|

市场调查报告书

商品编码

1797813

4D 成像雷达市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测4D Imaging Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

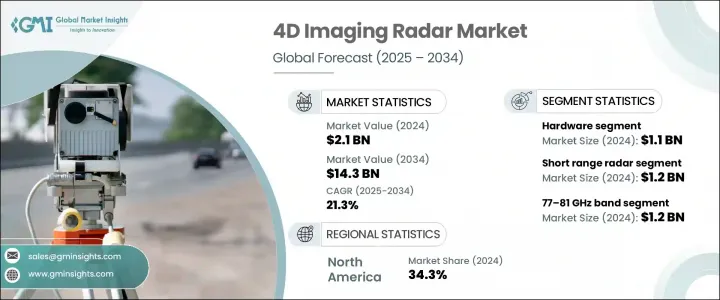

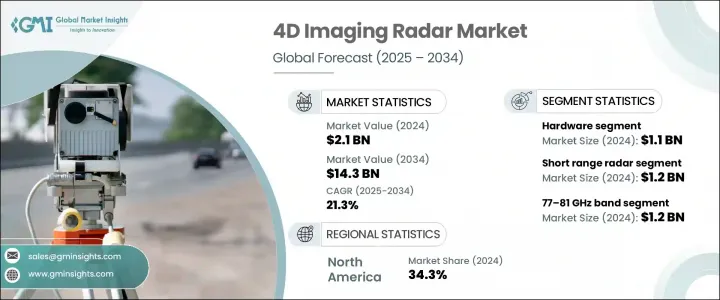

2024 年全球 4D 成像雷达市场价值为 21 亿美元,预计到 2034 年将以 21.3% 的复合年增长率成长,达到 143 亿美元。 2025 年至 2034 年期间,该产业的复合年增长率预计将达到 21.3%。这一强劲增长得益于人们对自动驾驶兴趣的日益浓厚、智慧移动解决方案部署的增加、对 ADAS 的投资扩大以及在军事系统、无人机 (UAV) 和工业自动化中的使用案例的不断扩大。 4D 成像雷达能够即时分析距离、仰角、速度和方位角,这使其在安全关键型应用中非常有价值。这些雷达能够进行高解析度环境测绘、精确的物体跟踪,并在雾、烟或黑暗等能见度较差的条件下保持可靠的性能。对 BVLOS 操作的支援不断增加,正在加速这些系统与无人机和无人驾驶飞机的集成,从而实现更安全、更自主的飞行。

此外,製造业和物流业日益推进的自动化进程,也推动了机器人对雷达增强感知的需求,尤其是在基于视觉的系统难以应对的充满挑战的动态环境中。传统的光学系统在低光照、多尘、多雾或烟雾瀰漫的环境中往往有其局限性,导致性能下降和安全风险。相较之下,4D成像雷达能够提供稳定的性能,并进行高解析度空间测绘和物体跟踪,不受环境限制。这种能力在自动堆高机、仓库机器人和自动配送系统等对精准度和可靠性要求极高的应用中至关重要,尤其适用于自动驾驶堆高机、仓库机器人和自动配送系统等。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 143亿美元 |

| 复合年增长率 | 21.3% |

2024年,硬体领域以11亿美元的估值领先全球4D成像雷达市场。这项优势得益于天线架构的突破,尤其是MIMO系统和相控阵技术的采用,这些技术显着提升了探测距离、精度和探测清晰度。雷达与视觉系统和雷射雷达等互补感测技术整合的需求日益增长,这增加了先进模组化硬体解决方案的复杂性和需求。为了满足汽车和无人机国防应用不断变化的需求,硬体製造商正专注于可扩展的MIMO架构和机器学习驱动的校准方法。

2024年,短程雷达市场规模达12亿美元。短程雷达的受欢迎程度源自于其在实现接近侦测、盲点监控和车载手势辨识等功能方面的关键作用。该领域受益于雷达分辨率和目标追踪能力的近期提升,这些紧凑型模组成为近距离高精度任务的理想选择。此外,小型化和高效的功耗提升也造就了经济高效的雷达单元,这些单元可轻鬆嵌入各种消费性电子和工业系统中。

2024年,美国4D成像雷达市场规模达6.462亿美元,预计2034年将维持21%的复合年增长率,维持强劲成长动能。先进驾驶辅助系统的快速部署以及各大都市地区自动驾驶汽车测试项目的不断发展,共同推动了这一成长。下一代平台越来越注重整合低延迟和高精度雷达系统,这推动技术供应商在系统层面进行创新。城市自动驾驶计程车专案和车队营运商正在优先考虑能够满足严苛响应时间和高角度精度的4D雷达解决方案。

影响 4D 成像雷达产业竞争格局的主要参与者包括瑞萨电子株式会社、Aptiv PLC、ZF Friedrichshafen AG、Mobileye、罗伯特·博世有限公司、英飞凌科技股份公司、Oculii、德州仪器公司、大陆集团、Arbe Robotics Ltd.、Hella Aglaia Mobile Vision Gmbing Ltd.Metal Corporation、Metling Corporation、Met Vision Gmbing、Met.a.这些公司继续引领创新,并为各种移动和自动化生态系统中的雷达整合製定未来标准。 4D 成像雷达市场的领先公司正专注于透过策略性研发投资来提升系统能力,尤其是在人工智慧驱动的讯号处理、可扩展硬体模组和自适应波束成形技术方面。为了提高市场渗透率,企业正在与汽车原始设备製造商、无人机製造商和机器人公司结成跨产业联盟,将雷达解决方案整合到新的行动平台中。针对特定用途需求(例如短程机器人或远端防御应用)进行客製化有助于供应商实现差异化。併购也被用来扩大智慧财产权组合併加快产品上市时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 衝击力

- 成长动力

- 新电子产品成本上涨

- 永续性和电子垃圾问题

- 消费性电子产品的扩张

- 增加工业和医疗设备的使用

- 第三方维修供应商的成长

- 产业陷阱与挑战

- 技术快速淘汰

- 对OEM零件和工具的存取受限

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依组件,2021-2034

- 主要趋势

- 硬体

- 收发器模组

- 天线和波束成形单元

- 讯号处理器

- 其他的

- 软体

- 物件侦测软体

- 感测器融合软体

- 雷达成像和测绘软体

- 其他的

- 服务

第六章:市场估计与预测:依雷达范围,2021-2034 年

- 主要趋势

- 短程雷达

- 中程雷达

- 远程雷达

第七章:市场估计与预测:依频段,2021-2034

- 主要趋势

- 24 GHz频段

- 60 GHz频段

- 77-81 GHz频段

- 其他的

第八章:市场估计与预测:依部署平台,2021-2034 年

- 主要趋势

- 地面车辆

- 搭乘用车

- 商用车

- 其他的

- 高空作业平台

- 无人机和无人驾驶飞机

- 载人飞机

- 海洋平台

- 海军舰艇

- 商船

- 其他的

- 其他的

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 高级驾驶辅助系统 (ADAS)

- 监控与安保

- 工业自动化

- 智慧基础设施

- 医疗保健监测

- 其他的

第 10 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 汽车

- 航太和国防

- 卫生保健

- 工业的

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Global Key Players

- Regional Key Players

- 颠覆者/利基市场参与者

- 爱因斯坦

- Arbe 机器人有限公司

- Metawave 公司

- 奥库利

- Vayyar 成像有限公司

The Global 4D Imaging Radar Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 14.3 billion by 2034. The industry is set to grow at a CAGR of 21.3% between 2025 and 2034. This robust growth is fueled by rising interest in autonomous driving, increased deployment of smart mobility solutions, expanded investment in ADAS, and widening use cases in military systems, unmanned aerial vehicles (UAVs), and industrial automation. The ability of 4D imaging radar to deliver real-time analysis of range, elevation, velocity, and azimuth makes it highly valuable for safety-critical applications. These radars enable high-resolution environmental mapping, precise object tracking, and reliable performance in adverse visibility conditions like fog, smoke, or darkness. Increasing support for BVLOS operations is accelerating the integration of these systems in UAVs and drones, allowing for safer and more autonomous flights.

Moreover, the increasing push toward automation across manufacturing and logistics is driving demand for radar-enhanced perception in robotics, especially in challenging, dynamic environments where vision-based systems struggle. Traditional optical systems often face limitations in low-light, dusty, foggy, or smoke-filled conditions, leading to performance drops and safety risks. In contrast, 4D imaging radar delivers consistent performance with high-resolution spatial mapping and object tracking, regardless of environmental constraints. This capability is critical in applications such as automated forklifts, warehouse robots, and autonomous delivery systems, where precision and reliability are essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 billion |

| Forecast Value | $14.3 billion |

| CAGR | 21.3% |

In 2024, the hardware segment led the global 4D imaging radar market with a valuation of USD 1.1 billion. This dominance is supported by breakthroughs in antenna architecture, particularly the adoption of MIMO systems and phased array technologies, which significantly boost range, precision, and detection clarity. The growing need to integrate radar with complementary sensing technologies, such as vision systems and lidar, is adding to the complexity and demand for advanced modular hardware solutions. To cater to the evolving demands of automotive and drone-based defense applications, hardware manufacturers are focusing on scalable MIMO-based architectures and machine-learning-driven calibration methods.

The short-range radar segment generated USD 1.2 billion in 2024. The preference for short-range radar is driven by its critical role in enabling features such as proximity detection, blind spot monitoring, and in-vehicle gesture recognition. The segment benefits from recent improvements in radar resolution and target tracking capabilities, making these compact modules ideal for high-precision tasks at close distances. Additionally, miniaturization efforts and efficient power usage have resulted in cost-effective radar units that are easily embedded into a wide array of consumer and industrial systems.

U.S. 4D Imaging Radar Market generated USD 646.2 million in 2024 and is expected to maintain strong momentum at a CAGR of 21% throughout 2034. Rapid deployment of advanced driver-assistance systems and evolving autonomous vehicle testing programs across major metropolitan areas are contributing to this growth. The increasing focus on integrating low-latency and high-accuracy radar systems in next-generation platforms is pushing technology providers to innovate at the system level. Urban robotaxi programs and fleet operators are prioritizing 4D radar solutions capable of meeting demanding response times and high angular accuracy.

Major players shaping the competitive landscape of the 4D Imaging Radar Industry include Renesas Electronics Corporation, Aptiv PLC, ZF Friedrichshafen AG, Mobileye, Robert Bosch GmbH, Infineon Technologies AG, Oculii, Texas Instruments Incorporated, Continental AG, Arbe Robotics Ltd., Hella Aglaia Mobile Vision GmbH, Metawave Corporation, NXP Semiconductors, Ainstein, and Vayyar Imaging Ltd. These companies continue to lead innovation and shape future standards for radar integration across a variety of mobility and automation ecosystems. Leading companies in the 4D imaging radar market are focusing on advancing system capabilities through strategic R&D investments, especially in AI-driven signal processing, scalable hardware modules, and adaptive beamforming techniques. To enhance market penetration, firms are forming cross-industry alliances with automotive OEMs, UAV manufacturers, and robotics companies to integrate radar solutions into new mobility platforms. Customization for use-specific needs, such as short-range robotics or long-range defense applications, helps vendors differentiate. Mergers and acquisitions are also being leveraged to expand IP portfolios and accelerate time-to-market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Radar range trends

- 2.2.3 Frequency band trends

- 2.2.4 Deployment platform trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cost of new electronics

- 3.2.1.2 Sustainability and e-waste concerns

- 3.2.1.3 Expansion of consumer electronics

- 3.2.1.4 Increasing industrial and medical device usage

- 3.2.1.5 Growth of third-party repair providers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Rapid technological obsolescence

- 3.2.2.2 Limited access to OEM parts and tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Transceiver modules

- 5.2.2 Antenna & beamforming units

- 5.2.3 Signal processors

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Object detection software

- 5.3.2 Sensor fusion software

- 5.3.3 Radar imaging & mapping software

- 5.3.4 Others

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Radar Range, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Short-range radar

- 6.3 Medium-range radar

- 6.4 Long-range radar

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 24 GHz band

- 7.3 60 GHz band

- 7.4 77-81 GHz band

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Deployment Platform, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Ground Vehicles

- 8.2.1 Passenger Vehicles

- 8.2.2 Commercial Vehicles

- 8.2.3 Others

- 8.3 Aerial Platforms

- 8.3.1 Drones & UAVs

- 8.3.2 Manned Aircraft

- 8.4 Marine Platforms

- 8.4.1 Naval Vessels

- 8.4.2 Commercial Ships

- 8.4.3 Others

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Advanced driver assistance systems (ADAS)

- 9.3 Surveillance & security

- 9.4 Industrial automation

- 9.5 Smart infrastructure

- 9.6 Healthcare monitoring

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Aerospace and Defense

- 10.4 Healthcare

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Aptiv PLC

- 12.1.2 Continental AG

- 12.1.3 NXP Semiconductors

- 12.1.4 Texas Instruments Incorporated

- 12.1.5 ZF Friedrichshafen AG

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 Mobileye (Intel)

- 12.2.1.2 Uhnder

- 12.2.1.3 Magna International

- 12.2.2 Europe

- 12.2.2.1 Hella Aglaia Mobile Vision GmbH

- 12.2.2.2 Robert Bosch GmbH

- 12.2.2.3 Infineon Technologies AG

- 12.2.3 Asia-Pacific

- 12.2.3.1 Renesas Electronics Corporation

- 12.2.3.2 Huawei

- 12.2.3.3 Smart Radar System

- 12.2.1 North America

- 12.3 Disruptors / Niche Players

- 12.3.1 Ainstein

- 12.3.2 Arbe Robotics Ltd.

- 12.3.3 Metawave Corporation

- 12.3.4 Oculii

- 12.3.5 Vayyar Imaging Ltd.