|

市场调查报告书

商品编码

1782096

麵糊预混料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Batter-Based Premixes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

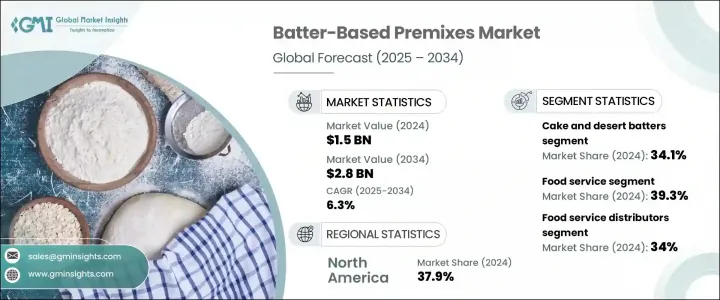

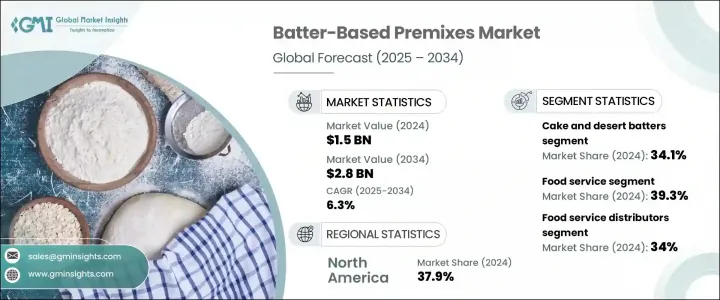

2024 年全球麵糊预混料市场价值为 15 亿美元,预计到 2034 年将以 6.3% 的复合年增长率增长至 28 亿美元。麵糊预混料是方便、即用的干性或半干性混合物,包含麵粉、淀粉、膨鬆剂、调味料和功能性添加剂等成分。这些混合物在油炸或烘烤前应用于肉类、海鲜、蔬菜和烘焙食品等各种食品,以确保所有批次的口味、质地和外观一致。由于其节省时间的优势和标准化的质量,它们广泛应用于餐饮服务、冷冻食品生产和家庭烹饪。消费者对方便食品的需求不断增长,以及快餐店 (QSR) 在城市和半城市地区的扩张,推动了市场稳步成长。

随着清洁标籤、无过敏原、植物性和功能性涂层越来越受到关注,以满足注重健康的消费者的需求,巨大的成长机会随之而来。无麸质和纯素麵糊的创新,以及人们对韩式、地中海式和天妇罗式油炸食品等民族美食日益增长的兴趣,正在扩大各地区的产品种类。冷冻涂层食品在零售业的日益流行,以及自有品牌和合约製造在发展中市场的兴起,为行业带来了进一步的成长途径和合作伙伴关係。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 6.3% |

2024年,蛋糕和甜点麵糊市场占据主导地位,市占率达34.1%,价值达5.214亿美元。此细分市场包括漏斗蛋糕、甜甜圈和特色甜点等产品的预拌粉,这得益于消费者对便利、即食甜点的强烈需求。由于其易用性、稳定的品质和创新的口味,该细分市场在餐饮服务、烘焙连锁店和零售业广受欢迎。此外,低糖和无过敏原等功能性甜点麵糊将继续提升该细分市场在传统市场和健康市场中的相关性。

餐饮服务领域在2024年占据39.3%的市场份额,估值达6.014亿美元。该领域占据领先地位,因为麵糊预混料在快餐店、休閒餐厅和机构餐饮服务中广泛使用,而稳定的品质、速度和口感对于油炸和裹粉类菜餚至关重要。消费者对油炸开胃菜、鸡肉菜餚、海鲜和国际风味的日益增长的喜爱推动了这一需求。餐饮服务提供者依靠专用麵糊来实现酥脆口感、保留风味,并在大量生产中保持高效。

2024年,北美麵糊预混料市场占据37.9%的市占率。该地区的领先地位得益于密集的快餐店、消费者对即食食品和加工食品的强劲需求,以及发达的餐饮服务和零售分销基础设施。 House-Autry Mills、Bowman Ingredients、Newly Weds Foods、Kerry Group PLC 和 Blendex Company 等大型公司在该地区占有重要地位,推动产品创新并扩大市场覆盖范围。持续的研发工作专注于清洁标籤、无过敏原和健康导向的麵糊配方,以满足消费者日益增长的透明度和便利性需求。

为了巩固市场地位,麵糊类预混料行业的公司高度重视产品创新,开发清洁标籤、无过敏原和植物性配方,以满足不断变化的消费者偏好。他们投资研发,客製化符合不同烹饪风格和地理口味的预混料。与餐饮连锁店、快餐店和零售店建立策略合作伙伴关係,有助于扩大分销管道并提升品牌知名度。此外,公司透过精简供应链来提高营运效率,并投资于强调便利性、健康益处和品质的行销活动,从而增强消费者忠诚度并加速市场渗透。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 煎饼和华夫饼预拌粉

- 传统煎饼粉

- 比利时华夫饼预拌粉

- 特色和风味变体

- 天妇罗和亚洲麵糊

- 传统天妇罗麵糊

- 酥脆的麵糊

- 亚洲特色应用

- 鱼和海鲜麵糊

- 炸鱼薯条麵糊

- 海鲜涂料混合物

- 预浸麵糊系统

- 蛋糕和甜点麵糊

- 漏斗蛋糕混合物

- 甜甜圈麵糊

- 特色甜点应用

- 特种功能性麵糊

- 无麸质配方

- 有机和清洁标籤产品

- 植物基和替代蛋白麵糊

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 餐饮服务

- 速食店

- 休閒餐厅

- 机构餐饮服务

- 商业食品製造

- 冷冻食品生产商

- 休閒食品製造商

- 海鲜加工商

- 零售和消费者

- 杂货店和超市连锁店

- 特色食品店

- 线上零售平台

- 工业和合约製造

- 自有品牌製造商

- 联合包装商和合约生产商

- 出口型製造商

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 製造商到食品服务

- 合约製造协议

- 食品服务分销商

- 广泛经销商

- 特色食品服务供应商

- 零售通路

- 超市和大卖场

- 特色食品店

- 线上零售平台

- 产业分布

- 原料分销商

- 设备及解决方案提供商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Kerry Group PLC

- Newly Weds

- Bowman Ingredients

- Breading & Coating Ltd.

- House-Autry mills Inc.

- BRATA Produktions

- Shimakyu

- Thai Nisshin Technomic Co., Ltd

- Arcadia Foods

- Blendex Company

The Global Batter-Based Premixes Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.8 billion by 2034. Batter-based premixes are convenient, ready-to-use dry or semi-dry blends that include ingredients such as flour, starches, leavening agents, seasonings, and functional additives. These mixes are applied to various food items like meat, seafood, vegetables, and baked goods before frying or baking to ensure consistent taste, texture, and appearance across all batches. Their widespread use spans foodservice, frozen food production, and home cooking due to the time-saving benefits and standardized quality they provide. The market's steady growth is fueled by rising consumer demand for convenience foods and the expansion of quick-service restaurants (QSRs) in urban and semi-urban regions.

Significant growth opportunities exist with increased focus on clean-label, allergen-free, plant-based, and functional coatings catering to health-conscious consumers. Innovations in gluten-free and vegan batters, along with growing interest in ethnic cuisines such as Korean, Mediterranean, and tempura-style fried foods, are broadening product variety across regions. The rising popularity of frozen coated foods in retail and the emergence of private label and contract manufacturing in developing markets present further growth avenues and partnerships.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 6.3% |

The cake and dessert batters segment led the market in 2024, holding 34.1% share with a value of USD 521.4 million. This segment includes mixes for products such as funnel cakes, donuts, and specialty desserts, driven by strong consumer demand for convenient, ready-to-cook sweet treats. Its popularity spans foodservice, bakery chains, and retail sectors, supported by ease of use, consistent quality, and innovative flavors. Additionally, functional dessert batters like low-sugar and allergen-free varieties continue to enhance the segment's relevance in both traditional and health-focused markets.

The foodservice segment has a 39.3% share in 2024, with a valuation of USD 601.4 million. This sector leads due to extensive use of batter premixes in QSRs, casual dining, and institutional foodservice, where consistent quality, speed, and texture are essential for fried and coated menu items. Growing consumer preference for fried appetizers, chicken dishes, seafood, and international flavors drives this demand. Foodservice providers rely on specialized batters to achieve crispiness, preserve flavor, and maintain efficiency in high-volume production.

North America Batter-Based Premixes Market held a 37.9% share in 2024. The region's leadership is supported by a dense presence of QSRs, strong consumer demand for ready-to-cook and processed foods, and well-developed foodservice and retail distribution infrastructures. Major companies such as House-Autry Mills, Bowman Ingredients, Newly Weds Foods, Kerry Group PLC, and Blendex Company have a significant presence here, driving product innovation and expanding market reach. Continuous R&D efforts focusing on clean-label, allergen-free, and health-oriented batter formulations align with growing consumer demand for transparency and convenience.

To strengthen their market position, companies in the batter-based premixes sector focus heavily on product innovation, developing clean-label, allergen-free, and plant-based formulations that resonate with evolving consumer preferences. They invest in research and development to customize premixes that cater to diverse culinary styles and regional tastes. Strategic partnerships with foodservice chains, quick-service restaurants, and retail outlets help expand distribution and boost brand visibility. Additionally, companies enhance operational efficiency through streamlined supply chains and invest in marketing campaigns that emphasize convenience, health benefits, and quality, building stronger consumer loyalty and accelerating market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pancake and waffle mixes

- 5.2.1 Traditional pancake mixes

- 5.2.2 Belgian waffle mixes

- 5.2.3 Specialty and flavoured variants

- 5.3 Tempura and asian batters

- 5.3.1 Traditional tempura batters

- 5.3.2 Crispy coating batters

- 5.3.3 Specialty asian applications

- 5.4 Fish and seafood batters

- 5.4.1 Fish and chips batters

- 5.4.2 Seafood coating mixes

- 5.4.3 Pre-dip batter systems

- 5.5 Cake and dessert batters

- 5.5.1 Funnel cake mixes

- 5.5.2 Donut batters

- 5.5.3 Specialty dessert applications

- 5.6 Specialty and functional batters

- 5.6.1 Gluten-free formulations

- 5.6.2 Organic and clean label products

- 5.6.3 Plant-based and alternative protein batters

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food service

- 6.2.1 Quick service restaurants

- 6.2.2 Casual dining restaurants

- 6.2.3 Institutional food service

- 6.3 Commercial food manufacturing

- 6.3.1 Frozen food producers

- 6.3.2 Snack food manufacturers

- 6.3.3 Seafood processors

- 6.4 Retail and consumer

- 6.4.1 Grocery and supermarket chains

- 6.4.2 Specialty food stores

- 6.4.3 Online retail platforms

- 6.5 Industrial and contract manufacturing

- 6.5.1 Private label manufacturers

- 6.5.2 Co-packers and contract producers

- 6.5.3 Export-oriented manufacturers

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.2.1 Manufacturer to food service

- 7.2.2 Contract manufacturing agreements

- 7.3 Food service distributors

- 7.3.1 Broad-line distributors

- 7.3.2 Specialty food service suppliers

- 7.4 Retail channels

- 7.4.1 Supermarkets and hypermarkets

- 7.4.2 Specialty food stores

- 7.4.3 Online retail platforms

- 7.5 Industrial distribution

- 7.5.1 Ingredient distributors

- 7.5.2 Equipment and solution providers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 1.1 Key trends

- 1.2 North America

- 1.2.1 U.S.

- 1.2.2 Canada

- 1.3 Europe

- 1.3.1 Germany

- 1.3.2 UK

- 1.3.3 France

- 1.3.4 Spain

- 1.3.5 Italy

- 1.3.6 Netherlands

- 1.3.7 Rest of Europe

- 1.4 Asia Pacific

- 1.4.1 China

- 1.4.2 India

- 1.4.3 Japan

- 1.4.4 Australia

- 1.4.5 South Korea

- 1.4.6 Rest of Asia Pacific

- 1.5 Latin America

- 1.5.1 Brazil

- 1.5.2 Mexico

- 1.5.3 Argentina

- 1.5.4 Rest of Latin America

- 1.6 Middle East and Africa

- 1.6.1 Saudi Arabia

- 1.6.2 South Africa

- 1.6.3 UAE

- 1.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Kerry Group PLC

- 9.2 Newly Weds

- 9.3 Bowman Ingredients

- 9.4 Breading & Coating Ltd.

- 9.5 House-Autry mills Inc.

- 9.6 BRATA Produktions

- 9.7 Shimakyu

- 9.8 Thai Nisshin Technomic Co., Ltd

- 9.9 Arcadia Foods

- 9.10 Blendex Company