|

市场调查报告书

商品编码

1636219

中国SLI电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)China SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

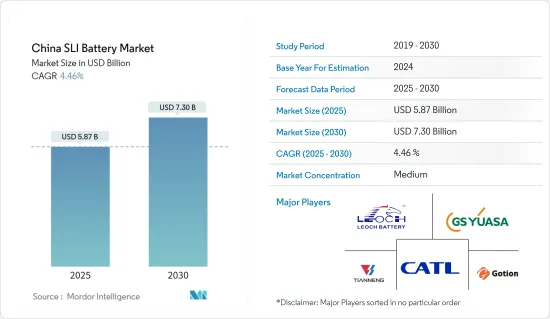

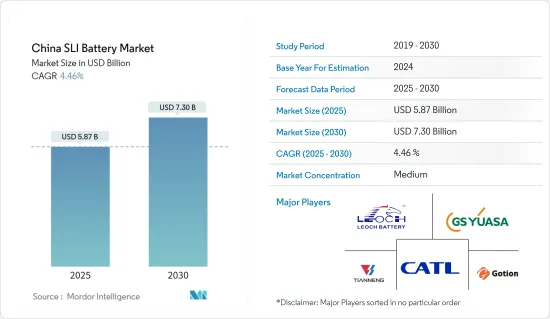

预计2025年中国SLI电池市场规模为58.7亿美元,预计2030年将达73亿美元,预测期间(2025-2030年)复合年增长率为4.46%。

主要亮点

- 从中期来看,该地区汽车产业的成长、政府对电池製造的支持性政策和法规等因素预计将成为预测期内中国SLI电池市场的主要驱动力。

- 另一方面,来自替代电池化学物质的竞争正在加剧,可能对预测期内的市场研究构成威胁。

- 儘管如此,对 SLI 电池的持续研发工作预计将在未来为 SLI 电池市场创造多个机会。

中国SLI电池市场趋势

VRLA 电池大幅成长

- 在中国汽车工业的快速成长和对免维护电池解决方案的需求不断增长的推动下,阀控式铅酸电池(VRLA)产业已成为中国SLI电池市场的主要参与者。 VRLA电池也称为密闭式铅酸电池,由于与传统电解型铅酸电池相比具有许多优点,因此在SLI市场中受到欢迎。

- 这些好处包括提高安全性、减少维护要求以及提高极端温度下的性能。随着中国作为全球最大汽车产业的地位不断巩固,SLI市场对VRLA电池的需求显着增长,国内外製造商都在争夺这个竞争激烈的市场份额。

- 根据国际汽车工业组织统计,由于国内外市场对汽车的需求迅速增加,中国汽车产量逐年大幅增加。例如,2022年至2023年,产量将成长11.6%以上,复合年增长率约为3.5%,显示我国汽车工业正在快速成长。

- 近年来,中国的 SLI VRLA 电池产业取得了显着的技术进步,製造商专注于提高电池寿命、充电接受能力和整体效率。该领域的主要趋势之一是增强板栅合金和活性材料配方的开发,从而延长循环寿命并改善冷启动性能。

- 例如,2023年12月,TAILG推出了尖端钠离子电池技术,开启了SLI电池领域的新篇章。与传统 VRLA 电池相比,这项创新技术具有令人印象深刻的远距性能、延长的保固期、改进的低温耐用性和增强的安全功能。 TAILG的高阶电动自行车将是配备这种先进钠离子电池的先锋车型,并将在中国独家推出。

- 此外,隔膜技术的进步提高了电解保留率并降低了内阻,进一步提高了 VRLA 电池在 SLI 应用中的整体性能。这些技术改进不仅使 VRLA 电池相对于传统的基于电解的铅酸电池更具竞争力,而且使 VRLA 电池成为某些汽车应用中新兴电池技术的可行替代品。

- 因此,鑑于上述几点,VRLA电池类型预计在预测期内将显着增长。

汽车产业的扩张推动市场成长

- 中国汽车工业的快速成长预计将成为未来几年中国 SLI 电池市场的主要推动力。作为全球最大的汽车市场,中国汽车产销量持续高速成长,对SLI电池的需求不断成长。这种成长不仅受到国内消费的推动,也受到中国作为世界汽车製造中心的崛起的推动。

- 中国推动汽车电气化(重点是全电动和插电式混合动力汽车)也正在影响 SLI 电池市场。轻度混合动力车和微混合动力汽车仍然依赖内燃机,但采用了不同程度的电气化,其发展正在为 SLI 电池製造商创造新的机会。这些混合动力系统通常需要更先进的电池解决方案,既可以处理传统的启动功能,也可以处理再生煞车和其他电力负载。

- 例如,根据国际能源总署(IEA)的数据,混合动力汽车在中国获得了大力支持。 2022年至2023年,该国混合动力汽车销量成长80%,2019年至2023年复合年增长率超过214.78%。这表明混合动力汽车在该国的普及,进而将推动对 SLI 电池的需求。

- 随着中国汽车製造商越来越多地采用这些混合动力技术作为全面电气化的基石,对能够满足这两个要求的先进 SLI 电池的需求预计将会增加。这一趋势凸显了 SLI 电池产业需要持续创新,以满足中国不断变化的汽车格局。

- 例如,2024年1月,中国制定了更雄心勃勃的目标,到2027年新能源汽车占新车销量的45%,以适应电动车型的快速普及。这一转变预计将对 SLI 电池市场产生重大影响,传统汽车电池的需求预计将下降,先进的电池技术将被采用。

- 日本的汽车生产规模如此之大,需要强大的汽车零件供应链,其中包括SLI电池,这对于传统内燃机汽车的启动、照明和点火系统至关重要。随着越来越多的汽车下线并上路,对原始设备(OE)和替换SLI电池的需求预计将激增,这为在中国市场运营的电池製造商带来了巨大的成长机会。

- 因此,如前所述,中国汽车工业的扩张预计将在预测期内推动市场。

中国SLI电池产业概况

中国的SLI电池市场呈现半瓜分状态。市场的主要企业(排名不分先后)包括GS汤浅国际有限公司、天能电池集团有限公司、理士国际科技有限公司、宁德时代新能源科技有限公司、宁德时代新能源科技有限公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 不断增长的汽车工业

- 政府扶持政策

- 抑制因素

- 与替代电池的竞争

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 按类型

- 电池被淹

- VRLA 电池

- EBF电池

- 按最终用户

- 车

- 其他最终用户

第六章 竞争状况

- 併购、合资、联盟、协议

- Strategies Adopted & SWOT Analysis for Leading Players

- 公司简介

- GS Yuasa International Ltd

- Tianneng Battery Group Co.

- Leoch International Technology Limited Inc.

- Contemporary Amperex Technology Co. Limited

- Gotion Inc.

- Farasis Energy(GanZhou)Co. Ltd

- Clarios International Inc.

- Guangzhou NPP Power Co. Ltd

- Qingyuan Yiyuan Power Supply Co. Ltd

- EVE Energy Co. Ltd

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第七章 市场机会及未来趋势

- 研发投资

简介目录

Product Code: 50003482

The China SLI Battery Market size is estimated at USD 5.87 billion in 2025, and is expected to reach USD 7.30 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive industry in the region and supportive government policies and regulations regarding battery manufacturing in the country are expected to be significant drivers for the Chinese SLI battery market during the forecast period.

- On the other hand, there is increasing competition from alternate battery chemistries that may pose a threat to the market studied during the forecast period.

- Nevertheless, continued efforts to conduct research and development regarding SLI batteries are expected to create several opportunities for the SLI battery market in the future.

China SLI Battery Market Trends

VRLA Battery to Witness Significant Growth

- The valve-regulated lead-acid (VRLA) battery segment has emerged as a significant player in the Chinese SLI battery market, driven by the country's rapidly growing automotive industry and increasing demand for maintenance-free battery solutions. VRLA batteries, also known as sealed lead-acid batteries, have gained popularity in the SLI market due to their numerous advantages over traditional flooded lead-acid batteries.

- These benefits include improved safety, reduced maintenance requirements, and enhanced performance in extreme temperatures. As China continues to solidify its position as the world's largest automotive industry, the demand for VRLA batteries in the SLI market has experienced substantial growth, with both domestic and international manufacturers vying for market share in this highly competitive landscape.

- According to the International Organization of Motor Vehicle Manufacturers, automobile production in China has been on a significant rise over the years due to burgeoning automobile demands from both domestic and international markets. For instance, between 2022 and 2023, production increased by more than 11.6%, with an annual average growth rate of approximately 3.5%, signifying the rapid growth in the country's automobile industry.

- The Chinese VRLA battery industry for SLI applications has witnessed remarkable technological advancements in recent years, with manufacturers focusing on improving battery life, charge acceptance, and overall efficiency. One of the key trends in this segment is the development of enhanced grid alloys and active material formulations, which have led to increased cycle life and improved cold-cranking performance.

- For instance, in December 2023, TAILG unveiled its cutting-edge sodium-ion battery technology, heralding a new chapter in the realm of SLI batteries. This innovative technology, which surpasses traditional VRLA batteries, boasts impressive long-range capabilities, extended warranties, heightened low-temperature resilience, and bolstered safety features. TAILG's premium e-bikes are expected to lead the charge, becoming the pioneering models to showcase these advanced sodium-ion batteries, with an initial launch set exclusively in China.

- Additionally, advancements in separator technology have resulted in better electrolyte retention and reduced internal resistance, further enhancing the overall performance of VRLA batteries in SLI applications. These technological improvements not only boosted the competitiveness of VRLA batteries against traditional flooded lead-acid batteries but also positioned them as viable alternatives to emerging battery technologies in specific automotive applications.

- Therefore, as per the points mentioned above, the VRLA battery types are expected to witness significant growth during the forecast period.

Expanding Automotive Industry to Drive the Market's Growth

- The rapid growth of China's automotive industry is poised to be a primary driver for the country's SLI battery market in the coming years. As the world's largest automotive market, China's vehicle production and sales volumes continue to expand at a remarkable pace, creating an ever-increasing demand for SLI batteries. This growth is not only driven by domestic consumption but also by China's rising prominence as a global automotive manufacturing hub.

- China's push toward vehicle electrification, while primarily focused on fully electric and plug-in hybrid vehicles, has implications for the SLI battery market. The development of mild hybrid and micro-hybrid vehicles, which still rely on internal combustion engines but incorporate varying degrees of electrification, creates new opportunities for SLI battery manufacturers. These hybrid systems often require more sophisticated battery solutions that can handle both traditional starting functions and support regenerative braking and other electrical loads.

- For instance, according to the International Energy Agency, hybrid vehicles have gained massive traction in China. Between 2022 and 2023, the sales of hybrid vehicles in the country increased by 80%, while between 2019 and 2023, the annual average growth rate was over 214.78%. This signifies the popularity of hybrid vehicles in the country, which, in turn, drives the demand for SLI batteries.

- As Chinese automakers increasingly adopt these hybrid technologies as a stepping stone toward full electrification, the demand for advanced SLI batteries capable of meeting these dual requirements is expected to rise. This trend underscores the need for continuous innovation in the SLI battery industry to keep pace with China's evolving automotive landscape.

- For instance, in January 2024, China set a more ambitious target, aiming for new energy vehicles to constitute 45% of all new auto sales by 2027, responding to the rapid adoption of electric models. This shift is expected to significantly impact the market for SLI batteries, as the demand for traditional automotive batteries is expected to decline in favor of advanced battery technologies.

- The sheer scale of vehicle production in the country necessitates a robust supply chain for automotive components, including SLI batteries, which are essential for the starting, lighting, and ignition systems of conventional internal combustion engine vehicles. As more vehicles roll off production lines and onto Chinese roads, the demand for both original equipment (OE) and replacement SLI batteries is expected to surge, providing substantial growth opportunities for battery manufacturers operating in the Chinese market.

- Therefore, as mentioned above, the country's expanding automotive industry is expected to drive the market during the forecast period.

China SLI Battery Industry Overview

The Chinese SLI battery market is semi-fragmented. Some of the key players in this market (in no particular order) are GS Yuasa International Ltd, Tianneng Battery Group Co., Leoch International Technology Limited Inc., Contemporary Amperex Technology Co. Limited, and Gotion Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Automotive Industry

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd

- 6.3.2 Tianneng Battery Group Co.

- 6.3.3 Leoch International Technology Limited Inc.

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Gotion Inc.

- 6.3.6 Farasis Energy (GanZhou) Co. Ltd

- 6.3.7 Clarios International Inc.

- 6.3.8 Guangzhou NPP Power Co. Ltd

- 6.3.9 Qingyuan Yiyuan Power Supply Co. Ltd

- 6.3.10 EVE Energy Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Investment in Research and Development Activities

02-2729-4219

+886-2-2729-4219