 9.9 Eurogerm KB

- 9.10 Ardent Mills

- 9.11 Lallemand Baking

- 9.12 FRITSCH Group

- 9.13 Rheon Automatic Machinery

- 9.14 Rondo AG