|

市场调查报告书

商品编码

1801931

滚筒烘干机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tumble Dryer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

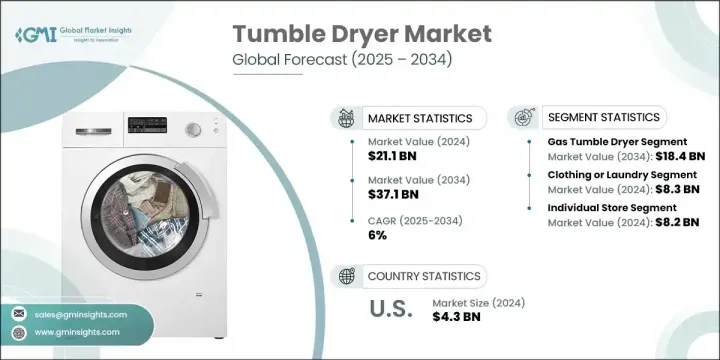

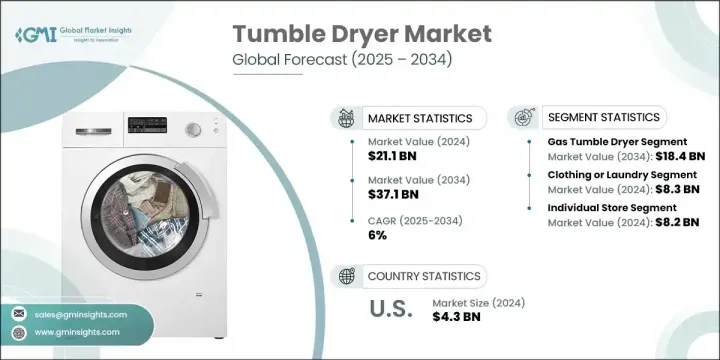

2024年,全球滚筒式干衣机市场规模达211亿美元,预计2034年将以6%的复合年增长率成长,达到371亿美元。这一成长动能的驱动力源自于城镇化进程的加速、消费者生活方式的转变、新兴市场收入的提高以及节能和智慧技术的显着进步。双收入家庭和居住在紧凑型城市环境中(户外烘干空间有限)的个人越来越多地选择滚筒式干衣机,因为它们方便且省时。不断提高的能源效率标准和广泛的激励措施正在鼓励消费者升级到现代化的干衣机。

製造商纷纷推出功能丰富、高效的机型,以满足住宅和商业场所(例如自助洗衣店和饭店)的需求。智慧互联功能(例如应用程式控制、湿度感测器和物联网诊断)正日益成为标配,吸引註重便利性和环保意识的消费者。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 211亿美元 |

| 预测值 | 371亿美元 |

| 复合年增长率 | 6% |

燃气滚筒烘干机在 2024 年占据该领域的首位,估值达 108 亿美元,预计到 2034 年将达到 184 亿美元。在北美等地区,燃气驱动的机型因其干燥时间更快、每个週期的运营成本更低以及能够达到更高的温度而受到青睐——这些优势对于需要高效干燥的大容量环境或大家庭至关重要。

服装或洗衣应用领域在2024年创造了83亿美元的市场规模,预计到2034年将以6.2%的复合年增长率成长。由于商业洗衣房和酒店等对高吞吐量和耐用性有较高要求的环境,该领域仍将占据主导地位。这些环境青睐商用级烘干机,因为它们性能卓越、可靠性高。

2024年,美国滚筒式干衣机市场规模达43亿美元,预计2025年至2034年的复合年增长率为6%。强劲的成长动能源自于消费者对省时电器的强烈偏好,以及洗衣基础设施投资的不断增加。房屋建筑商(尤其是在德克萨斯州和佛罗里达州等地区)正在将专用洗衣空间与标准化的家电介面整合到新建筑中,这进一步推动了滚筒式干衣机的普及。

影响全球滚筒式干衣机产业的关键参与者包括三星、伊莱克斯、Miele、海尔、美泰格、LG、Renzacci、Schulthess、小天鹅、GIRBAU、ASKO Appliances、Pellerin、Milnor、American Dryer、Dexter Laundry 和 Danube。为巩固市场地位,滚筒式干衣机製造商正专注于几个策略方向。他们正在加速热泵和混合技术的研发,以提供卓越的能源效率并吸引具有环保意识的客户。产品线现在整合了智慧家庭功能,如 Wi-Fi 控制、应用程式管理和湿度感应技术,以增强用户便利性并使品牌脱颖而出。该公司正在与房屋建筑商和房地产开发商建立合作伙伴关係,以将其设备嵌入新物业,尤其是在城市和郊区住房市场。全球物流和製造网路的扩展有助于有效满足需求,而对永续包装、可回收材料和碳减排计画的投资则增强了品牌信誉。强调耐用性、性能和服务支援的策略品牌建立活动进一步加强了消费者的信任和长期忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 电动滚筒烘干机

- 瓦斯滚筒烘干机

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 家庭

- 纺织业

- 服装或洗衣业

- 饭店业

- 其他(水疗、医疗保健等)

第七章:市场估计与预测:依定价,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 大型零售商店

- 专卖店

- 其他(个体店、百货公司等)

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- American Dryer

- ASKO Appliances

- Danube

- Dexter Laundry

- Electrolux

- GIRBAU

- Haier

- LG

- Little Swan

- Maytag

- Miele

- Pellerin Milnor

- Renzacci

- Samsung

- Schulthess

The Global Tumble Dryer Market was valued at USD 21.1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 37.1 billion by 2034. This momentum is driven by escalating urbanization, evolving consumer lifestyles, rising incomes in emerging markets, and significant advances in energy-efficient and smart technologies. Dual-income households and individuals living in compact urban settings-with limited outdoor drying space-are increasingly choosing tumble dryers for their convenience and time-saving capabilities. Enhanced energy efficiency standards and widespread incentives are encouraging consumers to upgrade to modern dryers.

Manufacturers are responding with feature-rich, efficient models that cater to demand in both residential homes and commercial settings such as laundromats and hospitality venues. Smart and connected capabilities-like app control, moisture sensors, and IoT-enabled diagnostics-are increasingly becoming standard, appealing to convenience-oriented and eco-conscious shoppers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.1 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 6% |

Gas tumble dryers led the segment in 2024 with a valuation of USD 10.8 billion and are forecast to reach USD 18.4 billion by 2034. In regions like North America, gas-powered models are preferred for their faster drying times, lower operational costs per cycle, and ability to reach higher temperatures-advantages that are critical in high-volume environments or large households needing efficient drying.

The clothing or laundry application segment generated USD 8.3 billion in 2024 and is expected to rise at a CAGR of 6.2% through 2034. This segment remains dominant due to its demand in settings that require high throughput and durability, such as commercial laundries and hotels. These environments favor commercial-grade dryers for their performance and reliability.

U.S. Tumble Dryer Market generated USD 4.3 billion in 2024, with anticipated growth at a CAGR of 6% from 2025 to 2034. This robust expansion is backed by a strong consumer preference for time-saving appliances and increased investment in laundry infrastructure. Homebuilders-especially in regions like Texas and Florida-are integrating dedicated laundry spaces with standardized appliance hookups into new constructions, further boosting tumble dryer adoption.

Key players shaping the Global Tumble Dryer Industry include Samsung, Electrolux, Miele, Haier, Maytag, LG, Renzacci, Schulthess, Little Swan, GIRBAU, ASKO Appliances, Pellerin, Milnor, American Dryer, Dexter Laundry, and Danube. To consolidate their market positions, tumble dryer manufacturers are focusing on several strategic directions. They are accelerating R&D in heat-pump and hybrid technologies to deliver superior energy efficiency and appeal to eco-conscious customers. Product lines now integrate smart-home features like Wi-Fi control, app management, and moisture-sensing technology to enhance user convenience and set brands apart. Companies are forging partnerships with homebuilders and real estate developers to embed their appliances in new properties, particularly in urban and suburban housing markets. Expansion of global logistics and manufacturing networks helps meet demand efficiently, while investments in sustainable packaging, recyclable materials, and carbon reduction initiatives bolster brand credibility. Strategic brand-building campaigns highlighting durability, performance, and service support further reinforce consumer trust and long-term loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Electric tumble dryer

- 5.3 Gas tumble dryer

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Household

- 6.3 Textile industry

- 6.4 Clothing or laundry industry

- 6.5 Hospitality industry

- 6.6 Others (spa, Healthcare, etc.)

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Mega retail stores

- 8.3.2 Specialty stores

- 8.3.3 Others (individual stores, departmental stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 American Dryer

- 10.2 ASKO Appliances

- 10.3 Danube

- 10.4 Dexter Laundry

- 10.5 Electrolux

- 10.6 GIRBAU

- 10.7 Haier

- 10.8 LG

- 10.9 Little Swan

- 10.10 Maytag

- 10.11 Miele

- 10.12 Pellerin Milnor

- 10.13 Renzacci

- 10.14 Samsung

- 10.15 Schulthess