|

市场调查报告书

商品编码

1797714

食品纤维市场机会、成长动力、产业趋势分析及2025-2034年预测Food Fibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

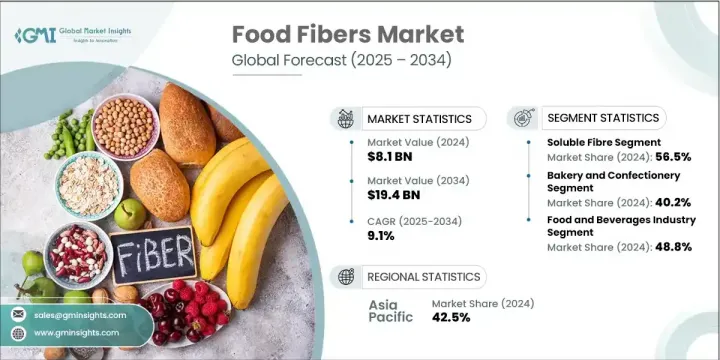

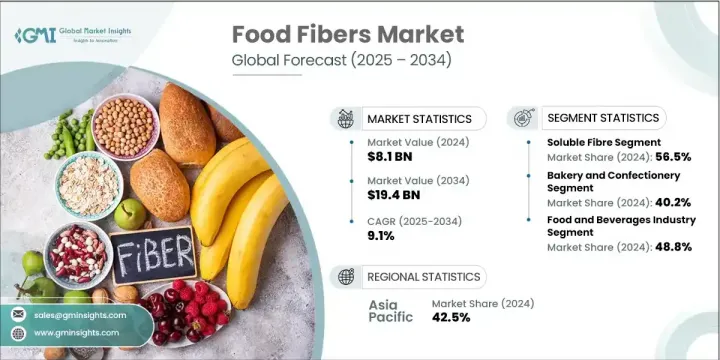

2024年,全球食品纤维市场规模达81亿美元,预计2034年将以9.1%的复合年增长率成长,达到194亿美元。食品纤维,俗称膳食纤维,是一种不可消化的植物性碳水化合物,具有多种健康益处,尤其有利于消化健康、调节血糖和控制食慾。这些纤维天然存在于水果、豆类、蔬菜和谷物中,并越来越多地被添加到各种消费品中,例如乳製品替代品、强化饮料和烘焙产品。随着全球消费者偏好转向功能性和健康饮食,食品纤维市场持续成长。

植物性生活方式的兴起、肠道菌丛健康意识的增强,以及鼓励强化纤维标籤和配方的扶持性政策,进一步放大了这一趋势。纤维提取和添加领域的创新技术(例如微胶囊化和高效挤压)为更先进、更具吸引力的食品产品打开了大门。製造商正在策略性地顺应这些发展趋势,以满足对天然、富含益生元、清洁标籤解决方案日益增长的需求。在消费者生活方式和营养意识不断演变的推动下,功能性纤维在全球范围内的快速普及,为该行业的强劲增长铺平了道路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 81亿美元 |

| 预测值 | 194亿美元 |

| 复合年增长率 | 9.1% |

2024年,可溶性纤维占56.5%的市场份额,贡献了46亿美元的市场价值。这类纤维包括菊粉、树胶和果胶,因其能够滋养有益微生物,从而促进肠道健康,被广泛应用于食品和饮料中。它们也广泛应用于植物奶和发酵饮料中,能够提升口感和营养密度。在食品生产过程中,可溶性纤维也能改善产品的稳定性和口感,尤其是在低糖或无乳製品中。这些纤维兼具双重功效,在食品业的各种配方中既充当功能性营养素,又可作为感官增强剂。它们在日常饮食中的日益普及,反映出消费者对消化和代谢健康的关注正在改变食品生产的配方策略。

烘焙和糖果业占据40.2%的市场份额,到2024年将达到33亿美元。由于膳食纤维在烘焙点心、全麦麵包和谷物等食品中的应用日益广泛,该领域仍然是食品纤维的主要应用领域。烘焙食品中的膳食纤维可以改善口感,增加饱足感,并符合避免使用人工添加剂的清洁标籤运动。糖果製造商也加入功能性纤维,以降低糖分和卡路里含量,同时又不影响口感和口感。高纤维零食和全麦烘焙产品需求的激增持续推动创新,尤其是在亚太和北美等消费者对健康产品需求激增的地区。

2024年,亚太地区食品纤维市场占有42.5%的份额。该地区的领先地位得益于消费者对消化健康的认知不断提升、中产阶级人口不断壮大以及功能性食品和饮料类别的快速增长。日本、中国、韩国和印度等国家正经历饮食习惯的转变,转向富含纤维、以植物为主的食物。健康政策和国家健康倡议的持续支持进一步推动了成长。随着植物基和富含纤维的产品越来越受欢迎,尤其是在烘焙食品和营养保健品等类别中,线上商务和数位零售基础设施在改善亚太地区不同人群的产品取得方面发挥着重要作用。

塑造全球食品纤维市场的关键公司包括阿彻丹尼尔斯米德兰公司 (ADM)、嘉吉公司、罗盖特公司、泰特莱尔公司和宜瑞安公司。为了保持竞争力并扩大市场份额,食品纤维领域的领先公司正着力于纤维提取和配方的创新。他们投入大量资金进行研发,以开发功能性强、易于整合且感官体验更佳的新型共混物。企业也透过负责任地采购植物材料和提高加工效率来优先考虑永续性。与食品科技公司和专注于营养的新创公司的合作,可以进入新的市场和获得新的技术。此外,各大品牌正在努力扩展其清洁标籤产品,以满足不断变化的消费者期望。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依纤维类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依纤维类型,2021 - 2034 年

- 主要趋势

- 可溶性纤维

- 菊粉和低聚果糖部分

- 果胶和树胶部门

- β-葡聚醣与特殊纤维

- 不溶性纤维

- 纤维素和改性纤维素

- 麦麸和谷物纤维

- 水果和蔬菜纤维

- 功能性益生元纤维

- 抗性淀粉技术

- 低聚半乳糖 (GOS) 和低聚果糖 (FOS)

- 新型和新兴纤维

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 烘焙和糖果

- 麵包和烘焙食品

- 早餐谷物和零食

- 糖果和甜点

- 饮料

- 功能性饮料和运动饮料

- 乳製品和植物替代品

- 果汁和强化水

- 乳製品和乳製品替代品

- 优格和发酵製品

- 乳酪及加工乳製品

- 植物基乳製品替代品

- 膳食补充剂

- 粉末和胶囊形式

- 益生元和肠道健康补充剂

- 体重管理和代谢健康

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料製造

- 大型食品生产商

- 区域和特色食品公司

- 技术和设备供应商

- 膳食补充剂行业

- 补充剂製造商和品牌

- 合约製造商和自有品牌

- 分销和零售通路

- 功能性食品及营养保健品

- 功能性食品开发

- 医疗食品和临床营养

- 运动和运动营养

- 动物饲料和宠物食品

- 优质宠物食品应用

- 畜牧业及水产养殖业

- 市场开发与创新

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Freres SA

- Kerry Group PLC

- International Flavors & Fragrances Inc

- J Rettenmaier & Sohne GmbH + Co KG

- Nexira Inc

The Global Food Fibers Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 19.4 billion by 2034. Food fibers, commonly known as dietary fibers, are indigestible plant-based carbohydrates that offer a variety of health benefits, particularly in digestive wellness, blood sugar regulation, and appetite control. These fibers are naturally present in fruits, legumes, vegetables, and grains, and are increasingly included in a wide range of consumables like dairy alternatives, fortified drinks, and bakery products. As global consumer preferences shift toward functional and health-forward eating, the market continues to gain momentum.

The trend is further amplified by the push for plant-based living, growing awareness of gut microbiome health, and supportive policies encouraging fiber-enhanced labeling and formulation. New innovations in fiber extraction and incorporation-such as microencapsulation and high-efficiency extrusion-are opening the door for more advanced and appealing food products. Manufacturers are strategically aligning with these developments to meet the growing demand for natural, prebiotic-rich, clean-label solutions. The rapid adoption of functional fibers globally, backed by evolving consumer lifestyles and nutritional awareness, is paving the way for robust growth in this industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 9.1% |

The soluble fibers held a 56.5% share in 2024, contributing USD 4.6 billion. These types of fibers, which include inulin, gums, and pectins, are widely used in foods and beverages because of their ability to support gut health by feeding beneficial microbes. Their use extends to plant-based milks and fermented beverages, where they enhance both texture and nutritional density. In the food manufacturing process, soluble fibers also improve product stability and mouthfeel, especially in reduced-sugar or dairy-free options. These fibers serve dual purposes, acting as both functional nutrients and sensory enhancers in various formulations across the food sector. Their rising inclusion in daily diets reflects how consumer interest in digestive and metabolic health is transforming formulation strategies within food production.

The bakery and confectionery segment held a 40.2% share, reaching USD 3.3 billion in 2024. This segment remains a dominant application area for food fibers, thanks to their growing use in items like baked snacks, whole grain breads, and cereals. Dietary fibers in baked goods improve texture, increase satiety, and align with the clean-label movement that avoids artificial additives. Confectionery manufacturers also integrate functional fibers to lower sugar and calorie content without compromising taste or texture. The surge in demand for high-fiber snack options and whole-grain bakery products continues to push innovation, especially across regions like Asia-Pacific and North America where consumer demand for wellness-oriented products is soaring.

Asia Pacific Food Fibers Market held a 42.5% share in 2024. This region's leadership is driven by increasing consumer education on digestive health, a swelling middle-class population, and rapid growth in functional food and beverage categories. Countries such as Japan, China, South Korea, and India are witnessing a transformation in dietary habits toward more fiber-rich, plant-centric foods. Ongoing support from health-conscious policies and national wellness initiatives is further driving growth. As plant-based and fiber-enhanced products gain popularity, especially in categories like baked goods and nutraceuticals, online commerce and digital retail infrastructure are playing a significant role in improving product access across diverse population groups in Asia Pacific.

Key companies shaping this Global Food Fibers Market include Archer Daniels Midland Company (ADM), Cargill, Incorporated, Roquette Freres SA, Tate & Lyle PLC, and Ingredion Incorporated. To stay competitive and expand their market share, leading companies in the food fibers sector are emphasizing innovation in fiber extraction and formulation. They are heavily investing in research to develop novel blends that are functional, easy to integrate, and have enhanced sensory properties. Businesses are also prioritizing sustainability by sourcing plant materials responsibly and improving processing efficiencies. Collaborations with food tech firms and nutrition-focused startups allow access to new markets and technologies. Moreover, brands are working to expand their clean-label offerings to align with evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fiber type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By fiber type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Fiber Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soluble fibres

- 5.2.1 Inulin and oligofructose segment

- 5.2.2 Pectin and gums segment

- 5.2.3 Beta-glucan and specialty fibres

- 5.3 Insoluble fibres

- 5.3.1 Cellulose and modified cellulose

- 5.3.2 Wheat bran and cereal fibres

- 5.3.3 Fruit and vegetable fibres

- 5.4 Functional and prebiotic fibres

- 5.4.1 Resistant starch technologies

- 5.4.2 Galacto-oligosaccharides (GOS) and fructo-oligosaccharides (FOS)

- 5.4.3 Novel and emerging fibres

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bakery and confectionery

- 6.2.1 Bread and baked goods

- 6.2.2 Breakfast cereals and snack foods

- 6.2.3 Confectionery and sweet goods

- 6.3 Beverages

- 6.3.1 Functional and sports beverages

- 6.3.2 Dairy and plant-based alternatives

- 6.3.3 Juice and enhanced water

- 6.4 Dairy and dairy alternatives

- 6.4.1 Yogurt and fermented products

- 6.4.2 Cheese and processed dairy

- 6.4.3 Plant-based dairy alternatives

- 6.5 Dietary supplements

- 6.5.1 Powder and capsule formats

- 6.5.2 Prebiotic and gut health supplements

- 6.5.3 Weight management and metabolic health

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverage manufacturing

- 7.2.1 Large-scale food manufacturers

- 7.2.2 Regional and specialty food companies

- 7.2.3 Technology and equipment suppliers

- 7.3 Dietary supplement industry

- 7.3.1 Supplement manufacturers and brands

- 7.3.2 Contract manufacturers and private label

- 7.3.3 Distribution and retail channels

- 7.4 Functional foods and nutraceuticals

- 7.4.1 Functional food development

- 7.4.2 Medical foods and clinical nutrition

- 7.4.3 Sports and performance nutrition

- 7.5 Animal feed and pet food

- 7.5.1 Premium pet food applications

- 7.5.2 Livestock and aquaculture

- 7.5.3 Market development and innovation

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill, Incorporated

- 9.2 Tate & Lyle PLC

- 9.3 Archer Daniels Midland Company

- 9.4 Ingredion Incorporated

- 9.5 Roquette Freres SA

- 9.6 Kerry Group PLC

- 9.7 International Flavors & Fragrances Inc

- 9.8 J Rettenmaier & Sohne GmbH + Co KG

- 9.9 Nexira Inc