|

市场调查报告书

商品编码

1801839

可生物降解智慧材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biodegradable Smart Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

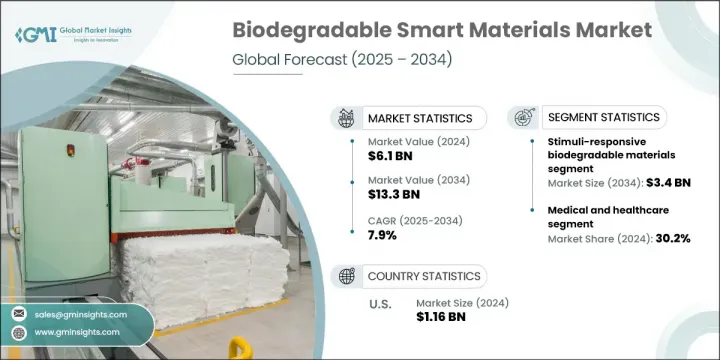

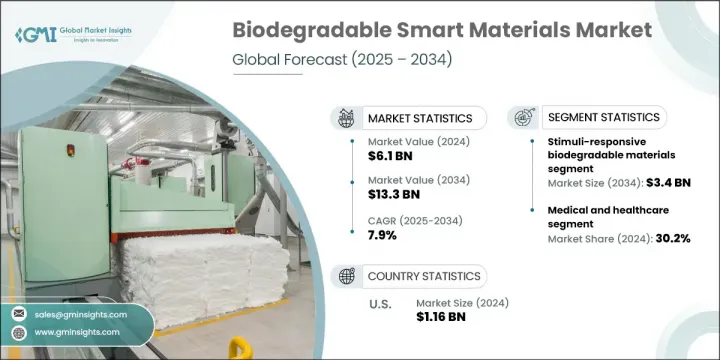

2024年,全球可生物降解智慧材料市场规模达61亿美元,预计2034年将以7.9%的复合年增长率成长,达到133亿美元。全球对塑胶污染和电子垃圾的认识不断提高,推动了这一增长,促使各国政府推出更严格的环境法规,包括产品生命週期规定、一次性塑胶禁令和生产者责任法规。随着消费者日益重视永续性和自身碳足迹,各行各业正将重点转向生态相容的替代品。可生物降解智慧材料正成为一种符合循环经济原则和环境法规的有前景的解决方案。其多功能性在各行各业日益受到青睐,为人们提供了既不影响性能又符合合规要求的实用替代品。

聚合物科学、奈米技术和生物工程领域的持续进步正在改变可生物降解智慧材料领域。这些创新推动了智慧可生物降解聚合物的开发,使其性能增强,包括对热或光等刺激的反应能力,以及记忆和自修復特性。因此,由于其在各种用例中的灵活性和适应性,其应用正在加速。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 61亿美元 |

| 预测值 | 133亿美元 |

| 复合年增长率 | 7.9% |

2024年,刺激响应型生物降解材料市场规模达16亿美元,预计2034年将达34亿美元。这类材料的吸引力在于其能够对pH值、温度、酵素或光等环境输入做出动态反应,从而提供精确且及时的反应。它们在高度特定应用中的应用正在不断扩展,尤其是在智慧包装和生物医学领域,材料的反应性和适应性对于性能和效率至关重要。

受生物相容性材料需求不断增长的推动,医疗保健领域在2024年占据了30.2%的市场份额。可生物降解智慧材料因其能够安全降解且不留有毒残留物,无需手术提取,并最大限度地降低了不良反应的风险,在医疗保健领域得到了广泛的应用。它们在植入物、再生医学和药物传输领域的应用正在重塑临床实践,降低併发症发生率并改善患者预后。

美国可生物降解智慧材料市场在2024年创收11.6亿美元,预计2034年复合年增长率将达到7.8%。该地区的需求受到日益高涨的环保意识的有力支撑。美国消费者越来越青睐永续产品,迫使企业转向可生物降解解决方案。这种需求已成为产品开发和创新的核心驱动力,为市场扩张创造了有利条件。

主导可生物降解智慧材料市场的关键参与者包括巴斯夫 SE、Novamont SpA、NatureWorks LLC、科思创 AG 和赢创工业 AG。为了提升市场地位,可生物降解智慧材料领域的公司正在利用几种关键策略。他们正在扩大研发投资以增强材料功能,例如整合刺激反应和记忆功能。与研究机构和科技公司的合作加速了创新週期。企业也正在与包装、医疗保健和消费品公司建立策略合作伙伴关係,以拓宽其应用基础。许多公司正在扩大生产能力以满足不断增长的需求,同时整合生物基投入以减少对石油基原料的依赖。此外,公司正致力于透过生态标籤和永续性认证来教育消费者和最终用户,以推动采用和品牌信任。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依材料类型,2021-2034

- 主要趋势

- 形状记忆生物降解材料

- 热响应形状记忆聚合物

- pH响应和化学触发系统

- 磁响应形状记忆材料

- 多刺激反应形状记忆系统

- 自修復可生物降解材料

- 内在自修復聚合物系统

- 外在自修復和微胶囊系统

- 仿生自修復机制

- 可逆、可重复的自修復材料

- 刺激响应型可生物降解材料

- 温度响应和热敏感系统

- pH响应和化学感测材料

- 光响应和光敏系统

- 湿度响应和湿度感测材料

- 导电可生物降解智慧材料

- 导电聚合物体系

- 离子导电和电解质材料

- 压电和能量收集材料

- 电磁屏蔽与防护材料

- 生物基和天然智慧材料

- 基于纤维素的智慧材料系统

- 蛋白质基和生物分子智慧材料

- 壳聚醣和海洋衍生智慧材料

- 淀粉基和农业废弃物智慧材料

第六章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 医疗保健

- 药物输送系统和控释

- 组织工程与再生医学

- 医疗植入物和生物相容性设备

- 伤口癒合和治疗

- 包装和消费品

- 主动智慧包装系统

- 食品包装和新鲜度监控

- 药品包装与药品保护

- 消费性电子产品的包装与保护

- 电子产品和穿戴式装置

- 柔性和可拉伸电子元件

- 穿戴式健康监测和感测设备

- 临时电子纹身和皮肤贴片

- 可生物降解感测器和环境监测

- 农业和环境

- 控释肥料和养分输送

- 农药输送与作物保护系统

- 土壤监测和农业感测

- 环境修復和污染控制

- 纺织和时尚产业

- 智慧面料和响应性纺织品

- 运动和运动服装

- 医用纺织品和保健布料

- 时尚唯美的智慧纺织品

第七章:市场规模及预测:依最终用途,2021-2034

- 主要趋势

- 医疗保健和医疗器械

- 製药和生物技术

- 医疗器材製造商和供应商

- 医院和医疗保健提供者

- 研究机构和临床组织

- 包装和消费品产业

- 食品和饮料包装

- 医药包装製造商

- 消费性电子与科技公司

- 零售与电子商务组织

- 电子及科技业

- 消费性电子产品製造商

- 穿戴式科技和物联网设备公司

- 半导体和零件製造商

- 电信和网路公司

- 农业与环境产业

- 农业化学品和肥料公司

- 精准农业和技术提供者

- 环境监测与感测公司

- 政府机构和环保组织

- 研究和学术机构

- 大学和学术研究中心

- 政府研究实验室和机构

- 私人研究和开发组织

- 技术孵化器与创新中心

第八章:市场规模及预测:依技术,2021-2034

- 主要趋势

- 生物基材料技术

- 合成可生物降解技术

- 智慧功能整合技术

- 製造和加工技术

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- BASF SE

- Covestro AG

- Evonik Industries AG

- NatureWorks LLC

- Novamont SpA

- Corbion

- Danimer Scientific

- Biome Bioplastics

- Solvay

- Eastman Chemical Company

The Global Biodegradable Smart Materials Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 13.3 billion by 2034. This growth is fueled by rising global awareness of plastic pollution and electronic waste, driving governments to impose stricter environmental laws. These include product lifecycle mandates, single-use plastic bans, and producer responsibility regulations. With consumers increasingly conscious of sustainability and their carbon footprint, industries are shifting focus toward eco-compatible alternatives. Biodegradable smart materials are emerging as a promising solution that aligns with circular economy principles and environmental legislation. Their multifunctional capabilities are gaining momentum across industries, offering practical alternatives that don't compromise performance or compliance.

Ongoing advancements in polymer science, nanotech, and bioengineering are transforming the biodegradable smart materials space. These innovations are enabling the development of smart biodegradable polymers with enhanced performance, including responsiveness to stimuli like heat or light, as well as memory and self-repair properties. As a result, adoption is accelerating due to their flexibility and adaptability across diverse use cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 7.9% |

In 2024, the stimuli-responsive biodegradable materials segment generated USD 1.6 billion and is forecasted to reach USD 3.4 billion by 2034. The appeal of these materials lies in their dynamic ability to react to environmental inputs like pH, temperature, enzymes, or light, delivering precise and timely responses. Their use in highly specific applications is expanding, particularly in smart packaging and biomedical fields, where material reactivity and adaptability are essential to performance and efficiency.

The medical and healthcare segment held 30.2% share in 2024, driven by a growing need for biocompatible materials. Biodegradable smart materials are widely adopted in healthcare due to their ability to safely degrade without leaving toxic residues, eliminating the need for surgical extraction and minimizing risk of adverse reactions. Their application in implants, regenerative medicine, and drug delivery is reshaping clinical practices by reducing complication rates and improving patient outcomes.

United States Biodegradable Smart Materials Market generated USD 1.16 billion in 2024 and is anticipated to register a CAGR of 7.8% through 2034. Demand in the region is heavily supported by a rising wave of environmental consciousness. American consumers are increasingly favoring sustainable products, pressuring businesses to pivot toward biodegradable solutions. This demand has become a central driver of product development and innovation, creating favorable conditions for market expansion.

Key players dominating the Biodegradable Smart Materials Market include BASF SE, Novamont S.p.A., NatureWorks LLC, Covestro AG, and Evonik Industries AG. To enhance their market position, companies in the biodegradable smart materials sector are leveraging several key strategies. They are expanding R&D investments to enhance material functionality-such as incorporating stimuli-responsiveness and memory capabilities. Collaboration with research institutions and tech firms accelerates innovation cycles. Businesses are also forging strategic partnerships with packaging, healthcare, and consumer goods companies to widen their application base. Many are scaling up manufacturing capacities to meet growing demand while integrating bio-based inputs to reduce dependency on petroleum-based feedstocks. Additionally, firms are focusing on educating consumers and End users through eco-labeling and sustainability certifications to drive adoption and brand trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Technology

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Shape memory biodegradable materials

- 5.2.1 Thermally responsive shape memory polymers

- 5.2.2 pH-responsive and chemically triggered systems

- 5.2.3 Magnetically responsive shape memory materials

- 5.2.4 Multi-stimuli responsive shape memory systems

- 5.3 Self-healing biodegradable materials

- 5.3.1 Intrinsic self-healing polymer systems

- 5.3.2 Extrinsic self-healing and microcapsule systems

- 5.3.3 Bio-inspired self-healing mechanisms

- 5.3.4 Reversible and repeatable self-healing materials

- 5.4 Stimuli-responsive biodegradable materials

- 5.4.1 Temperature-responsive and thermosensitive systems

- 5.4.2 Ph-responsive and chemical sensing materials

- 5.4.3 Light-responsive and photosensitive systems

- 5.4.4 Moisture-responsive and humidity sensing materials

- 5.5 Conductive biodegradable smart materials

- 5.5.1 Electrically conductive polymer systems

- 5.5.2 Ionically conductive and electrolyte materials

- 5.5.3 Piezoelectric and energy harvesting materials

- 5.5.4 Electromagnetic shielding and protection materials

- 5.6 Bio-based and natural smart materials

- 5.6.1 Cellulose-based smart material systems

- 5.6.2 Protein-based and biomolecular smart materials

- 5.6.3 Chitosan and marine-derived smart materials

- 5.6.4 Starch-based and agricultural waste smart materials

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Medical and healthcare

- 6.2.1 Drug delivery systems and controlled release

- 6.2.2 Tissue engineering and regenerative medicine

- 6.2.3 Medical implants and biocompatible devices

- 6.2.4 Wound healing and therapeutic

- 6.3 Packaging and consumer goods

- 6.3.1 Active and intelligent packaging systems

- 6.3.2 Food packaging and freshness monitoring

- 6.3.3 Pharmaceutical packaging and drug protection

- 6.3.4 Consumer electronics packaging and protection

- 6.4 Electronics and wearable devices

- 6.4.1 Flexible and stretchable electronic components

- 6.4.2 Wearable health monitoring and sensing devices

- 6.4.3 Temporary electronic tattoos and skin patches

- 6.4.4 Biodegradable sensors and environmental monitoring

- 6.5 Agriculture and Environmental

- 6.5.1 Controlled release fertilizers and nutrient delivery

- 6.5.2 Pesticide delivery and crop protection systems

- 6.5.3 Soil monitoring and agricultural sensing

- 6.5.4 Environmental remediation and pollution control

- 6.6 Textiles and fashion industry

- 6.6.1 Smart fabrics and responsive textiles

- 6.6.2 Athletics and performance wear

- 6.6.3 Medical textiles and healthcare fabrics

- 6.6.4 Fashion and aesthetic smart textile

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Healthcare and medical devices

- 7.2.1 Pharmaceutical and biotechnology

- 7.2.2 Medical device manufacturers and suppliers

- 7.2.3 Hospitals and healthcare providers

- 7.2.4 Research institutions and clinical organizations

- 7.3 Packaging and consumer goods industry

- 7.3.1 Food and beverage packaging

- 7.3.2 Pharmaceutical packaging manufacturers

- 7.3.3 Consumer electronics and technology companies

- 7.3.4 Retail and e-commerce organizations

- 7.4 Electronics and technology industry

- 7.4.1 Consumer electronics manufacturers

- 7.4.2 Wearable technology and IOT device companies

- 7.4.3 Semiconductor and component manufacturers

- 7.4.4 Telecommunications and networking companies

- 7.5 Agriculture and environmental industry

- 7.5.1 Agricultural chemical and fertilizer companies

- 7.5.2 Precision agriculture and technology providers

- 7.5.3 Environmental monitoring and sensing companies

- 7.5.4 Government agencies and environmental organizations

- 7.6 Research and academic institutions

- 7.6.1 Universities and academic research centers

- 7.6.2 Government research laboratories and agencies

- 7.6.3 Private research and development organizations

- 7.6.4 Technology incubators and innovation centers

Chapter 8 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Bio-based material technologies

- 8.3 Synthetic biodegradable technologies

- 8.4 Smart functionality integration technologies

- 8.5 Manufacturing and processing technologies

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Covestro AG

- 10.3 Evonik Industries AG

- 10.4 NatureWorks LLC

- 10.5 Novamont S.p.A.

- 10.6 Corbion

- 10.7 Danimer Scientific

- 10.8 Biome Bioplastics

- 10.9 Solvay

- 10.10 Eastman Chemical Company