|

市场调查报告书

商品编码

1803889

自规则系统成像雷达的专利形势的分析(2025年)Imaging Radar for Autonomous Systems Patent Landscape Analysis 2025 |

|||||||

成像雷达:高解析度自动驾驶的核心驱动力

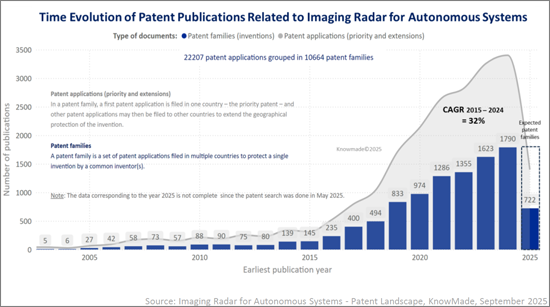

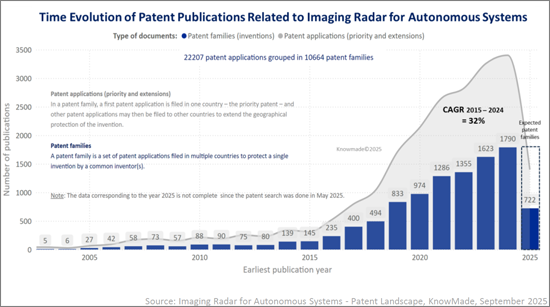

成像雷达是新一代雷达感测技术,旨在突破传统雷达仅限于基本距离和速度测量的限制。透过同时获取距离、速度、方位角和仰角,成像雷达可实现高解析度3D/4D感知。这些密集的雷达点云可实现高阶感知功能,例如物件分类、自由空间探测、地图绘製和场景重建。由于其在恶劣天气、低光源和复杂操作环境下的稳健性,成像雷达正成为安全可靠的自动驾驶系统的基础。其应用范围广泛,从ADAS、L2-L4自动驾驶和机器人计程车平台等地面移动应用,到空中无人机、船舶、机器人、太空和国防应用。专利活动的快速成长反映了这一势头。全球已确认超过 22,200 件专利申请,涵盖超过 10,600 个专利家族(发明),其中包括超过 2,800 个与成像雷达领域高度相关的核心专利家族。这一强劲的智慧财产权 (IP) 动态表明,成像雷达正在从一种补充感测器转变为主要的感知模式,塑造着自动驾驶的未来,并推动着先进感测领域竞争最激烈的智慧财产权战场之一。

全球智慧财产权趋势及策略参与者

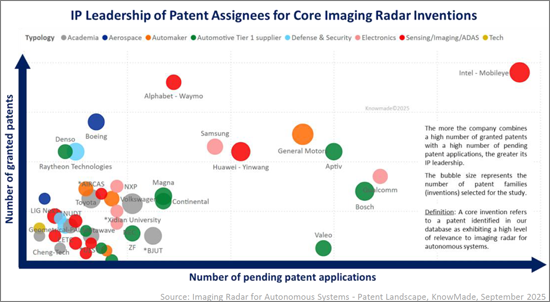

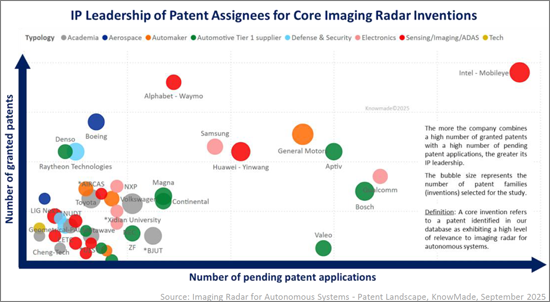

成像雷达专利格局正经历前所未有的加速发展。 2015 年至 2024 年间,成像雷达专利家族的出版数量增加了 1,100% 以上,从 145 件增加到 1,790 件,复合年增长率为 32%,开启了爆炸性创新时代。这一激增反映了技术向 4D 成像雷达、基于人工智慧的感知和多感测器融合的转变。美国和中国在该领域占主导地位,合计占全球申请的大部分占有率,而欧洲则透过博世、采埃孚和法雷奥等一级供应商保持强势地位。英特尔-Mobileye、博世、通用汽车、Alphabet-Waymo、华为-印网和麦格纳等现有企业拥有涵盖雷达硬体、感知软体和感测器融合的多元化专利组合。同时,Arbe Robotics、Uhnder、Aptiv 和 Metawave 等专业创新者正在建立专注于 4D 雷达晶片组、点云处理和即时环境感知的组合。包括西安电子科技大学、电子科技大学、北航和中科院航空工业研究院在内的学术机构,持续在波形、天线设计和波束赋形领域推动基础创新。产业领袖、新创公司和研究机构之间错综复杂的互动,定义了先进感测领域竞争最激烈的智慧财产权领域之一。

跨应用与科技层面的智慧财产权创新

成像雷达专利分为六大应用领域:陆地、空中、海上、航太、机器人和国防。此外,专利格局分为五个技术层面,涵盖11项关键赋能技术,涵盖波形设计和系统平台、校准、感知和感测器融合等各个。我们的分析表明,陆地移动出行是最具活力、技术最先进的领域,这得益于ADAS、L2-L4自动驾驶和自动驾驶计程车的部署。其他领域,如无人机导航、海事感测和国防应用,也不断扩展。在整个技术堆迭中,创新涵盖了从FMCW和MIMO讯号处理到AI增强感知和多感测器融合的各个领域,凸显了成像雷达在下一代自动驾驶中的核心作用。

本报告提供全球自规则系统成像雷达产业调查分析,超过1万600件的专利的Excel资料库之外又加上,全球专利趋势的说明,及主要企业的IP简介等。

本报告拿起的企业(摘录)

|

|

等等。

目录

简介

摘要整理

专利形势概要

- 知识产权动态

- 专利公布趋势:依国家/地区

- 主要专利持有人(按专利族、专利申请和核心发明;按类型、法律状态和国内/全球智慧财产权策略分类)

- 知识产权公司时间线

- 专利持有人智慧财产权领导力

- 主要公司专利的地理覆盖范围

- 已授权专利组合中具有影响力的专利持有人

- 知识产权生态系统

- 辅助品牌和内部部门

- 合资企业 - IP共同所有模式

- 收购相关企业

- 主要的共同所有IP

专利的市场区隔

- 市场区隔定义

- 专利的市场区隔 - 用途

- 市场区隔概要(专利系列数,积极的发明专利权者数,主要的发明专利权者,IP新加入厂商者,其他)

- 关于各市场区隔(陆上,航空,机器人工学,宇宙,海上,防卫)

- 专利组合概要(IP动态,地理范围等)

- 发明专利权者的IP龙头

- 值得注意的专利

- 陆上用途主要的发明专利权者的排行榜

- 专利的市场区隔 - 技术

- 市场区隔概要(专利系列数,积极的发明专利权者数,主要的发明专利权者,IP新加入厂商者等)

- 关于各市场区隔(11技术所构成的5个技术层)

- 成像雷达的各技术的引进

- 专利组合概要(IP动态,地理范围等)

- 值得注意的专利

- 4D成像雷达的发明专利权者的IP龙头

发明专利权者的IP简介

- General Motors,Intel - Mobileye,Bosch,Huawei -Yinwang,Magna,Alphabet - Waymo

- 各企业相关

- 专利组合概要(IP动态,市场区隔,法律上的现状,地理范围,引用,专利系列扩张比率,其他)

- 值得注意的专利

- 值得注意的申请中的专利

- 各企业相关

专利诉讼

附录

KnowMade的简报

The global IP battlefield is heating up: who are the key players, and which technologies will shape the future of imaging radar for autonomous mobility?

Key features:

- PDF >150 slides

- Excel database containing all patents analyzed in the report (>10,600 patent families), including patent segmentations and hyperlinks to an updated online database.

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments.

- Key players' IP position and the relative strength of their patent portfolio.

- IP ecosystems including sub-brands, JV with shared IP ownership, main co-owned IP, etc.

- Patents categorized by 6 application domains (terrestrial, aerial, robotics, space, marine, defense) and 5 technology layers comprising 11 techniques (FMCW, MIMO, Beamforming, 4D imaging radar, SAR, ISAR, calibration, point cloud, SLAM, tracking, AI and sensor fusion), with a focus on terrestrial applications and 4D imaging radar.

- IP profile of key players (patent portfolio overview, technical coverage, geographical coverage, notable granted and pending patents, etc.)

Imaging Radar A Core Driver of High-Resolution Autonomy

Imaging radar represents the next generation of radar sensing technologies, designed to overcome the limitations of conventional radars that provide only basic range and velocity measurements. By simultaneously capturing range, velocity, azimuth and elevation, imaging radar produces high-resolution 3D/4D perception. These dense radar point clouds enable advanced perception functions including object classification, free space detection, mapping and scene reconstruction. Thanks to its robustness in adverse weather, low light and complex operating environments, imaging radar is becoming a cornerstone for safe and reliable autonomous systems. Its deployment spans terrestrial mobility such as ADAS, L2-L4 autonomous driving and robotaxi platforms, as well as aerial drones, marine vessels, robotics, space, and defense applications. The rapid acceleration of patenting activity reflects this momentum. More than 22,200 patent applications grouped into over 10,600 patent families (inventions) have been identified worldwide, including more than 2,800 core patent families that demonstrate a high degree of relevance to the imaging radar domain. This strong intellectual property (IP) dynamic demonstrates that imaging radar is transitioning from a complementary sensor to a primary perception modality, shaping the future of autonomy and driving one of the most competitive IP battlefields in advanced sensing.

Global IP Trends and Strategic Players

The patent landscape for imaging radar has experienced an unprecedented acceleration. From 2015 to 2024, imaging radar patent family publications grew from 145 to 1,790, an increase of over 1100% and a CAGR of 32% marking a period of explosive innovation. This surge reflects the technological transition toward 4D imaging radar, AI-driven perception and multi-sensor fusion. The United States and China dominate the field, together accounting for more than half of global filings, while Europe maintains a strong position through Tier-1 suppliers such as Bosch, ZF and Valeo. Established players including Intel-Mobileye, Bosch, General Motors, Alphabet - Waymo, Huawei-Yinwang and Magna hold diversified patent portfolios that span radar hardware, perception software and sensor fusion. At the same time, specialized innovators such as Arbe Robotics, Uhnder, Aptiv and Metawave are building targeted portfolios in 4D radar chipsets, point cloud processing and real-time environmental perception. Academic institutions, notably Xidian University, UESTC, BUAA and AIRCAS, continue to shape foundational innovation in waveforms, antenna design and beamforming. This complex interplay of industrial leaders, startups and research institutes defines one of the most competitive IP domains in advanced sensing.

IP Innovation Across Applications and Technical Layers

Imaging radar patents are classified into six main application domains: terrestrial, aerial, marine, space, robotics and defense. The patent landscape has been further structured into five technology layers encompassing 11 key enabling techniques, ranging from waveform design and system platforms to calibration, perception and sensor fusion. Our analysis indicates that terrestrial mobility is the most active and technically advanced area, driven by ADAS, Level 2 to Level 4 autonomy and robotaxi deployment. Other domains such as UAV navigation, maritime sensing and defense applications are also expanding. Across the technology stack, innovation spans from FMCW and MIMO signal processing to AI-enhanced perception and multi-sensor fusion, highlighting the central role of imaging radar in next generation autonomy.

A Competitive and Rapidly Evolving IP Landscape

The imaging radar IP landscape is highly dynamic. Established OEMs and Tier-1 suppliers maintain strong positions, but new entrants are rapidly reshaping the field, with radar startups and ADAS suppliers particularly active. IP leadership now depends not only on the size of a portfolio but also on enforceability, geographic reach and technological impact. Companies such as GM, Intel-Mobileye, Bosch and Huawei-Yinwang combine extensive portfolios with a high volume of patent applications, while patent assignees like Arbe Robotics and Uhnder have demonstrated high IP strength and influence per patent.

In addition to individual patent portfolios, the IP ecosystem is shaped by sub-brands, joint ventures with shared IP ownership and co-owned patent families, all of which highlight the strategic role of IP in driving both competition and collaboration.

From Key Players to the Entire IP Landscape

This report provides in-depth insights into the IP strategies of the main actors shaping the imaging radar domain. It includes detailed profiles of General Motors, Intel-Mobileye, Bosch, Huawei-Yinwang, Magna and Alphabet-Waymo, covering portfolio dynamics, notable granted and pending patents, legal status and global coverage. Beyond these key players, the report delivers a comprehensive classification of all identified patent assignees including automakers, Tier-1 suppliers, sensing and ADAS companies, electronics manufacturers, technology firms, academia, and defense and aerospace players. Within each segment, we identify both the established IP leaders and the IP newcomers, providing a clear view of how innovation and competition are distributed across the ecosystem.

For executives, IP professionals and R&D teams, the report delivers a comprehensive overview of a fast-evolving and competitive technology space. By aligning patent intelligence with strategic planning, companies can strengthen their innovation roadmap, secure competitive advantage and position themselves at the forefront of autonomous mobility and advanced sensing.

Useful Excel patent database

This report includes an extensive Excel database with the 10,600+ patent families (inventions) analyzed in this study, including patent information (publication numbers, assignees, dates, title, abstract, etc.), hyperlinks to an updated online database (original documents, legal status, etc.), and structured classification by application segments (terrestrial, aerial, robotics, space, marine, and defense), five technology layers with 11 key technique segments (FMCW, MIMO, beamforming, 4D imaging radar, SAR, ISAR, calibration, point cloud, SLAM, tracking, AI and sensor fusion), as well as the identified core inventions. This database supports advanced multi-criteria searches and provides direct access to updated records, enabling users to benchmark portfolios, monitor competitors, identify potential partners or acquisition targets and evaluate freedom-to-operate constraints.

Companies mentioned in the report (non-exhaustive):

|

|

and more.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Scope and objectives of the report

- Reading guide

- Excel database

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- IP dynamics

- Time evolution of patent publications by countries

- Main patent assignees (according to number of patent families, number of patent applications, number of core inventions; classified by typology, by legal status, by domestic vs. global IP strategies, etc.)

- Timeline of IP players

- IP leadership of patent assignees

- Geographical coverage of main players' patents

- High-impact patent assignees for granted patent portfolios

- IP ecosystems

- Sub-brands and Internal Divisions

- Joint Ventures - Shared IP Ownership Models

- Acquisition-related Companies

- Main co-owned IP

PATENT SEGMENTATION

- Segments definition

- Patent segmentation - applications

- Segmentation overview (number of patent families, number of active patent assignees, main patent assignees, IP newcomers, etc)

- For each segment (terrestrial, aerial, robotics, space, marine, and defense):

- Patent portfolio overview (IP dynamics, geographic coverage, etc.)

- IP leadership of patent assignees

- Notable patents

- Main patent assignees ranking for terrestrial applications

- Patent segmentation - technologies

- Segmentation overview(number of patent families, number of active patent assignees, main patent assignees, IP newcomers, etc)

- For each segment (five technology layers comprising 11 techniques) :

- Introduction of each technology for imaging radar

- Patent portfolio overview (IP dynamics, geographic coverage, etc.)

- Notable patents

- IP leadership of patent assignees for 4D imaging radar

IP PROFILE OF A SELECTION OF PATENT ASSIGNEES

- General Motors, Intel - Mobileye, Bosch, Huawei -Yinwang, Magna and Alphabet - Waymo

- For each player:

- Patent portfolio overview (IP dynamics, segments, legal status, geographic coverage, citations, patent family extension ratio, etc.)

- Notable granted patents

- Notable pending patents

- For each player:

PATENT LITIGATION

ANNEX

- Methodology for patent search, selection and analysis

- Methodology to identify key patents

- Terminology