|

市场调查报告书

商品编码

1782152

疫苗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

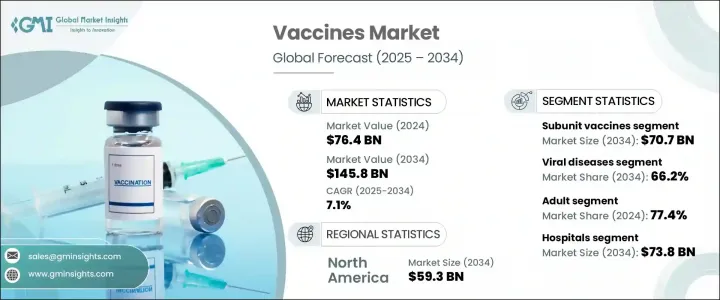

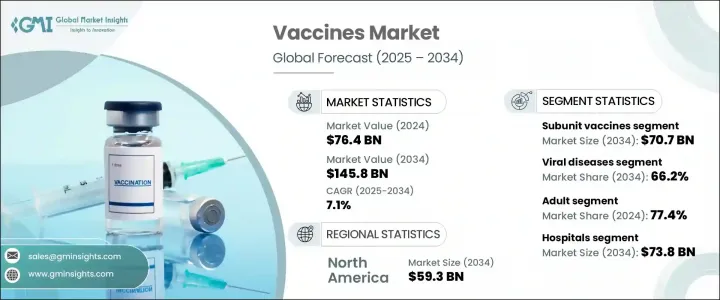

2024年,全球疫苗市场规模达764亿美元,预计2034年将以7.1%的复合年增长率成长,达到1,458亿美元。这一增长主要得益于肝炎、季节性流感和新型病毒株等传染病的不断涌现。由于这些疾病持续威胁公共卫生,各国政府和卫生组织正在加强免疫接种力度,以降低感染率。公共支持性措施、发展中地区医疗预算的增加以及疫苗研发的进步,持续为疫苗市场扩张创造了有利的环境。此外,全球联合疫苗的兴起(单剂即可获得针对多种疾病的免疫力),正在加速疫苗创新,简化免疫接种方案。

针对癌症、慢性感染和自体免疫疾病等复杂疾病的新一代疫苗的开发正在拓展市场的治疗范围。日益增长的老龄化人口(尤其是在已开发国家)仍然极易受到感染,这进一步刺激了全球疫苗需求。私人企业与公共卫生机构之间的紧密合作,加上mRNA和重组蛋白平台等不断发展的技术,正在提升疫苗的效力、递送和可及性。这些因素共同增强了市场的长期发展动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 764亿美元 |

| 预测值 | 1458亿美元 |

| 复合年增长率 | 7.1% |

2024年,亚单位疫苗市场规模为376亿美元,预计2034年将达到707亿美元,复合年增长率为6.9%。此类疫苗包括重组疫苗、多醣体疫苗和结合疫苗,每种疫苗都能在不使用完整病原体的情况下增强免疫原性。它们能够靶向致病菌中的特定蛋白质,从而提高安全性并减少不必要的免疫反应。由于亚单位疫苗具有T细胞依赖性免疫活化作用,能够促进更强的记忆反应、持久保护,并且适合婴幼儿等弱势群体,因此该领域持续受到关注。

病毒性疾病领域在2024年占据66.2%的市场份额,预计到2034年仍将保持强劲成长。此类别包括肝炎、流感、HPV、轮状病毒、带状疱疹、麻疹、腮腺炎、德国麻疹、腮腺炎和德国麻疹疫苗(MMR)、新冠肺炎(COVID-19)以及其他病毒的疫苗。随着认知和预防工作的不断提升,免疫接种计画在全球范围内规模化,提高了覆盖率和可及性。 mRNA和亚单位技术等生产平台的最新进展增强了病毒爆发期间的快速反应能力,支持了全球强有力的公共卫生策略,并提高了各年龄层的接种率。

北美疫苗市场在2024年产值为323亿美元,预计2034年将达到593亿美元,复合年增长率为6.6%。该地区的领先地位源于其完善的医疗基础设施、持续的公共免疫接种运动以及对预防保健的大量投入。持续的政策层面措施、高水准的认知度以及对HPV和其他病毒威胁疫苗的强劲需求,持续推动疫苗的销售。美国已广泛实施学校免疫接种计画和成人免疫接种活动,提高了各人口的可近性和依从性。

为全球疫苗市场竞争格局做出贡献的关键製造商包括赛诺菲、印度血清研究所、Valneva、CSL Seqirus、Emergent Biosolutions、辉瑞、Moderna、Novavax、葛兰素史克 (GSK)、阿斯特捷利康、Biofarma、科兴生物、Bharat Biotechharm、Haffkuine Bio-Penutical、VBIkacc.疫苗产业的领先公司正透过持续的研发投入,积极推进其产品线,尤其是在 mRNA、重组亚单位和基于载体的製剂等新型平台方面。

与生物技术公司、学术机构和政府卫生机构的合作与合资正在加速下一代疫苗的开发和监管批准。各公司也在全球扩大生产能力,以确保在疫情爆发期间快速实现规模化,并有效率地服务于服务不足的市场。策略性产品多元化,包括联合疫苗和治疗性疫苗的开发,正在帮助各公司应对更广泛的疾病负担。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 传染病发生率上升

- 扩大免疫覆盖计划

- 发展中经济体儿科人口不断增加

- 疫苗配方和生产效率的进步

- 产业陷阱与挑战

- 严格的监管审批流程

- 疫苗储存和运输成本高

- 市场机会

- 扩大疫苗分发的公私部门合作伙伴关係

- 联合疫苗日益受到关注

- 成长动力

- 成长潜力分析

- 技术格局

- 管道分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 扩张计划

第五章:市场估计与预测:按疫苗类型,2021-2034

- 主要趋势

- 亚单位疫苗

- 重组疫苗

- 结合疫苗

- 多醣体疫苗

- 类毒素疫苗

- 灭活疫苗

- 减毒活疫苗

- 其他疫苗类型

第六章:市场估计与预测:依疾病类型,2021-2034

- 主要趋势

- 病毒性疾病

- 肝炎

- 流感

- HPV

- 麻疹、腮腺炎和德国麻疹 (MMR)

- 轮状病毒

- 带状疱疹

- 新冠肺炎

- 其他病毒性疾病

- 细菌性疾病

- 脑膜炎球菌疾病

- 肺炎球菌疾病

- DPT

- 其他细菌性疾病

第七章:市场估计与预测:依年龄组,2021-2034

- 主要趋势

- 儿科

- 成人

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 医院

- 民众

- 私人的

- 专科诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AstraZeneca

- Bharat Biotech

- Biofarma

- CSL Seqirus

- Emergent Biosolutions

- GlaxoSmithKline (GSK)

- Haffkine Bio-Pharmaceutical

- Merck

- Moderna

- Novavax

- Pfizer

- Sanofi

- Serum Institute of India

- Sinovac

- Valneva

- VBI Vaccines

The Global Vaccines Market was valued at USD 76.4 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 145.8 billion by 2034. This growth is largely propelled by the continuous emergence of infectious diseases such as hepatitis, seasonal influenza, and novel virus strains. As these diseases remain a constant threat to public health, governments and health organizations are ramping up immunization efforts to reduce infection rates. Supportive public initiatives, increasing healthcare budgets in developing regions, and advancements in vaccine R&D continue to shape a favorable environment for expansion. Additionally, the global rise in combination vaccines, which deliver immunity for multiple diseases through a single dose, is accelerating innovation and simplifying immunization protocols.

Development of next-generation vaccines targeting complex conditions such as cancers, chronic infections, and autoimmune diseases is expanding the market's therapeutic scope. A growing aging population, especially across developed nations, remains highly susceptible to infections, further fueling global vaccine demand. Strong collaborations between private firms and public health bodies, coupled with evolving technologies such as mRNA and recombinant protein platforms, are enhancing vaccine efficacy, delivery, and accessibility. Collectively, these factors are reinforcing long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.4 Billion |

| Forecast Value | $145.8 Billion |

| CAGR | 7.1% |

In 2024, subunit vaccines segment was valued at USD 37.6 billion and is estimated to reach USD 70.7 billion by 2034, growing at a CAGR of 6.9%. These vaccines include recombinant, polysaccharide, and conjugate types, each contributing to heightened immunogenicity without using whole pathogens. Their ability to target specific proteins from disease-causing organisms improves safety profiles and reduces unwanted immune responses. The segment continues to gain traction due to its T cell-dependent immune activation, which promotes stronger memory responses, long-lasting protection, and suitability for vulnerable populations like infants and young children.

The viral diseases segment held 66.2% share in 2024 and is expected to maintain strong growth through 2034. The category comprises vaccines for hepatitis, influenza, HPV, rotavirus, herpes zoster, MMR, COVID-19, and other viruses. As awareness and prevention efforts have expanded, immunization programs have scaled globally, improving coverage and access. Recent advancements in manufacturing platforms like mRNA and subunit technologies have enhanced rapid-response capabilities during viral outbreaks, supporting robust public health strategies worldwide and increasing uptake across all age groups.

North America Vaccines Market generated USD 32.3 billion in 2024 and is expected to reach USD 59.3 billion by 2034 at a CAGR of 6.6%. The region's leadership stems from its comprehensive healthcare infrastructure, ongoing public immunization campaigns, and significant investment in preventive care. Consistent policy-level initiatives, high levels of awareness, and strong demand for vaccines targeting HPV and other viral threats continue to drive sales. The U.S. has implemented widespread school-based programs and adult immunization drives, enhancing access and compliance across population segments.

Key manufacturers contributing to the competitive dynamics of the Global Vaccines Market include Sanofi, Serum Institute of India, Valneva, CSL Seqirus, Emergent Biosolutions, Pfizer, Moderna, Novavax, GlaxoSmithKline (GSK), AstraZeneca, Biofarma, Sinovac, Bharat Biotech, Haffkine Bio-Pharmaceutical, VBI Vaccines, and Merck. Leading companies in the vaccines sector are actively advancing their pipelines through sustained investments in R&D, particularly in novel platforms like mRNA, recombinant subunits, and vector-based formulations.

Partnerships and joint ventures with biotech firms, academic institutions, and government health agencies are helping expedite development and regulatory clearance for next-gen vaccines. Firms are also expanding production capabilities globally to ensure rapid scalability during outbreaks and to serve underserved markets efficiently. Strategic product diversification, including development of combination and therapeutic vaccines, is helping companies address broader disease burdens.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vaccine type

- 2.2.3 Disease type

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of infectious disease

- 3.2.1.2 Growing immunization coverage programs

- 3.2.1.3 Increasing pediatric population in developing economies

- 3.2.1.4 Advancements in vaccine formulation and production efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval processes

- 3.2.2.2 High cost of storage and transportation of vaccine

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding public-private partnerships for vaccine distribution

- 3.2.3.2 Growing focus on combination vaccines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Pipeline analysis

- 3.6 Regulatory landscape

- 3.7 Future market trends

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Subunit vaccines

- 5.2.1 Recombinant vaccines

- 5.2.2 Conjugate vaccines

- 5.2.3 Polysaccharide vaccines

- 5.3 Toxoid vaccines

- 5.4 Inactivated vaccines

- 5.5 Live attenuated vaccines

- 5.6 Other vaccine types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Viral diseases

- 6.2.1 Hepatitis

- 6.2.2 Influenza

- 6.2.3 HPV

- 6.2.4 Measles, mumps, and rubella (MMR)

- 6.2.5 Rotavirus

- 6.2.6 Herpes zoster

- 6.2.7 Covid-19

- 6.2.8 Other viral diseases

- 6.3 Bacterial diseases

- 6.3.1 Meningococcal diseases

- 6.3.2 Pneumococcal diseases

- 6.3.3 DPT

- 6.3.4 Other bacterial diseases

Chapter 7 Market Estimates and Forecast, By Age Group, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adult

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.2.1 Public

- 8.2.2 Private

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Bharat Biotech

- 10.3 Biofarma

- 10.4 CSL Seqirus

- 10.5 Emergent Biosolutions

- 10.6 GlaxoSmithKline (GSK)

- 10.7 Haffkine Bio-Pharmaceutical

- 10.8 Merck

- 10.9 Moderna

- 10.10 Novavax

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Serum Institute of India

- 10.14 Sinovac

- 10.15 Valneva

- 10.16 VBI Vaccines