|

市场调查报告书

商品编码

1636268

法国 SLI 电池:市场占有率分析、产业趋势、成长预测(2025-2030 年)France SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

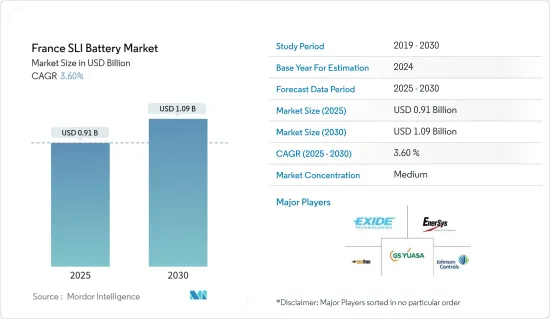

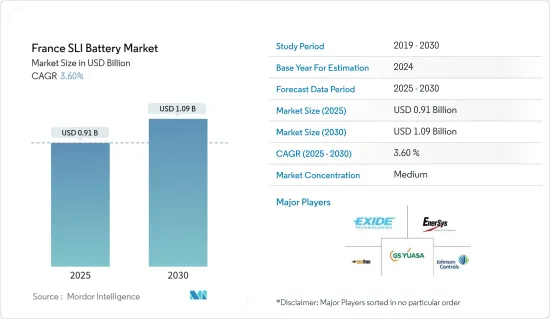

法国SLI电池市场规模预计到2025年为9.1亿美元,预计2030年将达到10.9亿美元,预测期内(2025-2030年)复合年增长率为3.6%。

主要亮点

- 从中期来看,工业和农业应用对 SLI 电池的需求不断增加以及汽车普及率的提高预计将在预测期内推动 SLI 电池的需求。

- 另一方面,由于替代电池的日益普及,预计市场成长将受到限制。

- 人们对电池回收的日益关注及其在新兴市场(无论是新车还是售后市场更换)的扩张预计将在不久的将来为市场参与企业创造重大机会。

法国SLI电池市场趋势

汽车普及带动市场

- 汽车在法国越来越受欢迎,推动了市场的成长。随着汽车越来越普及,对可靠、高效的汽车电池的需求不断增加。

- 强劲的汽车生产和销售支撑了欧洲对 SLI 电池的需求。德国和法国是重要的汽车市场,SLI 电池用于新车和售后替换产品。研究期间电动车销量大幅成长。

- 根据国际能源总署(IEA)统计,2023年法国电动车总销量为47万辆,较2022年成长38.24%。随着众多计划的启动,预计未来几年销售将呈指数级增长,预计将增加预测期内对 SLI 电池的需求。

- 此外,该国正在积极推广电动车(EV)的使用,以实现永续交通。随着世界透过鼓励使用电动车走向更绿色的未来,该国正在拥抱电力革命。

- 2024 年5 月,政府与主要汽车製造商签署了一项协议,其中包括新中期计划协议的临时目标,将电动车销量从2022 年的20 万辆增加到2027 年的80 万辆。 。政府也透过各种计画累计15 亿欧元(16 亿美元)用于生产和购买电动车。这些投资可能会在预测期内增加整个全部区域的电动车产量和对 SLI 电池的需求。

- 截至 2023 年,各公司正在电池技术方面取得进步,例如 VRLA 电池,由于其免维护特性和改进的性能而变得越来越受欢迎。这些电池在许多应用中逐渐取代传统电解型铅酸电池,预计这一因素将在预测期内为汽车应用创造更多机会。

- 此类计划和投资可能会增加全部区域的汽车产量,并在预测期内推动对 SLI 电池的需求。

汽车最终用户市场预计将成长

- 法国的汽车产业正在扩张,对乘用车和商用车的需求不断增加。这种增长增加了对可靠 SLI 电池的需求。过去几年汽车销量大幅成长,汽车产业产生的收益在此期间呈线性成长。

- 例如,根据OICA(国际汽车构造组织)的数据,2023年法国汽车销售量为221万辆,较2022年成长14.5%。随着政府宣布一系列提高全部区域汽车产量的措施和计划,汽车收益和销售量预计将在未来几年大幅成长。

- 法国汽车工业正在不断扩张,对乘用车和商用车的需求不断增加。这种增长增加了对可靠 SLI 电池的需求。过去几年汽车销量大幅成长,产业产生的收益也呈现线性成长。

- 例如,根据OICA(国际汽车构造组织)的数据,2023年法国国内汽车销量为221万辆,较2022年成长14.5%。随着政府宣布一系列提高全部区域汽车产量的措施和计划,汽车收益和销售量预计将在未来几年大幅成长。

- 法国政府透过一系列旨在减少污染、减少对石化燃料的依赖和促进永续发展的倡议,积极推广电动车(EV)。预计主要企业将在未来几年启动一系列计划,以扩大全部区域的汽车产量。

- 例如,2024年6月,中国电动车巨头比亚迪宣布将在法国开设电动车生产工厂,并在未来几年内在法国各地推出插电式混合动力汽车(PHEV)。该设施预计将于年终投入运作。此类计划将提高电动车产量,进而增加对 SLI 电池的需求。

- 法国的电池生产正在大幅扩张。 2023 年,Automotive Cells Company (ACC) 将在上法兰西大区的 Billie-Belclough/Deblanc 开设电池工厂。该工厂预计到 2024年终年产能将达到 13GWh,ACC 计划在 2030 年最终实现年产能 40GWh。该工厂每年将能够生产为20万至30万辆电动车提供动力所需的电池。

- 上法兰西地区还有其他几个计划正在进行中,使其成为快速发展的「电池谷」。特别是,远景AESC正在杜埃兴建新电池工厂,为雷诺供货,初期产能目标为2024年达到9GWh,到2030年达到24GWh。 Verkor 和辉能也在沿海城市敦克尔克建设设施,预计 2025 年至 2026 年开始生产。

- 此类措施和发展可能会促进汽车最终用户领域的成长。

法国SLI电池产业概况

法国SLI电池市场呈现半分裂状态。主要企业(排名不分先后)包括 Exide Technologies、EnerSys、East Penn Manufacturing Co、GS Yuasa International Ltd. 和 Johnson Controls International PLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 汽车普及率不断提高

- 工业和农业应用对 SLI 电池的需求不断增长

- 抑制因素

- 替代电池的扩展

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 电池被淹

- VRLA 电池

- EBF电池

- 最终用户

- 用于汽车

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- GS Yuasa International Ltd.

- Exide Technologies

- Johnson Controls International PLC

- EnerSys

- HBL Power Systems Ltd

- East Penn Manufacturing Company

- FIAMM Energy Technology

- Clarios

- SAFT Groupe SA

- Varta AG

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名分析

第七章 市场机会及未来趋势

- 人们越来越关注电池和回收

- 拓展新车和售后市场应用的新兴市场

简介目录

Product Code: 50003554

The France SLI Battery Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.09 billion by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing demand for SLI batteries from industrial and agricultural applications and increasing adoption of motor vehicles are expected to drive the demand for SLI batteries during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries is expected to restrain the growth of the market.

- Nevertheless, increased focus on battery recycling and expansion in emerging markets for both new vehicles and after-market replacements are expected to create significant opportunities for market players in the near future.

France SLI Battery Market Trends

Increasing Adoption of Motor Vehicles Drives the Market

- The increasing adoption of motor vehicles in France drives the growth of the market. The increasing adoption of motor vehicles is leading to increased demand for reliable and efficient automotive batteries.

- Robust automotive production and sales bolster the demand for SLI batteries in Europe. Germany and France are significant automotive markets, and SLI batteries are used in new vehicles and after-market replacements. The sales of electric vehicles rose significantly over the study period.

- According to the International Energy Agency, in 2023, the total number of EVs sold in France was 0.47 million, an increase of 38.24% compared to 2022. As numerous projects are initiated, sales are expected to rise exponentially in the coming years, which will raise the demand for SLI batteries during the forecast period.

- Furthermore, to achieve sustainable transportation, the country is actively promoting the use of electric vehicles (EVs). The country is embracing the electric revolution as the world transitions toward a greener future by encouraging the use of electric vehicles.

- In May 2024, the government signed an agreement with the leading car manufacturers involving an interim goal of 800,000 electric vehicle sales by 2027 under a new medium-term planning agreement with the government, up from 200,000 in 2022. The government also earmarked EUR 1.5 billion (USD 1.6 billion) for the production and purchase of electric vehicles through various programs. uch investments are likely to increase the production of EVs across the region and raise the demand for SLI batteries during the forecast period.

- As of 2023, companies were making advancements in battery technology, such as VRLA batteries, which became more popular due to their maintenance-free nature and improved performance. These batteries are gradually replacing traditional flooded lead-acid batteries in many applications; this factor is expected to create more opportunities for motor vehicles during the forecast period.

- Such projects and investments are likely to increase vehicle production across the region and raise the demand for SLI batteries during the forecast period.

The Automotive End-user Segment is Expected to Grow

- The automotive sector in France is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have risen significantly over the last few years, and the revenue generated by the automotive sector has risen linearly over the period.

- For instance, according to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2023, the domestic motor vehicle sales in France were 2.21 million units, an increase of 14.5% compared to 2022. Automobile revenue and sales are expected to rise significantly in the coming years as the government announces numerous initiatives and programs to raise vehicle production across the region.

- The automotive industry in France is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have risen significantly over the last few years, and the revenue generated by the industry has linearly increased.

- For instance, according to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2023, domestic motor vehicle sales in France amounted to 2.21 million units, an increase of 14.5% compared to 2022. Automobile revenue and sales are expected to rise significantly in the coming years as the government announces numerous initiatives and programs to increase vehicle production across the region.

- The French government has been proactive in promoting electric vehicles (EVs) through various initiatives aimed at reducing pollution, decreasing dependence on fossil fuels, and fostering sustainable development. The leading companies are expected to launch numerous projects to increase automobile production across the region in the coming years.

- For instance, in June 2024, BYD Company, a Chinese electric vehicle giant, announced it would open an EV production factory in France and roll out plug-in hybrid vehicles (PHEV) across the country in the coming years. The facility is expected to be operational by the end of next year. These types of projects boost EV production and, in turn, the demand for SLI batteries.

- Battery production in France is expanding significantly. In 2023, the Automotive Cells Company (ACC) inaugurated a battery plant in Billy-Berclau/Douvrin in the Hauts-de-France region. This facility, expected to reach an annual capacity of 13 GWh by the end of 2024, is part of ACC's plan to eventually produce 40 GWh per year at this site by 2030. The plant will be able to produce enough batteries for 200,000 to 300,000 electric vehicles annually.

- Several other projects are underway in the Hauts-de-France region, turning it into a burgeoning "Battery Valley." Notably, Envision AESC is constructing a new battery plant in Douai to supply Renault, targeting an initial capacity of 9 GWh by 2024 and 24 GWh by 2030. Verkor and ProLogium are also building facilities in Dunkirk and in another coastal city, respectively; these are set to start production between 2025 and 2026.

- Such initiatives and developments are likely to boost the growth of the automotive end-user segment.

France SLI Battery Industry Overview

The France SLI battery market is semi-fragmented. Some key players (not in particular order) include Exide Technologies, EnerSys, East Penn Manufacturing Co., GS Yuasa International Ltd, and Johnson Controls International PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Pestle Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls International PLC

- 6.3.4 EnerSys

- 6.3.5 HBL Power Systems Ltd

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 FIAMM Energy Technology

- 6.3.8 Clarios

- 6.3.9 SAFT Groupe SA

- 6.3.10 Varta AG

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

02-2729-4219

+886-2-2729-4219