|

市场调查报告书

商品编码

1797840

美国 SLI 电池市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测America SLI Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

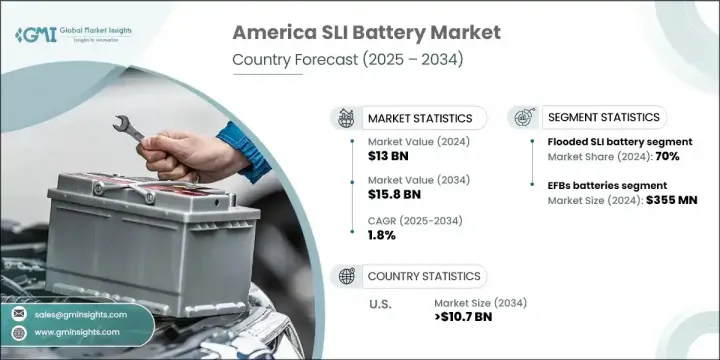

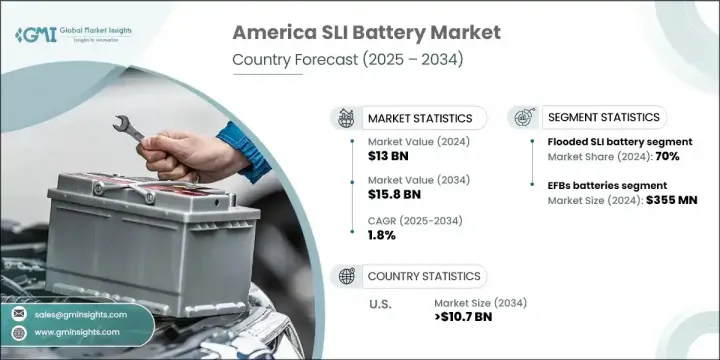

2024年,美国SLI电池市场规模达130亿美元,预计到2034年将以1.8%的复合年增长率成长,达到158亿美元。拖拉机和收割机等农业机械中SLI电池的使用日益增多,这推动了市场需求,尤其是在多个国家农业产业扩张的背景下。墨西哥和拉丁美洲其他地区的城市化和中产阶级的壮大也推动了汽车保有量的上升,这反过来又刺激了对可靠电池解决方案的需求。北美各地的环境法规鼓励电池回收,这有助于SLI电池产业更永续的製造和处置方式。虽然这些电池主要支援内燃机汽车,但它们在混合动力汽车中作为辅助功能的作用正变得越来越突出。

美国和巴西混合动力车销量的不断增长,以及计程车、货车和公车等商用车队的需求,进一步推动了市场的发展。这些车辆依靠SLI电池实现点火、照明和电力支援系统等基本功能,即使在混合动力和启动停止引擎技术中也是如此。由于车队营运商致力于最大限度地减少停机时间和维护成本,对可靠、长寿命电池的需求变得更加重要。此外,随着美洲各国政府推广更干净的交通解决方案和电气化,人们对混合动力车队的兴趣日益浓厚,这些车队继续使用SLI电池作为辅助功能。这种转变不仅加速了人口稠密的城市中心的需求,也加速了物流网络和公共交通系统快速发展的郊区和农村地区的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 130亿美元 |

| 预测值 | 158亿美元 |

| 复合年增长率 | 1.8% |

2024年,富液式SLI电池市场占了70%的市场份额,预计到2034年将以1.4%的复合年增长率成长。由于成本低廉且设计简单,富液式电池在价格敏感的拉丁美洲市场仍然很受欢迎。由于价格实惠且易于生产,它们成为日常车辆和农业应用的首选,尤其是在汽车电气化仍在发展的国家。

2024年,美国SLI电池市场产值达91亿美元,占70.2%的市占率。受轻型卡车和SUV需求旺盛的推动,美国可望持续成长。这些车型需要更高储备容量和更高冷启动电流的电池。政府推出的支持性政策,包括透过基础设施立法提供的补贴和激励措施,正在促进国内电池製造业的发展。儘管电动车电池生产备受关注,但铅酸电池生产商也受益于对供应链和劳动力发展的投资,从而增强了美国SLI电池市场的整体韧性和竞争力。

塑造美洲 SLI 电池格局的关键参与者包括 East Penn Manufacturing、Clarios、Exide Technologies、ACDelco 和 EnerSys。美洲 SLI 电池市场的领先公司专注于创新、成本优化和策略合作伙伴关係,以维持并提升其市场地位。他们投资研发,以提高电池性能、耐用性和环境永续性。企业越来越多地采用回收计划和环保生产方法,以遵守严格的环境法规。与汽车製造商和农业设备供应商的合作有助于扩大应用范围。企业也寻求地理扩张,瞄准汽车保有量不断成长的新兴市场和农业产业。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 供应链弹性和风险评估

- 原物料采购挑战

- 製造能力分析

- 物流及配送网络

- 地缘政治风险因素

- 进出口贸易分析

- 主要进口国

- 主要出口国

- 价格趋势分析,(美元/单位)

- 依技术

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 淹没

- 电子飞行包

- 阀控铅酸蓄电池

- 年度股东大会

- 凝胶

第六章:市场规模与预测:依国家/地区,2021 - 2032 年

- 主要趋势

- 我们

- 加拿大

- 阿根廷

- 巴西

- 墨西哥

- 智利

- 哥伦比亚

- 厄瓜多

- 巴拉圭

- 秘鲁

- 乌拉圭

- 巴拿马

- 多明尼加共和国

- 萨尔瓦多

第七章:公司简介

- ACDelco

- Acumuladores Moura

- Banner

- Clarios

- Continental Battery Systems

- Crown Battery

- Discover Battery

- Dyno Battery

- East Penn Manufacturing

- EnerSys

- ETNA

- Exide Industries

- Exide Technologies

- FIAMM Energy Technology

- GS Yuasa

- Hankook & Company

- Interstate Batteries

- Leoch International

- MEBCO Batteries

- MOLL Batterien

America SLI Battery Market was valued at USD 13 billion in 2024 and is estimated to grow at a CAGR of 1.8% to reach USD 15.8 billion by 2034. The rising use of SLI batteries in agricultural machinery such as tractors and harvesters is driving demand, especially with the expansion of agro-industries across several countries. Urbanization and a growing middle class in regions like Mexico and other parts of Latin America are also fueling higher vehicle ownership, which in turn supports the need for dependable battery solutions. Environmental regulations throughout North America encourage battery recycling, contributing to more sustainable manufacturing and disposal practices within the SLI battery sector. While these batteries primarily support internal combustion engine vehicles, their role in hybrid vehicles for secondary functions is becoming more prominent.

The increasing sales of hybrid vehicles in the U.S. and Brazil, along with the demand from commercial vehicle fleets such as taxis, delivery vans, and buses, further boost the market. These vehicles rely on SLI batteries for essential functions like ignition, lighting, and power support systems, even in hybrid and start-stop engine technologies. As fleet operators aim to minimize downtime and maintenance costs, the need for dependable, long-life batteries becomes more critical. Additionally, with governments across the Americas promoting cleaner transport solutions and electrification, there's a growing interest in hybrid fleets, which continue to utilize SLI batteries for auxiliary functions. This shift is accelerating demand not only in densely populated urban centers but also in expanding suburban and rural areas where logistics networks and public transport systems are evolving rapidly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $15.8 Billion |

| CAGR | 1.8% |

In 2024, the flooded SLI battery segment held a 70% share and is projected to grow at a CAGR of 1.4% through 2034. Due to their low cost and simple design, flooded batteries remain popular in price-sensitive Latin American markets. Their affordability and ease of production make them a preferred choice for everyday vehicles and agricultural applications, especially in countries where vehicle electrification is still developing.

U.S. America SLI Battery Market generated USD 9.1 billion in 2024, capturing a 70.2% share in 2024. The country is poised for continued growth, driven by the high demand for light-duty trucks and SUVs that require batteries with greater reserve capacity and cold-cranking amps. Supportive government policies, including grants and incentives through infrastructure legislation, bolster domestic battery manufacturing. Although electric vehicle battery production garners significant attention, lead-acid battery producers also benefit from investments in supply chains and workforce development, strengthening the overall resilience and competitiveness of the U.S. SLI battery market.

Key players shaping the Americas SLI battery landscape include East Penn Manufacturing, Clarios, Exide Technologies, ACDelco, and EnerSys. Leading companies in the America SLI Battery Market are focused on innovation, cost optimization, and strategic partnerships to maintain and grow their market position. They invest in R&D to enhance battery performance, durability, and environmental sustainability. Firms are increasingly adopting recycling initiatives and eco-friendly production methods to comply with stringent environmental regulations. Collaborations with automotive manufacturers and agricultural equipment providers help expand application reach. Companies also pursue geographic expansion, targeting emerging markets with growing vehicle ownership and agro-industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Supply chain resilience and risk assessment

- 3.3.1 Raw material sourcing challenges

- 3.3.2 Manufacturing capacity analysis

- 3.3.3 Logistics and distribution networks

- 3.3.4 Geopolitical risk factors

- 3.4 Import export trade analysis

- 3.4.1 Key importing countries

- 3.4.2 Key exporting countries

- 3.5 Price trend analysis, (USD/Unit)

- 3.5.1 By technology

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (Million Units & USD Million)

- 5.1 Key trends

- 5.2 Flooded

- 5.3 EFB

- 5.4 VRLA

- 5.4.1 AGM

- 5.4.2 GEL

Chapter 6 Market Size and Forecast, By Country, 2021 - 2032 (Million Units & USD Million)

- 6.1 Key trends

- 6.2 U.S.

- 6.3 Canada

- 6.4 Argentina

- 6.5 Brazil

- 6.6 Mexico

- 6.7 Chile

- 6.8 Colombia

- 6.9 Ecuador

- 6.10 Paraguay

- 6.11 Peru

- 6.12 Uruguay

- 6.13 Panama

- 6.14 Dominican Republic

- 6.15 El Salvador

Chapter 7 Company Profiles

- 7.1 ACDelco

- 7.2 Acumuladores Moura

- 7.3 Banner

- 7.4 Clarios

- 7.5 Continental Battery Systems

- 7.6 Crown Battery

- 7.7 Discover Battery

- 7.8 Dyno Battery

- 7.9 East Penn Manufacturing

- 7.10 EnerSys

- 7.11 ETNA

- 7.12 Exide Industries

- 7.13 Exide Technologies

- 7.14 FIAMM Energy Technology

- 7.15 GS Yuasa

- 7.16 Hankook & Company

- 7.17 Interstate Batteries

- 7.18 Leoch International

- 7.19 MEBCO Batteries

- 7.20 MOLL Batterien