|

市场调查报告书

商品编码

1645057

欧洲滚筒烘干机市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Tumble Dryers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

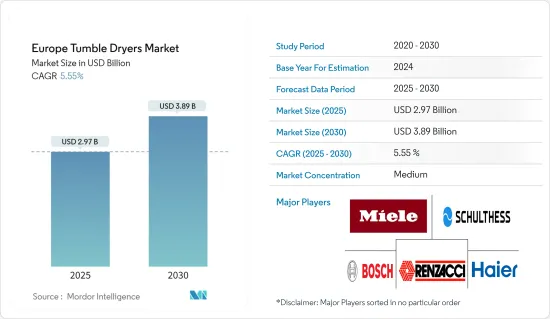

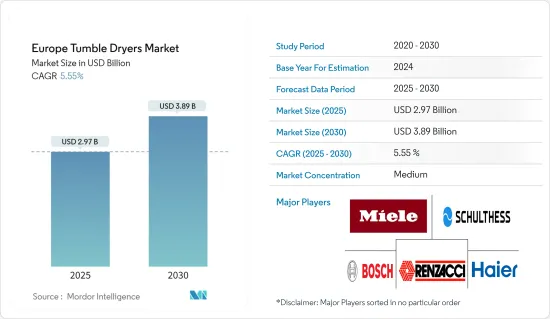

预计 2025 年欧洲滚筒式干衣机市场规模为 29.7 亿美元,到 2030 年将达到 38.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.55%。

滚筒式烘干机是用来烘干衣物的主要家用电器。欧洲主要家用电器的收益和需求的持续增长预计也将推动滚筒式烘干机的市场需求。欧洲人口已超过75%且就业率不断上升,人们更加青睐高效、省时的洗衣服家用电器,而滚筒式烘干机可以在短时间内快速烘干衣物,使洗衣服变得更加高效。

欧洲主要家用电器和洗衣机的平均收入和每户销售数量持续成长,推动了该地区滚筒式烘干机的销售。透过电子商务和直销网站等线上管道,滚筒烘干机销售市场呈现多样化,导致滚筒烘干机的线上收益占有率增加。

技术和产品创新促使製造商为滚筒式烘干机配备感测器和智慧功能。透过 Google 援助和 Alexa 的 Wi-Fi 连线和语音援助可协助使用者远端存取滚筒烘干机并根据织物和负载类型执行各种干燥循环。受此趋势影响,欧洲智慧家电市场规模不断扩大,消费者对烘干机具有智慧功能的需求不断增加。

欧洲滚筒烘干机市场的趋势

住宅领域的需求不断增加

由于住宅销售量不断增加,家庭数量不断增加对洗衣设备产生了新的需求,欧洲滚筒烘干机製造商的市场也不断扩大。该地区主要家用电器的市场规模和销量不断增长,为滚筒式烘干机进入住宅市场创造了市场机会。欧洲都市化、就业率和富裕程度的提高,使得德国、英国、义大利和法国成为住宅洗衣设备需求增加的主要国家,促使全球製造商在这些市场推出创新滚筒式烘干机。这些趋势使得住宅领域成为欧洲滚筒式烘干机製造商的关键市场。

法国引领欧洲市场

法国的家庭洗衣机拥有率超过80%,是家庭干衣机拥有率上升趋势的市场。法国为扩大销售和推出创新滚筒烘干机产品提供了机会,欧洲和国际滚筒烘干机製造商都转向这个市场来扩大销售。法国的住宅数量正在增加,这增加了对家用滚筒烘干机的需求。该国滚筒烘干机的年销售量超过60万台,城市人口的成长成为法国滚筒烘干机及其销售成长的主要因素。在法国,由于滚筒烘干机智慧功能的扩展和智慧家电销量的成长,预计滚筒烘干机市场将在一定时期内呈现正成长。

欧洲滚筒烘干机产业概况。

欧洲滚筒烘干机市场比较分散,有许多製造商在市场上推出自己的产品。随着製造商之间的竞争加剧,他们不断将智慧功能融入自己的产品中,以在市场上脱颖而出。欧洲滚筒烘干机市场的现有参与者包括 Miele、Schulthess、Renzacci、Bosch 和海尔。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 欧洲主要家电销售成长

- 由于住宅增加,住宅领域的需求增加

- 市场限制

- 全自动滚筒烘干机价格上涨

- 市场机会

- 智慧滚筒烘干机的需求不断增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 欧洲滚筒烘干机市场的技术创新

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 热泵滚筒烘干机

- 冷凝式滚筒烘干机

- 通风滚筒烘干机

- 按分销管道

- 在线的

- 离线

- 按最终用户

- 住宅

- 商业的

- 按国家

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Miele

- Schulthess

- Renzacci

- Bosch

- Haier

- Whirlpool

- Bosch

- Beko

- Brandt

- Indesit

- Candy*

第七章 市场未来趋势

第八章 免责声明及发布者

The Europe Tumble Dryers Market size is estimated at USD 2.97 billion in 2025, and is expected to reach USD 3.89 billion by 2030, at a CAGR of 5.55% during the forecast period (2025-2030).

Tumble dryers exist as a major appliance used for drying clothes. As the revenue and demand for major appliances in Europe are observing a continuous increase, it is expected to drive the market demand for tumble dryers as well. With a rising share of the urban population existing at more than 75% and an increasing employment rate, Europeans prefer efficient and time-saving appliances for their laundry and tumble dryers perform this work efficiently by drying the clothes shortly and quickly.

The average revenue per household and unit volume sold of major appliances and washing machines in Europe is observing a continuous rise, driving the sales of tumble dryers in the region. Diversification of tumble dryer sales through online channels of E-commerce and direct websites results in an increasing online revenue share of tumble dryers in the market.

Technological and product innovations lead to manufacturers equipping tumble dryers with sensors and smart features. Embedded Wi-Fi connectivity and voice assistance features of Google Assistance and Alexa help the user to access the tumble dryer remotely and various dryer cycles based on fabrics and types of load. With this trend, as the market size of smart appliances in Europe is observing a continuous rise, consumers are demanding tumble dryers equipped with smart features.

Europe Tumble Dryers Market Trends

Rising Demand from Residential Segment

With a continuous rise in the number of residential real estate unit sales in Europe, there is a continuous expansion of the market for tumble dryer manufacturers as rising households are generating new demand for laundry appliances. The increasing market size and sales volume of major home appliances in the region are creating a market opportunity for tumble dryers to increase their penetration in the residential segment. Rising urbanization, employment rate, and wealth in Europe led to Germany, the United Kingdom, Italy, and France emerging as major countries with increasing demand for laundry appliances by the residential segments and global manufacturers launching their innovative tumble dryers in these markets. These trends are leading to the residential segment emerging as a major market for the European tumble dryer manufacturer.

France Leading the European Market

With the household ownership rate of laundry appliances existing at more than 80%, France exists as a market with increasing household ownership of cloth dryers. It provides opportunities for expanding sales and launching innovative tumble dryers, leading to European as well as global tumble dryer manufacturers looking over the market to expand their sales. The increasing number of residential dwellings in France is leading to a rise in demand for tumble dryers by households segment. With annual sales of tumble dryers in the country existing at more than 0.6 million, the rising urban population is emerging as a major factor contributing to the increasing revenue of tumble dryers and their sales in France. Expanding smart features in tumble dryers and increasing sales of smart home appliances in France are expected to drive positive growth in the tumble dryer market over the coming period.

Europe Tumble Dryers Industry Overview

Europe's tumble dryers market is fragmented with a large number of manufacturers delivering their products in the market. Rising competition among the manufacturers is leading them to equip their products with smart features and create product differentiation in the market. Some of the existing players in the European tumble dryer market are Miele, Schulthess, Renzacci, Bosch and Haier.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Sales of Major Household Appliances in Europe

- 4.2.2 Rising Demand from Residential Segments with Increasing Housing

- 4.3 Market Restraints

- 4.3.1 Higher Price of Fully Automatic Tumble Dryers

- 4.4 Market Opportunities

- 4.4.1 Increasing Demand for Smart Features Equipped Tumble Dryers

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Europe Tumble Dryer Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Heat Pump tumble dryer

- 5.1.2 Condenser tumble dryer

- 5.1.3 Vented tumble dryer

- 5.2 By Distribution Channel

- 5.2.1 Online

- 5.2.2 Offline

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Miele

- 6.2.2 Schulthess

- 6.2.3 Renzacci

- 6.2.4 Bosch

- 6.2.5 Haier

- 6.2.6 Whirlpool

- 6.2.7 Bosch

- 6.2.8 Beko

- 6.2.9 Brandt

- 6.2.10 Indesit

- 6.2.11 Candy*